2018 Economic Outlook: Slowly Recovering, Yet Long-Term Challenges Remain

By Alissa K. DeJonge, VP of Research, Connecticut Economic Resource Center, Inc.

A mid numerous uncertainties, the outlook for the Connecticut economy in 2018 has positive signs.

The World: Strengthening Economic Activity as a Whole 1

Economic activity for the world as a whole is increasing, with global growth projected at 3.7 percent in 2018. Positive trends in the Euro Area, Japan, emerging Asia, emerging Europe, and Russia offset risks for the United States and the United Kingdom. Trends to note include:

- Euro Area: Growth in this region is estimated to rise to 1.9% in 2018. 2

- China: Growth is projected to be 6.5 percent in 2018 as authorities continue an expansionary policy with high public investment.

- Russia: Projected growth is 1.8 percent in 2018.

- U.K.: Growth is projected to be 1.5 percent.

The Nation: Tax Reform and Rebuilding From Hurricanes

The International Monetary Fund is anticipating that U.S. gross domestic product will increase by 2.3 percent in 2018. U.S. tax reform will provide a slight lift to overall economic growth, as will the rebuilding of areas affected by the hurricanes in the South. Tax reform that lowers rates on corporate and personal income should increase business investment and consumer consumption during 2018.

As inflation remains close to its 2 percent target and the labor situation continues its improvement, the federal funds rate is projected to rise gradually, perhaps to 1.75 percent by 2018 Q3.

However, after the tax reform boost, business investment is expected to slow, along with labor force growth, which will lower consumption later in the year and into 2019.3

In addition, a number of larger industry trends are taking place that will affect how businesses anticipate consumer demand, profitability and competitiveness. A selection of some of these critical trends is below.

Property & Casualty Insurance 4

The growth globally will be strong in terms of volume and value of premiums, particularly in the emerging markets. However, the growth in premiums in industrialized countries is expected to be moderate. Developments of new technology present changes to traditional insurance models and will require the insurance industry to adapt.

Retail 5

Brick and mortar stores still dominate retail sales transactions. However, they are adapting to the threat of online stores through several strategies that involve creating unique customer experiences and making customer purchases easier. Smaller stores and pop-up stores decrease the fixed floor space overhead while demonstrating products and providing touchpoints for unique and personalized services. The ability to reduce inventory and create customized products through 3D printing is also being explored by some retailers.

Online stores are also working to increase market share, improve the customer experience, and increase business profitability. In addition to offering faster delivery times, to build from some of the strengths of brick and mortar store locations, online businesses have formed partnerships with stores for pick-up and return options.

Warehousing

The warehousing and distribution industry is changing largely due to the influence of e-commerce. Where warehouses used to deliver large numbers of the same goods to businesses on pallets, now warehouses are expected to deliver a variety of goods in small packages quickly and directly to consumers. The expectation of consumers for rapid delivery times influences the number of warehouses and the need to be more closely located to the demanding consumers. 6

Financial Services 7

Financial technology innovators (i.e. FinTech) are disrupting the market with cost effective solutions, often focused on a single financial product with a user-friendly online interface. The traditional financial institutions need to adapt by incorporating some similar features and user experiences to avoid being pushed out of those particular product markets.

Another area to grow revenue streams in finance is through international expansion, taking advantage of economies of scale, and the emerging middle class in many parts of the world. Finally, enhancing cyber security is a critical defensive measure to maintain the reputation of an institution, and responding to breaches in a transparent and customer friendly way is essential to staying competitive.

Manufacturing 8

While robotics have been used in manufacturing for a couple of generations, the improvements in technology and the decrease in the start-up cost to convert processes to more automation is allowing this technology to become more widespread.

Automation and robotics are used predominantly for jobs that are dangerous or not feasible for people, enabling an increase in industry output. As these technologies further penetrate the manufacturing environment, there will likely be a disruption or displacement of some jobs. However, the fabrication jobs to produce robots, the software jobs to program them, and the field service maintenance jobs for them will create approximately 15 million new jobs in the U.S. over the next ten years.

Construction 9

Somewhat delayed compared to manufacturing, the construction industry is beginning to take advantage of similar technology advancements including the use of drones, other self-driving vehicles, and visualization software and hardware to help evaluate and generate interest in construction projects before they begin. Along with technology advancements, the cost-effective use of prefabricated modules will help improve efficiency within the industry. However, these gains will be offset by the increased costs in raw materials and labor that will challenge the industry. Combined with the level of demand, the net result will be slow growth overall, while areas that can capitalize on the demand for environmentally sustainable building products will continue to grow at a slightly higher rate.

Health Care 10

The cost of health care and medical procedures continues to rise, and a major focus of the industry is figuring out ways to reduce costs without compromising the quality of care. Industry drivers include evaluating and implementing ways to improve efficiency and optimize the rate of utilization of services.

The State: Modest Economic Growth Yet Needs a Boost

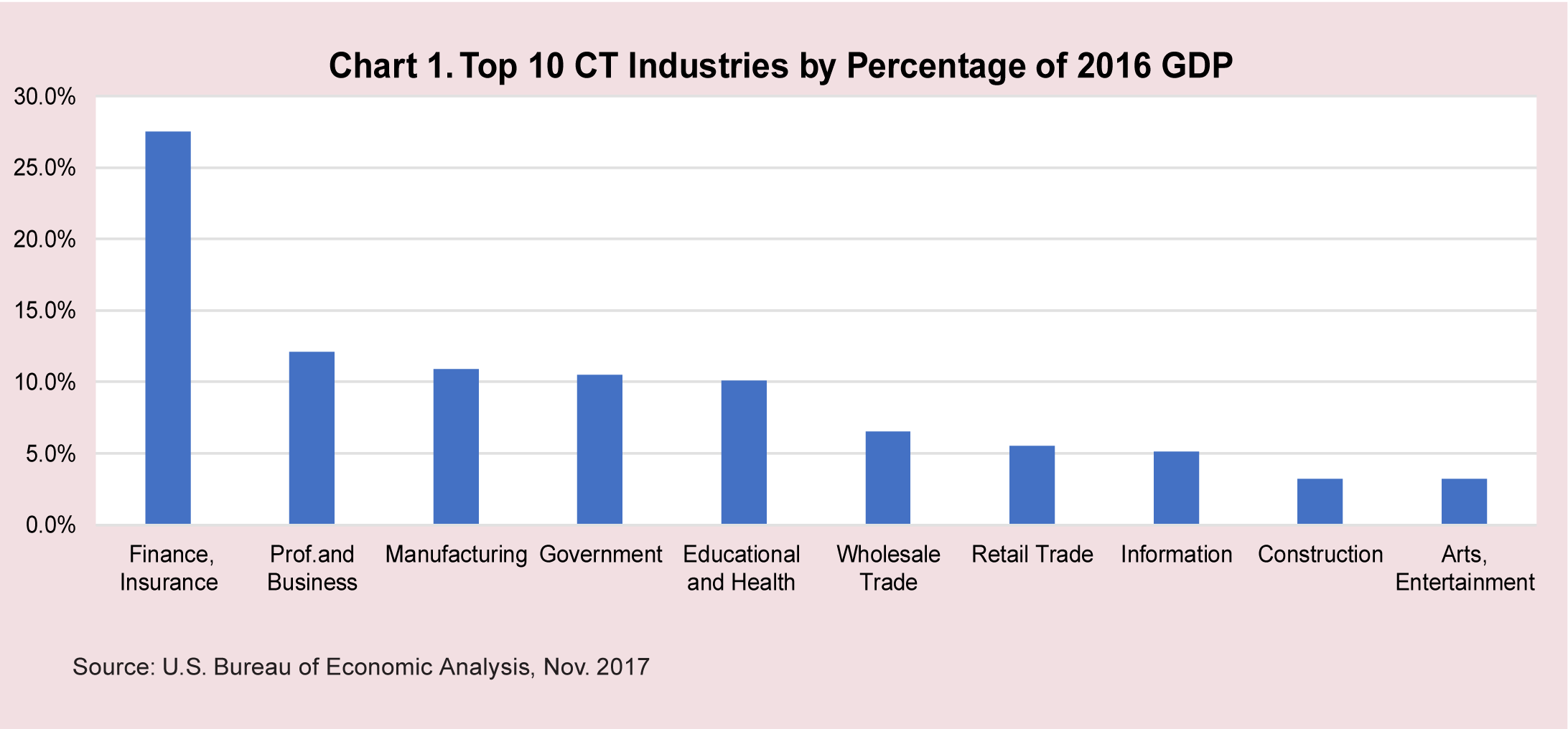

According to the U.S. Bureau of Economic Analysis, in 2016 (Chart 1), the largest industry sector in Connecticut was Finance, Insurance, Real Estate, Rental, and Leasing, which accounted for 27.5 percent of the state’s gross domestic product (GDP).

Changes have been taking place within this industry in Connecticut during the past few years. Besides Aetna being acquired by CVS, technological advancement is also calling for innovation within the industry.

Catherine Smith, Commissioner of Connecticut’s Department of Economic and Community Development, perceives “innovation and change a given within the insurance industry. And it’s challenging to keep in step with the many changes because the pace of change—as with time—waits for no one. One important driver of change is technology.” She believes that “insurance companies must rapidly integrate new technologies into their operations to remain competitive.” 11

She pointed out that a number of public and private partners support innovation within companies as well as encourage the formation of new innovative tech firms. An example is Connecticut Innovations’ VentureClash, a global investment challenge that identifies high potential early stage companies in digital health and financial technology. The winners receive investments from a $5 million award pool as they build businesses in the state. VentureClash, among other programs, supports FinTech companies in the state, which in turn can help insurance and other financial service companies better compete and operate more efficiently, as well as deliver services and interact with clients in new ways.

Defense Manufacturing: Bright Spot for Connecticut

The defense manufacturing sector in Connecticut sees new growth opportunities ahead with the recent progress in a new defense bill. Congressional negotiators finalized a defense bill in late 2017 that should greatly boost the number of F-35s, Black Hawk helicopters, submarines and other weapon systems made in Connecticut. 12

Overall Employment: Still Recovering Jobs Lost During the Great Recession

Four of the ten major industry supersectors lost employment in the past 12 months, while six increased employment.

The state’s private sector has now regained 89.7 percent (100,200) of the 111,700 private sector jobs lost in the Great Recession (March 2008 through February 2010) while the Government supersector shed 24,300 positions since March 2008. 13 As a whole, Connecticut has recovered 69.9 percent (83,300 jobs) of the 119,100 seasonally adjusted jobs lost in the Great Recession. The job recovery is into its 93rd month and the state needs an additional 35,800 jobs to reach an overall nonfarm employment expansion.

Population Shifts Affect Economic Potential

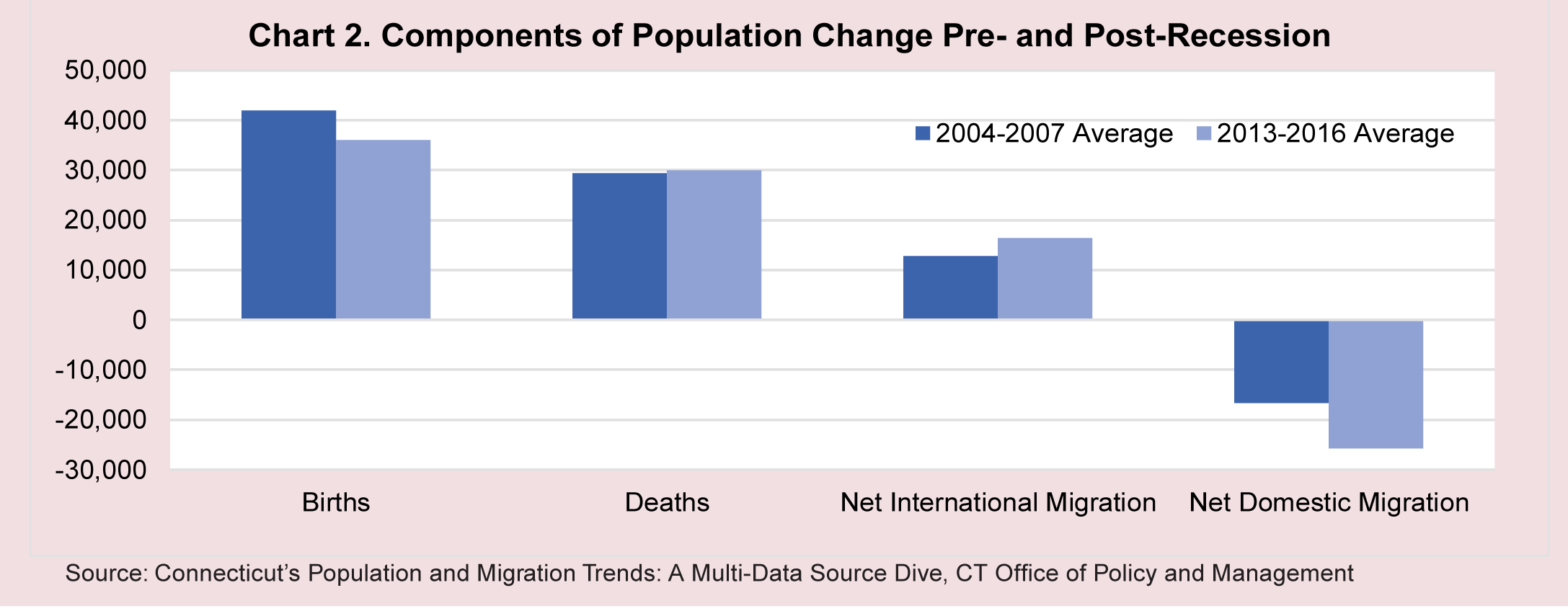

The overall Connecticut population has been declining for the past three years. According to a study by Connecticut Office of Policy and Management and Connecticut Data Collaborative, 14 declining birth rates and increasing death rates have affected the recent declines in Connecticut’s total population. The primary cause is increasing rates of net domestic out-migration (more people moving out of Connecticut to another U.S. state). The study shows that more households moved into Connecticut from New York and New Jersey (11,948 between 2011-2014) 15 than left Connecticut (9,607) for those states. On the other hand, more people left Connecticut for Massachusetts and Florida than moved in from those states (11,263 vs. 7,273). There is a positive side. International migration has helped boost Connecticut’s population, as there has been about a 30 percent increase (or about 3,700 people) in the average number of net migrants per year since the recession ended compared to before the recession (Chart 2). The study also finds that compared to the state’s population distribution by education, “international migration pulls in most people at either the highest (graduate degree) or lowest (less than high school) education levels.” 16

In addition, the younger population in Connecticut has been declining while the population age 65 and over is increasing steadily. These are findings in the U.S. Census Bureau’s latest American Community Survey, which provides demographic estimates between the decennial counts of the nation’s population.

During the period from 2010 to 2016, as with many other states, Connecticut has seen a steady increase of retirement-age population, while the school age population (below 25) and working age population (25-64) experienced a small but steady decrease. Consistent with these natural demographic shifts, there is also a substantial decline in the student population attending public schools. Compared to an average 2.7 percent increase over the next 10 years in the student population attending public schools throughout the nation, the U.S. Department of Education predicts that Connecticut is likely to experience a 14.2 percent decline in this population group—the second-largest proportional decline among all states.

What do these demographic shifts mean for Connecticut? The overall population declines affect consumer demand and overall economic potential. In addition, the large generation of baby boomers continues to retire while the next generation, the Gen Xers, is a smaller age group, which will further reduce the overall level of economic demand and output. The demand decrease should eventually be mitigated by the larger Millennial generation, but in the mid-term, there could very well be a dip in the amount of GDP produced in the state, because of these demographic shifts.

Confidence Declines

Connecticut residents increasingly believe that overall business conditions in the state are worsening, and an increasing percentage – now nearly half - expect that conditions will be about the same six months from now, according to the 2017 Q3 InformCT Consumer Confidence Survey. 17 More people are of the opinion that business conditions will continue to worsen than are of the view that they will improve. More than twice as many residents, 51 percent, do not believe the Connecticut economy is improving, compared with 24 percent that believe it is. That is a slightly less pessimistic view than the previous quarter, when the breakdown was 55 percent to 21 percent.

A more stable policy and budget environment would help boost the recovery and growth including business and consumer confidence after the Great Recession.

Amid Numerous Uncertainties, the Outlook for the Economy in 2018 has Positive Signs

Although the projections for global and national economic growth are positive, the estimate for Connecticut's economic performance in 2018 is modest. A number of overall industry trends affecting business competitiveness all over the nation and globe will also affect how well companies do in the state. Any substantial changes in population or employment will affect Connecticut's economy.

1 World Economic Outlook, October 2017 Seeking Sustainable Growth: Short-Term Recovery, Long-Term Challenges, International Monetary Fund

2 IBID

3 http://ww2.cfo.com/the-economy/2017/11/oecd-raises-2018-us-growth-forecast-2-5/

4 Deloitte; Munich RE

5 http://tcfcr.com/2018-retail-trends/

6 https://3plcenter.com/impact-e-commerce-warehousing-industry/

7 https://www.business2community.com/finance/5-trends-impacting-financial-services-industry-2017-01770543

8 https://www.weforum.org/agenda/2017/06/what-s-going-on-with-manufacturing-b013f435-1746-4bce-ac75-05c642652d42/

9 https://esub.com/6-construction-industry-trends-expect-2018/

10 https://www.pwc.com/us/en/health-industries/health-research-institute/behind-the-numbers.html

11 2016 Connecticut Insurance Market Brief, PwC

12 https://ctmirror.org/2017/11/08/congress-authorizes-big-boost-in-ct-defense-spending/

13 Industry Sectors Employment-Connecticut

14 Connecticut’s Population and Migration Trends: A Multi-Data Source Dive

15 IBID

16 Connecticut’s Population and Migration Trends: A Multi-Data Source Dive

17 Inform CT CERC