Connecticut Exports: 2017 in Review

By Laura Jaworski, Office of International and Domestic Business Development, DECD2017 was a year in which international relations dominated the news headlines. Whether it was talk of the renegotiation of NAFTA and other free trade agreements, the status of the Trans-Pacific Partnership, currency manipulation and commodity dumping, the threat of a nuclear armed North Korea or entry and/or withdrawal from global pacts, geopolitics was front and center. Recently, President Trump signed an order on new tariffs on imported steel and aluminum. With such tariff increases, analysis must happen as to the potential impact on the defense industry, its subcontractors and supply chain. Will trade partners retaliate? What will be the impact on sales? As a defense-oriented state, Connecticut must monitor the evolution of such discussions. In the meantime, a review of the state's 2017 export position follows.

Annual Export Figures

In 2017, Connecticut's commodity exports totaled $14.75 billion, a 2.53% increase and positive upswing from the $14.39 billion registered in 2016. It is important to note, as significant as commodity exports are, they omit service exports, for which the collection of data is inexact and unavailable at the state level. All U.S. states face this data gap. This means that export figures for a state like Connecticut- with a large concentration of insurance, financial and other services understate the true magnitude of its overall export value. 1

Data indicates that 5,717 companies exported from Connecticut in 2014. 89% of these companies were small and medium-sized enterprises (SMEs) with fewer than 500 employees. SMEs account for 23% of Connecticut commodity exports. In 2015, 70,038 U.S. jobs were supported by goods exported from Connecticut. 2

Connecticut's export ranking among the states has held steady for many years. As in previous years, in 2017 Connecticut ranked 27th in the U.S. Texas, California, Washington, New York and Illinois were the top five export states in 2017, ranked in terms of export commodity dollars. Among all the states, West Virginia experienced the greatest percentage increase in 2017 at 42.29%, likely due to a surge in the state's coal and natural gas exports.

U.S. Exports

U.S. commodity exports rebounded in 2017 and totaled more than $1.54 trillion in 2017, representing a 6.60% increase over the $1.45 trillion recorded in 2016. Due to geographic proximity and NAFTA, it should come as no surprise that Canada and Mexico were the top two destinations for U.S. exports in 2017, followed by China, Japan and the United Kingdom.

New England Exports

In New England in 2017, only Massachusetts' exports value ranked higher than Connecticut's, as has been the case since 2005. As a regional trading block, New England's commodity exports totaled more than $55.25 billion in 2017, a 5.11% increase from 2016. The top five export destinations for New England commodities were Canada, Mexico, Germany, China and the United Kingdom.

Connecticut Export

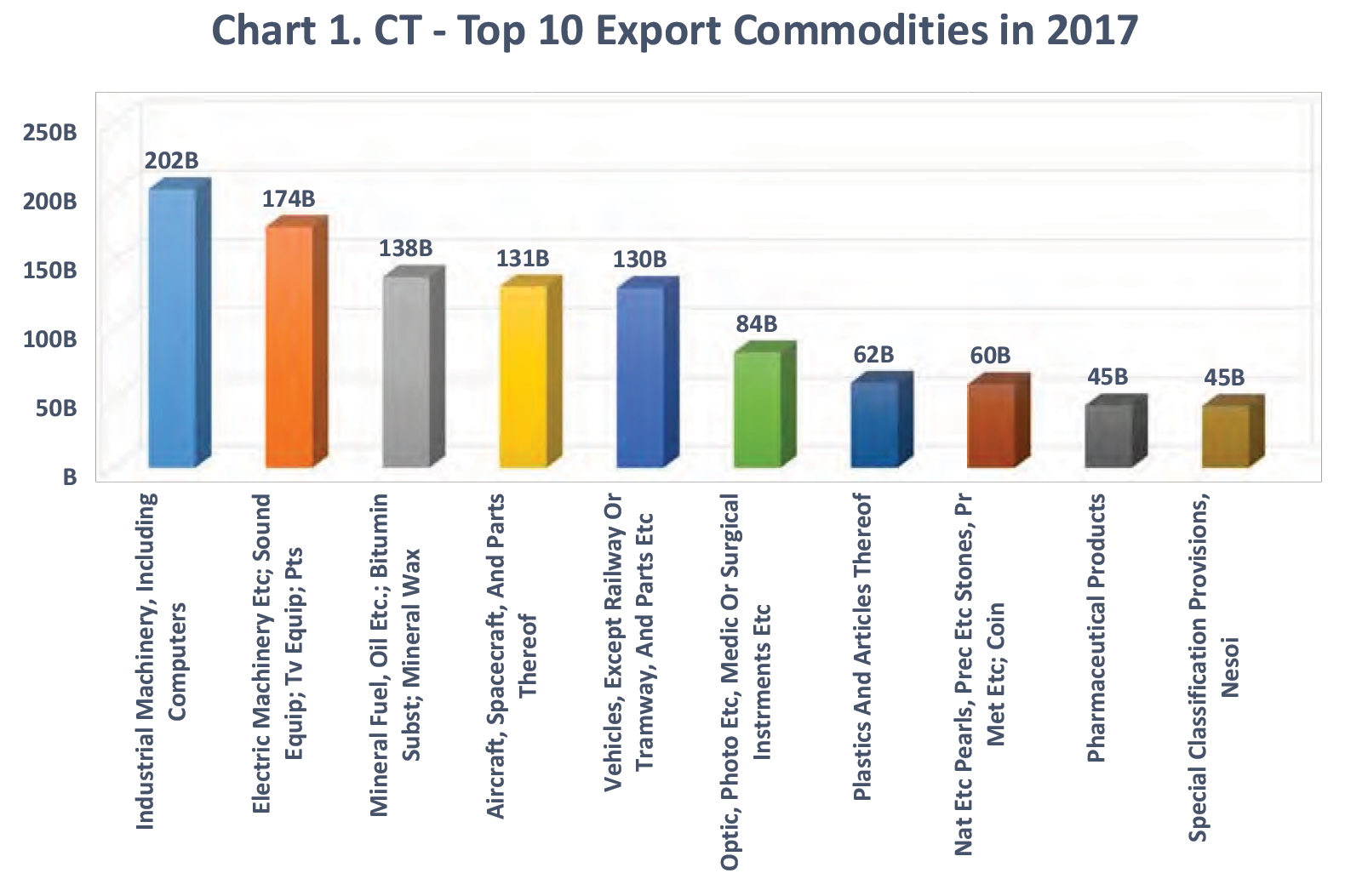

Composition Connecticut's top export commodities mirror the state's advanced manufacturing strengths and there is a demonstrated consistency among the state's top exports. 2017 was no exception. Last year at the two-digit Harmonized System (HS) commodity code level, Connecticut's top five export commodities were (1) aircraft, spacecraft and parts thereof; (2) industrial machinery, including computers; (3) optic, photo, medical or surgical instruments; (4) electric machinery, sound equipment, TV equipment, parts and (5) special classification provisions, not elsewhere specified or indicated (Nesoi). The bulk of special classification provisions were composed of exports of repaired imports. Please refer to the associated (Chart 1) for greater visibility as to the state's export strengths and composition.

Drilling down an additional layer into the HS commodity codes for greater export insight reveals the transportation sector's dominance of Connecticut exports in the aerospace and defense industry. At the four-digit HS level, the state's top exports included civilian aircraft, engines, parts; exports of repaired imports; and turbojets, turbopropellers.

To put these figures into national and regional context, the U.S. and New England states' top export commodities were similar to Connecticut's. In 2017, the top five U.S. export commodities were (1) industrial machinery, including computers; (2) electric machinery, sound equipment, TV equipment, parts; (3) mineral fuel, oil, bitumin substances, mineral wax; (4) aircraft, spacecraft and parts thereof and (5) vehicles, except railway or tramway, and parts. In 2017, the New England region's top five export commodities were (1) electric machinery, sound equipment, TV equipment, parts; (2) industrial machinery, including computers; (3) optic, photo, medical or surgical instruments; (4) aircraft, spacecraft, and parts thereof and (5) natural or cultured pearls, precious stones, precious metal clad materials, imitation jewelry and coins.

State Export Partners

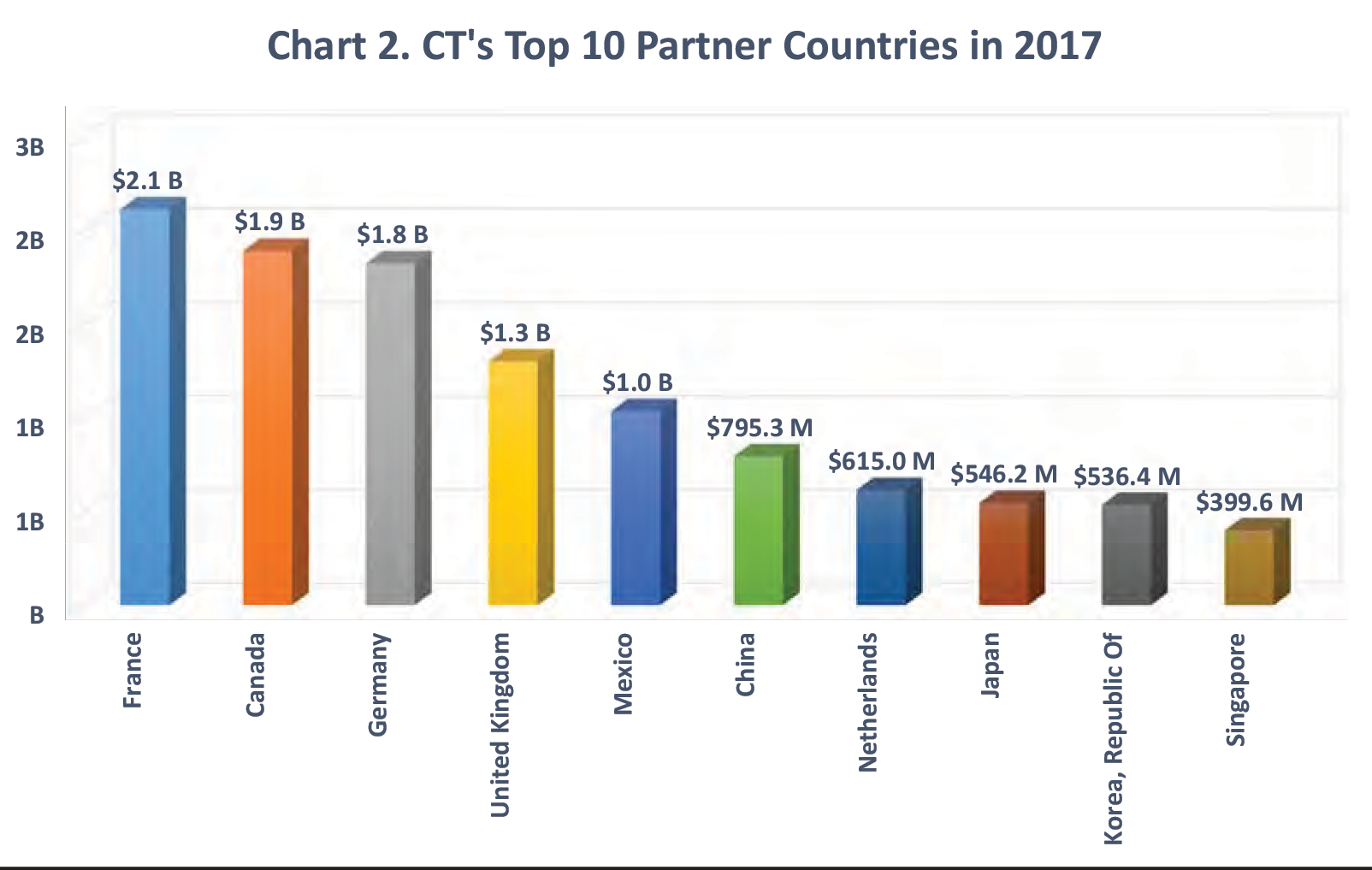

The state's top ten commodity export destinations were France, Canada, Germany, the United Kingdom, Mexico, China, the Netherlands, Japan, Korea and Singapore (Chart 2). Connecticut exported over $1 billion to each of its top five trade partners in 2017, with over $2.11 billion directed to France. Among the state's top ten partners, all but two experienced export increases, the most significant percentage increases belonging to the United Kingdom (45.72%) and South Korea (47.10%). Connecticut exports of aircraft, spacecraft, parts and organic chemicals increased substantially to the U.K., while state exports of electric machinery; stone, plaster, cement; and railway, tramway stock and traffic signal equipment increased markedly to South Korea, perhaps due to build-out and ramp up for the infrastructure and events of the PyeongChang 2018 Winter Olympics.

State Trade Expansion Promotion (STEP)

Grant The state and federal government continue to partner to develop export opportunities. To that end, DECD administers a State Trade Expansion Promotion (STEP) grant award from the U.S. Small Business Administration (SBA). The program's goals are to increase the number of small business exporters and increase export sales. In conjunction with organizations such as the Connecticut Center for Advanced Technology (CCAT), local U.S. Department of Commerce Export Assistance Center (USEAC), Small Business Development Center (SBDC) and others, DECD directs STEP funds towards small businesses for export development and training opportunities, company participation in foreign and domestic trade shows and trade missions, website translation, as well as other export initiatives and events.

For more information about DECD's international programs and services, including STEP grant activities, eligibility standards, program guidelines and application procedures, please contact Laura Jaworski at 860-500-2368 or laura.jaworski@ct.gov.

1 WISER database, http://www.wisertrade.org.

2 “Connecticut Exports, Jobs, & Foreign Investment,” U.S. Department of Commerce International Trade Administration, https://www.trade.gov/mas/ian/statereports/states/ct.pdf March 7, 2018.