|

| Published monthly since 1996 by the Connecticut Department of Labor, Office of Research. |

|

|

he Connecticut Economic Digest's purpose is to regularly provide users with a comprehensive source for the most current, up-to-date data available on the workforce and economy of the state, within perspectives of the region and nation. he Connecticut Economic Digest's purpose is to regularly provide users with a comprehensive source for the most current, up-to-date data available on the workforce and economy of the state, within perspectives of the region and nation.

Every month the Connecticut Economic Digest provides the most current economic data available for Connecticut. Decision-makers from many arenas are better informed because the Digest makes it possible to follow the trends and understand the status of economic forces that influence Connecticut's labor markets. We are pleased to continue providing information that is useful in making decisions, setting plans, and engaging in informed conversation.

Articles from the Connecticut Economic Digest may be reprinted if the source is credited. Please send copies of the reprinted material to the Managing Editor. The views expressed by the authors are theirs alone and may not reflect those of the Connecticut Department of Labor. Managing Editor: Jungmin Charles Joo.

For further information, call the Office of Research at 860-263-6290 or e-mail to dol.econdigest@po.state.ct.us.

Become a Connecticut Economic Digest subscriber!

Send message addressed to: listserv@list.ct.gov with the following in the body of the message. (leave subject blank) Send message addressed to: listserv@list.ct.gov with the following in the body of the message. (leave subject blank)

SUBSCRIBE DOL-CTEconomicDigest your_name (type in your name where it says your_name). SUBSCRIBE DOL-CTEconomicDigest your_name (type in your name where it says your_name).

To Unsubscribe from Connecticut Economic Digest list.

Compose an e-mail to listserv@list.ct.gov from same email account when subscribing to DOL-CTEconomicDigest. Compose an e-mail to listserv@list.ct.gov from same email account when subscribing to DOL-CTEconomicDigest.

Leave the subject line blank and in the body of the message type: Signoff DOL-CTEconomicDigest. Click send. Leave the subject line blank and in the body of the message type: Signoff DOL-CTEconomicDigest. Click send. |

|

|

|

Reference over 200 articles focusing on

Connecticut's economic climate including: |

|

|

|

| Adobe Reader is the global standard for electronic document sharing. Use Adobe Reader to view, search, digitally sign, verify, print, and collaborate on Adobe PDF files. Download Acrobat Reader. |

|

|

|

|

|

|

|

|

August 2025 - December 2025 Connecticut Economic Digest |

|

| Due to circumstances beyond our control, the Connecticut Economic Digest was not published in the latter months of 2025. Shortly, we will be posting some of the tables and other information that would have been published in those issues below.

|

|

|

|

July 2025 Connecticut Economic Digest |

|

Covered Employment and Wages 2024: A 2024 Annual Review

By Jonathan Kuchta, Research Analyst, Department of Labor

ccording to the most recent

data published by the

Quarterly Census of Employment

and Wages (QCEW) program, the

number of jobs in Connecticut

increased by 0.9 percent during

2024. Employment growth

slowed in 2024 but continued the

upward post-pandemic trend.

Total private industry

employment, constituting 86.7

percent of the state's

employment total, increased by

0.8 percent. Total government

employment increased by 1.6

percent. ccording to the most recent

data published by the

Quarterly Census of Employment

and Wages (QCEW) program, the

number of jobs in Connecticut

increased by 0.9 percent during

2024. Employment growth

slowed in 2024 but continued the

upward post-pandemic trend.

Total private industry

employment, constituting 86.7

percent of the state's

employment total, increased by

0.8 percent. Total government

employment increased by 1.6

percent.

Average annual wages for all

Connecticut jobs increased by

4.3 percent, to $87,403. In 2024,

private sector wages increased

by 4.6 percent to $88,835;

government wages increased 2.6

percent to $78,051. New business establishments

continued to grow, though at a

slightly slower pace than in 2023.

The establishment counts for

2023 were revised after the

.... [ read more ]

|

|

|

|

June 2025 Connecticut Economic Digest |

|

Connecticut Exports Grew for the Fourth Year

By Patrick J. Flaherty, Director of Research and Information

onnecticut exports grew for the fourth consecutive year in 2024. Commodity exports increased by more than $1.5 billion or 9.7% (the ninth fastest in the nation) after increasing 3.2% in 2023.1 Many Connecticut companies export. The most recent data indicates that 4,714 companies exported from Connecticut in 2022. 89% of these companies were small and medium-size enterprises (SMEs) with fewer than 500 employees. According to the most recent data, approximately 50,000 jobs were supported by Connecticut exports. onnecticut exports grew for the fourth consecutive year in 2024. Commodity exports increased by more than $1.5 billion or 9.7% (the ninth fastest in the nation) after increasing 3.2% in 2023.1 Many Connecticut companies export. The most recent data indicates that 4,714 companies exported from Connecticut in 2022. 89% of these companies were small and medium-size enterprises (SMEs) with fewer than 500 employees. According to the most recent data, approximately 50,000 jobs were supported by Connecticut exports.

In 2024 at the two-digit Harmonized System (HS) commodity code level, Connecticut top five export commodities were (1) aircraft, spacecraft, and parts thereof; (2) industrial machinery, including computers (3) electric machinery, sound equipment, TV equipment, Parts; (4) optic, photo, medical or surgical instruments; and (5) special classification provisions, which typically consists of exports of repaired imports. This top five list is unchanged from 2023. Each of the top five export commodity sectors experienced increases in 2024.

[ read more ]

Town Unemployment Rates Remain Low in 2024

By Jungmin Charles Joo, CT Department of Labor

In 2024, the annual average statewide unemployment rate was 3.2%, unchanged over the year. After two years of strong labor force growth when unemployment rates fell sharply in most towns, most towns saw small changes (up or down) in 2024, with 39 towns seeing no change from the 2023 level. The Local Area Unemployment Statistics (LAUS) underwent a major change reflecting new geographies, so all 169 cities and towns were revised for 2016-2024. In 2024, the annual average statewide unemployment rate was 3.2%, unchanged over the year. After two years of strong labor force growth when unemployment rates fell sharply in most towns, most towns saw small changes (up or down) in 2024, with 39 towns seeing no change from the 2023 level. The Local Area Unemployment Statistics (LAUS) underwent a major change reflecting new geographies, so all 169 cities and towns were revised for 2016-2024.

The unemployment rate in 60% of the cities and towns in the state fell in 2024. Roxbury had the lowest unemployment rate of 1.9%, while the residents of both Hartford and Waterbury experienced the highest rate of 5.0% last year (see table on page 3 for the complete town data). Overall, a total of 129 cities and towns had jobless rates below the 2024 statewide figure of 3.2%, 29 had rates above it, and 11 had rates equal to it. By comparison, 122 cities and towns had rates below the 2023 statewide average of 3.2%, 39 above it, and 8 were the same. [ read more ]

|

|

|

|

May 2025 Connecticut Economic Digest |

|

Connecticut Short-Term Projections: Job Growth 2024Q2 to 2026Q2

By Matthew Krzyzek, Economist, Department of Labor

onnecticut's economy is projected to add almost 39,000 jobs through the end of the short-term projections period (2nd quarter 2026). The industries driving this growth include Health Care, Educational Services, Public Administration, and Manufacturing. Through 2026Q2, we project overall employment in Connecticut to increase by 2.1% from 1,849,153 to 1,887,722 including self-employment and unpaid family workers. The Goods-Producing sector is projected to grow by 2.9% and the Service-Providing sector is projected to grow by 2.0% over two years. This latter sector represents 86.3% of industry employment in the state. onnecticut's economy is projected to add almost 39,000 jobs through the end of the short-term projections period (2nd quarter 2026). The industries driving this growth include Health Care, Educational Services, Public Administration, and Manufacturing. Through 2026Q2, we project overall employment in Connecticut to increase by 2.1% from 1,849,153 to 1,887,722 including self-employment and unpaid family workers. The Goods-Producing sector is projected to grow by 2.9% and the Service-Providing sector is projected to grow by 2.0% over two years. This latter sector represents 86.3% of industry employment in the state.

Each year, the Office of Research at the Connecticut Department of Labor produces short-term employment projections by industry and occupation. Among the 20 industry groups shown in Figure 1, 14 are projected to increase over two years and 6 are projected to decline. The largest increases are expected in Health Care (+6,396), Educational Services (+4,917), Government (+4,656), and Manufacturing (+4,315). These four industries represent a combined 39% of base quarter 2024Q2 employment and 56% of total industry growth through 2026Q2.

[ read more ]

|

|

|

|

April 2025 Connecticut Economic Digest |

|

JOLTS - it's not about electricity

By Patrick.Flaherty, Director of Research, Department of Labor

ach month the U.S.

Bureau of Labor Statistics

(BLS) and each of the states

report on the number of payroll

jobs for the previous month.

Most recently, the BLS reported

that the nation added 177,000

jobs in April 2025. These reports

are the results of a survey that

asks employers to report the

number of workers they had on

their payrolls during the pay

period that includes the twelfth

of the month. These responses

are then used to estimate the

level of employment - the

number of payroll jobs at a

particular point in time. ach month the U.S.

Bureau of Labor Statistics

(BLS) and each of the states

report on the number of payroll

jobs for the previous month.

Most recently, the BLS reported

that the nation added 177,000

jobs in April 2025. These reports

are the results of a survey that

asks employers to report the

number of workers they had on

their payrolls during the pay

period that includes the twelfth

of the month. These responses

are then used to estimate the

level of employment - the

number of payroll jobs at a

particular point in time.

While

the net change from month to

month often makes headlines

(those who were hired into a new job minus those who left or lost a

job) the pace of hiring and

separations is also important.

Hires and separations are

reported each month by BLS in

the Job Openings and Labor

Turnover Survey (JOLTS) report

which gives insight into the

dynamics in the labor market

that underlie the monthly job

changes which are more widely

reported. For example, in 2024

U.S. jobs increased an average of

168,000 jobs per month, but on

average more than 5.4 million

workers were hired and started a

new job each month while on

average more than 5.2 million

left or lost a job each month. [ read more ]

Help Wanted Online Job Ads, 2019-2025

By Matthew Krzyzek, Economist, Department of Labor

he Connecticut Department of Labor publishes monthly Help Wanted OnLine (HWOL) job ad data to show the number and types of job ads posted by employers in the state. These monthly reports include deduplicated breakouts by workforce development area to provide jobseekers with information relevant to their local market. Though related, HWOL job ad data differs from the JOLTS data published by the Bureau of Labor Statistics (BLS). A job ad may be posted for a variety of reasons and won't necessarily lead to or represent an available job opening that will subsequently be filled. he Connecticut Department of Labor publishes monthly Help Wanted OnLine (HWOL) job ad data to show the number and types of job ads posted by employers in the state. These monthly reports include deduplicated breakouts by workforce development area to provide jobseekers with information relevant to their local market. Though related, HWOL job ad data differs from the JOLTS data published by the Bureau of Labor Statistics (BLS). A job ad may be posted for a variety of reasons and won't necessarily lead to or represent an available job opening that will subsequently be filled.

The dramatic shifts the economy has experienced since 2019 are reflected in the total job ad count at both the state and national level. Monthly total deduplicated job ad counts for the U.S. and CT began to increase dramatically during the beginning of 2021. The graph below illustrates this rise to series peaks of over 122,000 in Connecticut and over 9.2 million in the U.S. by March 2022. This compares to March 2021 levels of 66,500 in Connecticut and 7.4 million in the U.S. [ read more ]

Shore Line East Then and Now (Electric)

By Al Sylvestre, AICP, Research Analyst

ntroduced in May 1990 as a temporary alternative to construction-induced traffic on I-95, as well as pending construction of the new Q Bridge in New Haven, the Clamdigger commuter rail connecting New Haven and Old Saybrook, soon took on the more forthright—and less seafood restaurant menu item — moniker, Shore Line East (SLE). Following completion of I-95 construction, because of SLE's better-than-expected popularity, the Connecticut Department of Transportation (CTDOT) continued and expanded the service, including... [ read more ] ntroduced in May 1990 as a temporary alternative to construction-induced traffic on I-95, as well as pending construction of the new Q Bridge in New Haven, the Clamdigger commuter rail connecting New Haven and Old Saybrook, soon took on the more forthright—and less seafood restaurant menu item — moniker, Shore Line East (SLE). Following completion of I-95 construction, because of SLE's better-than-expected popularity, the Connecticut Department of Transportation (CTDOT) continued and expanded the service, including... [ read more ]

|

|

|

|

March 2025 Connecticut Economic Digest |

|

Connecticut's Economy Continued to Grow in 2024

By Jungmin Charles Joo, Connecticut Department of Labor

onnecticut employment continued to grow for the fourth year in a row, surpassing the pre-pandemic levels in 2024.

The revised annual average total nonfarm employment rose 0.8% to a level of 1,708,300 in 2024. Last year�s annual average unemployment rate was unchanged over the year at 3.2%. Overall, the 2024 economy

continued to grow moderately as per the annual diffusion index. onnecticut employment continued to grow for the fourth year in a row, surpassing the pre-pandemic levels in 2024.

The revised annual average total nonfarm employment rose 0.8% to a level of 1,708,300 in 2024. Last year�s annual average unemployment rate was unchanged over the year at 3.2%. Overall, the 2024 economy

continued to grow moderately as per the annual diffusion index.

After the latest annual revision (based on annual average, not seasonally adjusted data), in 2024 Connecticut gained 13,300 jobs (0.8%), fewer than the increase of 26,800 jobs (1.6%) in 2023. In the

nation employment rose 1.3% in 2024, after having increased 2.2% in 2023. (Seasonally adjusted, Connecticut added 16,000 jobs from December 2023 to December 2024.)

[ read more ]

|

|

|

|

February 2025 Connecticut Economic Digest |

|

Connecticut's Work-Related Fatality Fell in 2023

By Erin C. Wilkins, Associate Research Analyst, CT DOL

onnecticut lost 33 lives to work injuries in 2023, for a rate of 2.0 deaths per 100,000 full-time equivalent workers.

This is a decrease from 2022�s 34 deaths and is below Connecticut�s annual average since 1992 of 37 work-related deaths and the nation�s 2023 rate of 3.5. Only two states � Rhode Island and

New Jersey� recorded a rate lower than Connecticut�s. onnecticut lost 33 lives to work injuries in 2023, for a rate of 2.0 deaths per 100,000 full-time equivalent workers.

This is a decrease from 2022�s 34 deaths and is below Connecticut�s annual average since 1992 of 37 work-related deaths and the nation�s 2023 rate of 3.5. Only two states � Rhode Island and

New Jersey� recorded a rate lower than Connecticut�s.

The nation lost 5,283 lives to workplace injuries in 2023, a decrease from 2022�s 5,486 deaths. The fatal injury rate decreased from 3.7 per 100,000 full-time equivalent workers in 2022 to 3.5 in 2023. The highest

loss was seen in Texas with 564 deaths, followed by California with 439 deaths, and Florida with 306 deaths. High rates were recorded in Wyoming (16.0) and West Virginia (8.3). Rhode Island had six deaths, the

lowest recorded number for states. [ read more ]

|

|

|

|

|

|

|

December 2024 Connecticut Economic Digest |

|

The "Buzz" About New Britain, Connecticut - A City Profile

By Caroline Czajkowski, Research Analyst, CT Department of Labor

ew Britain, Connecticut, or lovingly called �Hard Hittin� New Britain due to its industrial and blue-collar past,

was originally settled as part of Farmington in 1687. By 1754, the rural hamlet separated from Farmington and became part of the township of Berlin. However, due to its central location and access to

waterpower from local rivers, the area developed into a major manufacturing hub specifically in hardware and tools. ew Britain, Connecticut, or lovingly called �Hard Hittin� New Britain due to its industrial and blue-collar past,

was originally settled as part of Farmington in 1687. By 1754, the rural hamlet separated from Farmington and became part of the township of Berlin. However, due to its central location and access to

waterpower from local rivers, the area developed into a major manufacturing hub specifically in hardware and tools.

With the establishment of Russwin (P.&F. Corbin) in 1839 and Stanley Works (now Stanley Black and Decker) in 1843, the community grew large enough to be incorporated as a city in 1850. Eventually the city

garnered the moniker of �Hardware City� due to the residence of many high-profile companies such as Corbin Cabinet Lock Company, North & Judd Manufacturing Company, Fafnir Bearing Company, and Landers, Fray & Clark, in addition to the two previously mentioned.

New Britain was compared to a beehive buzzing with activity and hard work. This imagery was even adopted into the city�s seal and emblem. New Britain�s need for a growing workforce while the prospect of attaining the American Dream attracted waves of immigrants including Italian, Irish, German, Polish, and Ukrainian populations.

[ read more ]

|

|

|

|

November 2024 Connecticut Economic Digest |

|

Affordable Housing Production Incentives

By Al Sylvestre, AICP, Research Analyst

ousing costs have received national attention in recent months. While the Consumer Price Index measure of inflation

has abated in recent months, up just 2.6% in the year ending October 2024, the price of shelter is up 4.9% in the same period�on the heels of a 26.4% increase over the past five years according to the

Bureau of Labor Statistics. Connecticut workers, including municipal workers such as firefighters, teachers, and police officers, need housing they can afford. ousing costs have received national attention in recent months. While the Consumer Price Index measure of inflation

has abated in recent months, up just 2.6% in the year ending October 2024, the price of shelter is up 4.9% in the same period�on the heels of a 26.4% increase over the past five years according to the

Bureau of Labor Statistics. Connecticut workers, including municipal workers such as firefighters, teachers, and police officers, need housing they can afford.

Against this backdrop, Connecticut�s efforts to address housing costs precede the five-year increase in the cost of shelter. The Regional Fair Housing Compact1 and its statutory companion, the Connecticut

Housing Partnership Program2 represent incentive approaches to foster affordable housing development:

� The Regional Fair Housing Compact encourages development of regional goals for need-based affordable housing consistent with environmental, economic, and infrastructure conditions using guidance and technical assistance provided by the state Office of Policy and Management (OPM) and

� The Connecticut Housing Partnership Program provides incentives to increase the supply of affordable housing by giving program participants guidance and technical assistance3 while identifying resources in partnership with the state Department of Housing.

[ read more ]

|

|

|

|

October 2024 Connecticut Economic Digest |

|

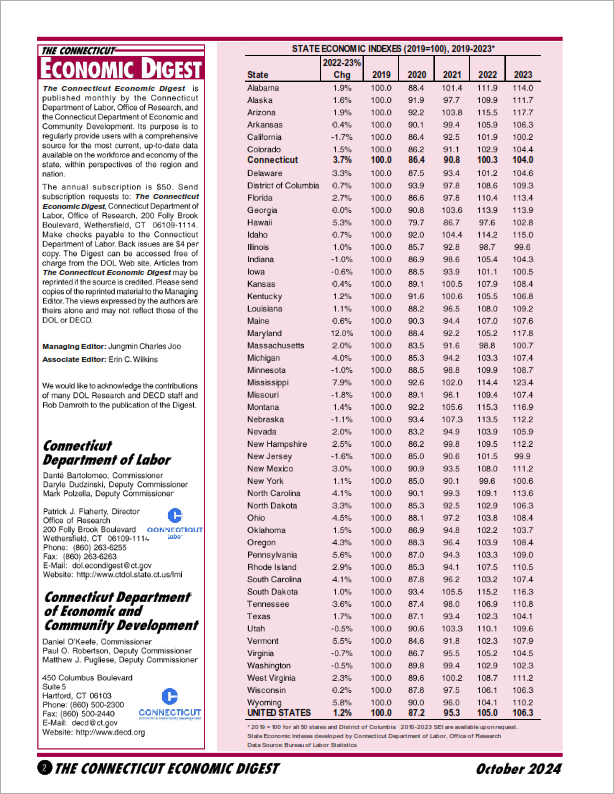

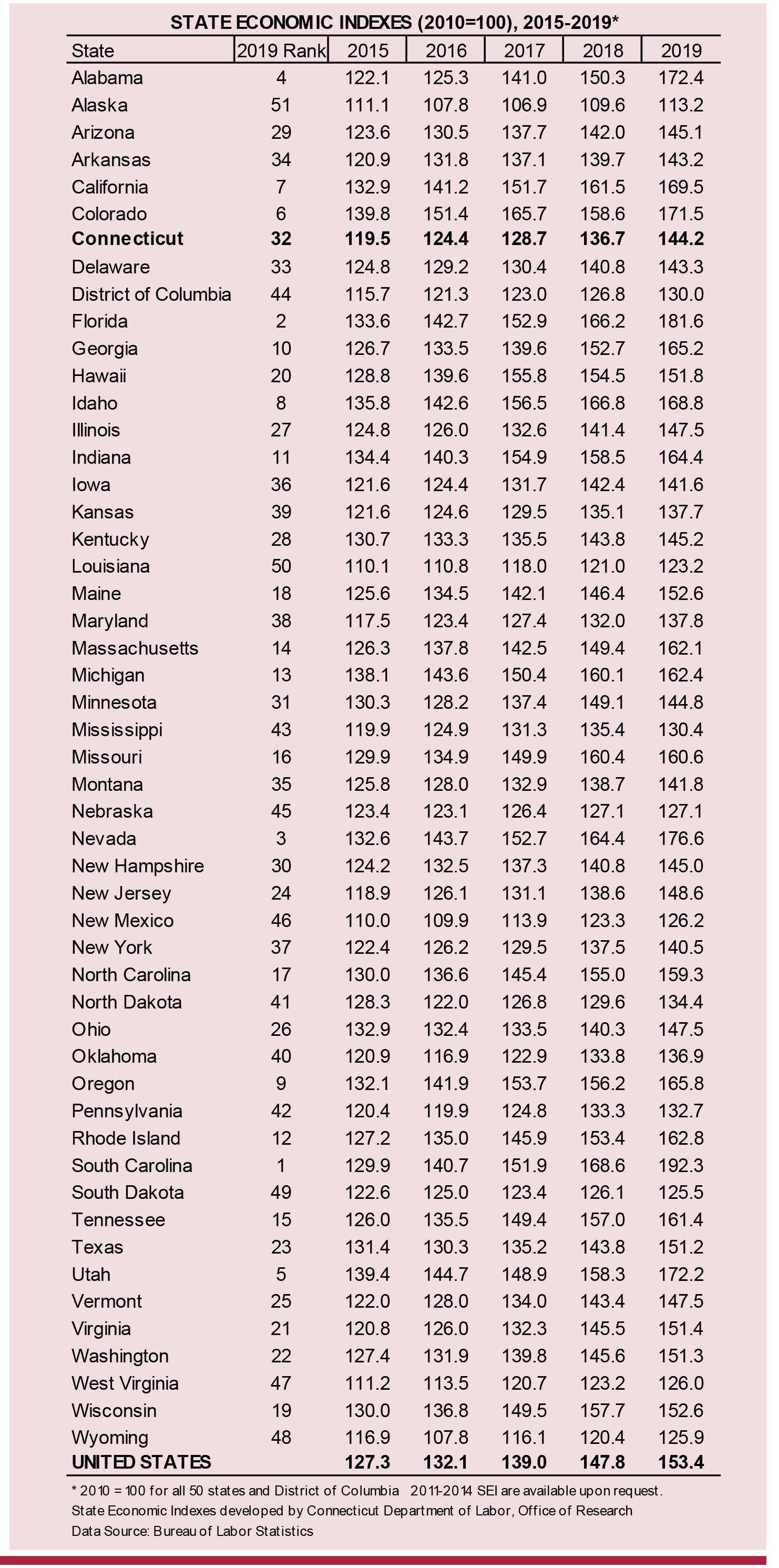

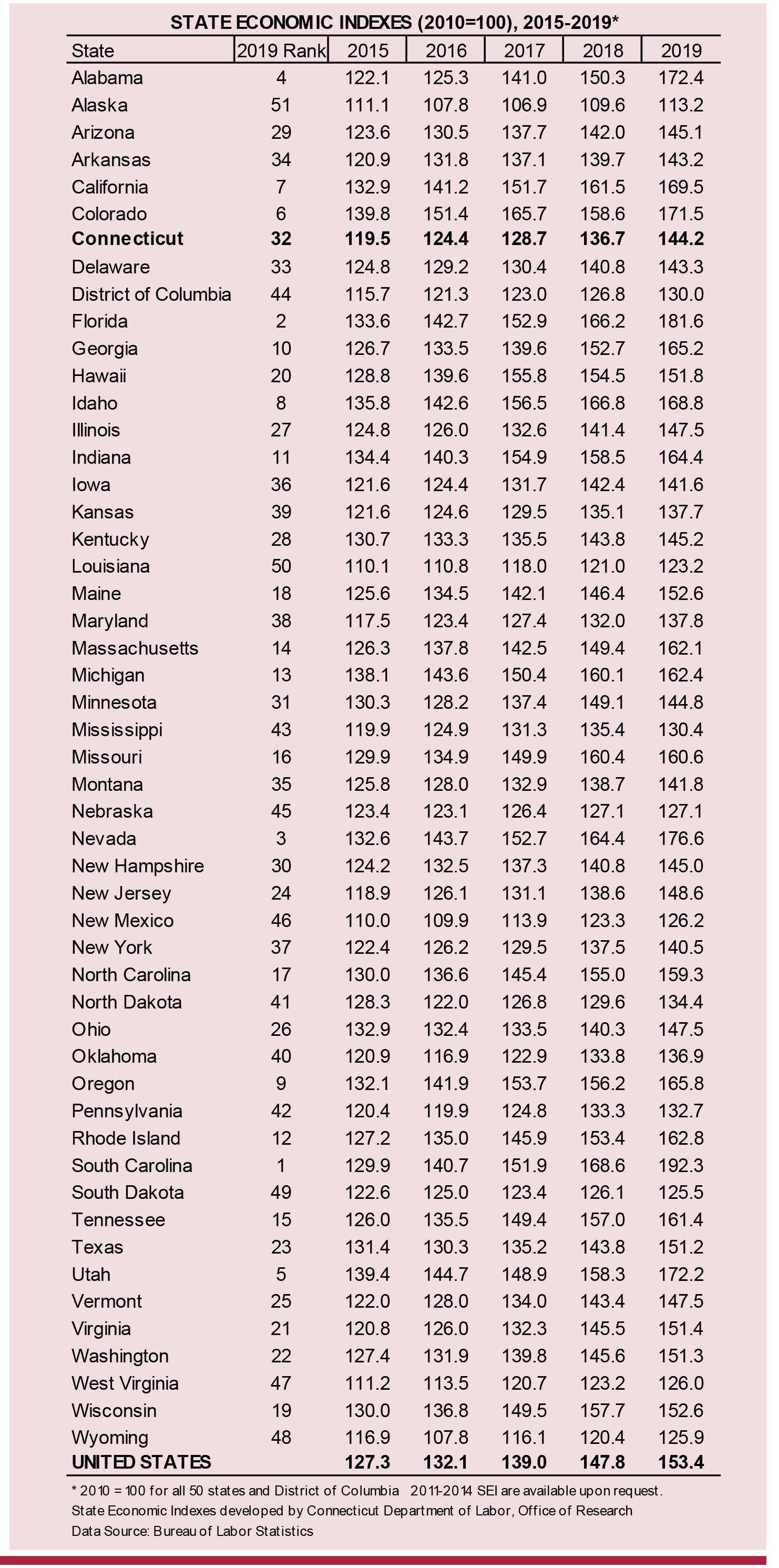

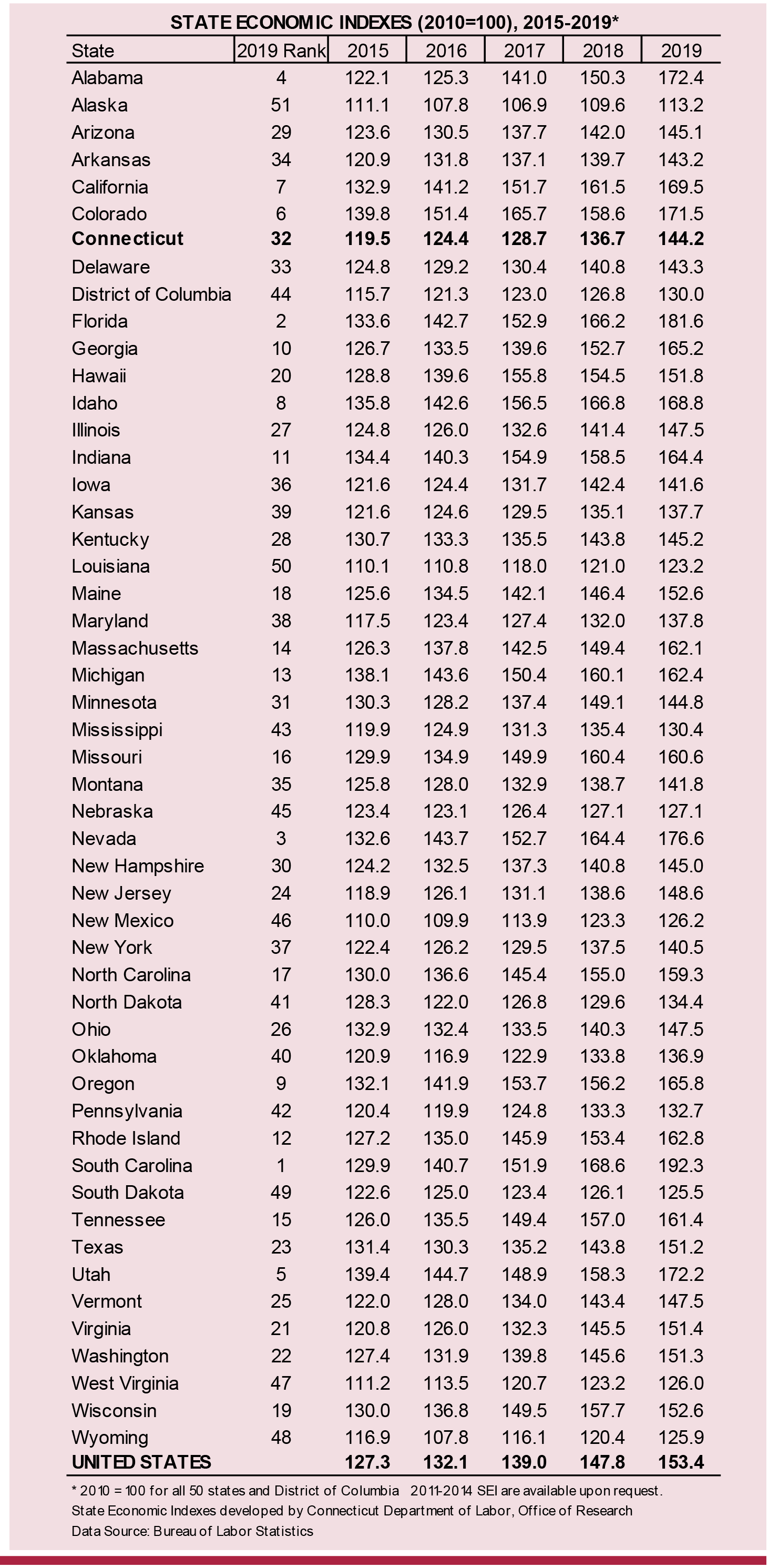

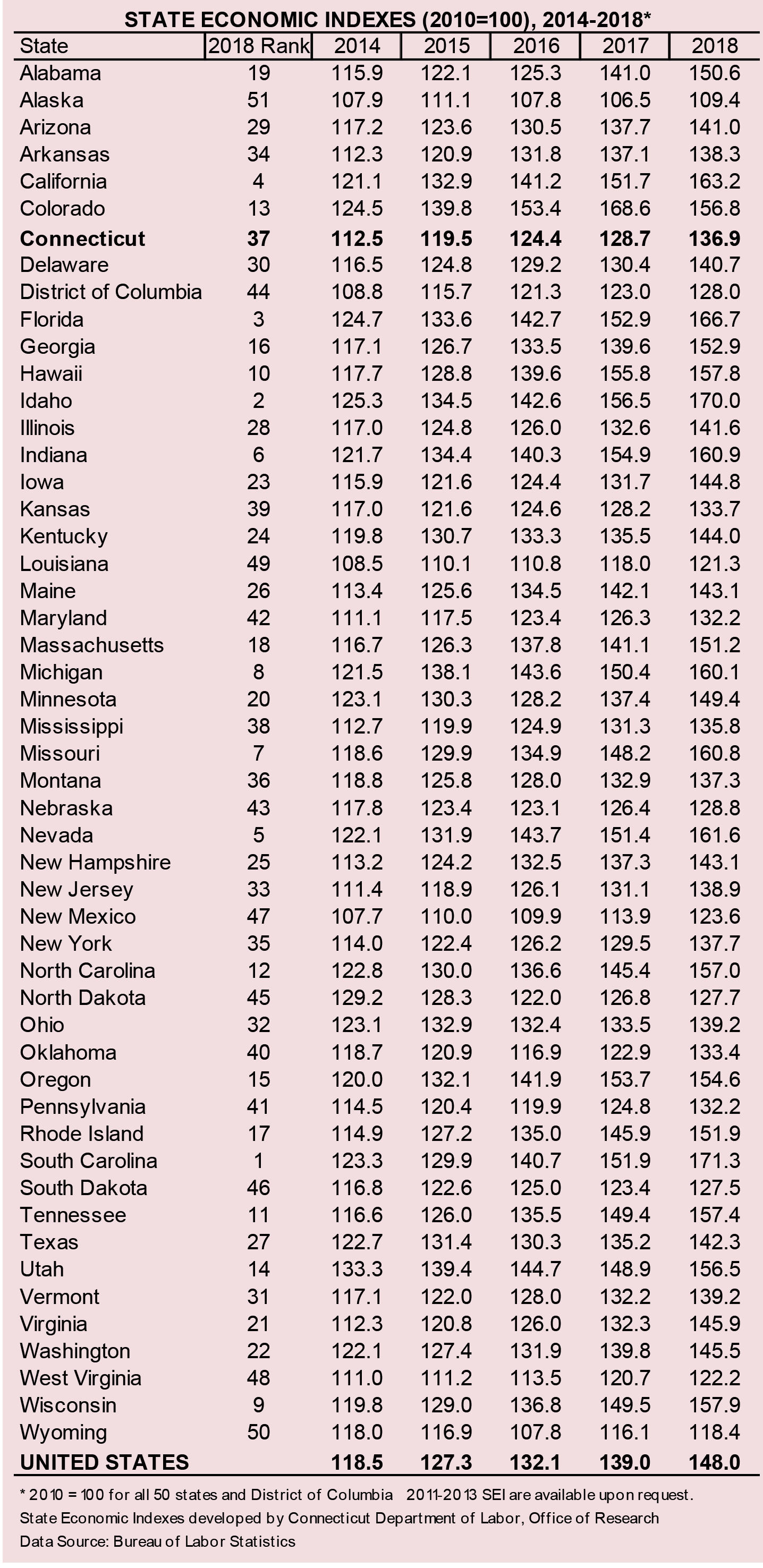

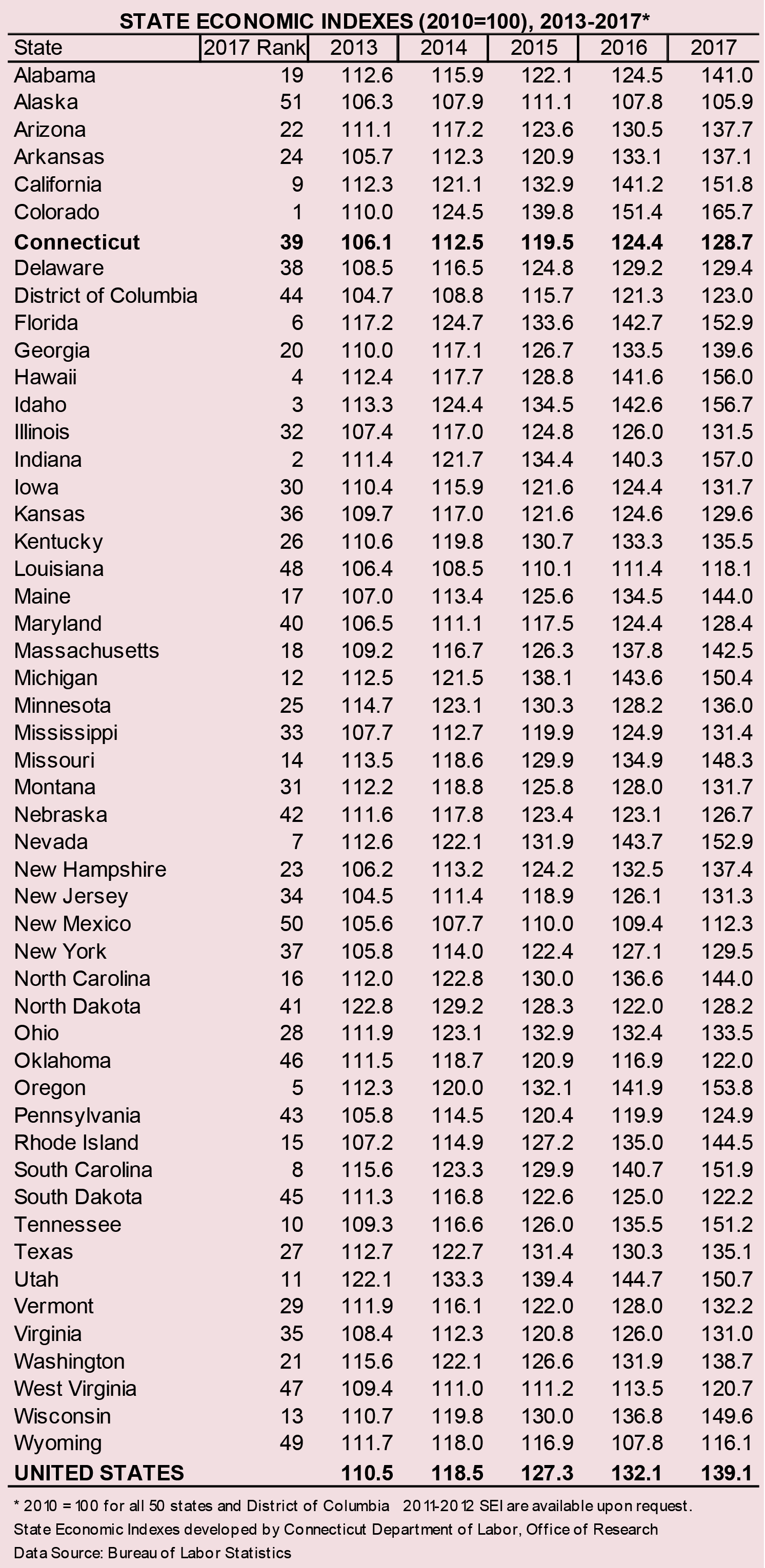

Connecticut State Economic Index Outpaces Nation in 2023

By Jungmin Charles Joo, and Dana Placzek

fter two years of all state indexes increasing, 2023 saw 10 out of 50 states and the District of Columbia experiencing a

drop over the year. However, all state indexes but two are above their 2019 levels (year before the pandemic shutdown). Connecticut had the twelfth-highest 2023 growth in the nation at 3.7%, exceeding the nation�s

1.2% increase. fter two years of all state indexes increasing, 2023 saw 10 out of 50 states and the District of Columbia experiencing a

drop over the year. However, all state indexes but two are above their 2019 levels (year before the pandemic shutdown). Connecticut had the twelfth-highest 2023 growth in the nation at 3.7%, exceeding the nation�s

1.2% increase.

SEI: Methodology

Applying the same components and methodology of the Connecticut Town Economic Indexes (See September 2024 issue), the Connecticut Department of Labor�s Office of Research also developed the State Economic Indexes for all 50 states

and DC. With recently available annual average data from the Quarterly Census Employment and Wages (QCEW) program, along with the revised annual average unemployment rate from Local Area Unemployment Statistics (LAUS), annual SEI is re-estimated for the 2010-2023 period.

These indexes provide a measure of the overall economic strength of each state that can be compared and ranked. Four annual average state economic indicators were used as components: 1. the number of the total covered business establishments, 2. total covered employment,

3. real covered wages, and 4. the unemployment rate. [ read more ]

Download SEI2010-2023data.xlsx

|

|

|

|

September 2024 Connecticut Economic Digest |

|

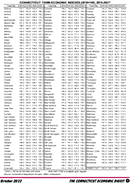

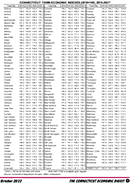

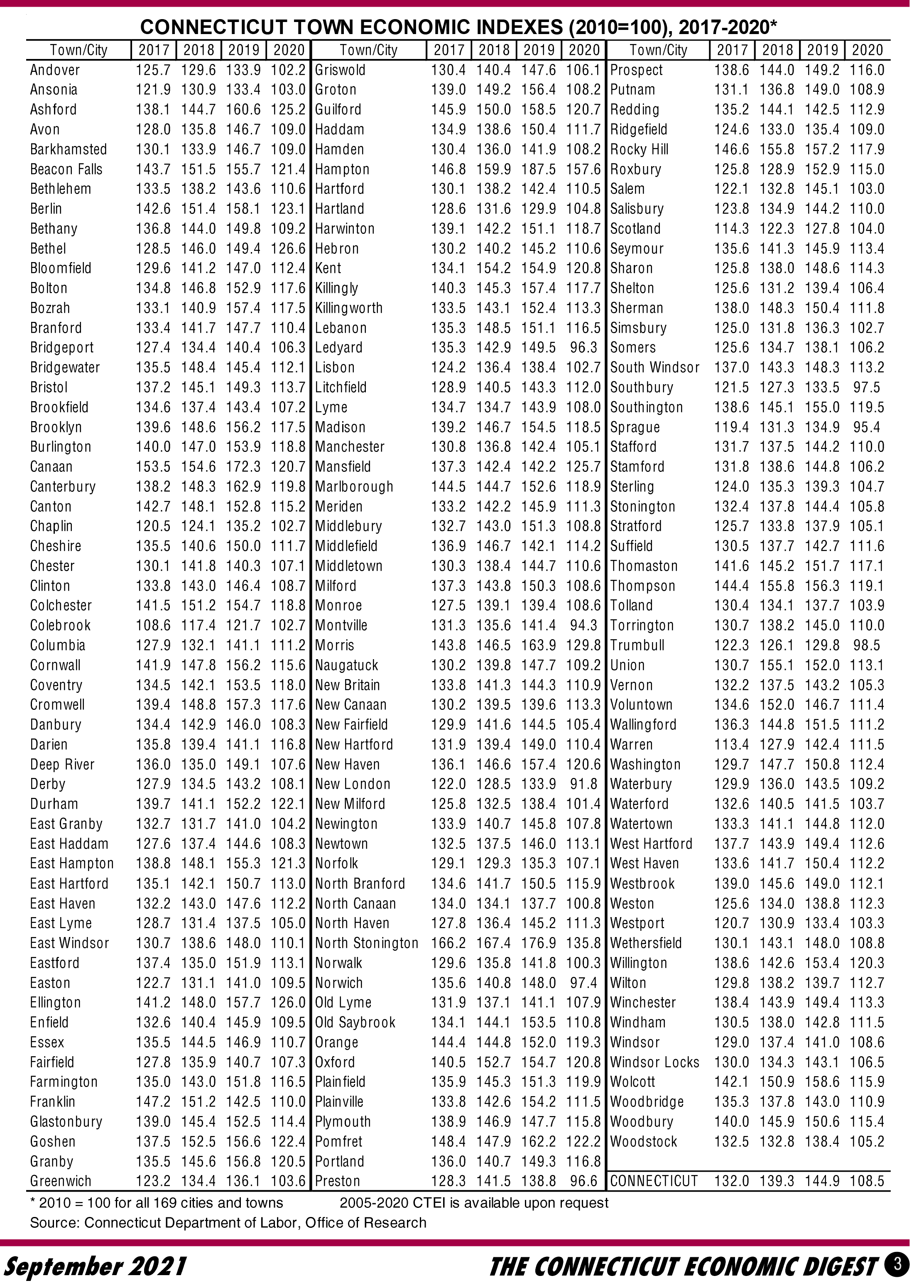

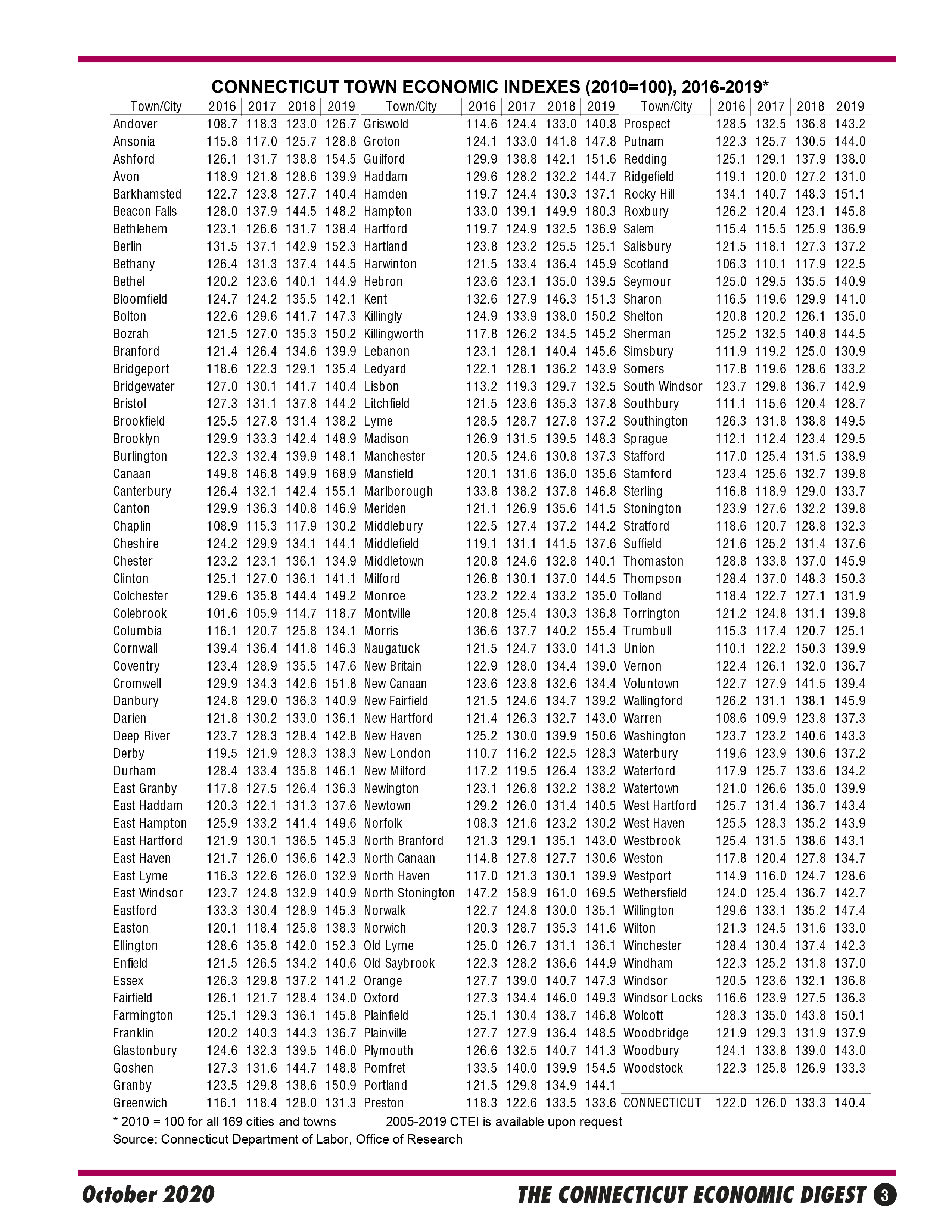

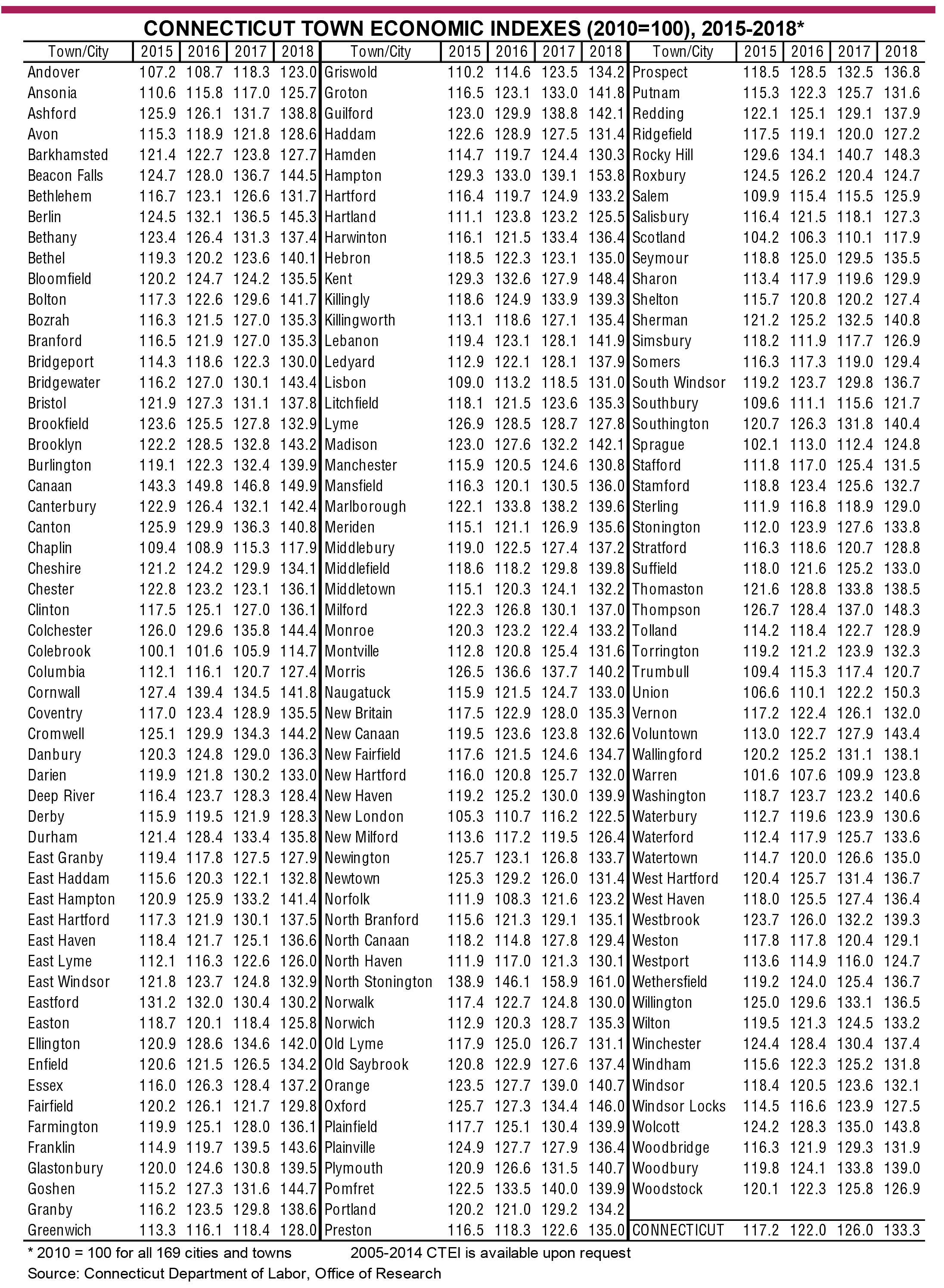

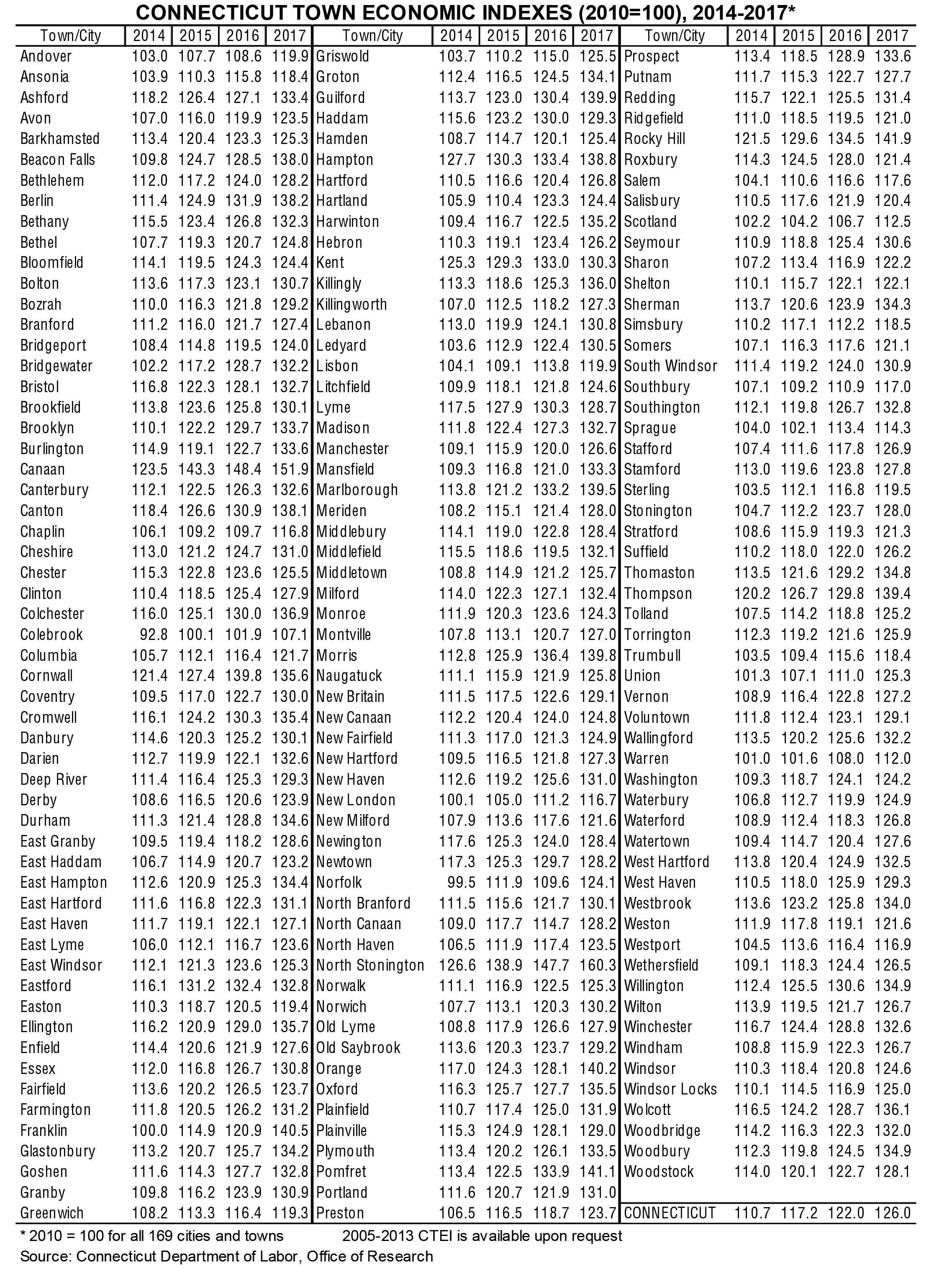

Connecticut Town Economic Indexes Grew in 2023

By Jungmin Charles Joo, and Dana Placzek

onnecticut's overall economy grew last year with nearly all towns seeing increases. Fully 136 of Connecticut's 169 cities and towns were above pre-COVID-19 pandemic (2019)

levels in 2023. The indexes on page 3 give a broad measure of business and resident economic well-being of each town, allowing comparisons among them. onnecticut's overall economy grew last year with nearly all towns seeing increases. Fully 136 of Connecticut's 169 cities and towns were above pre-COVID-19 pandemic (2019)

levels in 2023. The indexes on page 3 give a broad measure of business and resident economic well-being of each town, allowing comparisons among them.

The Connecticut Town Economic Indexes (CTEI) were introduced in 2015 and are released annually. The Connecticut Department of Labor�s Office of Research developed the

composite indexes of all 169 municipalities in the state to measure each town or city�s overall economic health, which then can be ranked and compared to others to gain

perspective. The four annual average town economic indicators used as components are total covered business establishments, total covered employment, inflation-adjusted

covered annual average wages, and the unemployment rate.

Establishments are the physical work units located in the municipality. Employment is the number of payroll employees in establishments that are located in the town. Wages are the aggregate payroll pay divided by the total average employment. [ read more ]

Download SEI2010-2023data.xlsx

|

|

|

|

August 2024 Connecticut Economic Digest |

|

Covered Employment and Wages: A 2023 Annual Review

By Jonathan Kuchta, Research Analyst, Department of Labor

ccording to the most recent data published by the Quarterly Census of Employment and Wages (QCEW) program, the number of jobs in Connecticut increased by 1.6 percent during 2023.1 Employment growth was modest in 2023 but continued the upward post-pandemic trend. Total private industry employment, constituting 86.8 percent of the state�s employment total, increased by 1.5 percent. Total government

employment increased by 2.0 percent. Connecticut has now recovered all the jobs lost during the pandemic, though some sectors have understandably fared better than others as business models change. ccording to the most recent data published by the Quarterly Census of Employment and Wages (QCEW) program, the number of jobs in Connecticut increased by 1.6 percent during 2023.1 Employment growth was modest in 2023 but continued the upward post-pandemic trend. Total private industry employment, constituting 86.8 percent of the state�s employment total, increased by 1.5 percent. Total government

employment increased by 2.0 percent. Connecticut has now recovered all the jobs lost during the pandemic, though some sectors have understandably fared better than others as business models change.

Average annual wages for all Connecticut jobs increased by 3.1 percent, to $83,773. In 2023, private sector wages increased by 3.1 percent to $84,948; government wages also increased 3.1 percent to $76,044.

New business establishments continued their significant growth, though they continue to be heavily influenced by registrations for teleworkers. New business starts were 14,210 in 2023, compared to 17,007 (revised) in 2022. Overall, establishments rose to 149,796 in 2023, an increase of 4.9 percent over 2022. [ read more ] |

|

|

|

July 2024 Connecticut Economic Digest |

|

Bioscience Industry Employment Trends, 2001-2023

By Matthew Krzyzek, Economist, Department of Labor

onnecticut's bioscience cluster includes advanced manufacturing and service sector Research and Development (R&D) industries focused on the design and production of pharmaceuticals and other medical equipment and technology. onnecticut's bioscience cluster includes advanced manufacturing and service sector Research and Development (R&D) industries focused on the design and production of pharmaceuticals and other medical equipment and technology.

Figure 1 shows annual average Bioscience employment from 2001 to 2023. Overall, Bioscience employment fell from 2001 to 2017, driven by declines in its manufacturing component industries. The combined Bioscience cluster grew 2.5% and 4.4% in 2018 and 2019. After a slight 0.3% dip from 2019 to 2020, the cluster grew by 6.2% and 5.1% in 2021 and 2022. Bioscience fell slightly in 2023, down 344 or -1.3% in 2023 but the number of establishments increased. [ read more ]

Occupational Profile: Electricians

By Jennifer Goddu, Research Analyst, Department of Labor

lectricians are skilled trade workers responsible for installing, maintaining, and repairing electrical wiring, equipment, and fixtures. Trained electricians ensure that electrical work is done in accordance with state and local building regulations based on the National Electrical Code. Enforced in all 50 states, NFPA 70, National Electrical Code, is the benchmark for safe electrical design, installation, and inspection to protect people and property from electrical hazards. Electricians work both indoors and outdoors at homes, businesses, factories, and construction sites. Duties may include installing electrical systems in newly constructed buildings or maintaining electrical equipment and systems. Maintenance work can include fixing or replacing parts, light fixtures, control systems and motors, or inspecting electrical components such as transformers and circuit breakers. Electricians read blueprints of electrical systems that show the location of circuits, outlets, and other equipment. They use a variety of tools to perform their jobs, such as conduit benders, wire strippers, screw drivers, pliers, and drills. Electricians also use a variety of testing equipment such as voltmeters, ohmmeters, ammeters, thermal scanners, and cable testers to identify electrical problems and ensure components are working properly. [ read more ] lectricians are skilled trade workers responsible for installing, maintaining, and repairing electrical wiring, equipment, and fixtures. Trained electricians ensure that electrical work is done in accordance with state and local building regulations based on the National Electrical Code. Enforced in all 50 states, NFPA 70, National Electrical Code, is the benchmark for safe electrical design, installation, and inspection to protect people and property from electrical hazards. Electricians work both indoors and outdoors at homes, businesses, factories, and construction sites. Duties may include installing electrical systems in newly constructed buildings or maintaining electrical equipment and systems. Maintenance work can include fixing or replacing parts, light fixtures, control systems and motors, or inspecting electrical components such as transformers and circuit breakers. Electricians read blueprints of electrical systems that show the location of circuits, outlets, and other equipment. They use a variety of tools to perform their jobs, such as conduit benders, wire strippers, screw drivers, pliers, and drills. Electricians also use a variety of testing equipment such as voltmeters, ohmmeters, ammeters, thermal scanners, and cable testers to identify electrical problems and ensure components are working properly. [ read more ]

|

|

|

|

June 2024 Connecticut Economic Digest |

|

Connecticut Housing Market Trends

By Matthew Krzyzek, Economist, Department of Labor

n the years after the brief 2020 COVID-recession, Connecticut has experienced numerous shifts that have impacted the housing market. Inventory is down, prices are increasing, and multi-unit construction has become a majority of new housing development in the state.

From 2017-2019, the pre-COVID housing monthly inventory ranged between 14,000 and 20,000 units in the state. After 2020, inventories tracked downward through 2024 and reached a low of 3,071 by February 2024. Part of the inventory decline is due to the large decrease in the time that a home is on the market. The median number of days a home was on the market in Connecticut from 2017-2019 ranged between about 50 days during peak summer months to a high of over 80 days during January of those years. After 2020, the median number of days on the market reached a low of 18 in May 2022. As inventory fell, buyers had fewer options and were eager to secure a sale, which helped shorten listing duration, further reducing inventory. In April 2024, statewide inventory was 3,432 and homes were on the market for a median of 32 days. Five years earlier (April 2019), inventory was over 15,000 and homes were on the market for a median of 53 days. [ read more ] n the years after the brief 2020 COVID-recession, Connecticut has experienced numerous shifts that have impacted the housing market. Inventory is down, prices are increasing, and multi-unit construction has become a majority of new housing development in the state.

From 2017-2019, the pre-COVID housing monthly inventory ranged between 14,000 and 20,000 units in the state. After 2020, inventories tracked downward through 2024 and reached a low of 3,071 by February 2024. Part of the inventory decline is due to the large decrease in the time that a home is on the market. The median number of days a home was on the market in Connecticut from 2017-2019 ranged between about 50 days during peak summer months to a high of over 80 days during January of those years. After 2020, the median number of days on the market reached a low of 18 in May 2022. As inventory fell, buyers had fewer options and were eager to secure a sale, which helped shorten listing duration, further reducing inventory. In April 2024, statewide inventory was 3,432 and homes were on the market for a median of 32 days. Five years earlier (April 2019), inventory was over 15,000 and homes were on the market for a median of 53 days. [ read more ]

Most Towns Experienced Decreases in the Unemployment Rate in 2023

By Jungmin Charles Joo, Department of Labor

n 2023, the annual average statewide unemployment rate was 3.8%, down from 4.1% in 2022. As the labor force bounced back for the third year from the impact of the COVID-19 pandemic, most of the municipalities continued to experience a decrease in their unemployment rate last year. n 2023, the annual average statewide unemployment rate was 3.8%, down from 4.1% in 2022. As the labor force bounced back for the third year from the impact of the COVID-19 pandemic, most of the municipalities continued to experience a decrease in their unemployment rate last year.

2022 to 2023

The unemployment rate in 89% of the cities and towns in the state fell in 2023. Washington had the lowest unemployment rate of 2.3%, while the residents of Waterbury experienced the highest rate of 5.9% last year (see table on page 3 for the complete town data). Overall, a total of 131 cities and towns had jobless rates below the 2023 statewide figure of 3.8%, 30 had rates above it, and 8 had rates equal to it. By comparison, 125 cities and towns had rates below the 2022 statewide average of 4.1%, 38 above it, and 6 were the same.

Of the five largest cities in the state with a population of 100,000 or more, Stamford had the lowest unemployment rate of 3.5% in 2023. Waterbury posted the highest jobless rate among the large cities at 5.9%. All five cities experienced over-the-year unemployment rate decreases. [ read more ]

|

|

|

|

May 2024 Connecticut Economic Digest |

|

Short-Term Employment Projected to Grow Modestly Through 2025

By Matthew Krzyzek, Economist, Department of Labor

onnecticut's economy is projected to add almost 30,000 jobs through the end of the short-term projections period (2nd quarter 2025). In addition to that net increase, the state is projected to have over 425,000 openings across all occupational categories and every educational level. The industries driving this growth include Health Care, Educational Services, Manufacturing, and Transportation & Warehousing. Through 2025Q2, we project overall employment in Connecticut to increase by 1.6% from 1,824,865 to 1,854,557 including self-employment and unpaid family workers (UFW). The Goods-Producing sector is projected to grow by 2.1% and the Service-Providing sector is projected to grow by 1.5% over two years. This latter sector represents 86.6% of industry employment in the state. The current projections round spans the second quarter of 2023 to the second quarter of 2025. onnecticut's economy is projected to add almost 30,000 jobs through the end of the short-term projections period (2nd quarter 2025). In addition to that net increase, the state is projected to have over 425,000 openings across all occupational categories and every educational level. The industries driving this growth include Health Care, Educational Services, Manufacturing, and Transportation & Warehousing. Through 2025Q2, we project overall employment in Connecticut to increase by 1.6% from 1,824,865 to 1,854,557 including self-employment and unpaid family workers (UFW). The Goods-Producing sector is projected to grow by 2.1% and the Service-Providing sector is projected to grow by 1.5% over two years. This latter sector represents 86.6% of industry employment in the state. The current projections round spans the second quarter of 2023 to the second quarter of 2025.

Projections by Industry

Each year, the Office of Research at the Connecticut Department of Labor produces short-term employment projections by industry and occupation. Among the 20 industry groups shown in Figure 1 (page 3), 16 are projected to increase over two years and 4 are projected to decline. The largest increases are expected in Health Care (+9,255), Educational Services (+2,954), Manufacturing (+2,787), and Transportation & Warehousing (+2,692). [ read more ] |

|

|

|

April 2024 Connecticut Economic Digest |

|

Exports Grew for the Third Year

By Laura Jaworski, Office of Business Development, DECD

onnecticut exports grew for the third consecutive year in 2023. Commodity exports increased 3.13% over 2022, totaling over $15.82 billion. More Connecticut companies are exporting as well. The most recent data indicates that 4,761 companies exported from Connecticut in 2021, up from 4,606 companies in 2020. 89% of these companies were small and medium-sized enterprises (SMEs) with fewer than 500 employees. According to the most recent data, approximately 50,705 U.S. jobs were supported by Connecticut exports. onnecticut exports grew for the third consecutive year in 2023. Commodity exports increased 3.13% over 2022, totaling over $15.82 billion. More Connecticut companies are exporting as well. The most recent data indicates that 4,761 companies exported from Connecticut in 2021, up from 4,606 companies in 2020. 89% of these companies were small and medium-sized enterprises (SMEs) with fewer than 500 employees. According to the most recent data, approximately 50,705 U.S. jobs were supported by Connecticut exports.

Connecticut Partner Countries

In 2023, the state's top ten commodity export destinations were Germany, Canada, the Netherlands, the United Kingdom, Mexico, France, China, Singapore, South Korea, and Japan. Among the top ten destinations, except for the U.K., Mexico, and France, all experienced export growth. Exports to the U.K. dropped most significantly, down 19.59% over 2022.

In 2023, there were decreases in many of the top ten Connecticut export commodity sectors to the United Kingdom, the largest being in the aircraft, spacecraft, and parts sector. A potential reason for this is continued regulatory challenges of Brexit and customs barriers. Higher inflation and rising energy prices in the United Kingdom have also shifted consumer goods spending. [ read more ]

Connecticut's Population Gains

By Patrick.Flaherty, Director of Research, Department of Labor

he latest population estimates from the U.S. Census Bureau show that Connecticut's population increased by 8,470 in 2023 with births outnumbering deaths by 2,115 and net migration from other states and countries totaling 6,248. While it will be some months before a breakdown by state and age will be available for 2023, the available data through 2022 show encouraging signs for Connecticut. [ read more ] he latest population estimates from the U.S. Census Bureau show that Connecticut's population increased by 8,470 in 2023 with births outnumbering deaths by 2,115 and net migration from other states and countries totaling 6,248. While it will be some months before a breakdown by state and age will be available for 2023, the available data through 2022 show encouraging signs for Connecticut. [ read more ]

|

|

|

|

March 2024 Connecticut Economic Digest |

|

Connecticut's Economy in 2023 Shows Growth over 2022

By Jungmin Charles Joo, Associate Research Analyst, Department of Labor

onnecticut employment continued to grow for the third year in a row, nearly completely recovering to the pre-pandemic levels in 2023. (The January 2024 jobs numbers, released in March, show jobs have more than fully recovered from pandemic losses.) The revised annual average total nonfarm employment rose 1.6% to a level of 1,694,200 in 2023. Correspondingly, last year's annual average unemployment rate dropped further to 3.8% from 4.1% in 2022. Overall, the 2023 economy continued to recover moderately as per the annual diffusion index. onnecticut employment continued to grow for the third year in a row, nearly completely recovering to the pre-pandemic levels in 2023. (The January 2024 jobs numbers, released in March, show jobs have more than fully recovered from pandemic losses.) The revised annual average total nonfarm employment rose 1.6% to a level of 1,694,200 in 2023. Correspondingly, last year's annual average unemployment rate dropped further to 3.8% from 4.1% in 2022. Overall, the 2023 economy continued to recover moderately as per the annual diffusion index.

Nonfarm Employment

After the latest annual revision (based on annual average, not seasonally adjusted data), in 2023 Connecticut regained 26,100 jobs (1.6%), fewer than the gain of 51,800 jobs (3.2%) in 2022. In the nation employment rose 2.3% in 2023, after having increased 4.3% in 2022.

As shown in Chart 1, most of Connecticut's industry sectors continued to add jobs last year. Eight of eleven major industry sectors have gained employment over the year, while three shed jobs. The biggest job growth occurred in education and health services (13,200, +3.9%), and leisure and hospitality (4,200, +2.8%). However, information (-300, -1.0%), professional and business services (-900, -0.4%), and financial activities (-200, -0.2%) posted slight declines in employment in 2023. [ read more ]

|

|

|

|

February 2024 Connecticut Economic Digest |

|

Connecticut's Work-Related Fatality Rate Second Lowest in Nation for Two Years in a Row

By Erin C. Wilkins, Associate Research Analyst, Department of Labor

onnecticut lost 34 lives to work injuries in 2022, for a rate of 2.0 deaths per 100,000 full-time equivalent workers. This is an increase from 2021's 23 deaths but is below Connecticut's annual average of 38 work-related deaths (Chart 1). Only one other state - Rhode Island - recorded a rate lower than Connecticut's (Table 1). onnecticut lost 34 lives to work injuries in 2022, for a rate of 2.0 deaths per 100,000 full-time equivalent workers. This is an increase from 2021's 23 deaths but is below Connecticut's annual average of 38 work-related deaths (Chart 1). Only one other state - Rhode Island - recorded a rate lower than Connecticut's (Table 1).

The nation lost 5,486 lives to workplace injuries in 2022, an increase from 2021's 5,190 deaths. The fatal injury rate increased from 3.6 per 100,000 full-time equivalent workers in 2021 to 3.7 in 2022. The highest loss was seen in Texas with 578 deaths, followed by California with 504 deaths and Florida with 307 deaths. High rates were recorded in Wyoming (12.7) and North Dakota (9.8). Rhode Island had 7 deaths, the lowest recorded number for states.

Industry

Nationally, the construction industry recorded the highest number of deaths at 1,069 followed by transportation and warehousing with 1,053 deaths. Together, these two industries account for 39 percent of deaths.

The construction industry and the transportation and warehousing industry each had 9 deaths in Connecticut. Together, they accounted for 53 percent of 2022's deaths. Manufacturing came in third with 4 deaths, or 11.8 percent of total deaths (Table 2). With an overall rate of 2.0, Connecticut saw a rate of 9.4 in transportation and utilities and 6.7 in construction. Rates for other industry sectors did not meet publishing criteria. [ read more ] |

|

|

|

January 2024 Connecticut Economic Digest |

|

2024 Economic Outlook: An Uncommonly Ordinary Year?

By Steven P. Lanza, Associate Professor-in-Residence, UConn Department of Economics

he past several years have witnessed some extraordinary economic events. In 2020, a once-in-a-century virus triggered a near-collapse of the world economy. In 2021 real output grew at a breakneck pace as populations gained immunity against Covid and went back to work. In 2022 living costs jumped higher than at any time in more than a generation. Then in 2023, against all odds, price pressures were brought to heel without the feared sacrifice of high unemployment and reduced output. Now, with inflation nearly tamed, monetary authorities set to reverse rate hikes, and output and job growth on course to track closer to historical trends, 2024 is shaping up to be an uncommonly ordinary year. he past several years have witnessed some extraordinary economic events. In 2020, a once-in-a-century virus triggered a near-collapse of the world economy. In 2021 real output grew at a breakneck pace as populations gained immunity against Covid and went back to work. In 2022 living costs jumped higher than at any time in more than a generation. Then in 2023, against all odds, price pressures were brought to heel without the feared sacrifice of high unemployment and reduced output. Now, with inflation nearly tamed, monetary authorities set to reverse rate hikes, and output and job growth on course to track closer to historical trends, 2024 is shaping up to be an uncommonly ordinary year.

The Global Economy

Following a 3.5% rise in world output in 2022, the International Monetary Fund (IMF) projects that global growth will slow to 3.0% 2023, and to 2.9% in 2024, below the 20-year annual average of 3.8%. The IMF outlook hinges on the assumptions that fuel and nonfuel commodity prices will ease in response to the slowdown in world economic activity, interest rates will peak and begin to inch downward in 2024 as major central banks begin to reduce rates, and 2024 will be a year of "fiscal consolidation" in developed and emerging economies alike, with fiscal tightening expected to be greatest among those countries that saw the largest increases in government debt in response to the pandemic. The IMF characterizes its overall outlook as consistent with a much-desired "soft landing" wherein price levels continue to ease while a major economic downturn is averted.

Beneath these topline projections, however, lies a divergence between the emerging and developed worlds. For the advanced economies, including the United States and Western Europe, output is expected to slow from 2.6% in 2022 to 1.5% in 2023 and 1.4% in 2024 (well below the 20-year annual average of more than 2%). In emerging markets and developing economies, growth is expected to largely hold steady, from 4.1% in 2022 to 4.0% in both 2023 and 2024. Even so, those rates of growth remain below the 20-year trend of over 5% annually. [ read more ] |

|

|

|

|

|

|

|

|

December 2023 Connecticut Economic Digest |

|

Summary of Boston Consulting Group's Report: "Getting Young People Back on Track"

By Xian Guan, Associate Research Analyst, Department of Labor

n October 2023, the Boston Consulting Company (BCG) released "Getting Young People Back on Track," an important blueprint for identifying and re-engaging disconnected and at-risk youth. The report was produced using data from the state's P20 WIN project and reached audiences including policymakers, youth services professionals, safety net service agencies, and media outlets. To further the efforts to reach at-risk young people, the Connecticut Department of Labor (CTDOL) presents the report's key findings followed by a synopsis of how the underlying data was compiled through the Connecticut longitudinal data system, P20 WIN. Additionally, CTDOL's Research Unit, a P20 WIN partner, offers three data-driven recommendations for future research. n October 2023, the Boston Consulting Company (BCG) released "Getting Young People Back on Track," an important blueprint for identifying and re-engaging disconnected and at-risk youth. The report was produced using data from the state's P20 WIN project and reached audiences including policymakers, youth services professionals, safety net service agencies, and media outlets. To further the efforts to reach at-risk young people, the Connecticut Department of Labor (CTDOL) presents the report's key findings followed by a synopsis of how the underlying data was compiled through the Connecticut longitudinal data system, P20 WIN. Additionally, CTDOL's Research Unit, a P20 WIN partner, offers three data-driven recommendations for future research.

At-Risk and Disconnected Young People

"Getting Young People Back on Track" concluded that during the 2021-2022 school year Connecticut had 119,000 youth between 14-26 years old who are either disconnected or at risk. Using the below definitional framework, this total is comprised of 63,000 disconnected and 56,000 at-risk youth.

On-track: young people aged 14-26 who are engaged in the educational system or on-track for gainful employment.

At-risk: three sub-populations-off-track, those students who do not meet state credit attainment requirements; at-risk due to other factors, such as absenteeism and/or behavioral issues; and severely off-track, those students are off-track and display additional risk factors. [ read more ] [ read more ]

|  |

|

|

November 2023 Connecticut Economic Digest |

|

The Evolution of Zoning

By Al Sylvestre, Research Analyst, Department of Labor

bnoxious sounds, smells, and danger from manufacturing, farming, and mining are high on the list of things we want to keep from our bedrooms, kitchens, and living spaces. Methods for achieving this evolved over time to be embodied in what land use planners call Euclidean zoning that is by turns confounding, controversial, mystifying, and aspirational. What follows is a brief examination of how zoning has become a useful tool even as its application can become an economic trap for real estate developers, regulators, small businesses, and residents. While the challenges of housing affordability and sprawl are daunting, the aforementioned planners, together with public officials, real estate developers, and community financial institutions, are formulating responses designed to give rise to communities of human scale that encourage interaction among their inhabitants. bnoxious sounds, smells, and danger from manufacturing, farming, and mining are high on the list of things we want to keep from our bedrooms, kitchens, and living spaces. Methods for achieving this evolved over time to be embodied in what land use planners call Euclidean zoning that is by turns confounding, controversial, mystifying, and aspirational. What follows is a brief examination of how zoning has become a useful tool even as its application can become an economic trap for real estate developers, regulators, small businesses, and residents. While the challenges of housing affordability and sprawl are daunting, the aforementioned planners, together with public officials, real estate developers, and community financial institutions, are formulating responses designed to give rise to communities of human scale that encourage interaction among their inhabitants.

As people grew accustomed to living in group settlements, the walled cities of antiquity became places in which their denizens lived, worshipped, and carried out their civic business. Land outside the walls was reserved for the slaughter and rendering of animals, waste disposal, brick firing, mining, and other forms of extraction; the aboriginal form of zoning that separated incompatible land uses as shown in illustration 1 thus came into being. As populations grew and occupied ever more land, the protozoan form of cities, suburbs, and rural areas began to take shape where earth, space, vegetation, or any combination thereof came to serve as buffers separating incompatible land uses. As most work took place within the home before the industrial revolution of 1760 to 1840, residential areas in settlements of the time were centers of labor and commerce that gave rise to an urban environment of mixed residential and commercial land uses. The industrial revolution brought with it more intensive land uses such as manufacturing that took place in single large structures, on campuses, and within interconnected complexes occupied by up to thousands of workers gathered for labor that included assembly, slaughter and rendering of animals, and the processing of sewage and storm-water runoff. The scale at which industry did its work made the separation of working and living spaces a more urgent proposition; enter the concept of Euclidean zoning. [ read more ] |

|

|

|

October 2023 Connecticut Economic Digest |

|

All State Economic Indexes Rose Again in 2022

By Jungmin Charles Joo, Department of Labor and Dana Placzek, Research, Department of Labor

or the second year in a row, all state economic indexes increased last year. Connecticut had the twelfth-highest 2022 growth in the nation at 17.8%, exceeding the nation's 17.6% increase. Rhode Island, Colorado, Missouri, and New Jersey grew the most in 2022 while Washington, Kentucky, Nebraska, and Utah were the slowest. or the second year in a row, all state economic indexes increased last year. Connecticut had the twelfth-highest 2022 growth in the nation at 17.8%, exceeding the nation's 17.6% increase. Rhode Island, Colorado, Missouri, and New Jersey grew the most in 2022 while Washington, Kentucky, Nebraska, and Utah were the slowest.

SEI: Methodology

Applying the same components and methodology of the Connecticut Town Economic Indexes (See September 2023 issue), the Connecticut Department of Labor's Office of Research also developed the State Economic Indexes for all 50 states and DC. With recently available annual average data from the Quarterly Census Employment and Wages (QCEW) program, along with the revised annual average unemployment rate from Local Area Unemployment Statistics (LAUS), annual SEI is reestimated for the 2010-2022 period.

These indexes provide a measure of the overall economic strength of each state that can be compared and ranked. Four annual average state economic indicators were used as components: 1. the number of the total covered business establishments, 2. total covered employment, 3. real covered wages, and 4. the unemployment rate.

Business establishments are the physical work units located in the state. Employment is the number of payroll employees in the establishments that are located in the state who are covered under the unemployment insurance law (nearly the universe count of all the payroll employees in each state). Average annual pay is the aggregate wages earned divided by the total average employment. Establishments, employment, and wages are proxies for each state's business activities and its overall economic strength, while the unemployment rate measures the overall economic health of each state's working residents. [ read more ]

Download SEI 2010-2022 data.xlsx |

|

|

|

September 2023 Connecticut Economic Digest |

|

All of Connecticut Town Economic Indexes Recover in 2022

By Jungmin Charles Joo, Department of Labor and Dana Placzek, Research, Department of Labor

onnecticut's overall economy bounced back last year, as all municipalities' indexes rose in 2022, a recovery for all 169 cities and towns that fell in 2020 from the effects of the COVID-19 pandemic. The indexes on page 3 give a broad measure of business and resident economic well-being of each town, allowing comparisons among them. onnecticut's overall economy bounced back last year, as all municipalities' indexes rose in 2022, a recovery for all 169 cities and towns that fell in 2020 from the effects of the COVID-19 pandemic. The indexes on page 3 give a broad measure of business and resident economic well-being of each town, allowing comparisons among them.

The CTEI Methodology

The Connecticut Town Economic Indexes (CTEI) were introduced in 2015 and are released annually. The Connecticut Department of Labor's Office of Research developed the composite indexes of all 169 municipalities in the state to measure each town or city's overall economic health, which then can be ranked and compared to others to gain perspective. The four annual average town economic indicators used as components are total covered business establishments, total covered employment, inflation-adjusted covered annual average wages, and the unemployment rate.

Establishments are the physical work units located in the municipality. Employment is the number of payroll employees in establishments that are located in the town. Wages are the aggregate payroll pay divided by the total average employment. These three measures come from the Quarterly Census of Employment and Wages (QCEW) program and include all those who are covered under the unemployment insurance law, thus capturing nearly 100 percent of all payroll employees in each town. [ read more ]

Download CTEI 2005-2022 data.xlsx |

|

|

|

August 2023 Connecticut Economic Digest |

|

Covered Employment and Wages: A 2022 Annual Review

By Jonathan Kuchta, Research Analyst, Department of Labor

ccording to the most recent data published by the Quarterly Census of Employment and Wages (QCEW) program, the number of jobs in Connecticut increased by 3.2 percent during 2022.1 A combination of employment returning from pandemic losses and a strong job market contributed to this increase. Total private industry employment, constituting 86.9 percent of the state's employment total, increased by 3.4 percent. Total government employment increased slightly by 1.6 percent. Since the economic shutdown in March 2020, Connecticut has recovered nearly all the jobs lost, though some sectors have understandably fared better than others. ccording to the most recent data published by the Quarterly Census of Employment and Wages (QCEW) program, the number of jobs in Connecticut increased by 3.2 percent during 2022.1 A combination of employment returning from pandemic losses and a strong job market contributed to this increase. Total private industry employment, constituting 86.9 percent of the state's employment total, increased by 3.4 percent. Total government employment increased slightly by 1.6 percent. Since the economic shutdown in March 2020, Connecticut has recovered nearly all the jobs lost, though some sectors have understandably fared better than others.

Average annual wages for all Connecticut jobs increased by 4.4 percent, to $81,241. In 2022, private sector wages increased by 4.5 percent to $82,373; government wages increased 3.2 percent to $73,754.

Like 2021, new business establishment creation was up significantly compared to pre-pandemic, as new firms continue to explore new opportunities. New business starts were 16,459 in 2022, compared to 16,978 (revised) in 2021. Overall, establishments rose to 142,858 in 2022, an increase of 6.7 percent over 2021. Total private establishments represented nearly all of the increase, reaching 139,442 in 2022. Government worksites increased 1.5 percent in the state, from 3,374 in 2021 to 3,424 in 2022. [ read more ] |

|

|

|

July 2023 Connecticut Economic Digest |

|

Improved Trade Momentum Continues into 2022

By Laura Jaworski, Office of International and Domestic Business Development, DECD

mproved trade momentum coming out of 2021 carried into 2022. Geopolitical issues influenced the global trade scene, namely the Russian war on Ukraine, as sanctions were imposed, supply chains disrupted, and countries looked to purchase more energy from the U.S. Rising interest rates, inflation, higher energy prices, labor shortages, and increased transportation and logistics costs continued to impact supply and demand conditions as well as consumer spending. With this background in mind, the following is a review of the state's 2022 export performance. mproved trade momentum coming out of 2021 carried into 2022. Geopolitical issues influenced the global trade scene, namely the Russian war on Ukraine, as sanctions were imposed, supply chains disrupted, and countries looked to purchase more energy from the U.S. Rising interest rates, inflation, higher energy prices, labor shortages, and increased transportation and logistics costs continued to impact supply and demand conditions as well as consumer spending. With this background in mind, the following is a review of the state's 2022 export performance.

Annual Export Figures

In Annual 2022, Connecticut commodity exports increased 5.47% over 2021, totaling over $15.34 billion. Please refer to the associated tables for greater detail on the state's export composition. Although Connecticut continues to recover from the pandemic and there are encouraging signs of growth and momentum, state commodity exports have not returned to pre-pandemic levels nor the high of $17.4 billion recorded in 2018.

Due to the unavailability of data, we are unable to ascertain the differential between the number of companies that exported pre- and post-COVID-19. The most recent data indicates that 4,606 companies exported from Connecticut in 2020. 89% of these companies were small and medium-sized enterprises (SMEs) with fewer than 500 employees. In 2019, approximately 63,000 U.S. jobs were supported by Connecticut exports. [ read more ]

Solving the Office to Residential Conversion Puzzle

By Al Sylvestre, Research Analyst, Department of Labor

ith almost a quarter of Hartford's available office space lying fallow as the city's residential vacancy rate hovers near two percent, shrinking office footprints suggest an obvious solution to the capital region's housing shortage. While the Capital Region Development Authority (CRDA) and state agencies work with real estate developers to turn the office glut into housing opportunity, an examination of office to residential conversion feasibility illustrates the complexity of achieving the office to residential space balance that can make the long-held vision of Hartford as a vibrant 24-hour city a reality. Examples from Philadelphia (1600 Arch Street) and Manhattan (180 Water Street) illustrate the challenges and opportunities for converting office space into desirable dwelling units. ith almost a quarter of Hartford's available office space lying fallow as the city's residential vacancy rate hovers near two percent, shrinking office footprints suggest an obvious solution to the capital region's housing shortage. While the Capital Region Development Authority (CRDA) and state agencies work with real estate developers to turn the office glut into housing opportunity, an examination of office to residential conversion feasibility illustrates the complexity of achieving the office to residential space balance that can make the long-held vision of Hartford as a vibrant 24-hour city a reality. Examples from Philadelphia (1600 Arch Street) and Manhattan (180 Water Street) illustrate the challenges and opportunities for converting office space into desirable dwelling units.

A building envelope's shape, along with the placement of its structural columns, elevator shafts, and stairwells, constitutes the geometry within which an apartment's living, sleeping, and workspace areas are laid out. Developers, architects, and designers must solve for the adequacy of light and air movement that make a dwelling unit livable. The building's location and proximity to public amenities completes the value proposition of conversion versus demolition and new construction. [ read more ]

|

|

|

|

June 2023 Connecticut Economic Digest |

|

How COVID has changed the Labor Market

By Patrick.Flaherty, Director of Research, Department of Labor

ow that three years have passed since the emergence of COVID-19 it is possible to begin to distinguish between the short-term and long-term effects of the pandemic. To provide additional measures of the effects of the COVID-19 pandemic on the labor market, the Bureau of Labor Statistics (BLS) conducted a series of Business Response Surveys. The initial survey was conducted in July through September 2020. Additional surveys were conducted in July to September 2021 and August to September 2022. The results of these surveys give some insights into the effects of the pandemic on the labor market nationally and here in Connecticut. In addition, the Job Openings and Labor Turnover Survey (JOLTS) from BLS and the Job-to-Job Flows from the U.S. Census show one unexpected effect of the pandemic - the greater willingness of workers to voluntarily leave their jobs and the resulting increase the number of job openings. ow that three years have passed since the emergence of COVID-19 it is possible to begin to distinguish between the short-term and long-term effects of the pandemic. To provide additional measures of the effects of the COVID-19 pandemic on the labor market, the Bureau of Labor Statistics (BLS) conducted a series of Business Response Surveys. The initial survey was conducted in July through September 2020. Additional surveys were conducted in July to September 2021 and August to September 2022. The results of these surveys give some insights into the effects of the pandemic on the labor market nationally and here in Connecticut. In addition, the Job Openings and Labor Turnover Survey (JOLTS) from BLS and the Job-to-Job Flows from the U.S. Census show one unexpected effect of the pandemic - the greater willingness of workers to voluntarily leave their jobs and the resulting increase the number of job openings.

The 2020 Business Response Survey showed that Connecticut's business response to the pandemic was similar to businesses in the nation as a whole. For example, 51.9% of establishments nation-wide told employees not to work and 51.3% of these continued to pay employees some or all of their pay while not working. In Connecticut, it was 52.8% and 48.1% respectively. Nationally, 55.6% of establishments experienced a decrease in demand for their products or services and 18.7% experienced a government-mandated closure. Connecticut's portion with decreased demand was 56.3% while the portion with a mandated closure was 17.3% in Connecticut. Only 17.8% of establishments nationally and 17.1% in Connecticut reported that they experienced no impact from the pandemic on their business operations. [ read more ]

The Unemployment Rate of All Towns Fell in 2022

By Jungmin Charles Joo, Department of Labor

n 2022, the annual average statewide unemployment rate was 4.2%, down from 6.3% in 2021. As the labor force bounced back for the second year from the impact of the COVID-19 pandemic, all 169 municipalities experienced a decrease in their unemployment rate last year. n 2022, the annual average statewide unemployment rate was 4.2%, down from 6.3% in 2021. As the labor force bounced back for the second year from the impact of the COVID-19 pandemic, all 169 municipalities experienced a decrease in their unemployment rate last year.

2021 to 2022

The unemployment rate in all 169 cities and towns in the state fell in 2022. Roxbury had the lowest unemployment rate of 2.5%, while the residents of Hartford experienced the highest rate of 6.5% last year (see table on page 3 for the complete town data). Overall, a total of 128 cities and towns had jobless rates below the 2022 statewide figure of 4.2%, 37 had rates above it, and 4 had rates equal to it. By comparison, 134 cities and towns had rates below the 2021 statewide average of 6.3%, 30 above it, and 5 were the same.

Of the five largest cities in the state with a 2010 Census population of 100,000 or more, Stamford had the lowest unemployment rate of 3.9% in 2022. Hartford posted the highest jobless rate among the large cities at 6.5%. All five cities experienced over-the-year unemployment rate decreases. [ read more ]

|

|

|

|

May 2023 Connecticut Economic Digest |

|

How Does Connecticut's Economic Growth Stack Up Against the Recent Budget Surpluses?

By Manisha Srivastava, Connecticut Office of Policy and Management

here is a common adage that a strong stock market does not necessarily indicate a strong underlying economy, that the stock market is not the economy. What about budget surpluses - do year upon year of budget surpluses indicate a strong underlying economy? here is a common adage that a strong stock market does not necessarily indicate a strong underlying economy, that the stock market is not the economy. What about budget surpluses - do year upon year of budget surpluses indicate a strong underlying economy?

Connecticut (CT) has shifted from ongoing budget deficits during the 2010s following the Great Recession to budget surpluses, including billion plus dollar surpluses more recently. There are multiple factors responsible for these budget surpluses. As a result of the COVID-19 pandemic, the federal government stepped in with financial assistance including the Paycheck Protection Program and Enhanced Unemployment Insurance. In addition, the pandemic-mandated work from home policy (where possible) reduced state office expenses while waivers and other safety-oriented accommodations reduced the level of interactions with the public and hence expenses. And finally, certain tax revenue sources have continued to outperform and come in above projections. What do these strong revenues indicate regarding CT's economy, have CT's economic indicators similarly outperformed? Let's find out.

The primary revenue sources for the General Fund (GF) include Income Tax and Sales and Use Tax; in Fiscal Year (FY)1 2022, Income Tax made up 48.7% and Sales Tax made up 19.4% of General Fund revenues.2 There are two components to Income Tax, Withholding and Estimates & Finals, representing 31.7% and 17.1%, respectively, of General Fund revenues in FY 2022. About 20 other taxes, revenues, fees, and federal grants comprise the remaining 31.9% of the General Fund, including sources such as Corporation Tax, slot revenues, Real Estate Conveyance Tax, and the Pass-through Entity Tax. The primary drivers of the budget surpluses include Income, Sales, and the Pass-through Entity Tax. [ read more ]

|

|

|

|

April 2023 Connecticut Economic Digest |

|

Short-Term Employment Projections Through 2024

By Matthew Krzyzek, Economist, Department of Labor

onnecticut's economy is projected to add jobs through the end of the short-term projections period. Each year, the Office of Research at the Connecticut Department of Labor produces short-term employment projections by industry and occupation. The current round spans the second quarter of 2022 to the second quarter of 2024. Through 2024Q2, we project overall employment in Connecticut to increase by 2.5% from 1,800,395 to 1,845,444 including self-employment and unpaid family workers (UFW). The Goods-Producing sector is projected to grow by 3.7% and the Service-Providing Sector is projected to grow by 2.2% over two years. This latter sector represents 86.7% of industry employment in the state. onnecticut's economy is projected to add jobs through the end of the short-term projections period. Each year, the Office of Research at the Connecticut Department of Labor produces short-term employment projections by industry and occupation. The current round spans the second quarter of 2022 to the second quarter of 2024. Through 2024Q2, we project overall employment in Connecticut to increase by 2.5% from 1,800,395 to 1,845,444 including self-employment and unpaid family workers (UFW). The Goods-Producing sector is projected to grow by 3.7% and the Service-Providing Sector is projected to grow by 2.2% over two years. This latter sector represents 86.7% of industry employment in the state.

Projections by Industry

Among the 20 industry groups shown in figure 1, 16 are projected to increase over two years and 4 are projected to decline. The largest increases are expected in Health Care (+6,156), Accommodation & Food Services (+5,493), Manufacturing (+5,478), and Transportation & Warehousing (+4,643). These four industries account for more than half of the projected overall growth across all industries. The projected Health Care growth will bring that industry to early 2020 pre-pandemic employment levels. Accommodation & Food Services was one of the hardest hit industries during the COVID-19 lockdown and fell by almost 50% during the first half of 2020 from 134,000 to 71,000. That industry is projected to increase to almost 138,000 workers by the second quarter of 2024, exceeding 2020 pre-pandemic levels but still down from a series high of 144,000 reached in late 2019. The gains in Manufacturing are driven in large part by Transportation Equipment Manufacturing (NAICS 336), which is projected to account for 2,957 of the 5,478 job increase projected for the overall sector. Transportation & Warehousing quickly rebounded from the COVID-19 lockdown and added jobs throughout the recovery. The industry was up 14,500 jobs or 25% from 2020Q2 to 2022Q2 and is expected to continue to grow by 7% through 2024Q2. [ read more ]

The Provision State - Connecticut's Private Defense-Related Employment into the 21st Century

By Labor Department Research Staff Update

he Office of Research at the Connecticut Department of Labor has been documenting and tracking industry employment in the state with our federal partners, the U.S. Bureau of Labor Statistics (BLS), since at least the late 1930's. Since the statistics began (and we have employment data back to 1939) defense-related manufacturing has been of interest to policymakers and the public. Tracking employment was a necessary endeavor during WW II for the planning of defense production in the war effort. Office of Research folklore has it rumored that future Governor Ella Grasso worked together with our office when she was assistant state director of research of the Federal War Manpower Commission during WW II.1 Consequently, the first Cold War end was expedited by a major U.S. defense industry build-up in the 1980's and supported strong statewide employment growth during that decade. Connecticut's aerospace and shipbuilding industry employment amongst other industry sectors helped the U.S. end the Cold War. [ read more ] he Office of Research at the Connecticut Department of Labor has been documenting and tracking industry employment in the state with our federal partners, the U.S. Bureau of Labor Statistics (BLS), since at least the late 1930's. Since the statistics began (and we have employment data back to 1939) defense-related manufacturing has been of interest to policymakers and the public. Tracking employment was a necessary endeavor during WW II for the planning of defense production in the war effort. Office of Research folklore has it rumored that future Governor Ella Grasso worked together with our office when she was assistant state director of research of the Federal War Manpower Commission during WW II.1 Consequently, the first Cold War end was expedited by a major U.S. defense industry build-up in the 1980's and supported strong statewide employment growth during that decade. Connecticut's aerospace and shipbuilding industry employment amongst other industry sectors helped the U.S. end the Cold War. [ read more ]

|

|

|

|

March 2023 Connecticut Economic Digest |

|

Connecticut's Economy Recovers to its Pre-Pandemic Level in 2022

By Jungmin Charles Joo, Associate Research Analyst, Department of Labor

onnecticut employment continued to improve for the second year in a row, nearly completely recovering to the pre-pandemic levels. The revised annual average total nonfarm employment rose 3.1% to a level of 1,665,600 in 2022. Correspondingly, last year's annual average unemployment rate dropped significantly to 4.2% from 6.3% in 2021. In fact, 2022 economy recovered the strongest over the last nine years as per annual diffusion index. onnecticut employment continued to improve for the second year in a row, nearly completely recovering to the pre-pandemic levels. The revised annual average total nonfarm employment rose 3.1% to a level of 1,665,600 in 2022. Correspondingly, last year's annual average unemployment rate dropped significantly to 4.2% from 6.3% in 2021. In fact, 2022 economy recovered the strongest over the last nine years as per annual diffusion index.

Nonfarm Employment

After the latest annual revision (based on annual average, not seasonally adjusted data), in 2022 Connecticut regained 49,300 jobs (3.1%), more than the gain of 45,600 jobs (2.9%) in 2021. In the nation employment rose faster at 4.3% in 2022, after having increased 2.9% in 2021.

As shown in Chart 1, all but one of Connecticut's industry sectors bounced back last year. Ten of eleven major industry sectors have added jobs back over the year, while mining was unchanged. The biggest recovery occurred in leisure and hospitality (10.9%), other services (4.8%), and information (3.7%). Leisure and hospitality was also the biggest job gainer (14,700), followed by education and health services (8,300). Financial activities (0.2%) and government (1.3%) posted the slowest job growth in 2022. [ read more ]

|

|

|

|

February 2022 Connecticut Economic Digest |

|

2023 Economic Outlook: Major Challenges After Year of Solid Growth

By Steven P. Lanza, Associate Professor-in-Residence, UConn Department of Economics