|

|

|

|

| Home | About | Publications | FAQ | Glossary | Contact |

|

| Connecticut Help Wanted Monthly & Weekly OnLine Data Series (HWOL) | Last Updated: December 26th, 2025 |

| Monthly Connecticut Help Wanted OnLine Data Series (HWOL) |

| The Conference Board Help Wanted OnLine Data Series (HWOL) measures the number of new, first-time Online job postings and jobs reposted from the previous month for over 50,000 Internet job boards, corporate boards and smaller job sites that serve niche markets and smaller geographic areas. |

|

| Statewide Highlights | |

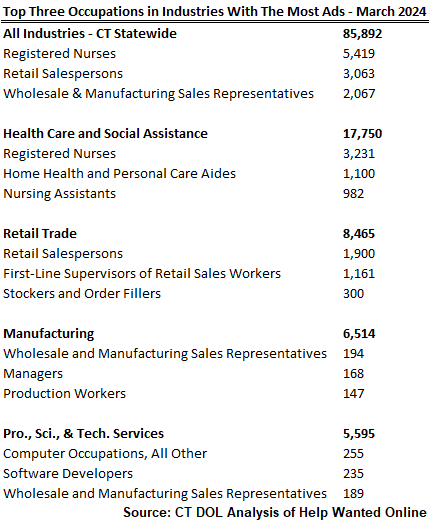

| Total postings in Connecticut was 81,102 in November 2025, down from an October 2025 posting count of 85,545.

Industry sectors with the most job postings were Health Care and Social

Assistance (17,719 postings), Retail Trade (10,133 posting), Professional, Scientific, & Technical Occupations

(6,040 postings), and Manufacturing

(5,935 postings).

Occupations with the most postings were Registered Nurses (5,706 postings), Home Health & Personal Care Aides (3,056 postings), Retail Salespersons (2,995 postings), and Supervisors of Retail Sales Workers (1,583 postings). | |

| |

| |

Workforce Development Areas: Eastern | North Central | Northwest | South Central | Southwest | |

| |

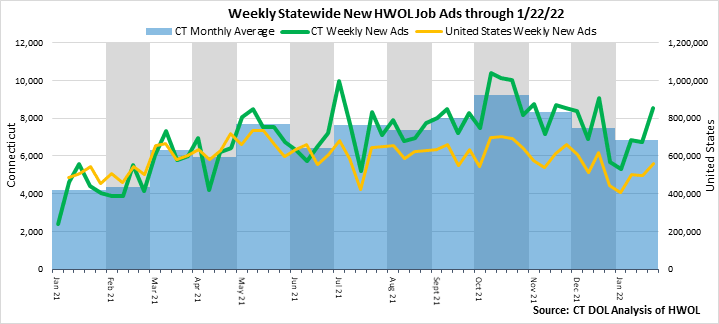

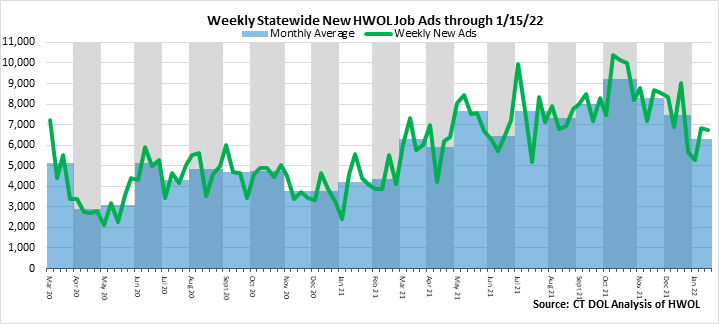

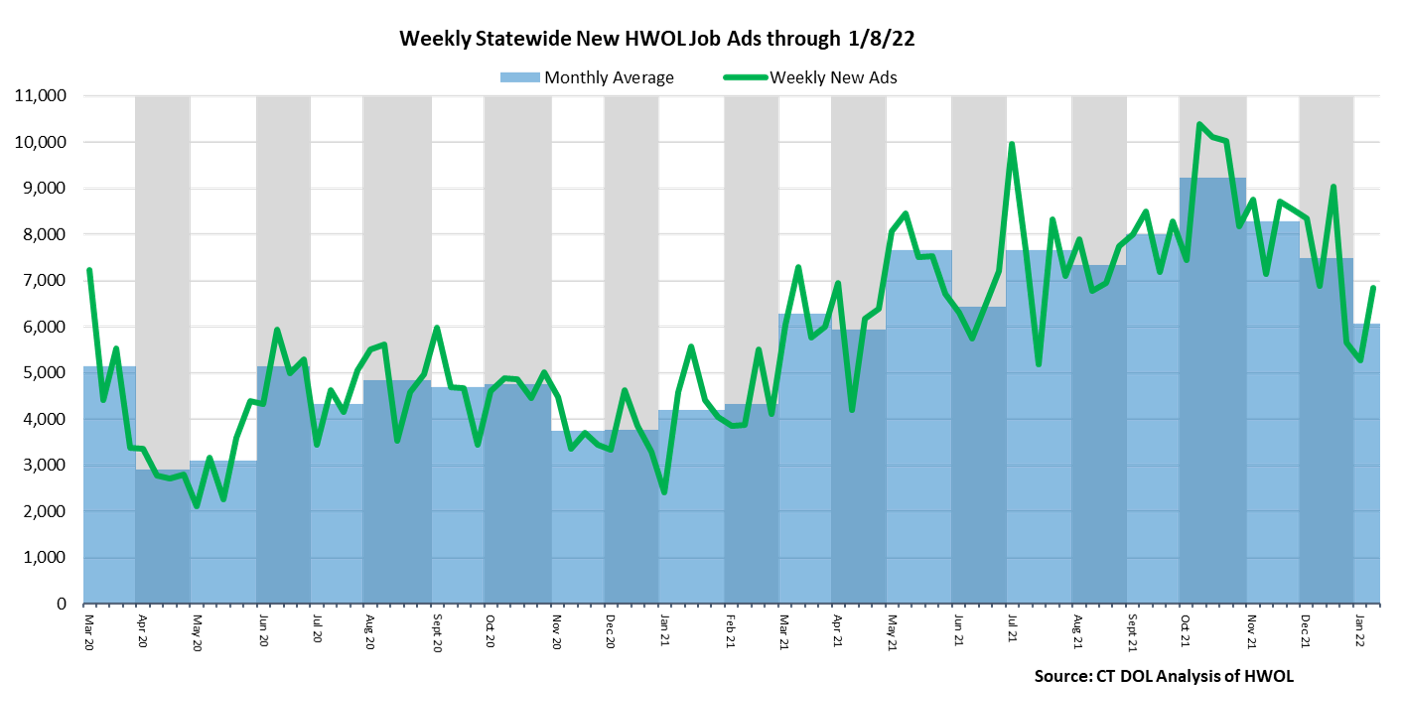

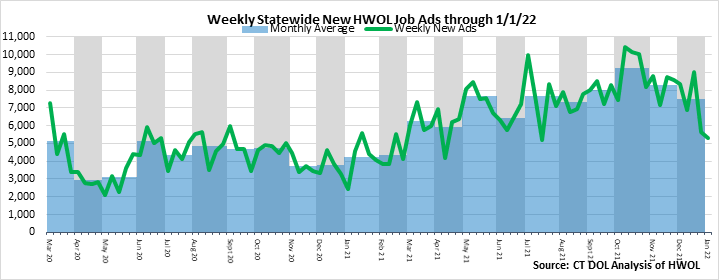

| Weekly Connecticut Help Wanted OnLine Data Series (HWOL) |

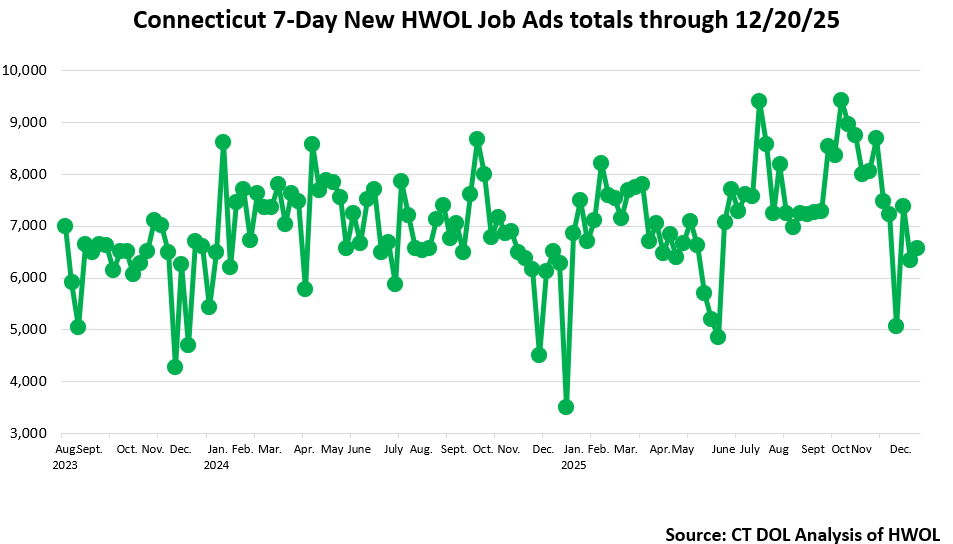

December 20th 2025 Help Wanted OnLine Data Series |

|

|

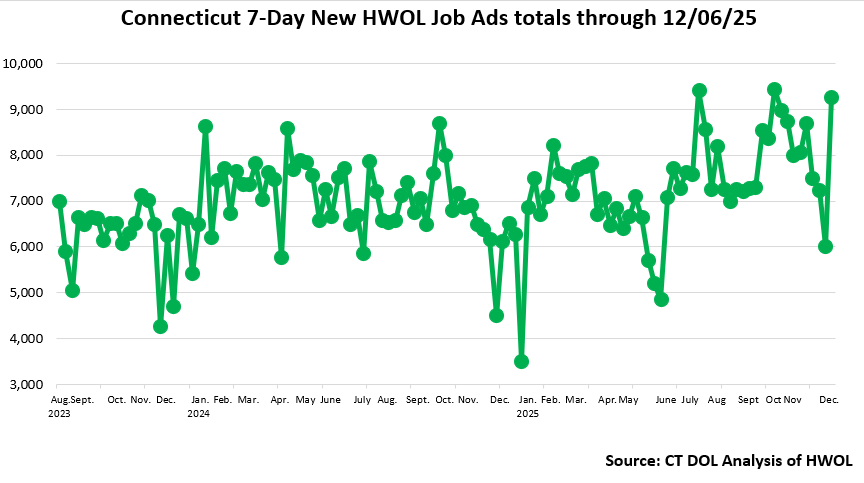

December 6th 2025 Help Wanted OnLine Data Series |

|

|

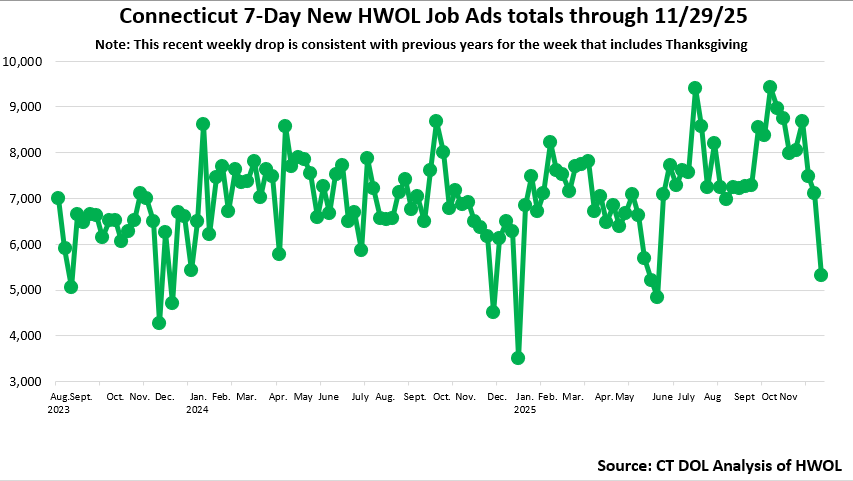

November 29th 2025 Help Wanted OnLine Data Series |

|

|

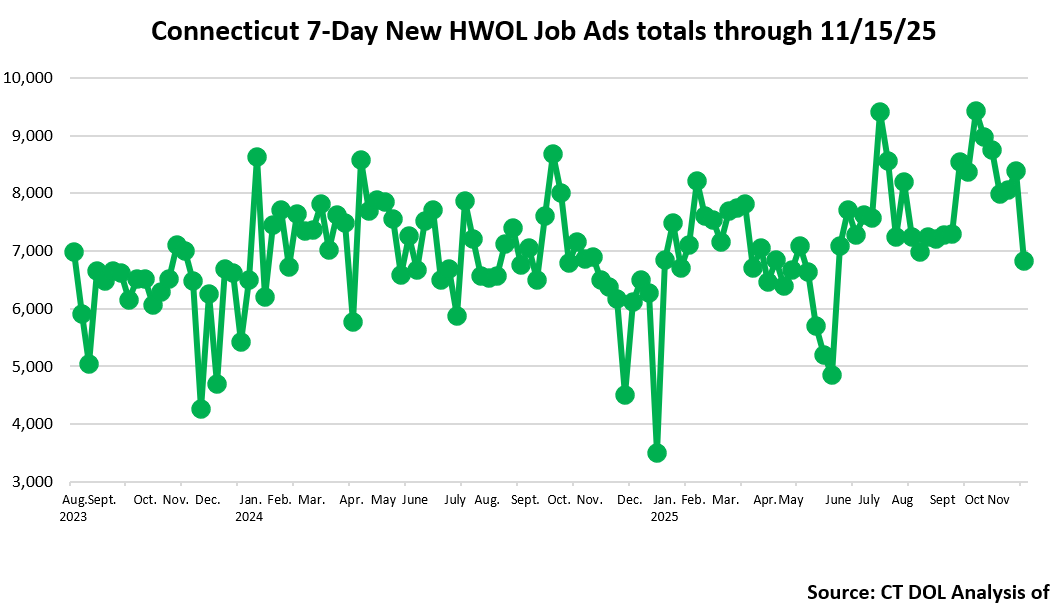

November 15th 2025 Help Wanted OnLine Data Series |

|

|

November 8th 2025 Help Wanted OnLine Data Series |

|

|

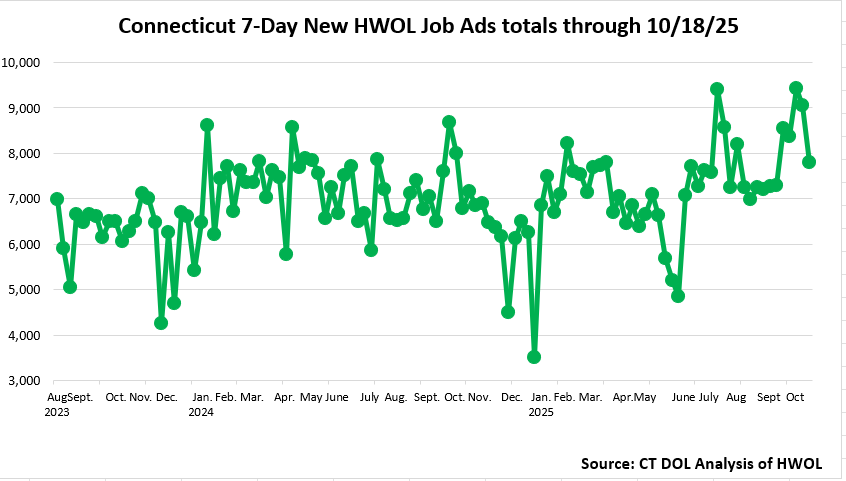

October 18th 2025 Help Wanted OnLine Data Series |

|

|

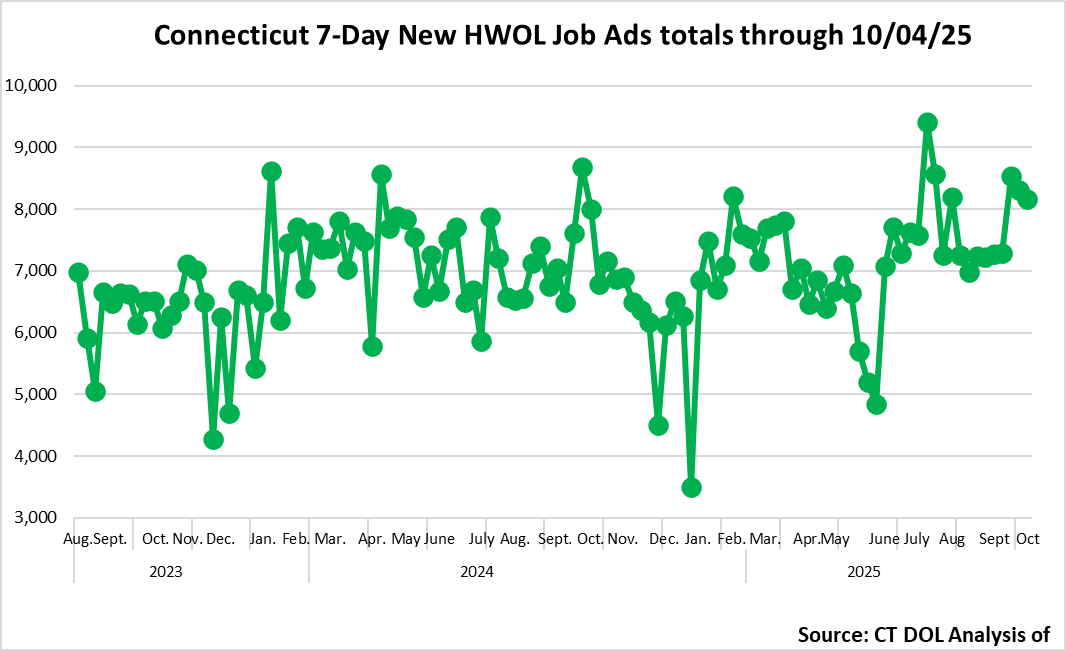

October 7th 2025 Help Wanted OnLine Data Series |

|

|

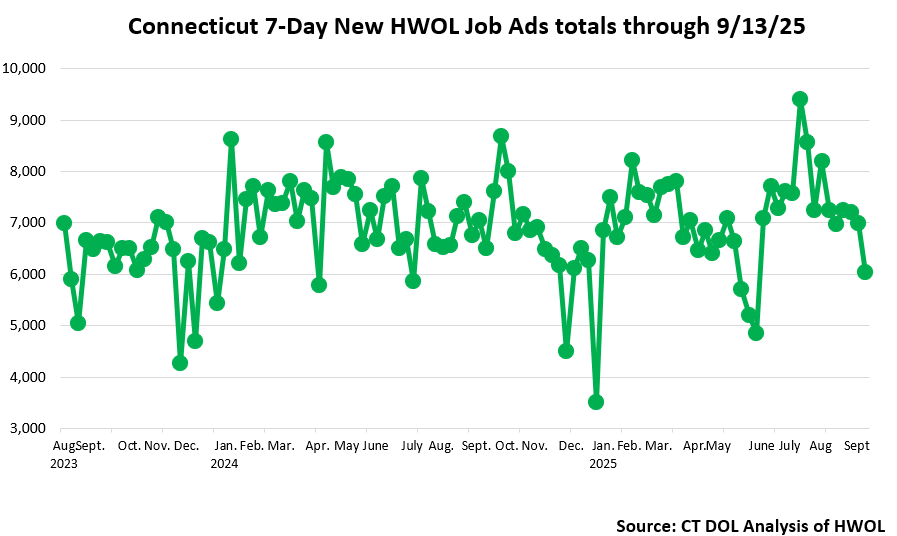

September 13th 2025 Help Wanted OnLine Data Series |

|

|

| Weekly Connecticut Help Wanted OnLine Data Series (HWOL) |

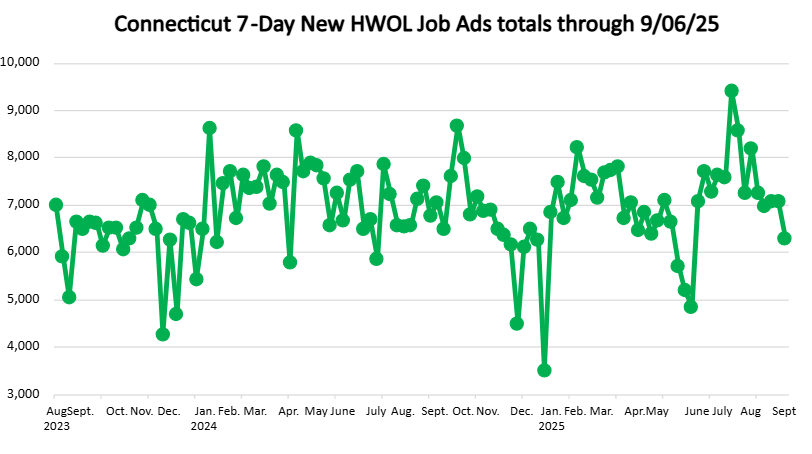

September 6th 2025 Help Wanted OnLine Data Series |

|

|

| Weekly Connecticut Help Wanted OnLine Data Series (HWOL) |

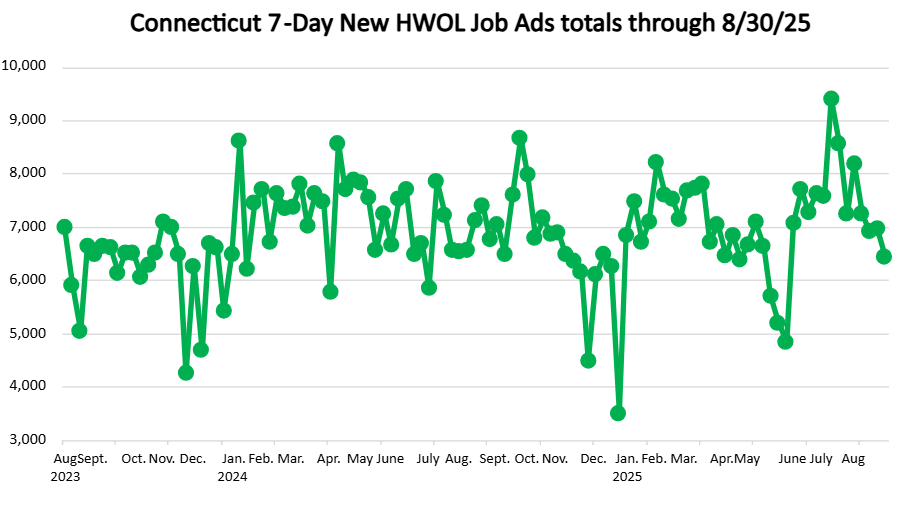

August 30th 2025 Help Wanted OnLine Data Series |

|

|

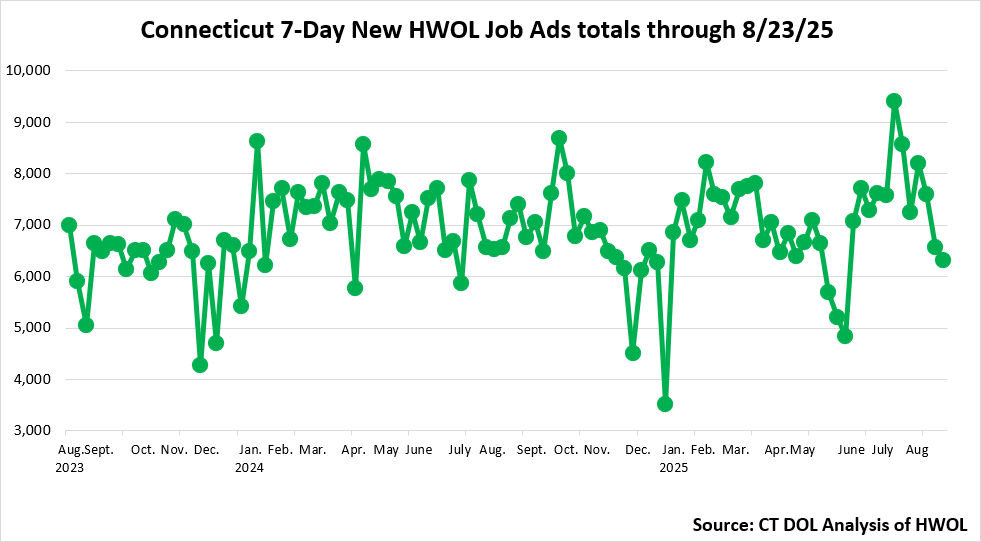

August 23rd 2025 Help Wanted OnLine Data Series |

|

|

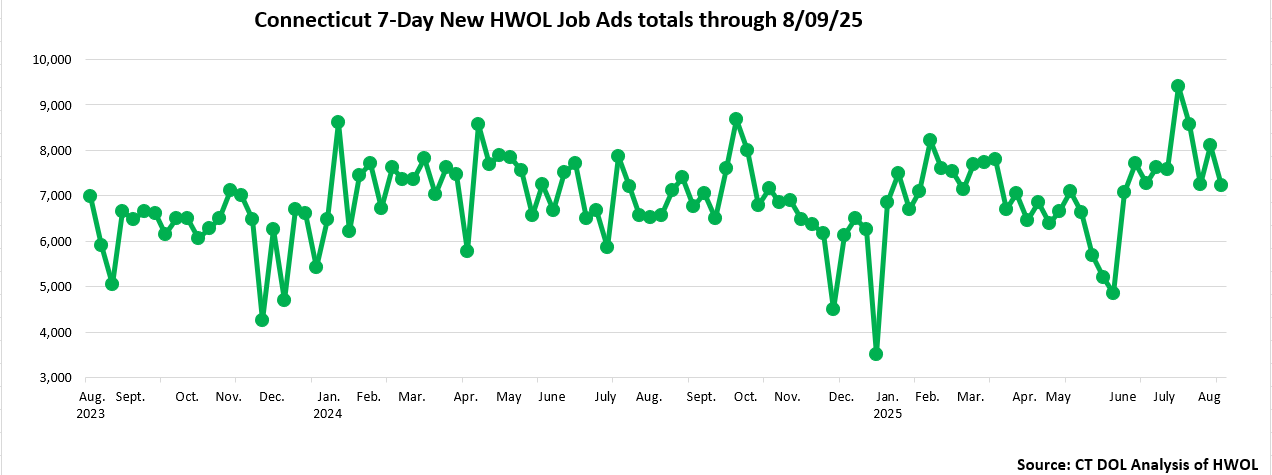

August 9th 2025 Help Wanted OnLine Data Series |

|

|

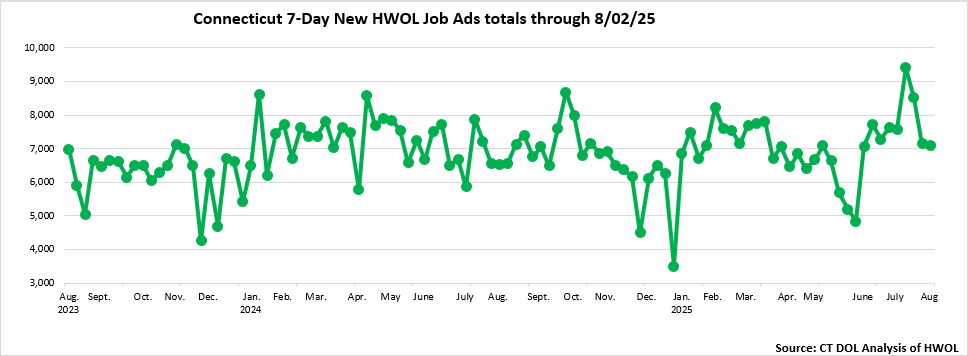

August 2nd 2025 Help Wanted OnLine Data Series |

|

|

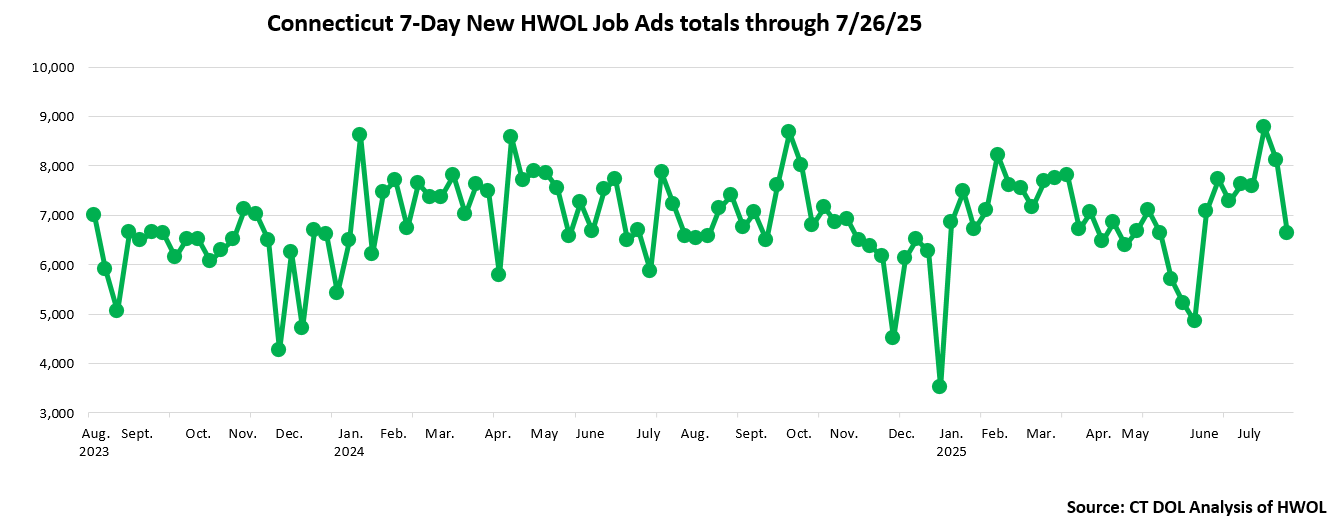

July 26th 2025 Help Wanted OnLine Data Series |

|

|

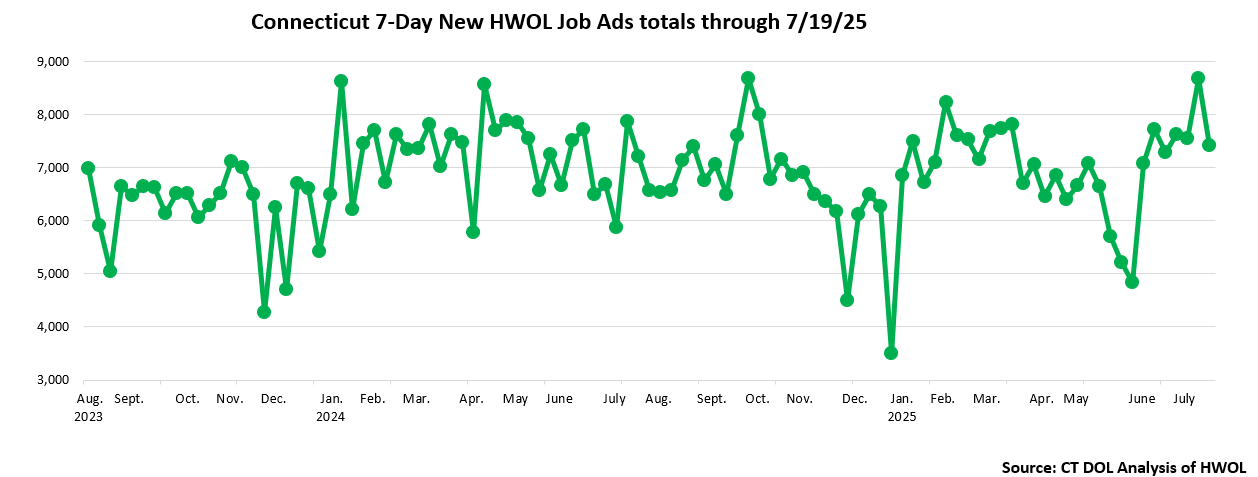

July 19th 2025 Help Wanted OnLine Data Series |

|

|

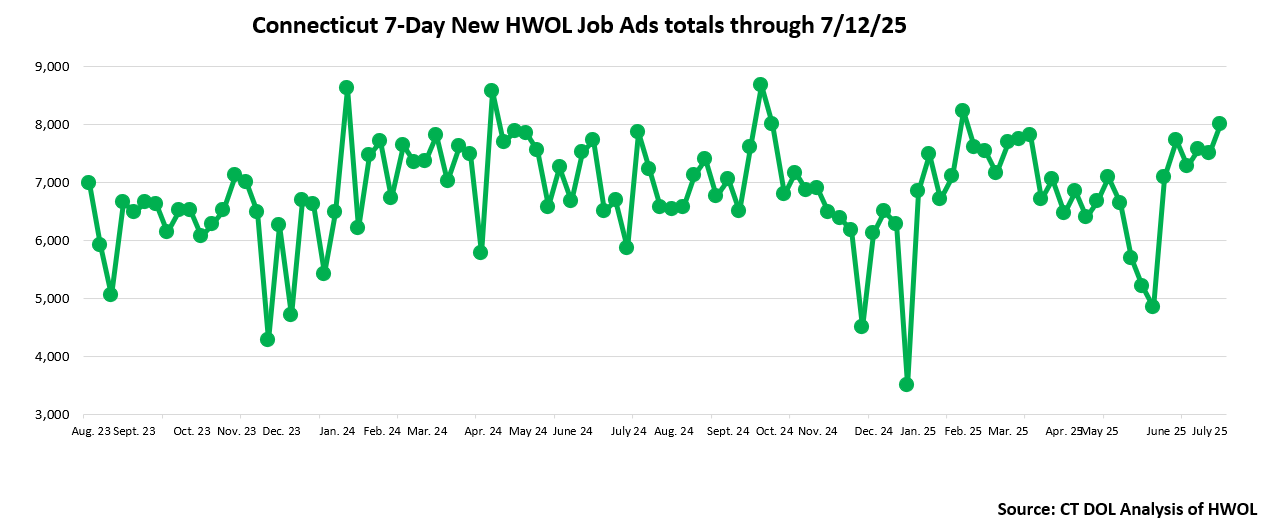

July 12th 2025 Help Wanted OnLine Data Series |

|

|

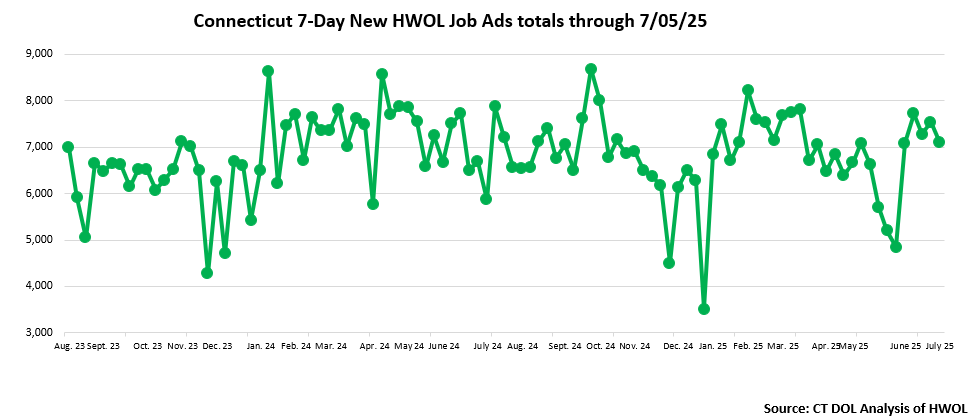

July 5th 2025 Help Wanted OnLine Data Series |

|

|

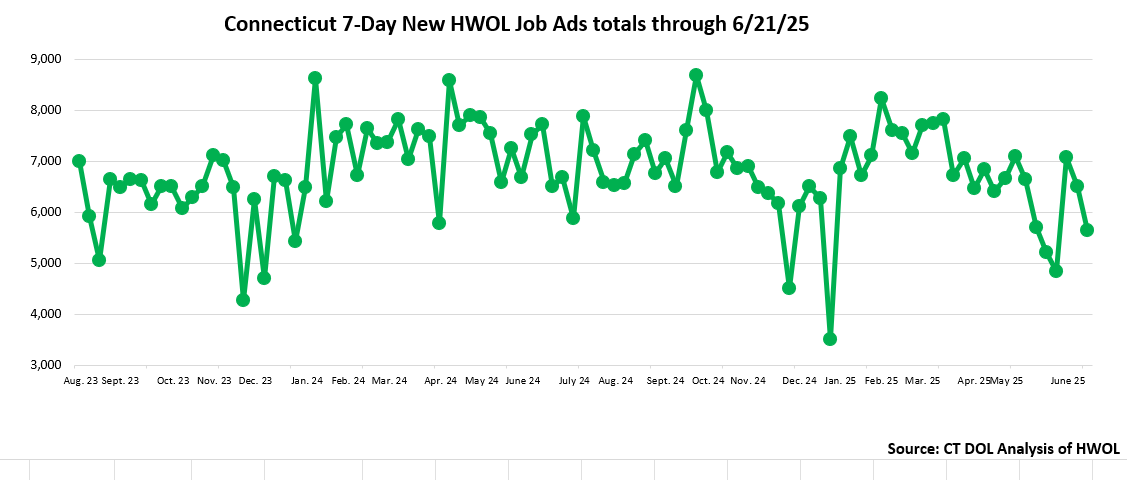

June 21st 2025 Help Wanted OnLine Data Series |

|

|

June 7th 2025 Help Wanted OnLine Data Series |

|

|

May 24th 2025 Help Wanted OnLine Data Series |

|

|

May 17th 2025 Help Wanted OnLine Data Series |

|

|

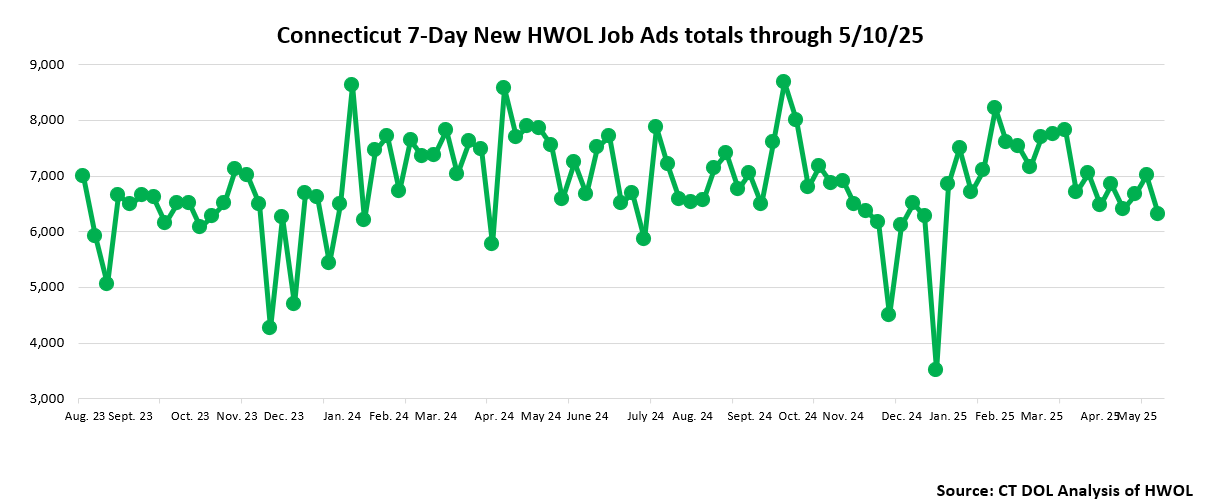

May 10th 2025 Help Wanted OnLine Data Series |

|

|

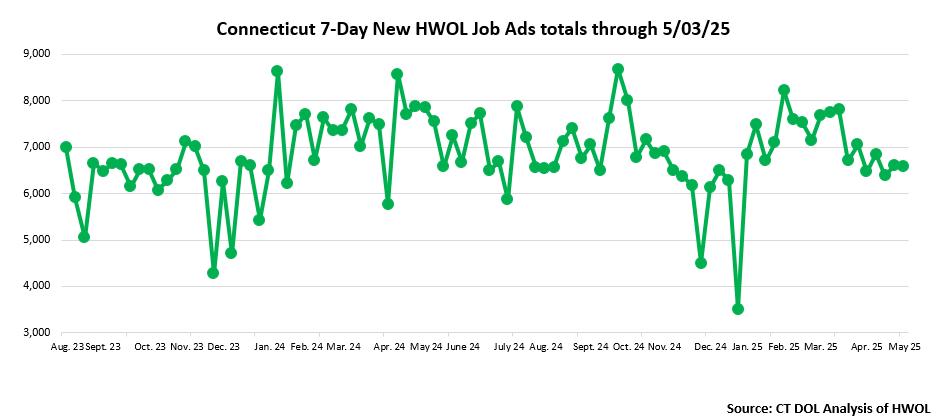

May 3rd 2025 Help Wanted OnLine Data Series |

|

|

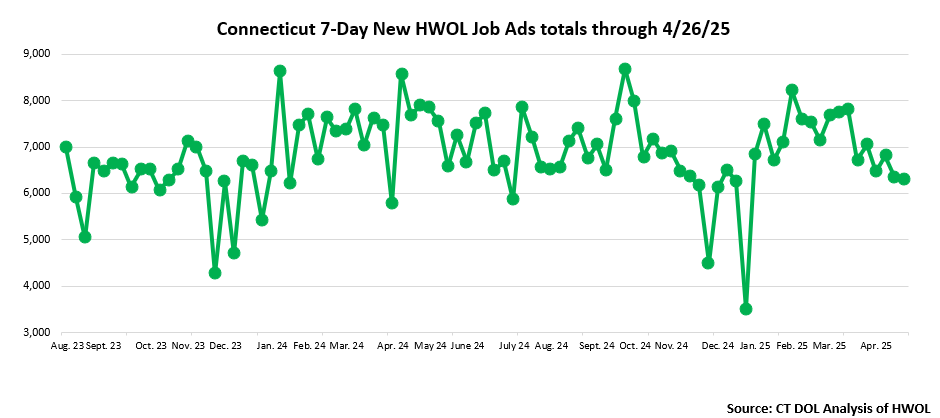

April 26th 2025 Help Wanted OnLine Data Series |

|

|

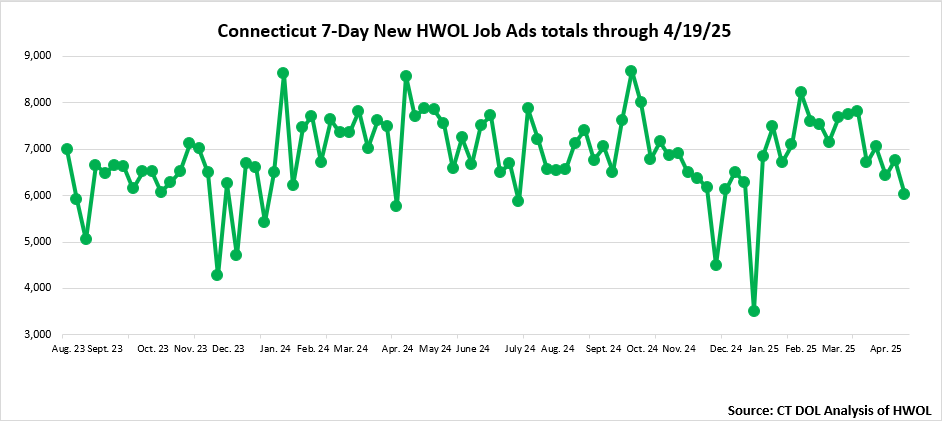

April 19th 2025 Help Wanted OnLine Data Series |

|

|

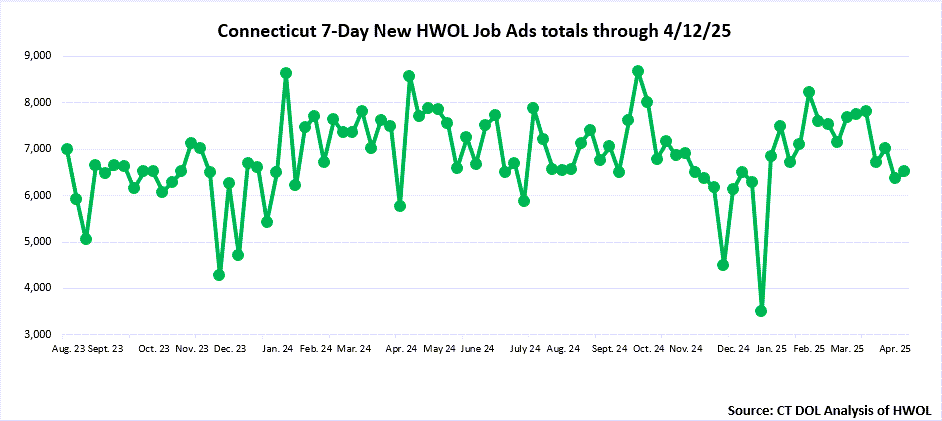

April 15th, 2025 Help Wanted OnLine Data Series |

|

|

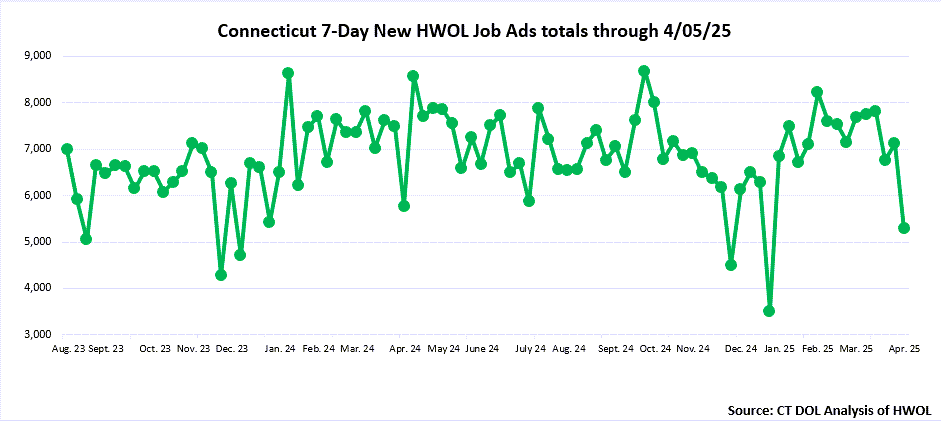

April 5th, 2025 Help Wanted OnLine Data Series |

|

|

April 1st, 2025 Help Wanted OnLine Data Series |

|

|

March 22nd, 2025 Help Wanted OnLine Data Series |

|

|

March 15th, 2025 Help Wanted OnLine Data Series |

|

|

March 8th, 2025 Help Wanted OnLine Data Series |

|

|

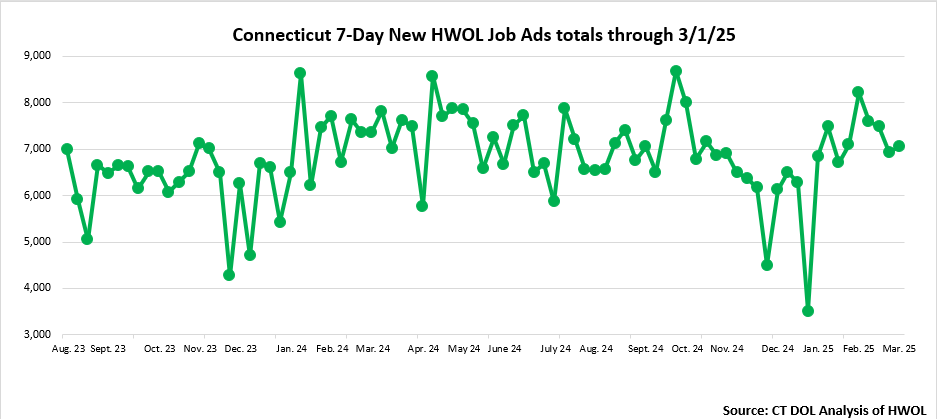

March 1st, 2025 Help Wanted OnLine Data Series |

|

|

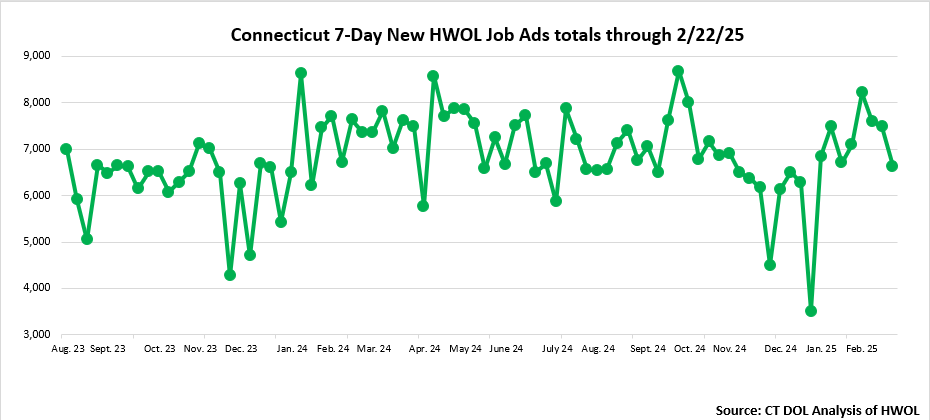

February 22nd, 2025 Help Wanted OnLine Data Series |

|

|

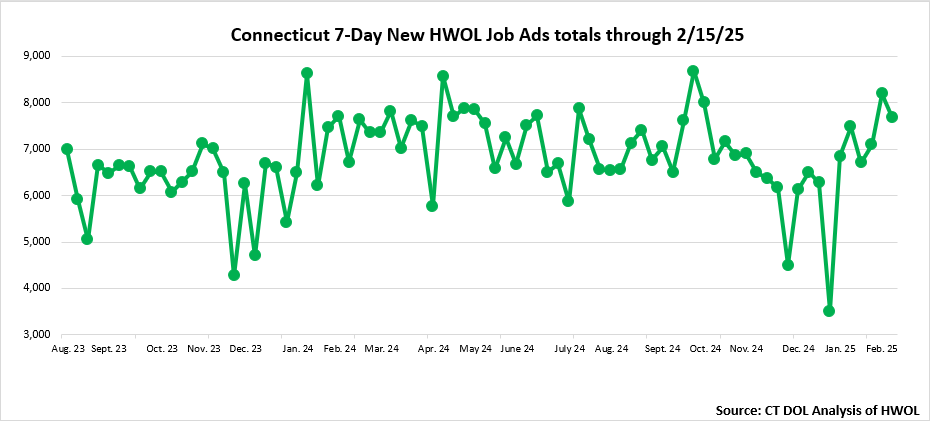

February 15th, 2025 Help Wanted OnLine Data Series |

|

|

February 8th, 2025 Help Wanted OnLine Data Series |

|

|

February 1st, 2025 Help Wanted OnLine Data Series |

|

|

January 18th, 2025 Help Wanted OnLine Data Series |

|

|

January 11th, 2025 Help Wanted OnLine Data Series |

|

|

January 4th, 2025 Help Wanted OnLine Data Series |

|

|

December 28st, 2024 Help Wanted OnLine Data Series |

|

|

December 21st, 2024 Help Wanted OnLine Data Series |

|

|

December 14th, 2024 Help Wanted OnLine Data Series |

|

|

December 9th, 2024 Help Wanted OnLine Data Series |

|

|

November 30th, 2024 Help Wanted OnLine Data Series |

|

|

November 23th, 2024 Help Wanted OnLine Data Series |

|

|

November 18th, 2024 Help Wanted OnLine Data Series |

|

|

November 9th, 2024 Help Wanted OnLine Data Series |

|

|

November 1st, 2024 Help Wanted OnLine Data Series |

|

|

October 28th 2024 Help Wanted OnLine Data Series |

|

|

October 19th 2024 Help Wanted OnLine Data Series |

|

|

October 12th 2024 Help Wanted OnLine Data Series |

|

|

October 5th 2024 Help Wanted OnLine Data Series |

|

|

September 28th 2024 Help Wanted OnLine Data Series |

|

|

September 14th 2024 Help Wanted OnLine Data Series |

|

|

September 7th 2024 Help Wanted OnLine Data Series |

|

|

August 31st 2024 Help Wanted OnLine Data Series |

|

|

August 24th 2024 Help Wanted OnLine Data Series |

|

|

August 17th 2024 Help Wanted OnLine Data Series |

|

|

August 10th 2024 Help Wanted OnLine Data Series |

|

|

July 13th 2024 Help Wanted OnLine Data Series |

|

|

July 6th 2024 Help Wanted OnLine Data Series |

|

|

June 29th 2024 Help Wanted OnLine Data Series |

|

|

June 22nd 2024 Help Wanted OnLine Data Series |

|

|

June 15th 2024 Help Wanted OnLine Data Series |

|

|

June 8th 2024 Help Wanted OnLine Data Series |

|

|

May 18th 2024 Help Wanted OnLine Data Series |

|

|

May 11th 2024 Help Wanted OnLine Data Series |

|

|

May 4th 2024 Help Wanted OnLine Data Series |

|

|

April 27th 2024 Help Wanted OnLine Data Series |

|

|

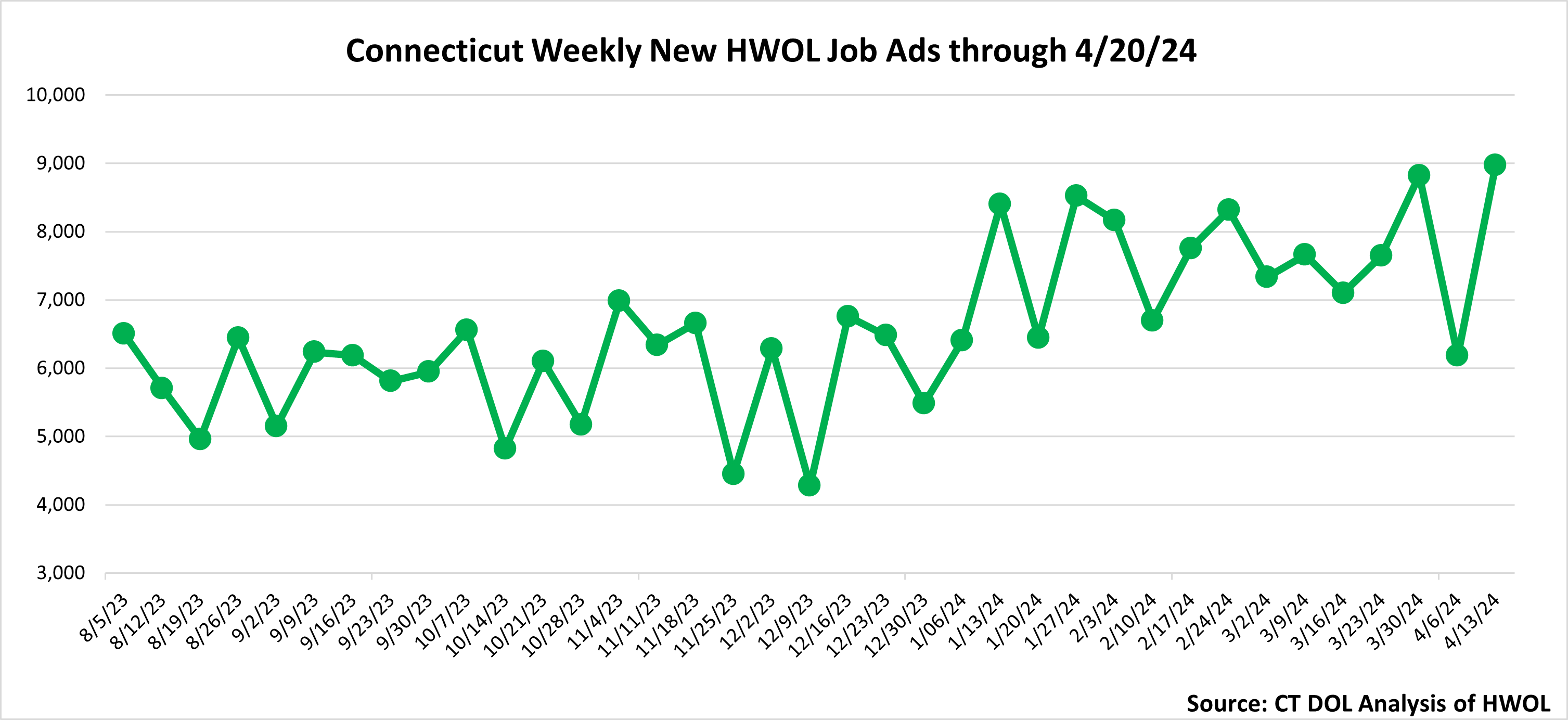

April 20th 2024 Help Wanted OnLine Data Series |

|

|

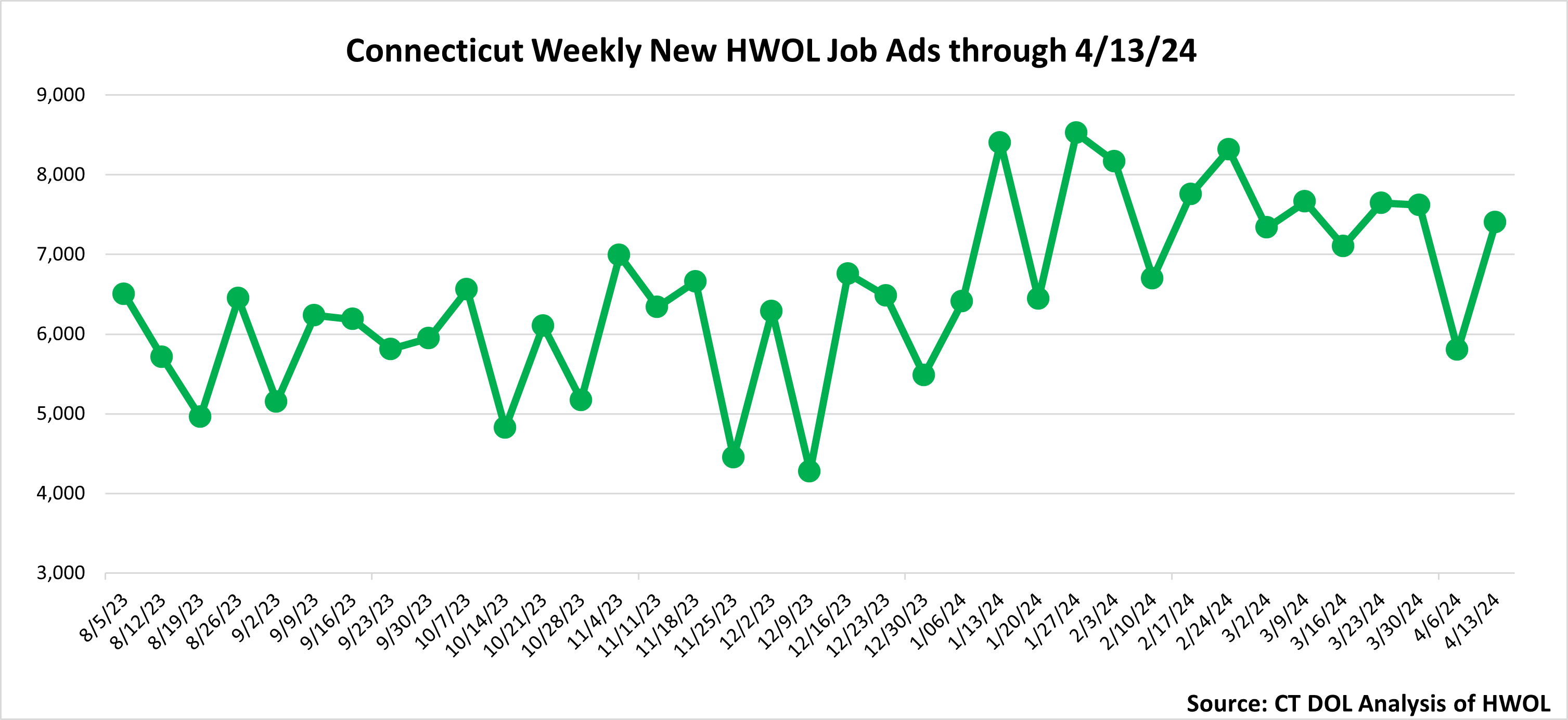

April 13th 2024 Help Wanted OnLine Data Series |

|

|

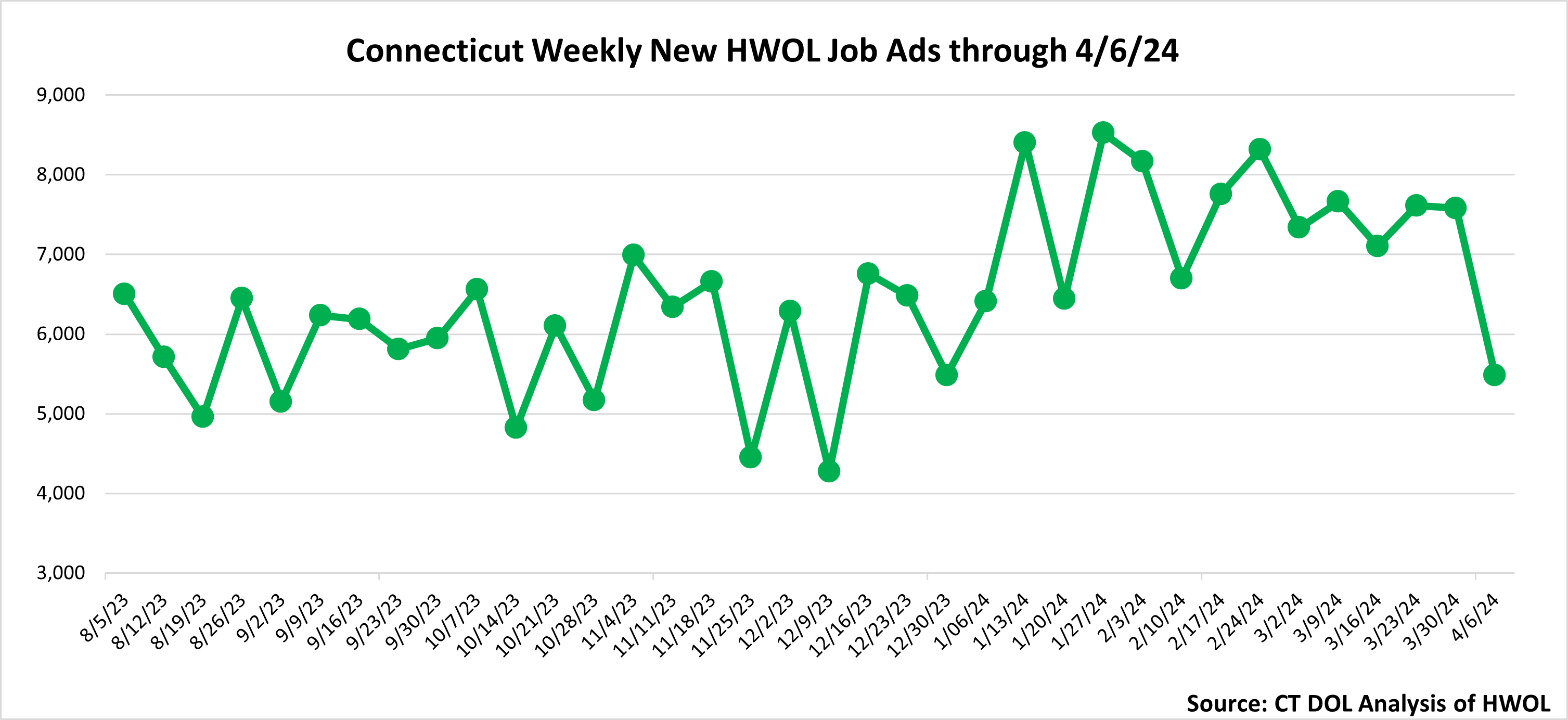

April 6th 2024 Help Wanted OnLine Data Series |

|

|

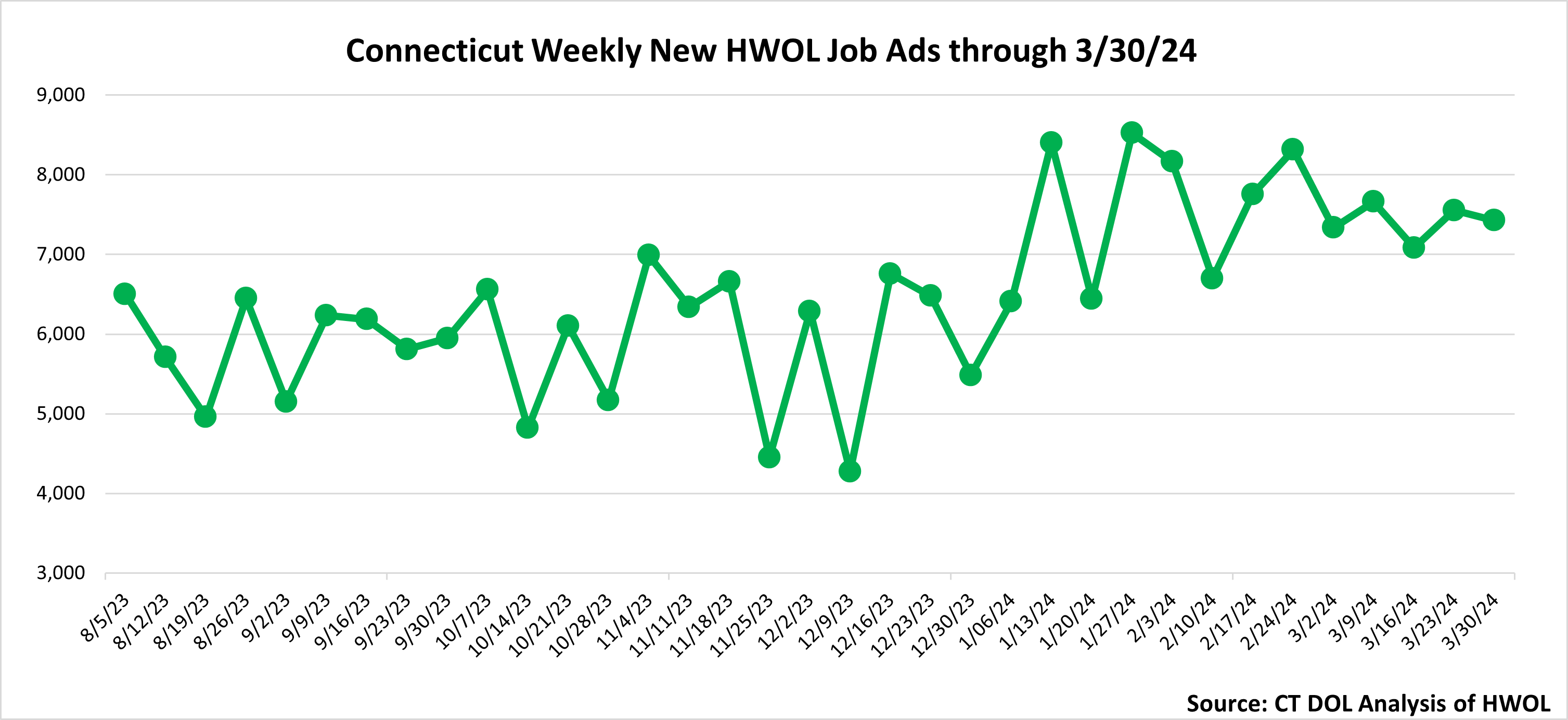

March 30th 2024 Help Wanted OnLine Data Series |

|

|

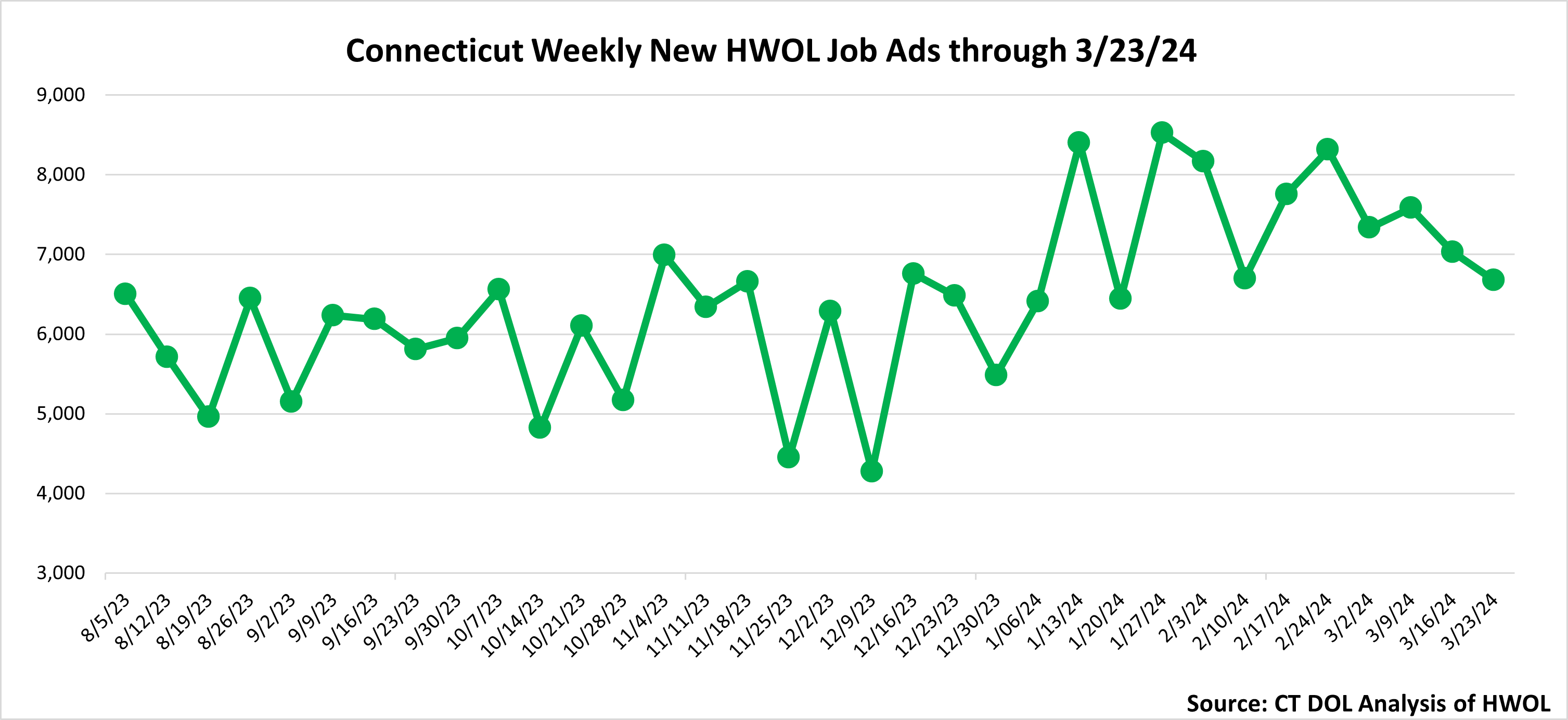

March 23rd 2024 Help Wanted OnLine Data Series |

|

|

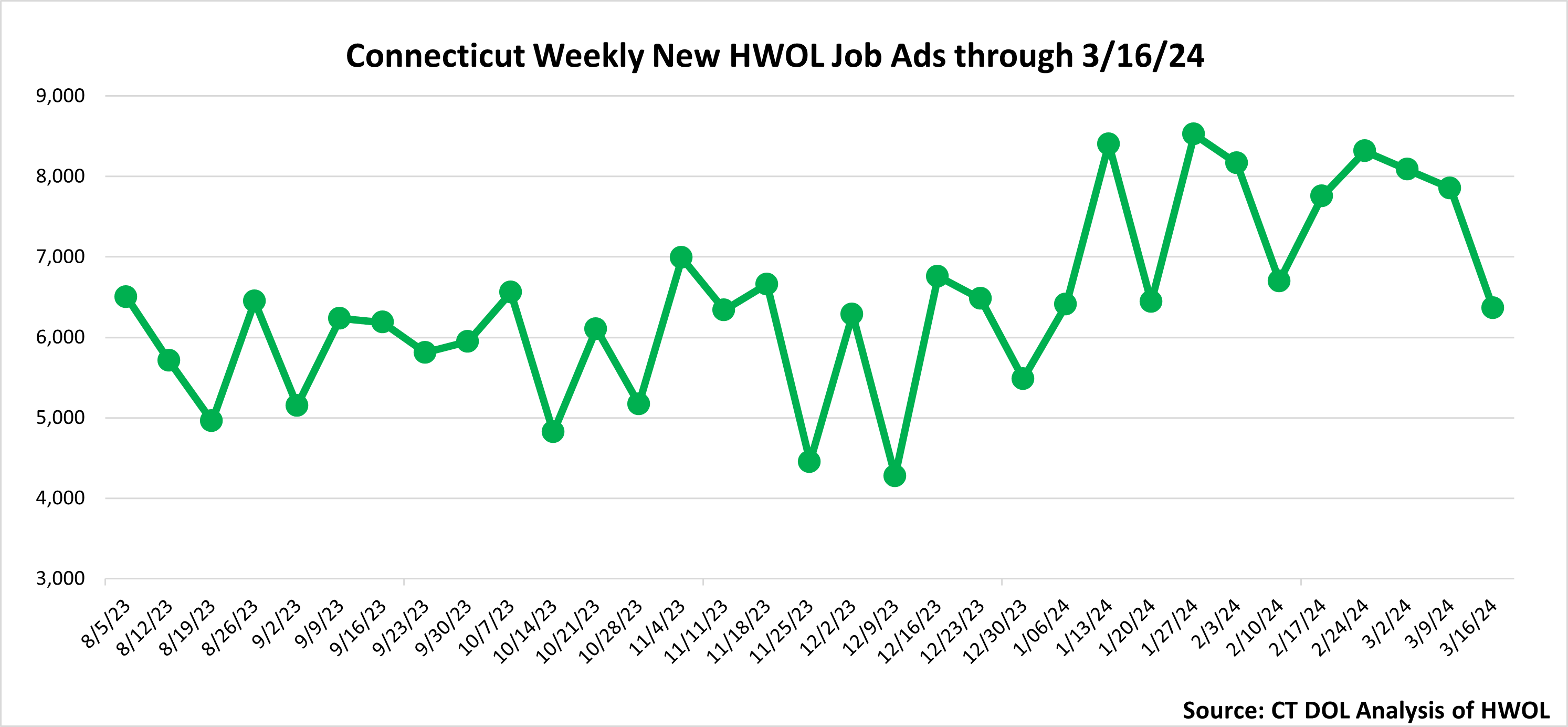

March 16th 2024 Help Wanted OnLine Data Series |

|

|

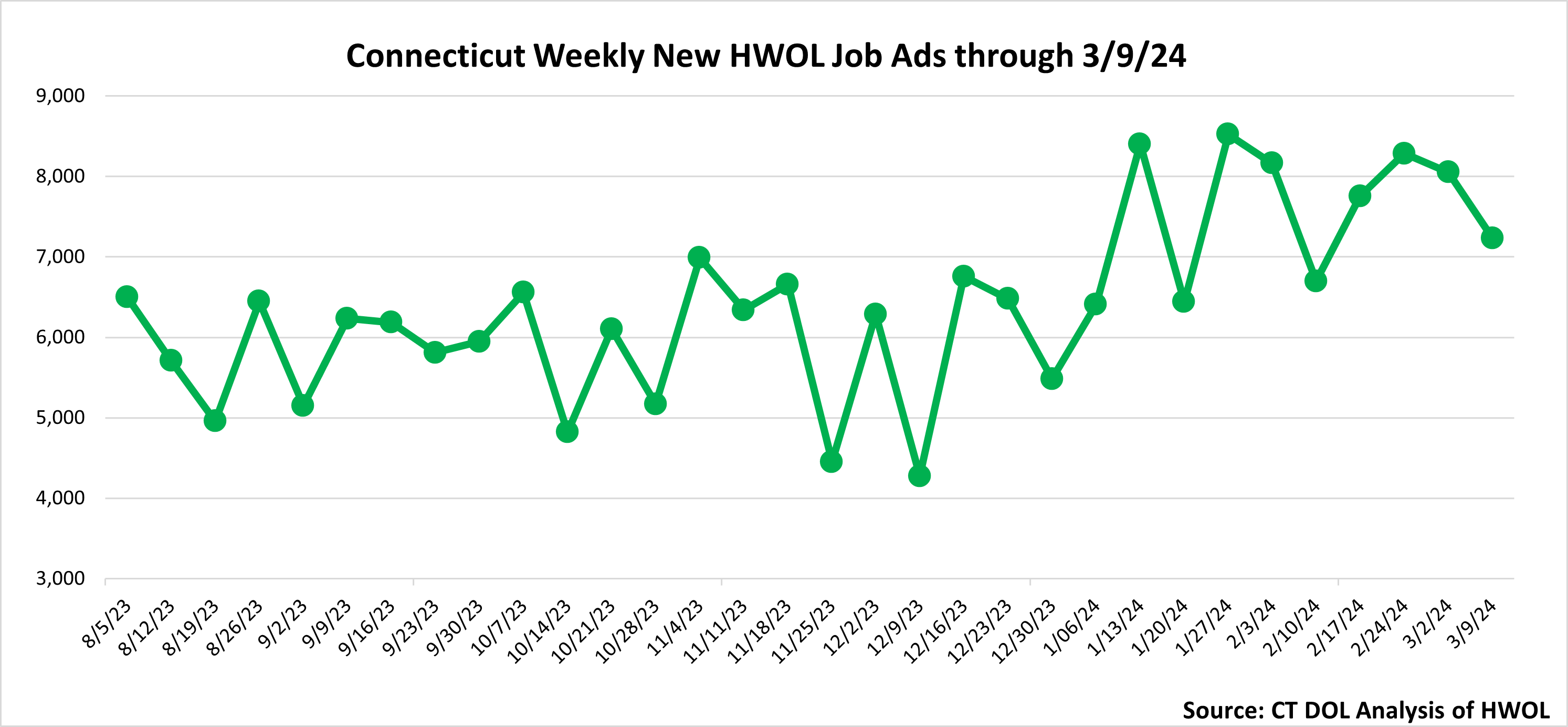

March 9th 2024 Help Wanted OnLine Data Series |

|

|

March 1st 2024 Help Wanted OnLine Data Series |

|

|

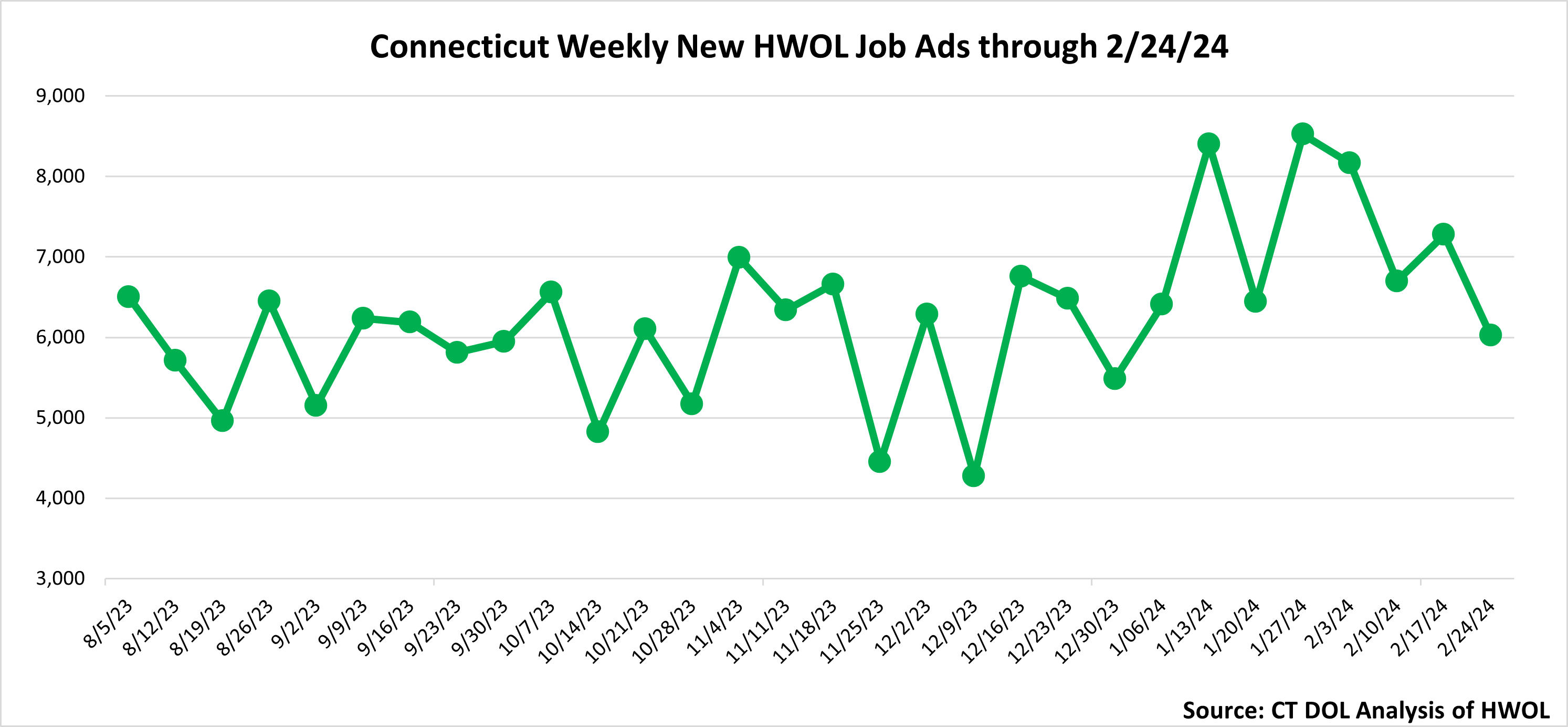

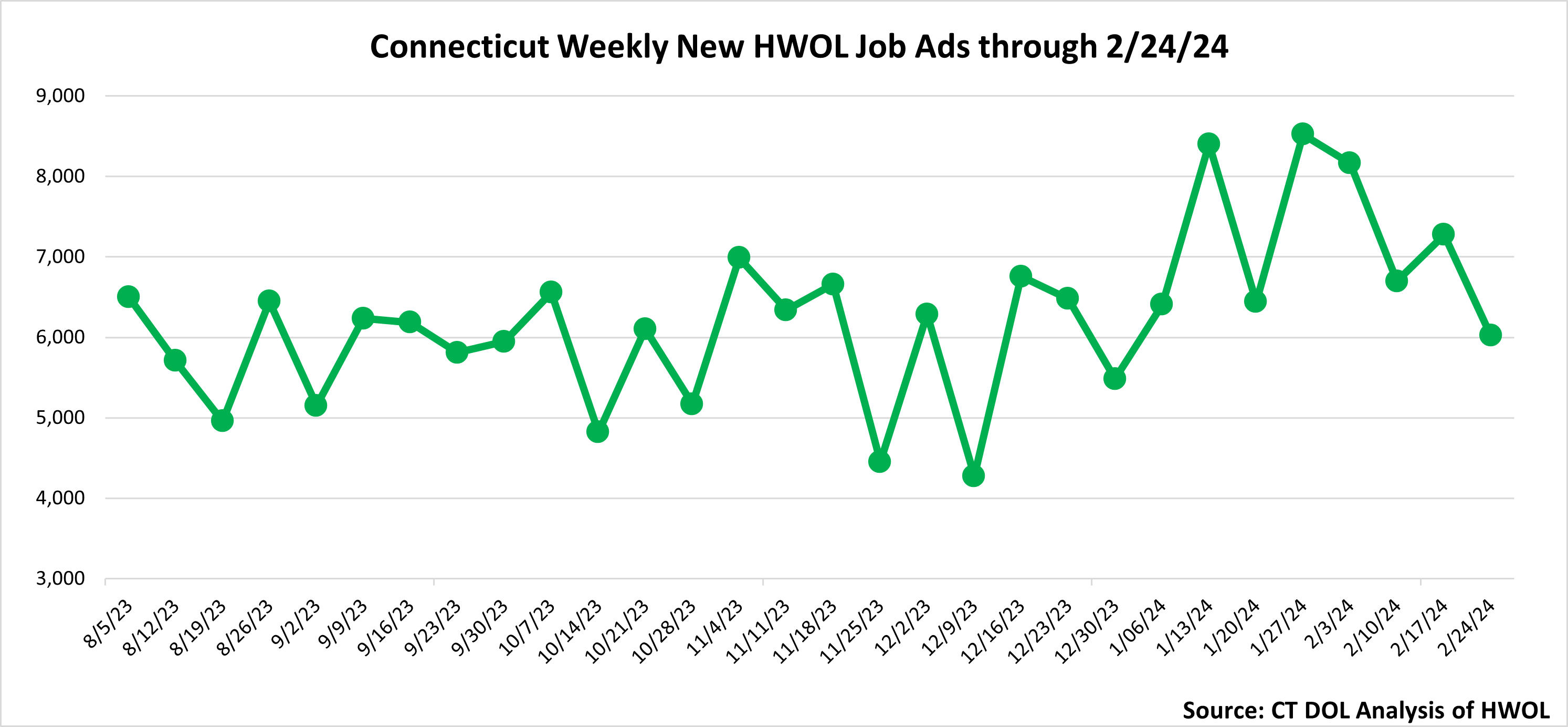

February 24th 2024 Help Wanted OnLine Data Series |

|

|

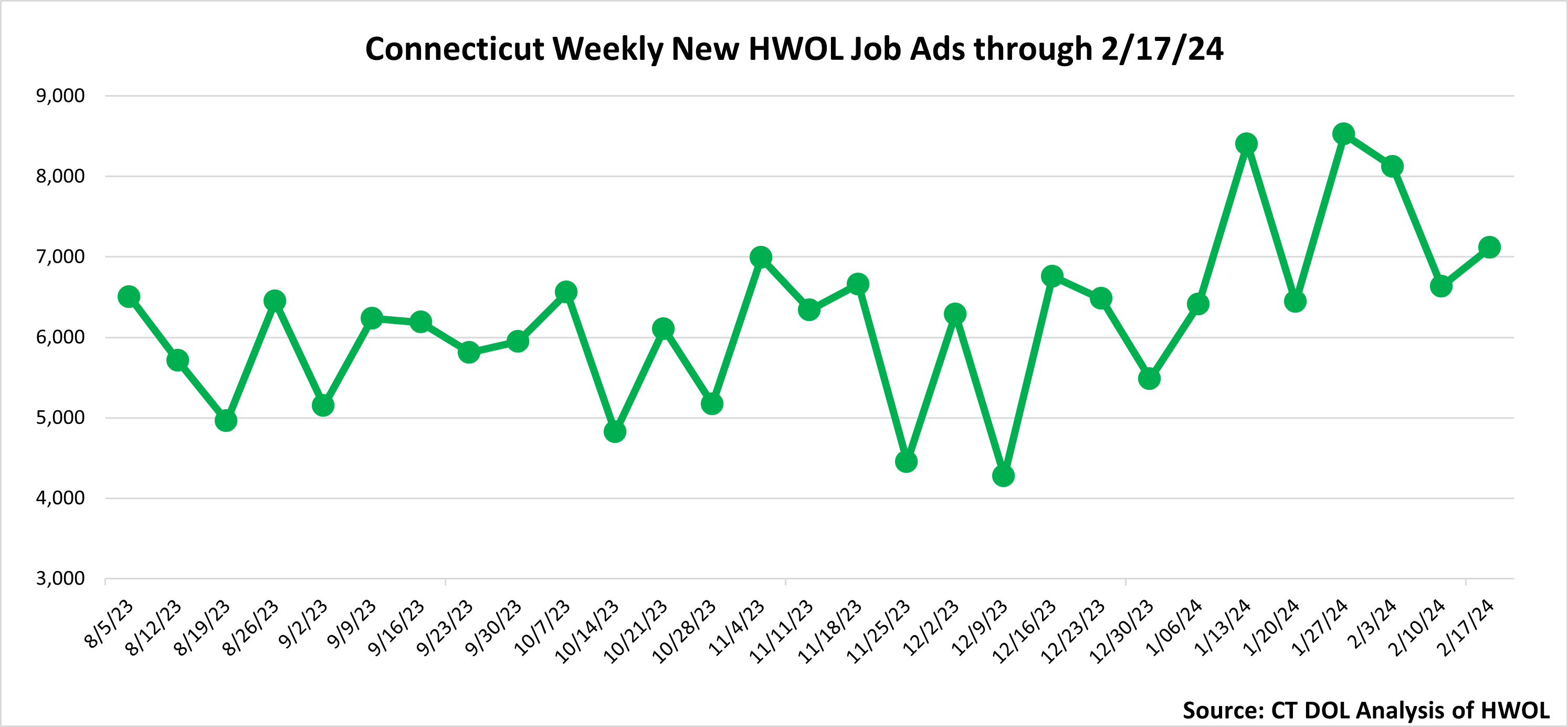

February 17th 2024 Help Wanted OnLine Data Series |

|

| |

| |

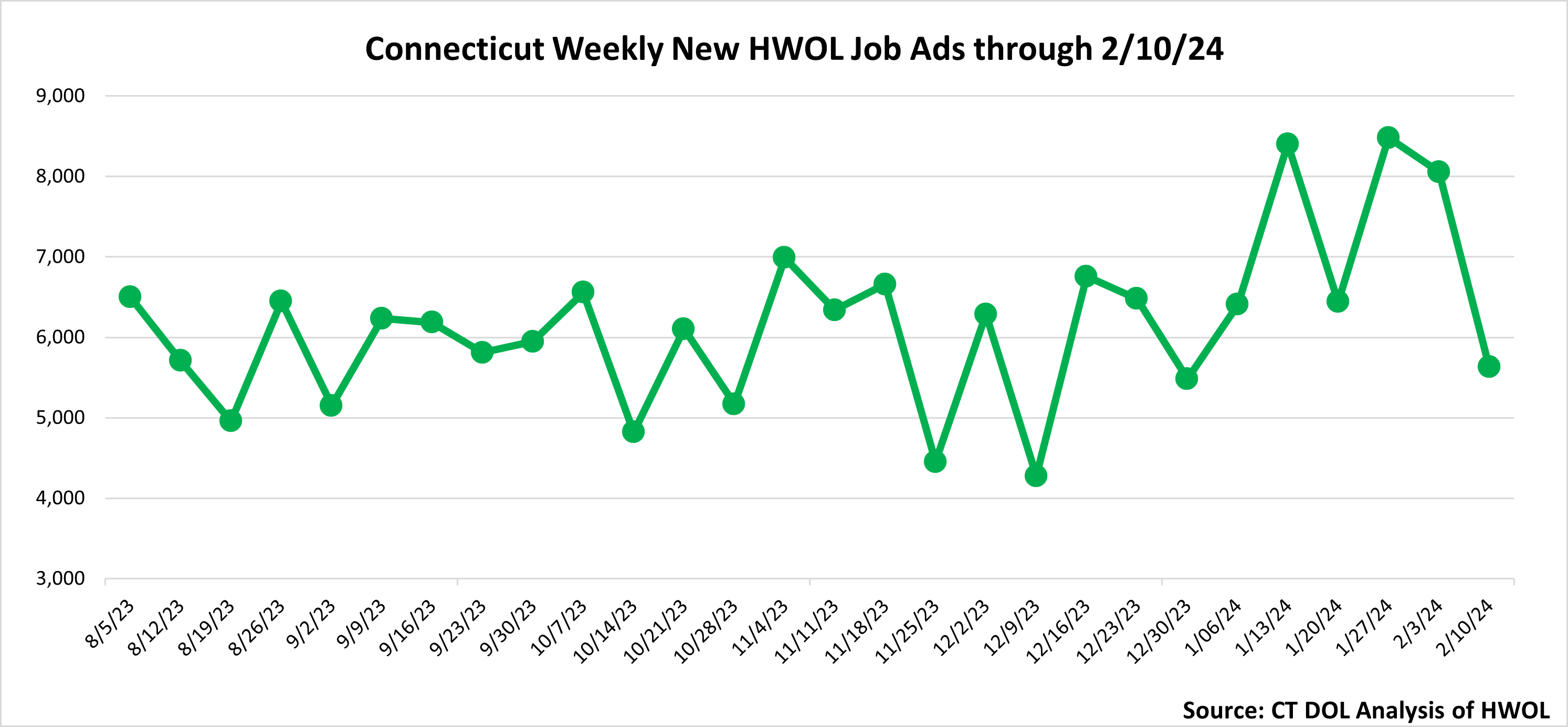

February 10th 2024 Help Wanted OnLine Data Series |

|

| |

| |

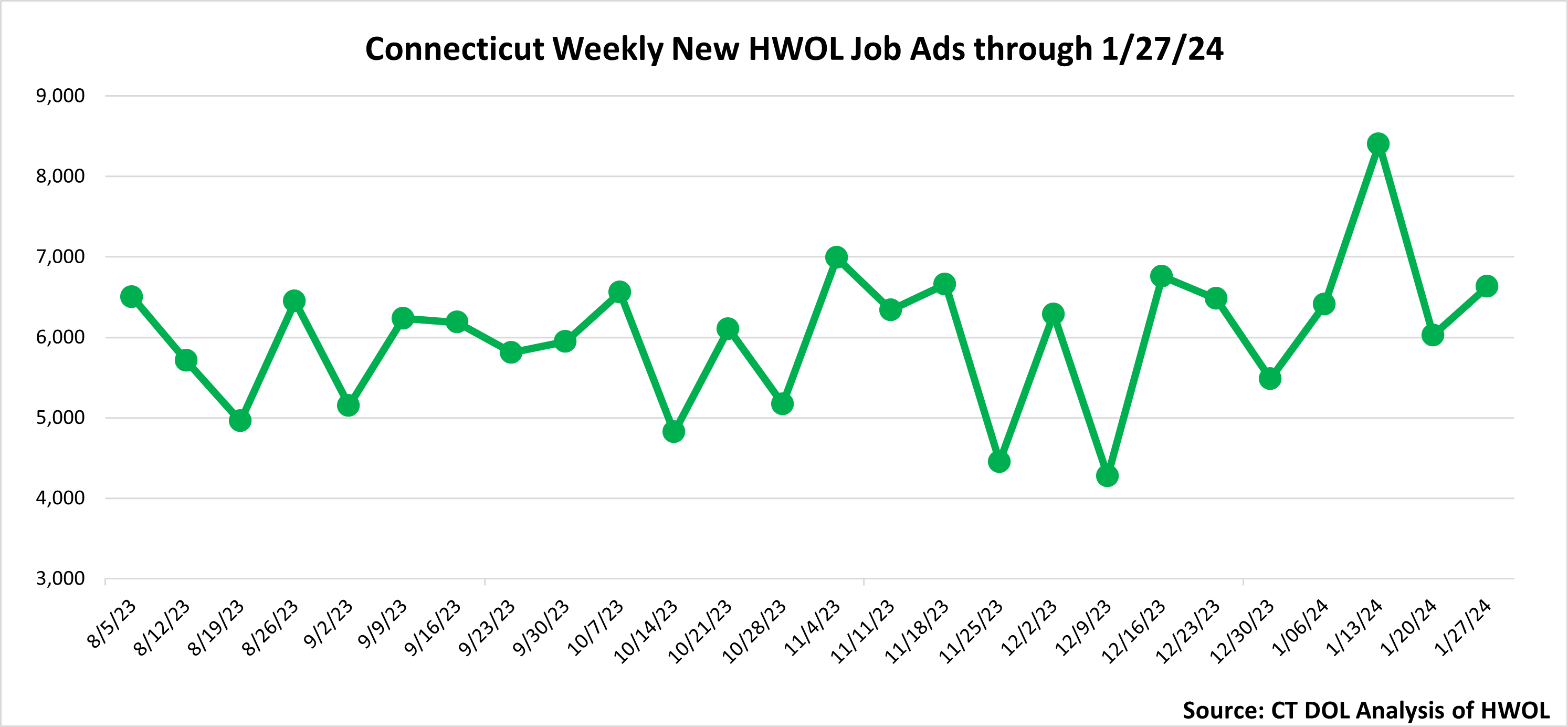

January 27th 2024 Help Wanted OnLine Data Series |

|

| |

| |

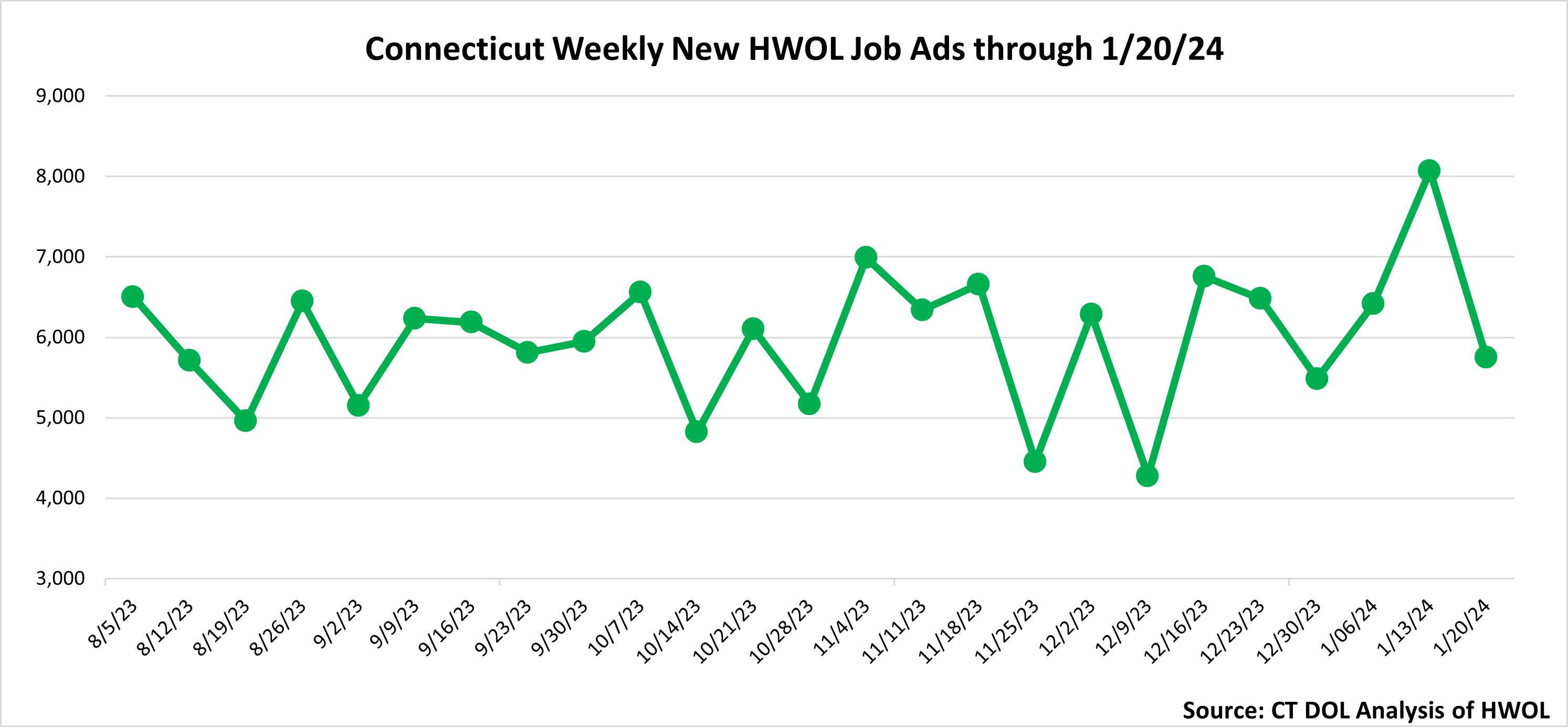

January 20th 2024 Help Wanted OnLine Data Series |

|

| |

| |

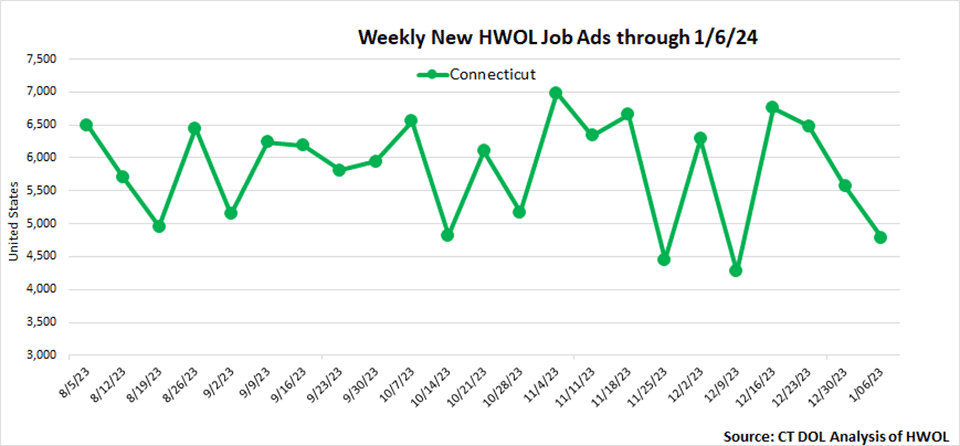

January 6th 2024 Help Wanted OnLine Data Series |

|

| |

| |

December 23rd 2023 Help Wanted OnLine Data Series |

|

| |

| |

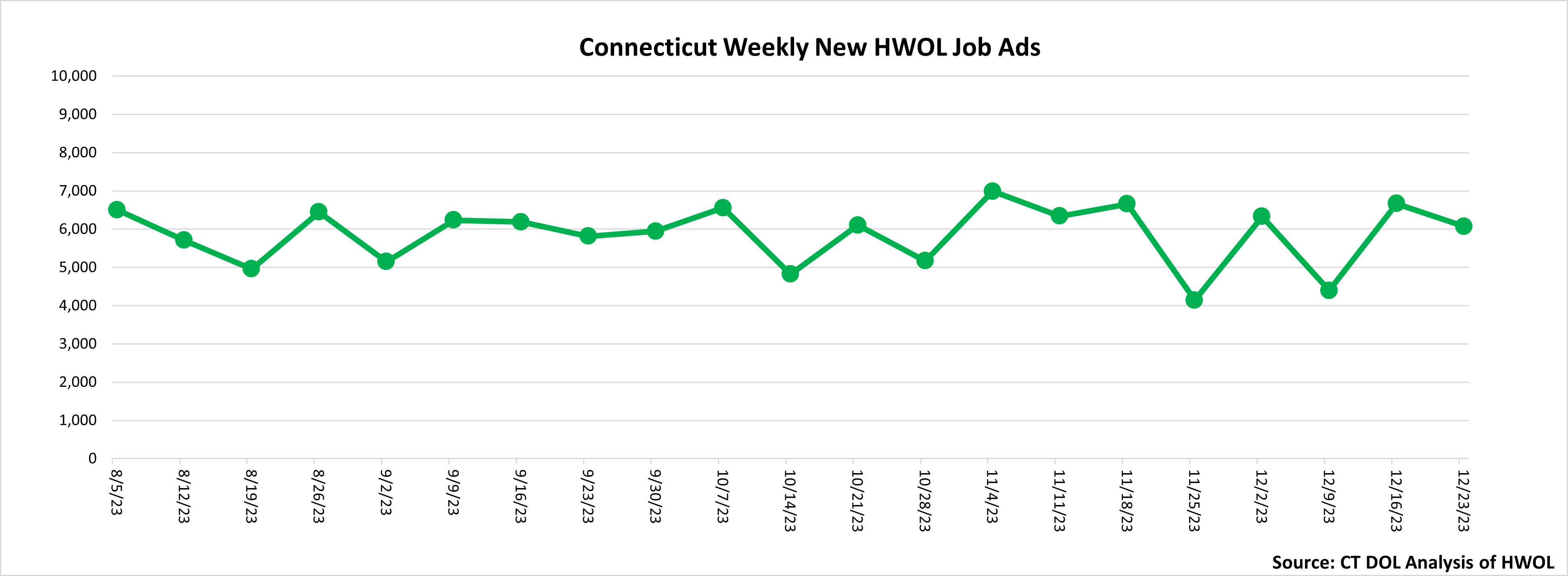

December 16th 2023 Help Wanted OnLine Data Series |

|

| |

| |

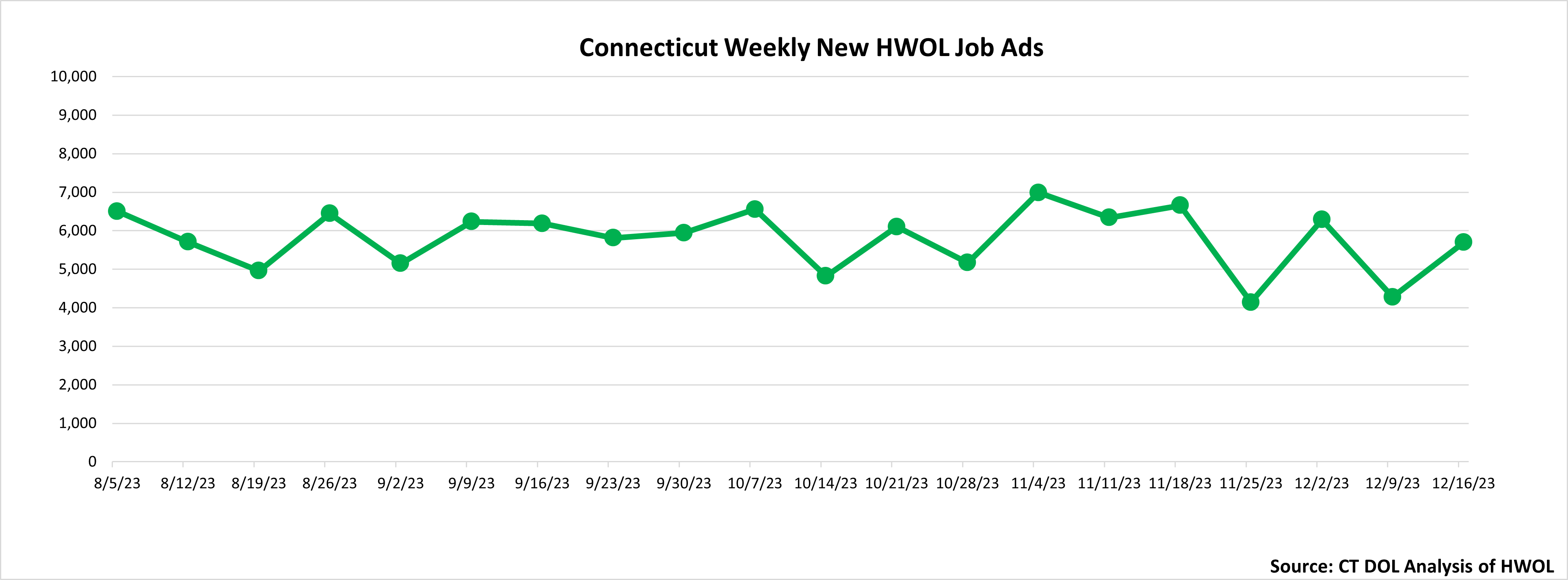

December 11th 2023 Help Wanted OnLine Data Series |

|

| |

| |

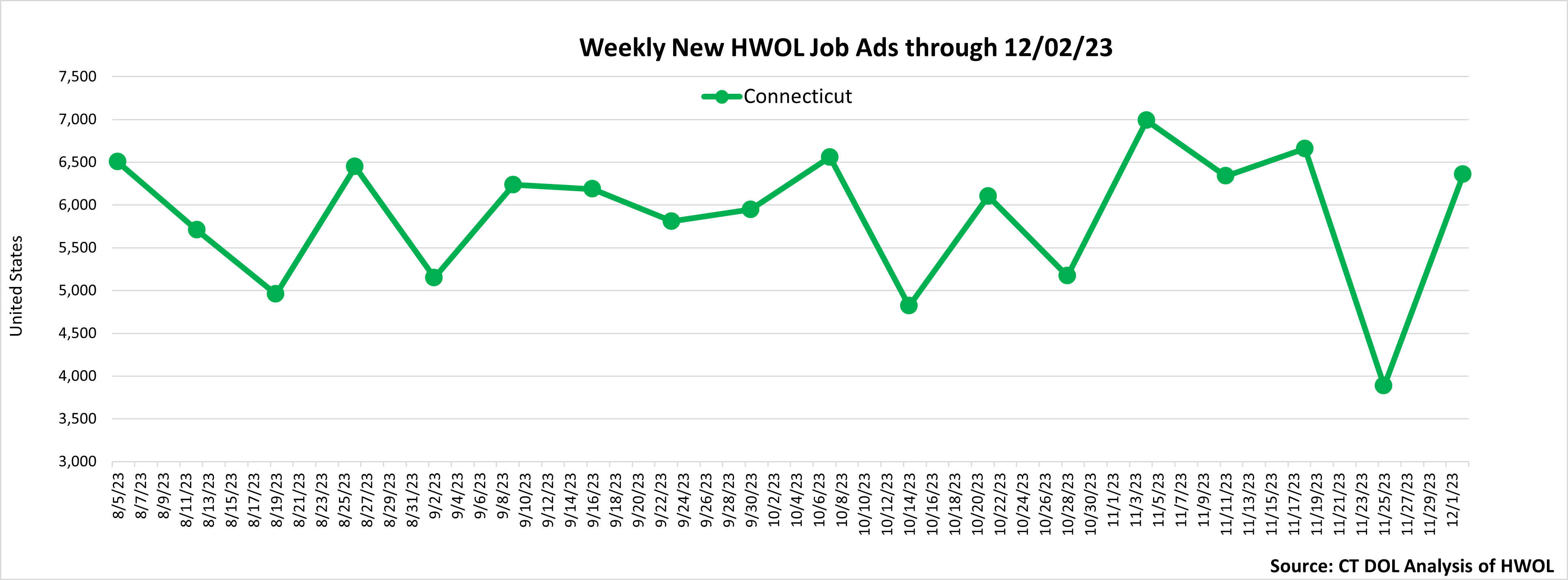

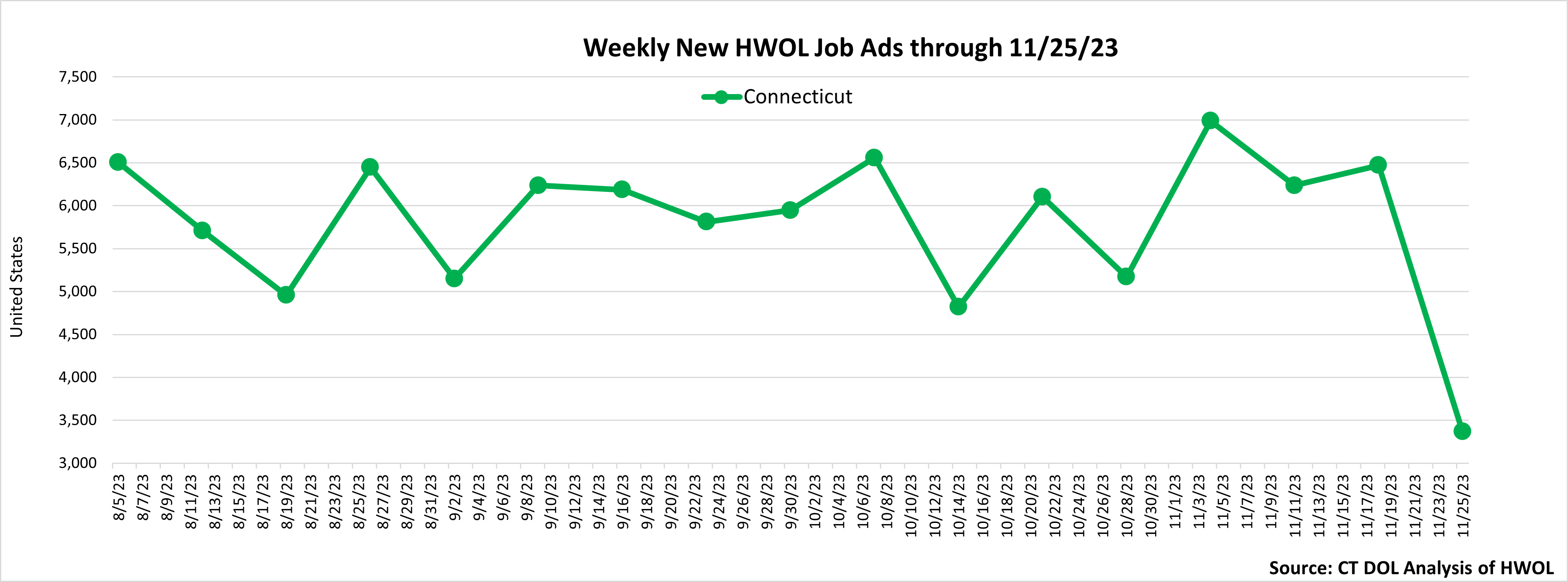

November 25th 2023 Help Wanted OnLine Data Series |

|

| |

| |

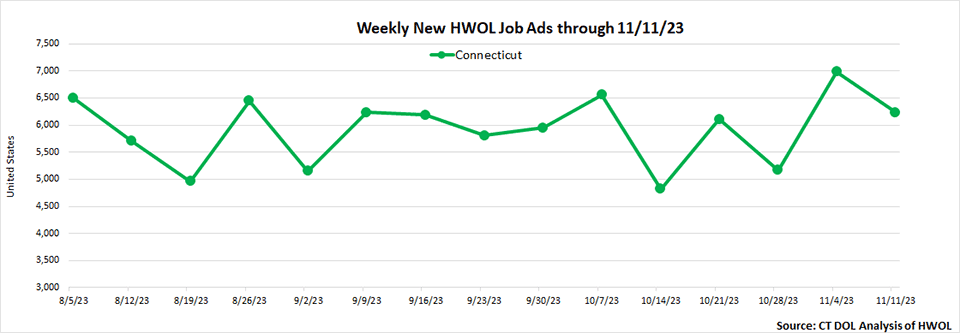

November 18th 2023 Help Wanted OnLine Data Series |

|

| |

| |

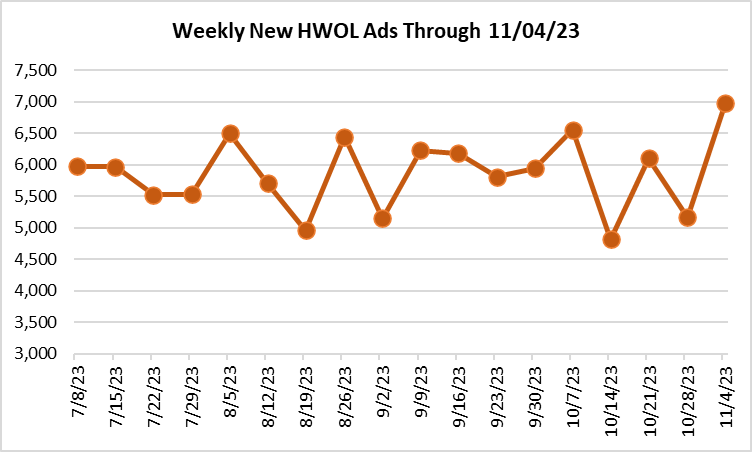

November 4th 2023 Help Wanted OnLine Data Series |

|

|

|

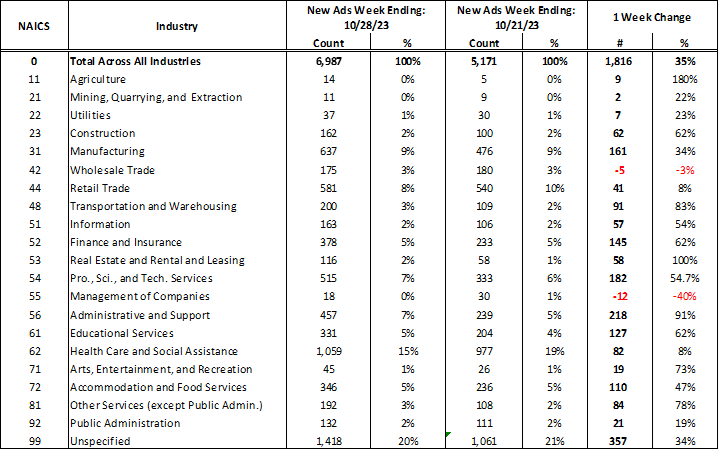

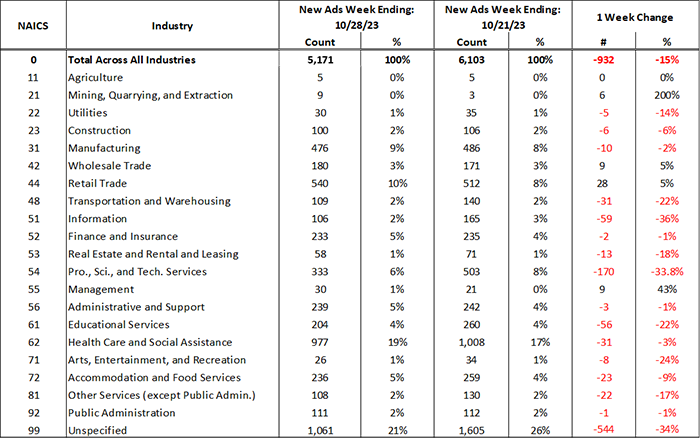

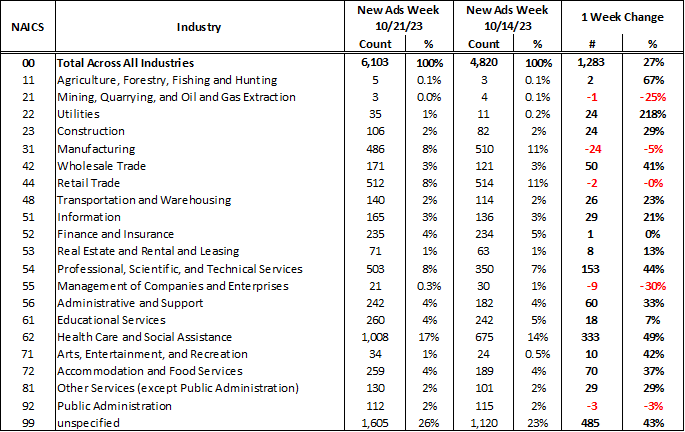

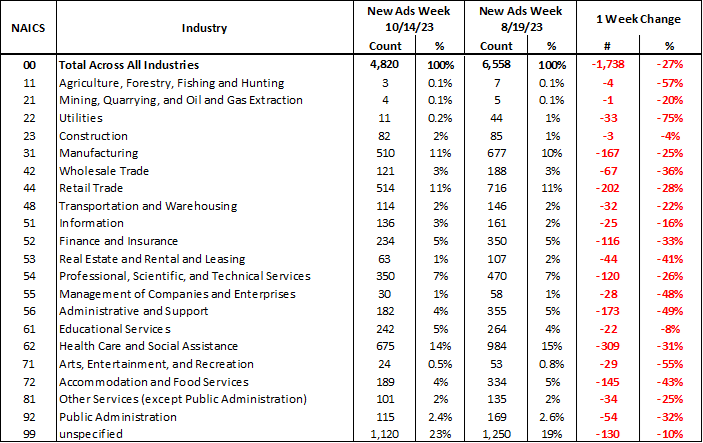

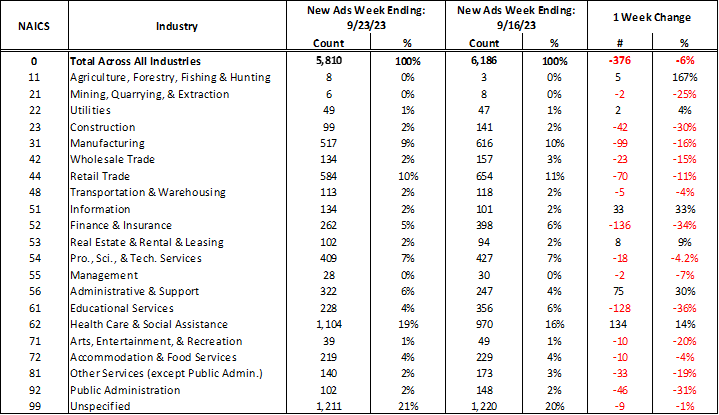

| Industries with the most new postings include Health Care & Social Assistance, Manufacturing, and Retail Trade.

Occupations with the most new postings include Registered Nurses, Retail Salespersons, and Supervisors of Retail Sales Works. Employers with the most new postings include Yale New Haven Health, Middlesex Health System, State of Connecticut. | |

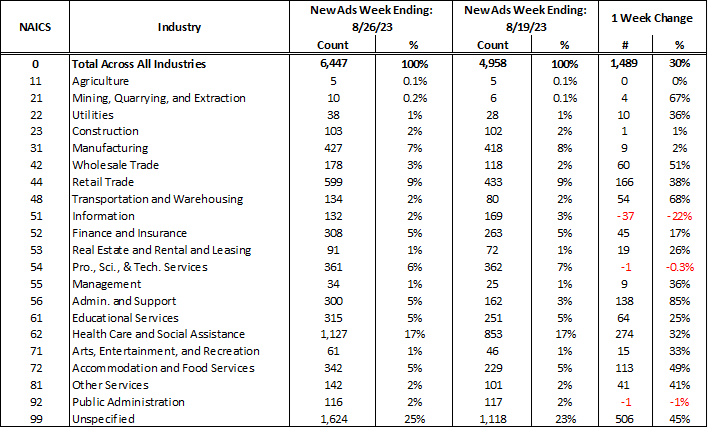

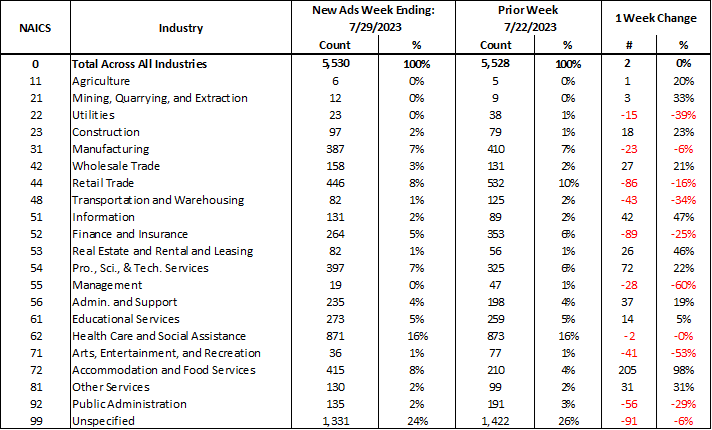

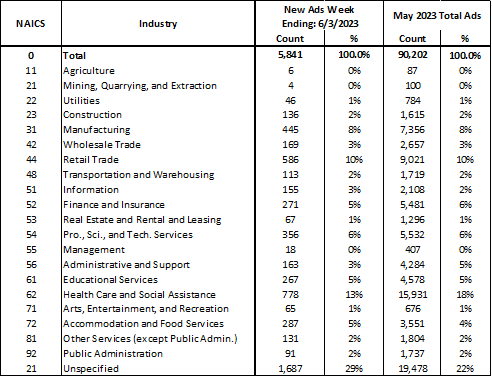

New Weekly Job Postings by Industry | |

The three industries with the most new job postings were:

| |

| |

|

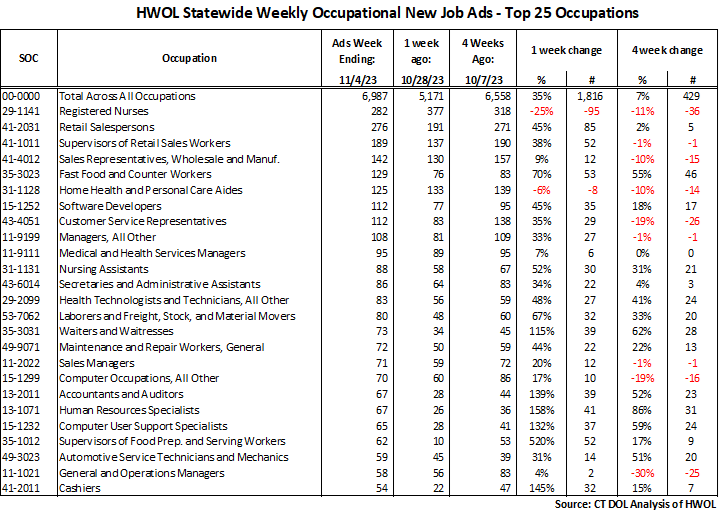

The table below highlights the 25 occupations with the most new job ads during the week ending November 4th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The 25 occupations account for 38% of the 6,987 new ads during the week. The three occupations with the most new ads were Registered Nurses (282 new ads), Retail Salespersons (276 new ads), and Supervisors of Retail Sales Workers (189 new ads). Employers with the most job ads for those three occupations respectively are Yale New Haven Health (87 new ads), TJX 18 new ads), and CVS Health (22 new ads). Among the 25 occupations with the most new ads, the median annual salary ranged from $34,432 (Fast Food and Counter Workers) to $135,680 (Software Devlopers). | |

| |

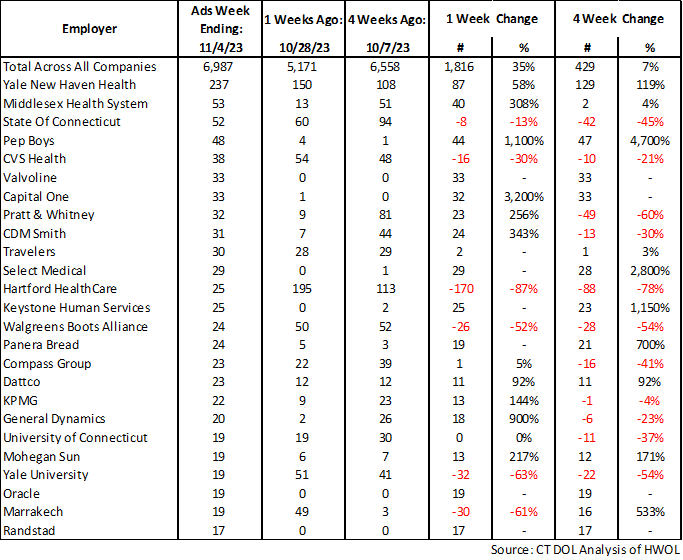

| Employers with the most new job postings during the week ending November 4th, 2023 were mostly within Retail Trade, Healthcare, and Administrative & Support. The employers with the most ads in those respective industries were Yale New Haven Health (237 new ads), Pep Boys (48 new ads), and Compass Group (23 new ads). Eightteen employers in the top 25 had over the week new ad increases, one was unchanged, and six declined. The largest over-the-week increase among the 25 employers occurred at Yale New Haven Health (+87 new ads) and the largest decrease occurred at Hartford Healthcare (-170 new ads). | |

| |

| |

October 28th 2023 Help Wanted OnLine Data Series |

|

|

|

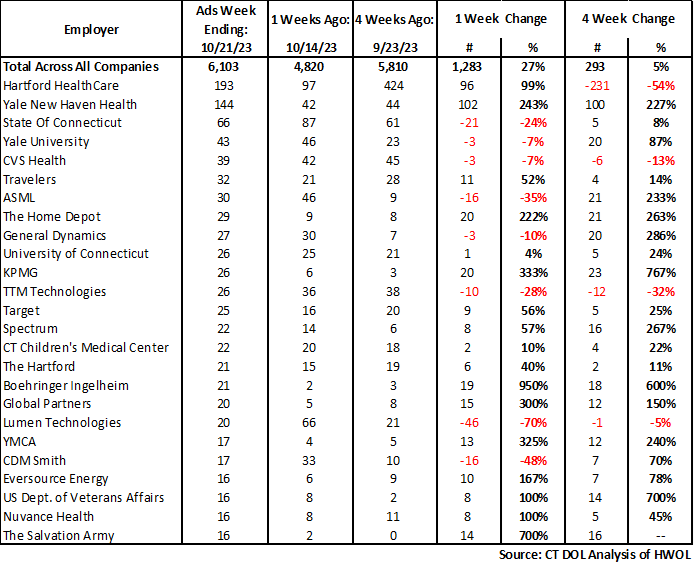

| Industries with the most new postings include Health Care & Social Assistance, Retail Trade, Manufacturing.

Occupations with the most new postings include Registered Nurses, Retail Salespersons, and Supervisors of Retail Sales Works. Employers with the most new postings include Hartford Healthcare, Yale New Haven Health, and Trinity Health. | |

New Weekly Job Postings by Industry | |

The three industries with the most new job postings were:

| |

| |

|

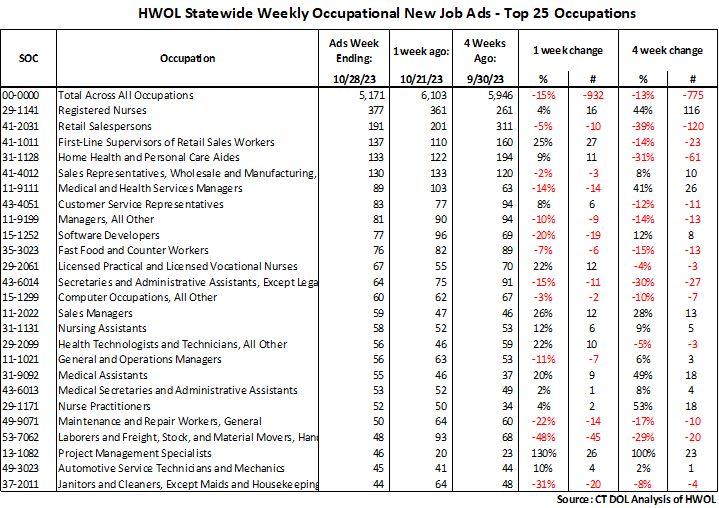

The table below highlights the 25 occupations with the most new job ads during the week ending October 28th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The 25 occupations account for 15% of the 6,103 new ads during the week. The three occupations with the most new ads were Registered Nurses (361 new ads), Retail Salespersons (201 new ads), and Wholesale & Manufacturing Sales Representatives (133 new ads). Among job ads with advertised salary information, these three occupations had respective median advertised annual incomes of $88,832 per year, $34,432 per year, and $60,032 per year. Among the 25 occupations with the most new ads, the median annual salary ranged from $32,640 (Fast Food and Counter Workers) to $129,792 (Software Developers). | |

| |

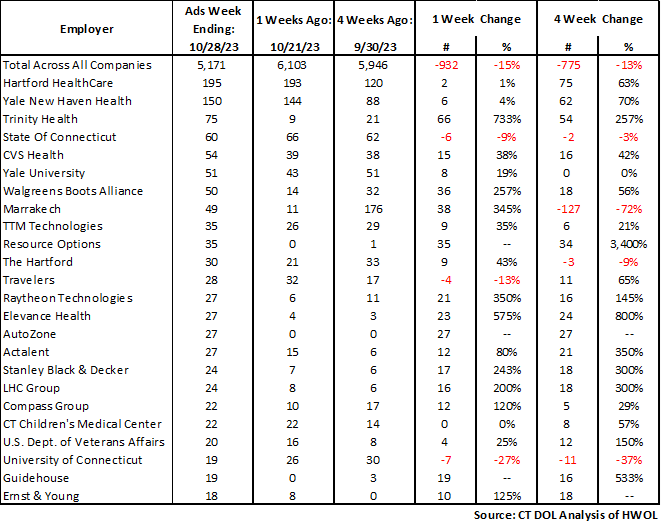

| Employers with the most new job postings during the week ending October 28th, 2023 were mostly within Healthcare, Retail Trade, and Manufacturing. These three industries The employers with the most ads in those respective industries were Hartford Healthcare (193 new ads), CVS Health (39 new ads), and ASML (30 new ads). Seventeen employers in the top 25 had over the week new ad increases and eight declined. The largest over-the-week increase among the 25 employers occurred Yale New Haven Health System (+102 new ads) and the largest decrease occurred at Lumen Technologies (-46 new ads). | |

| |

| |

October 21st 2023 Help Wanted OnLine Data Series |

|

| |

|

The above table highlights the 25 occupations with the most new job ads during the week ending October 21st, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The 25 occupations account for 15% of the 6,103 new ads during the week. The three occupations with the most new ads were Registered Nurses (361 new ads), Retail Salespersons (201 new ads), and Wholesale & Manufacturing Sales Representatives (133 new ads). Among job ads with advertised salary information, these three occupations had respective median advertised annual incomes of $88,832 per year, $34,432 per year, and $60,032 per year. Among the 25 occupations with the most new ads, the median annual salary ranged from $32,640 (Fast Food and Counter Workers) to $129,792 (Software Developers). | |

| |

| Employers with the most new job postings during the week ending October 21st, 2023 were mostly within Healthcare, Retail Trade, and Manufacturing. These three industries The employers with the most ads in those respective industries were Hartford Healthcare (193 new ads), CVS Health (39 new ads), and ASML (30 new ads). Seventeen employers in the top 25 had over the week new ad increases and eight declined. The largest over-the-week increase among the 25 employers occurred Yale New Haven Health System (+102 new ads) and the largest decrease occurred at Lumen Technologies (-46 new ads). | |

| |

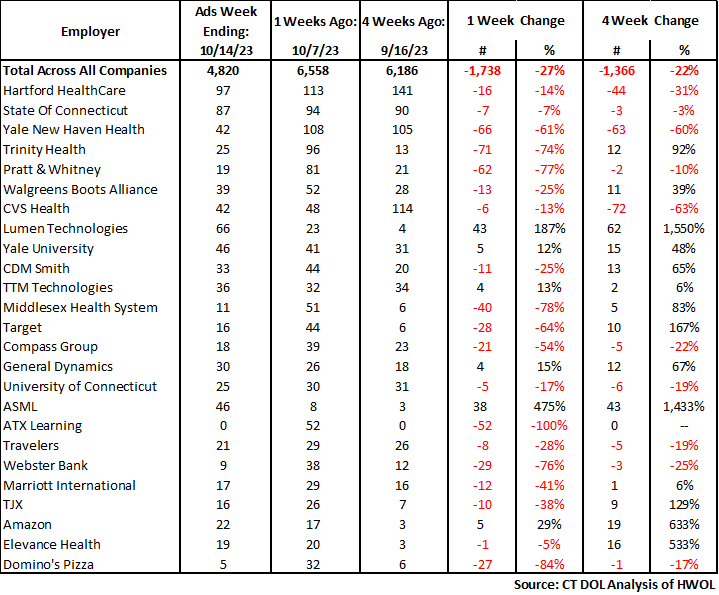

October 14th 2023 Help Wanted OnLine Data Series |

|

| |

|

The above table highlights the 25 occupations with the most new job ads during the week ending October 14th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The 25 occupations account for 38% of the 4,820 new ads during the week. The three occupations with the most new ads were Registered Nurses (205 new ads), Retail Salespersons (184 new ads), and Supervisors of Retail Sales Workers (136 new ads). Among job ads with advertised salary information, these three occupations had respective median advertised annual incomes of $102,144 per year, $36,992 per year, and $42,112 per year. Among the 25 occupations with the most new ads, the median annual salary ranged from $32,640 (Fast Food and Counter Workers) to $132,608 (Software Developers). | |

| |

| Employers with the most new job postings during the week ending October 14th, 2023 were mostly within Retail Trade, Health Care, and Manufacturing. The employers with the most ads in those respective industries were Walgreens (39 new ads), Hartford Healthcare (33 new ads), and Pratt & Whitney (19 new ads). Nineteen employers in the top 25 had over the week new ad declines and six increased. The largest over the week decline among the 25 employers occurred at Trinity Health (71 new ads) and the largest increase occurred at Lumen Technologies (+43 new ads). | |

| |

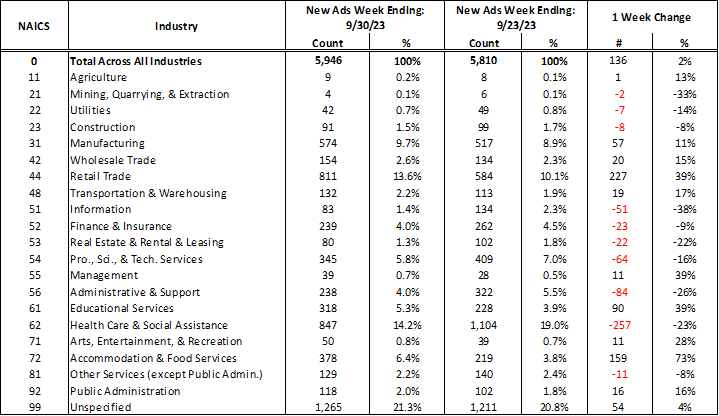

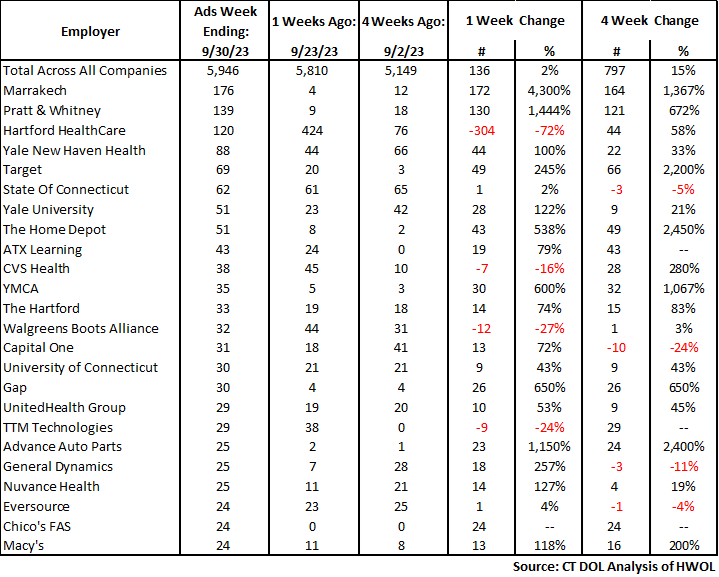

September 30th 2023 Help Wanted OnLine Data Series |

|

| |

|

The above table highlights the 25 occupations with the most new job ads during the week ending September 30th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The 25 occupations account for 40% of the 5,946 new ads during the week. The three occupations with the most new ads were Retail Salespersons (311 new ads), Registered Nurses (261 new ads), and Home Health & Personal Care Aides (194 new ads). Among job ads with advertised salary information, these three occupations had respective median advertised annual incomes of $35,456 per year, $100,608 per year, and $35,456 per year. Among the 25 occupations with the most new ads, the median annual salary ranged from $33,408 (Fast Food and Counter Workers) to $144,896 (Software Developers). | |

| |

| Employers with the most new job postings during the week ending September 30th, 2023 were mostly within Retail Trade, Finance & Insurance, and Health Care. The employers with the most ads in those respective industries were Target (69 new ads), The Hartford (33 new ads), and Hartford Healthcare (120 new ads). The Largest over the week increase among the top 25 employers occurred at Marrakech (+172 new ads) and the largest decreases occurred at Hartford Healthcare (-304). Twenty-one of the top 25 employers increased over the week and four decreased. | |

| |

September 23rd 2023 Help Wanted OnLine Data Series |

|

| |

|

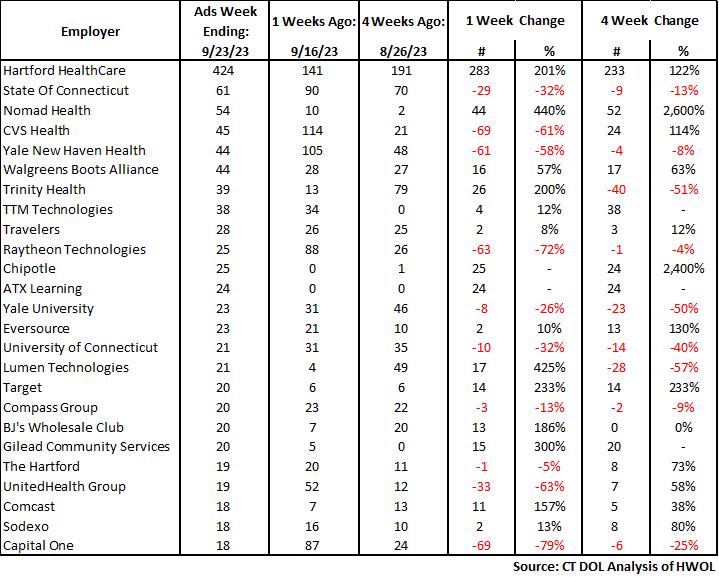

The above table highlights the 25 occupations with the most new job ads during the week ending September 23rd, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The 25 occupations account for 42% of the 5,810 new ads during the week. The three occupations with the most new ads were Registered Nurses (518 new ads), Retail Salespersons (216 new ads), and Supervisors of Retail Sales Workers (156 new ads). Among job ads with advertised salary information, these three occupations had respective median advertised annual incomes of $103,4,704 per year, $35,968 per year, and $45,696 per year. Among the 25 occupations with the most new ads, the median advertised annual salary ranged from $33,408 (Fast Food and Counter Workers) to $138,752 (Software Developers). | |

| |

| Employers with the most new job postings during the week ending September 23rd, 2023 were mostly within Retail Trade, Finance & Insurance, and Health Care. The employers with the most ads in those respective industries were CVS Health (45 new ads), Travelers (28 new ads), and Hartford Healthcare (424 new ads). The Largest over the week increase among the top 25 employers occurred at Hartford Healthcare (+283 new ads) and the largest decreases occurred at CVS Health and Capital One, both down 69 new ads over the week. Fifteen of the top 25 employers increased over the week and ten decreased. | |

| |

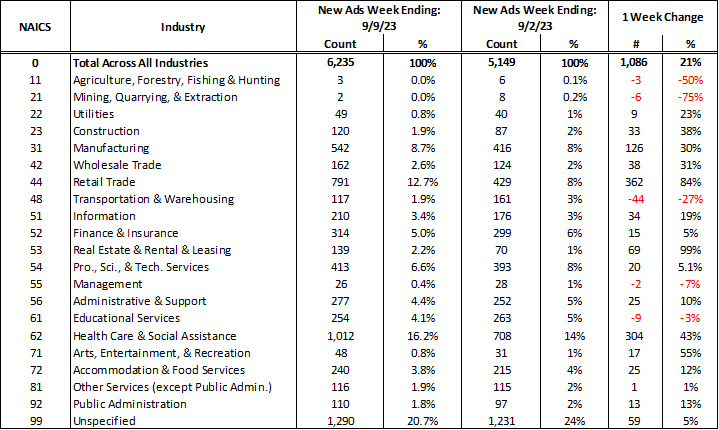

September 9th 2023 Help Wanted OnLine Data Series |

|

| |

|

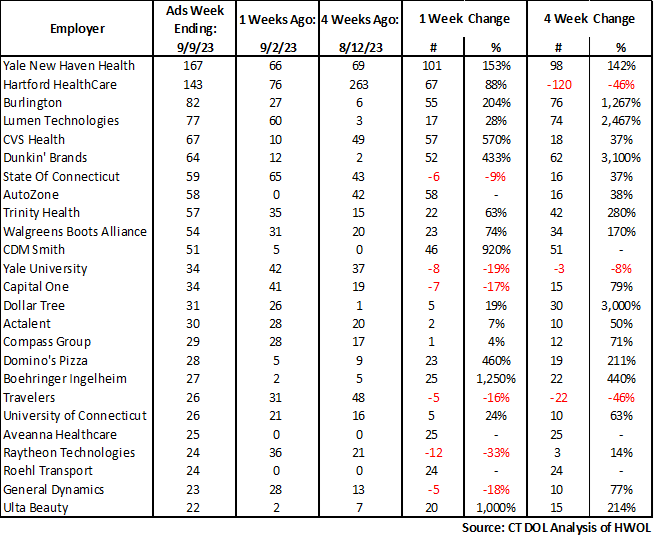

The above table highlights the 25 occupations with the most new job ads during the week ending September 12th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The 25 occupations account for 41% of the 6,235 new ads during the week. The three occupations with the most new ads were Registered Nurses (346 new ads), Retail Salespersons (269 new ads), and Supervisors of Retail Sales Workers (216 new ads). Among job ads with advertised salary information, these three occupations had respective median advertised annual incomes of $33,920 per year, $86,272 per year, and $40,832 per year. Among the 25 occupations with the most new ads, the median advertised annual salary ranged from $31,200 (Cashiers) to $150,272 (Computer Occupations). Within the 25 specific occupations shown above, the largest increase occurred in Retail Salespersons (+80 new ads) and the largest decrease occurred in Secretaries and Administrative Assistants (-28 new ads). | |

| |

| Employers with the most new job postings during the week ending September 9th, 2023 were mostly within Retail Trade, Health Care, and Finance & Insurance. The employers with the most ads in those respective industries were Burlington (82 new ads), Yale New Haven Health (167 new ads), and Capital One (34 new ads). The Largest over the week increase among the top 25 employers occurred at Yale New Haven Health (+101 new ads) and the largest decrease occurred at Raytheon (-12 new ads). Nineteen of the top 25 employers increased over the week and six decreased. | |

| |

August 26th 2023 Help Wanted OnLine Data Series |

|

| |

|

The above table highlights the 25 occupations with the most new job ads during the week ending August 26th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The 25 occupations account for 35% of the 6,447 new ads during the week. The three occupations with the most new ads were Registered Nurses (338 new ads), Retail Salespersons (288 new ads), and Supervisors of Retail Sales Workers (134 new ads). Among job ads with advertised salary information, these three occupations had respective median advertised annual incomes of $103,168 per year, $33,408 per year, and $46,976 per year. Across all occupations, 1,947 of 6,447 new job ads had salary information during the week ending 8/26/23, and the median salary across those ads was $49,536 per year. Among the 25 occupations with the most new ads, the median advertised annual salary ranged from $33,408 (Retail Salespersons) to $145,920 (Software Developers). | |

| |

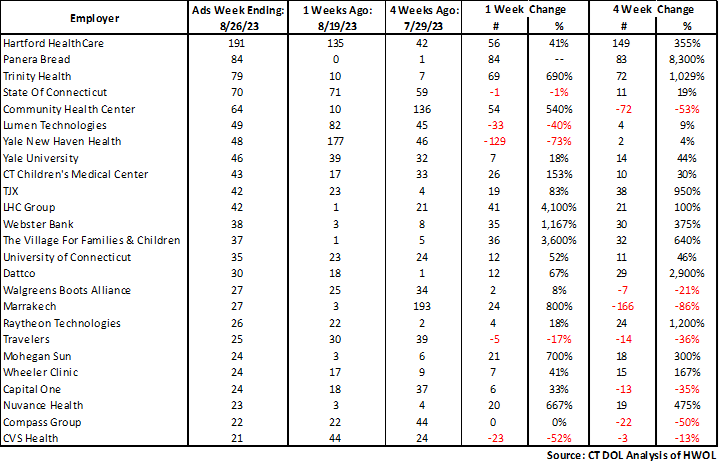

| Employers with the most new job postings during the week ending August 19th,2023 were mostly within Health Care, Retail Trade, and Finance & Insurance. The employers with the most ads in those respective industries were Hartford Healthcare (191 new ads), Panera Bread (84 new ads), and Webster Bank (38 new ads). The Largest over the week increase among the top 25 employers occurred at Pantera Bread (+84 new ads) and the largest decrease occurred at Yale New Haven Health (-129 new ads). Nineteen of the top 25 employers increased over the week, one was unchanged, and five decreased. | |

| |

August 19th 2023 Help Wanted OnLine Data Series |

|

| |

|

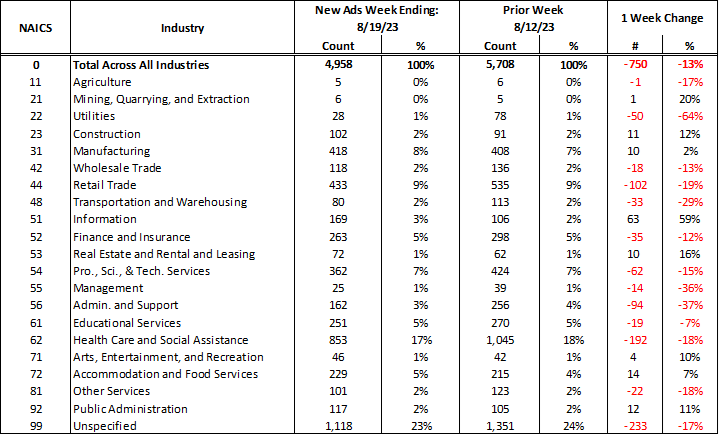

The above table highlights the 25 occupations with the most new job ads during the week ending August 19th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The 25 occupations account for 37% of the 4,958 new ads during the week. The three occupations with the most new ads were Registered Nurses (259 new ads), Retail Salespersons (157 new ads), and Supervisors of Retail Sales Workers (157 new ads). Among job ads with advertised salary information, these three occupations had respective median advertised annual incomes of $83,200 per year, $33,920 per year, and $49,024 per year. Across all occupations, 2,002 of 4,958 new job ads had salary information during the week ending 8/19/23, and the median salary across those ads was $50,048 per year. Among the 25 occupations with the most new ads, the median advertised annual salary ranged from $33,128 (Fast Food & Counter Workers) to $144,896 (Software Developers). | |

| |

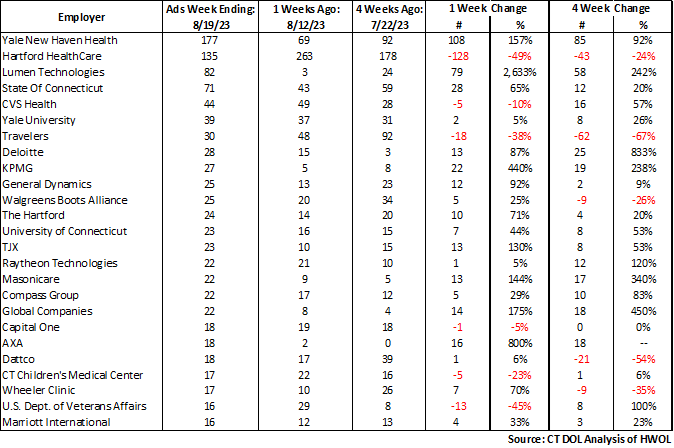

| Employers with the most new job postings during the week ending August 19th,2023 were mostly within Finance & Insurance, Health Care, and Retail Trade. The employers with the most ads in those respective industries were Travelers (30 new ads), Yale New Haven Health (177 new ads), and Walgreens (25 new ads). The Largest over the week increase among the top 25 employers occurred at Yale New Haven Health (+108 new ads) and the largest decrease occurred at Hartford Healthcare (-128 new ads). Nineteen of the top 25 employers increased over the week and six decreased. | |

| |

August 12th 2023 Help Wanted OnLine Data Series |

|

| |

|

The above table highlights the 25 occupations with the most new job ads during the week ending August 12th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The three occupations with the most new ads were Registered Nurses (351 new ads), Retail Salespersons (254 new ads), and Supervisors of Retail Sales Workers (134 new ads). Among job ads with advertised salary information, these three occupations had respective median advertised annual incomes of $98,560 per year, $36,480 per year, and $50,048 per year. Across all occupations, 2,390 of 5,708 new job ads had salary information during the week ending 8/12/23, and the median salary across those ads was $51,072 per year. Among the 25 occupations with the most new ads, the median advertised annual salary ranged from $33,408 (Fast Food & Counter Workers) to $140,032 (Software Developers). | |

| |

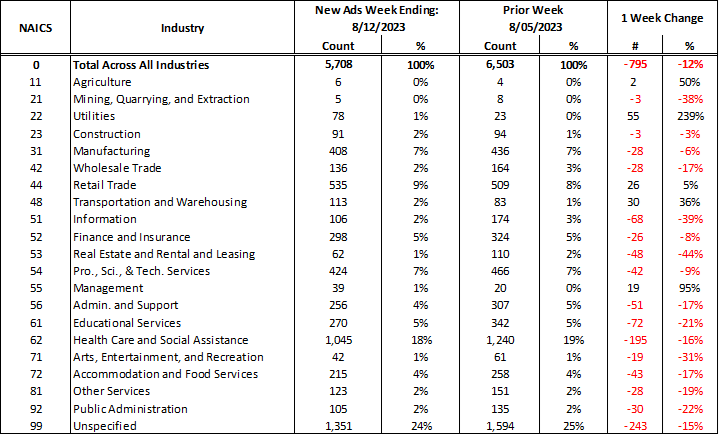

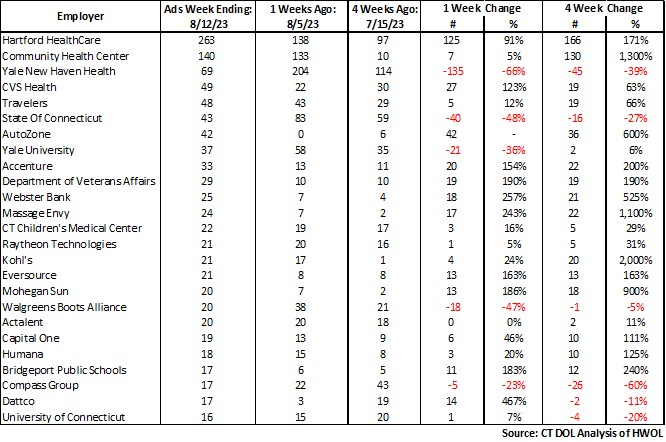

| Employers with the most new job postings during the week ending August 12th,2023 were mostly within Retail Trade, Health Care & Social Assistance, and Finance & Insurance. The employers with the most ads in those respective industries were Autozone (42 new ads), Hartford Healthcare (263 new ads), and Travelers (48 new ads). Within the 25 employers with the most new ads during the week ending 8/12/23, nineteen increased from a week ago, one was unchanged, and five decreased. The largest increase occurred at Hartford Healthcare (+125 new ads) and the largest decrease occurred at Yale New Haven Health (-135 new ads). | |

| |

August 5th 2023 Help Wanted OnLine Data Series |

|

| |

|

The above table highlights the 25 occupations with the most new job ads during the week ending August 5th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The three occupations with the most new ads were Registered Nurses (378 new ads), Retail Salespersons (231 new ads), and Software Developers (151 new ads). Twenty of the twenty-five occupations had over-the-week increases and five decreased. The occupation with the largest increase within the top 25 was Registered Nurses (+106 new ads) and the occupation with the largest decrease was Home Health & Personal Care Aides (-81 new ads). Among all occupations, 2,612 of the 6,503 new ads during the week ending 8/05/23 contained salary information, and the median annual advertised salary across those ads was $51,584. Among the 25 occupations with the most new ads, the median advertised annual incomes ranged from Waiters and Waitresses ($33,408) to Marketing Managers ($142,848). | |

| |

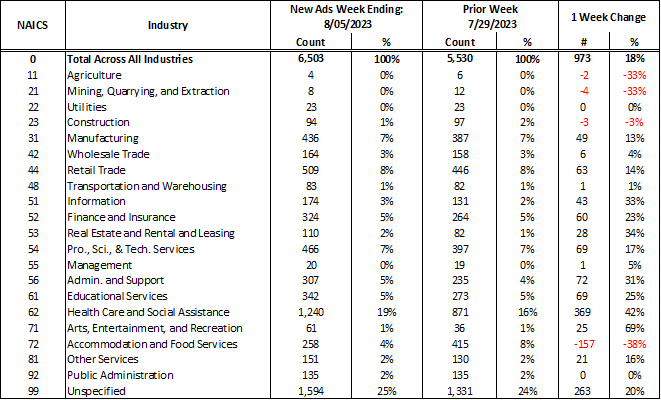

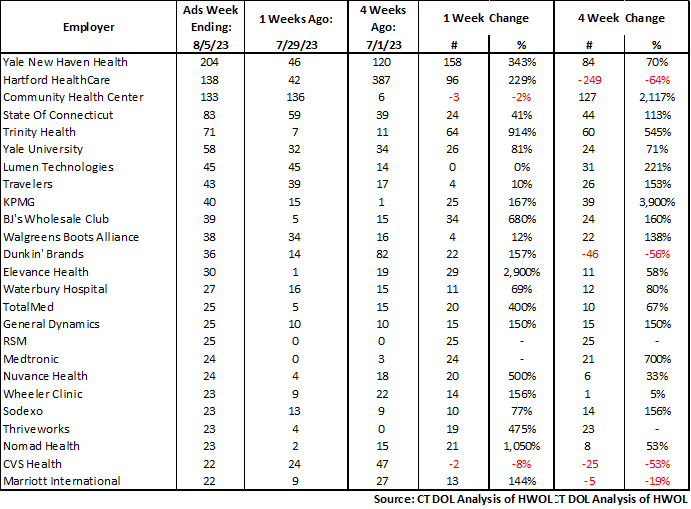

| Employers with the most new job postings during the week ending August 5th,2023 were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. Eleven of the twenty-five employers with the most ads were in Health Care and Social Assistance. The largest healthcare employers were Yale New Haven Health (204 new ads), Hartford Healthcare (138 new ads), and Community Health Center (133 new ads). Across the top-25 employers, 22 had over-the-week increases, one was unchanged, and two decreased. The largest over-the-week increase occurred at Yale New Haven Health (+158 new ads), and the largest decrease occurred at Hartford Healthcare (-249 new ads). | |

| |

| Weekly Connecticut Help Wanted OnLine Data Series (HWOL) |

July 29th 2023 Help Wanted OnLine Data Series |

|

| |

|

The above table highlights the 25 occupations with the most new job ads during the week ending July 29th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The three occupations with the most new ads were Registered Nurses (272 new ads), Retail Salespersons (175 new ads), and Home Health & Personal Care Aides (172 new ads). Fifteen of the twenty-five occupations had over-the-week increases, one was unchanged, and nine decreased. The occupation with the largest increase within the top 25 was Home Health & Personal Care Aides (+95 new ads) and the two occupations with the largest decrease were Supervisors of Retail Sales Workers and Software Developers, both down thirty-eight ads. Among all occupations, 2,332 of the 5,530 new ads during the week ending 7/29/23 contained salary information, and the median annual advertised salary across those ads was $52,608. Among the 25 occupations with the most new ads, the median advertised annual incomes ranged from Fast Food & Counter Workers ($33,408) to Software Developers ($156,160). | |

| |

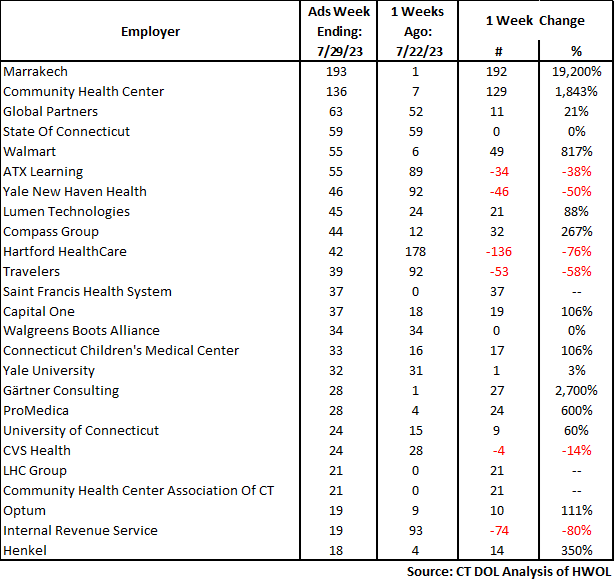

| Employers with the most new job postings during the week ending July 29th were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. The employers with the most new ads in these three respective industries were Marrakech (193 new ads), Walmart (55 new ads), and Travelers (39 new ads). Overall, the 25 employers with the most ads account for a combined 21 percent of total new ads. Among the 25 employers with the most ads, the largest over-the-week increase occurred at Marrakech (+192 new ads) and the largest decrease occurred at Hartford Healthcare (-136 new ads). | |

| |

| Weekly Connecticut Help Wanted OnLine Data Series (HWOL) |

July 22nd 2023 Help Wanted OnLine Data Series |

|

| |

|

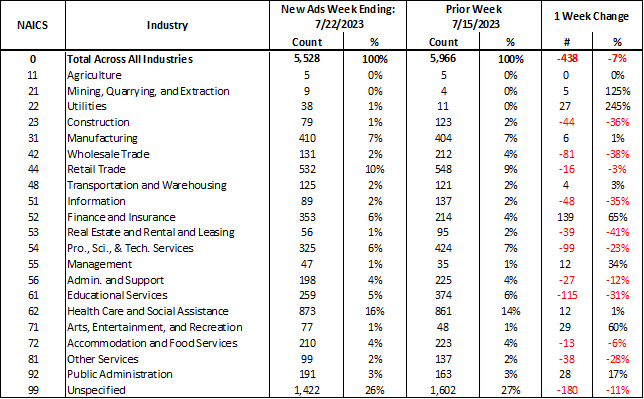

The above table highlights the 25 occupations with the most new job ads during the week ending July 22nd, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The three occupations with the most new ads were Registered Nurses (266 new ads), Retail Salespersons (198 new ads), and Supervisors of Retail Sales Workers (144 new ads). Among the new ads that week, 2,388 (43% of total new ads) had salary info for over 300 specific occupations. Those new ads with salary info had a median advertised salary of $52,096 per year or $25.05 per hour. Among the 25 occupations with the most new ads, five had advertised annual medians of over $100,000. These include Software Developers ($139,776), Computer Occupations ($135,936), and General & Operations Managers ($116,992). The occupations with the lowest median income in the top 25 include Hotel, Motel, & Resort Desk Clerks ($30,080), Fast Food & Counter Workers ($33,408), and Retail Salespersons ($34,432). | |

| |

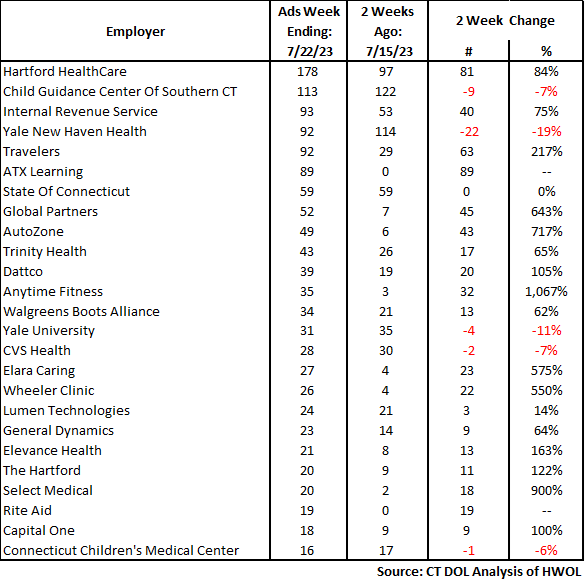

| Employers with the most new job postings during the week ending July 22nd were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. The employers with the most new ads in these three respective industries were Hartford Healthcare (178 new ads), Walgreens (34 new ads), and Travelers (92 new ads). Overall, the 25 employers with the most ads account for a combined 22 percent of total new ads. | |

| |

July 15th 2023 Help Wanted OnLine Data Series |

|

| |

|

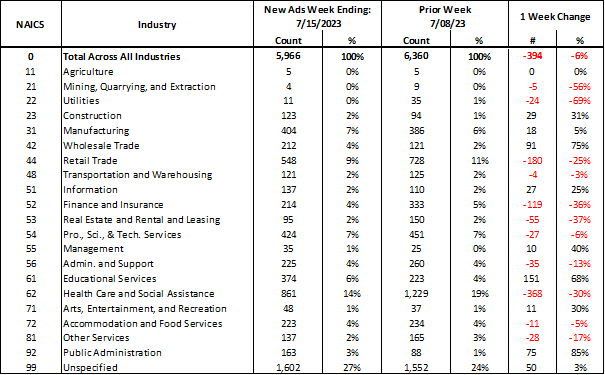

The above table highlights the 25 occupations with the most new job ads during the week ending July 15th, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The three occupations with the most new ads were Registered Nurses (276 new ads), Retail Salespersons (247 new ads), and Supervisors of Retail Sales Workers (166 new ads). Among the new ads that week, 2,452 (41% of total new ads) had salary info for over 300 specific occupations. Those new ads with salary info had a median advertised salary of $49,792 per year or $23.94 per hour. Among the 25 occupations with the most new ads, three had advertised annual medians of over $100,000. These were Computer Occupations ($129,792), Software Developers ($129,536), and Medical & Health Service Managers ($128,256). The occupations with the lowest median income in the top 25 include Fast Food & Counter Workers ($32,640), Retail Salespersons ($35,456), and Stockers & Order Fillers ($36,480). | |

| |

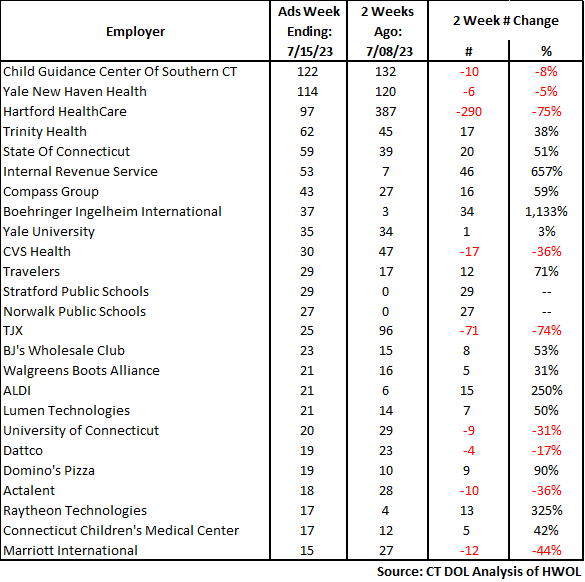

| Employers with the most new job postings during the week ending June 24th were mostly within Retail Trade, Health Care & Social Assistance, and Educational Services. The employers with the most new ads in these three respective industries were Child Guidance Center Of Southern CT (122 new ads), CVS Health (30 new ads), and Yale University (35 new ads). Overall, the 25 employers with the most ads account for a combined 16 percent of total new ads. | |

| |

June 24th 2023 Help Wanted OnLine Data Series |

|

| |

|

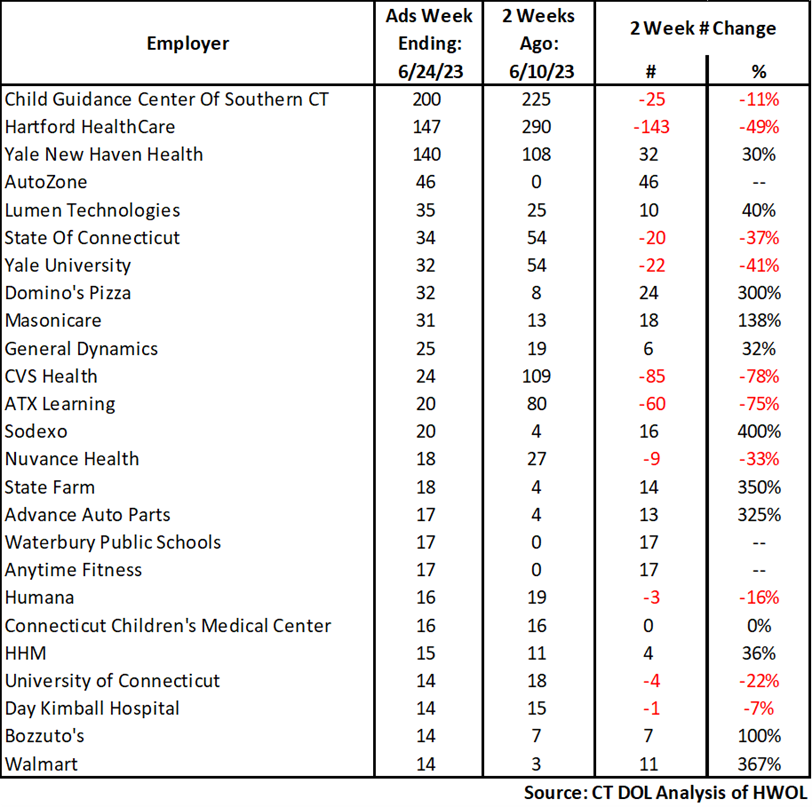

The above table highlights the 25 occupations with the most new job ads during the week ending June 24rd, 2023. During that week, employers posted new job ads for over 700 specific occupations in the state. The three occupations with the most new ads were Registered Nurses (271 new ads), Retail Salespersons (143 new ads), and Supervisors of Retail Sales Workers (130 new ads). Among the new ads that week, 1,897 had salary info for over 300 specific occupations. Those new ads with salary info had a median advertised salary of $48,000 per year or $23.08 per hour. Among the 25 occupations with the most new ads, five had advertised annual medians of over $100,000. The largest being Computer Occupations ($139,776), Sales Managers ($126,720), and Software Developers ($125,184). The occupations with the lowest median income in the top 25 include Fast Food & Counter Workers ($33,408), Retail Salespersons ($35,456), and Home Health & Personal Care Aides ($35,968). | |

| |

| Employers with the most new job postings during the week ending June 24th were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. The employers with the most new ads in these three respective industries were Child Guidance Center Of Southern CT (200 new ads), AutoZone (46 new ads), and State Farm (18 new ads). Overall, the 25 employers with the most ads account for a combined 20 percent of total new ads. | |

| |

June 3rd 2023 Help Wanted OnLine Data Series |

|

| |

|

The above table highlights the 25 occupations with the most new job ads during the week ending June 3rd, 2023. During that week, employers posted new job ads for over 400 specific occupations in the state. The three occupations with the most ads were Registered Nurses (289 new ads), Retail Salespersons (174 new ads), and Supervisors of Retail Sales Workers (171 new ads). Across all occupations, 2,345 new ads contained salary info. The median advertised salary among those ads was $23.32 per hour or $48,512 annually. Among the top 25 occupations shown above, the median advertised salary ranged from a low of $17.05 per hour for Home Health & Personal Care Aides to a high of $77.05 per hour for Computer Occupations, All Other. Seventeen of the twenty-five occupations shown above fall within the following five major occupational groups; Management (SOC 11), Healthcare Practitioners (SOC 29), Healthcare Support (SOC 31), Sales & Related Occupations (SOC 41), Office & Admin. Support (SOC 43), and Transportation & Material Moving Occupations (SOC 53). | |

| |

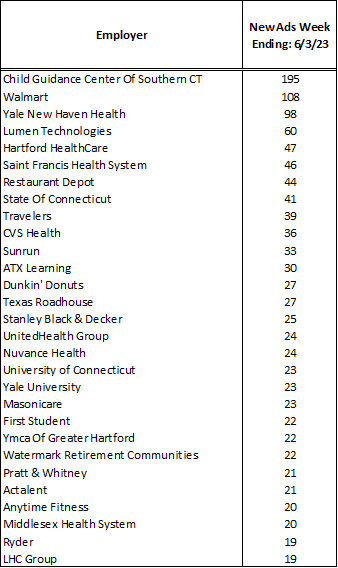

| Employers with the most new job postings during the week ending June 3rd were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. The employers with the most new ads in these three respective industries were Child Guidance Center of Southern Connecticut (195 new ads), Walmart (108 new ads), and Travelers Insurance (39 new ads). Overall, the 25 employers with the most ads account for a combined 20 percent of total new ads | |

| |

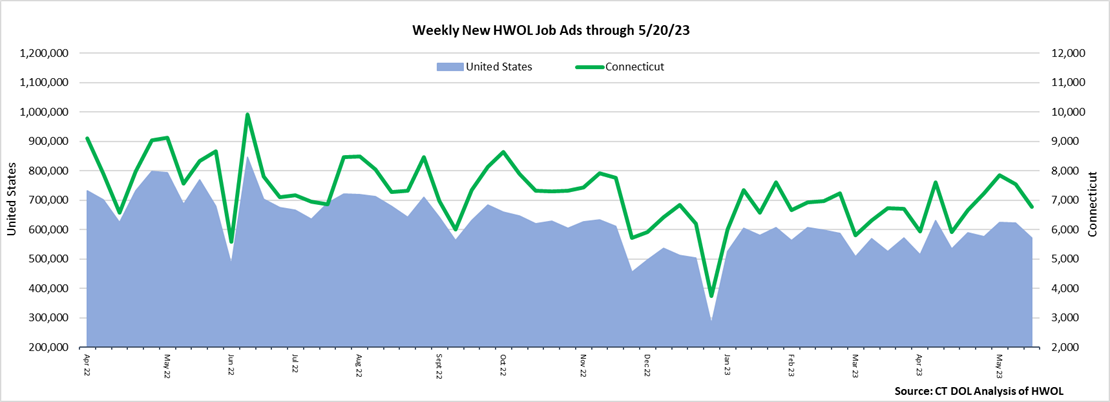

May 20th 2023 Help Wanted OnLine Data Series |

|

| |

|

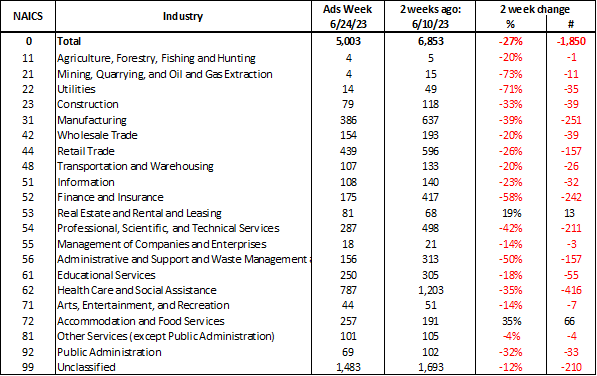

During the week ending May 20th, 19 of 21 industries decreased. The largest industry decreases occurred in Educational Services (-155 new ads), Manufacturing (-148 new ads), and Pro., Sci., & Tech. Services (-78 new ads). These three industries accounted for 47% of the total decline across all industries. The largest over-the-week employer declines in these three industries were Middletown Public Schools (-29 new ads), Raytheon (-55 new ads), and Lumen Technologies (-42 new ads) respectively. 12 industries had over the week decreases between -21% and 43%. The only industry with a large over-the-week increase was Retail Trade (+130 new ads). Total ads were down 1,644 new ads from four weeks ago. The largest four-week industry declines occurred in Manufacturing (-428 new ads), Retail Trade (-200 new ads), and Finance & Insurance (-193 new ads).

Employers with the most new job postings during the week ending May 20th were mostly within Health Care & Social Assistance, Retail Trade, and Educational Services. The employers with the most new ads in these three respective industries were Hartford Healthcare (191 new ads), Walgreens Boots Alliance (145 new ads), and the University of New Haven (71 new ads). Overall, the 25 employers with the most ads account for a combined 25 percent of total new ads. Among the 25 employers shown above, 19 increased, one was unchanged, and 5 decreased. |

|

| |

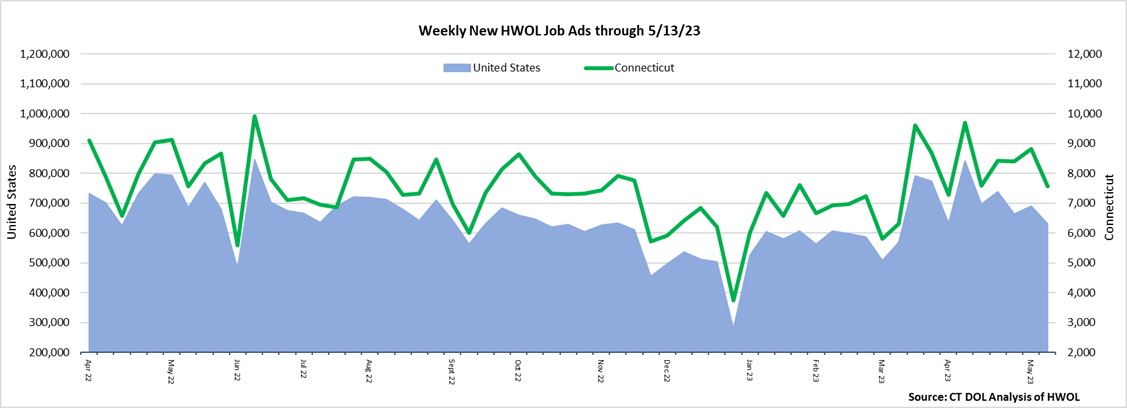

May 13th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending May 13th, 15 industries decreased and 6 increased. The overall decrease of 1,247 new ads across all industries was driven by declines in Health Care & Social Assistance (-377 new ads), Retail Trade (-277 new ads and Accommodation & Food Services (-254 new ads). The largest employer declines in those three respective industries were Hartford Healthcare (-130 new ads), Burlington Stores (-70 new ads), and Dunkin' Donuts (-23 new ads). Over Four weeks, total ads were largely unchanged, down 20 new ads overall or -0.3%. The largest four-week industry decline was Retail Trade (-169 new ads) and the largest increase was Health Care & Social Assistance (+136 new ads).

Employers with the most new job postings during the week ending May 13th were mostly within Health Care & Social Assistance, Finance & Insurance, and Educational Services. The employers with the most new ads in these three respective industries were Yale-New Haven Health System (192 new ads), Cigna Corporation (74 new ads), and Yale University (43 new ads). Overall, the 25 employers with the most ads account for a combined 19 percent of total new ads. Among the 25 employers shown above, 19 increased over the week and 6 decreased. |

|

| |

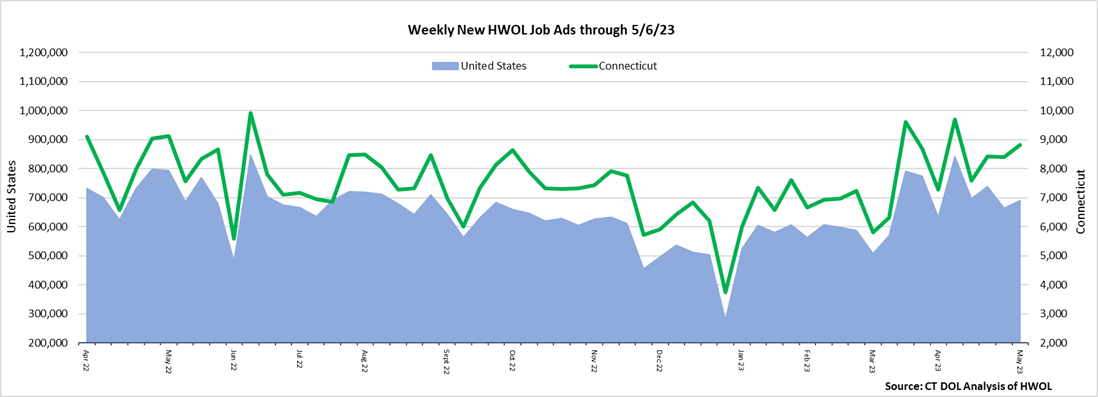

May 6th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending May 6th, 13 industries decreased and 8 increased. Growing industries include Educational Services, Accommodation & Food Services, and Retail Trade. Among the three increasing industries, the largest employer gains were respectively had at East Hartford Public Schools (+54 new ads), Barcelona Wine Bar (+23 new ads), and Walmart (+282 new ads). Decreasing industries include Health Care & Social Assistance, Wholesale Trade, and Finance & Insurance. The largest respective employer new ad losses in those industries occurred at Hartford Healthcare (-106 new ads), Crossmark (-33 new ads), and Humana (-53 new ads). Over four weeks, 13 industries are down, and total ads are down by 844 new ads. Four weeks ago had the highest overall ad count since June 2022.

Employers with the most new job postings during the week ending May 6th were mostly within Retail Trade, Health Care & Social Assistance, and Finance & Insurance. The employers with the most new ads in these three respective industries were Walmart (287 new ads), Hartford Healthcare (321 new ads), and UnitedHealth Group (83 new ads). Overall, the 25 employers with the most ads account for a combined 25 percent of total new ads. Among the 25 employers shown above, 17 increased over the week and 8 decreased. |

|

| |

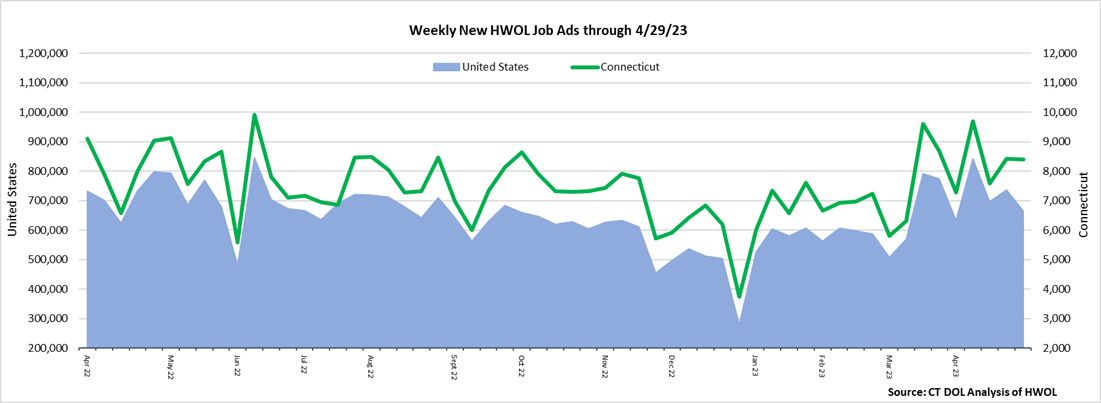

April 29th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending April 29th, 12 industries decreased and 9 increased. The 12 decreasing industries fell by a combined 880 ads. The three largest decreasing industries were Manufacturing (-301 new ads), Retail Trade (-157 new ads), and Educational Services (-148 new ads). Within these three industries, the largest respective employer decreases occurred at Raytheon (-338 new ads), Tractor Supply Company (-41 new ads), and Hartford Public Schools (-25 new ads). The 9 increasing industries grew by a combined 864 new ads, with more than half of that occurring within Healthcare & Social Assistance (+467 new ads). Most of that industry increase occurred at Hartford Healthcare (+411 new ads). Other industries with some of the highest over-the-week increases include Other Services (+97 new ads) and Accommodation & Food Service (+69 new ads).

Employers with the most new job postings during the week ending April 29th were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. The employers with the most new ads in these three respective industries were Hartford Healthcare (427 new ads), The Home Depot (103 new ads), and Humana (82 new ads). Overall, the 25 employers with the most ads account for a combined 22 percent of total new ads. Among the 25 employers shown above, 17 increased over the week and 8 decreased. |

|

| |

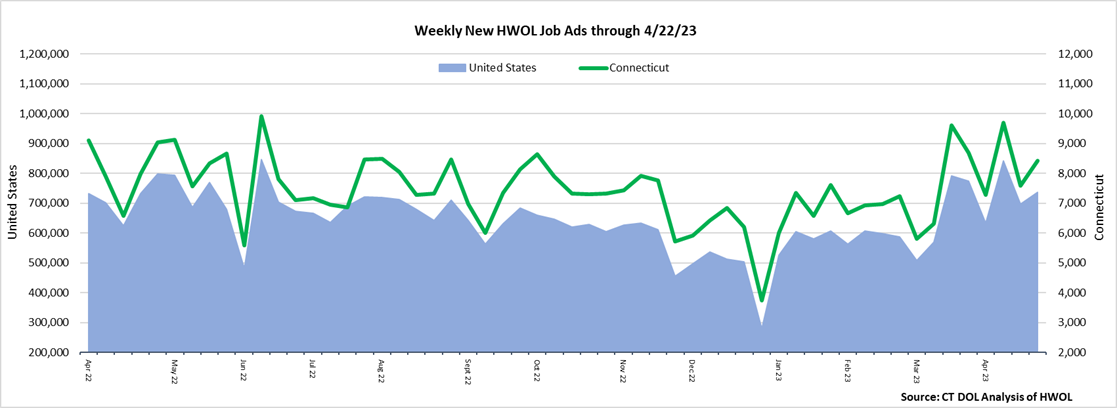

April 22nd 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending April 22nd, 12 of 21 industries had over-the-week increases. Most of the overall 819 new ad increase across all industries occurred in Manufacturing (+263 new ads), Health Care & Social Assitance (+178 new ads), and Retail Trade (+161 new ads). The employers with the largest increases within three respective industries were Raytheon (+334 new ads), Yale-New Haven Health System (+139 new ads), and Chico's (+45 new ads). The 12 increasing industries grew by a combined 982 new ads. The 9 industries with over the week decreases fell by a combined 163 new ads and the largest industry decrease occurred within Accommodation & Food Services (-82 new ads). The largest employer decrease within Accommodation & Food Services was Dunkin' (-27 new ads).

Employers with the most new job postings during the week ending April 15th, were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. The employers with the most new ads in these three respective industries were Yale-New Haven Health System (205 new ads), Walgreens (67 new ads), and Raytheon (398 new ads). Overall, the 25 employers with the most ads account for a combined 26 percent of total new ads. Among the 25 employers shown above, 22 increased over the week and 3 decreased. |

|

| |

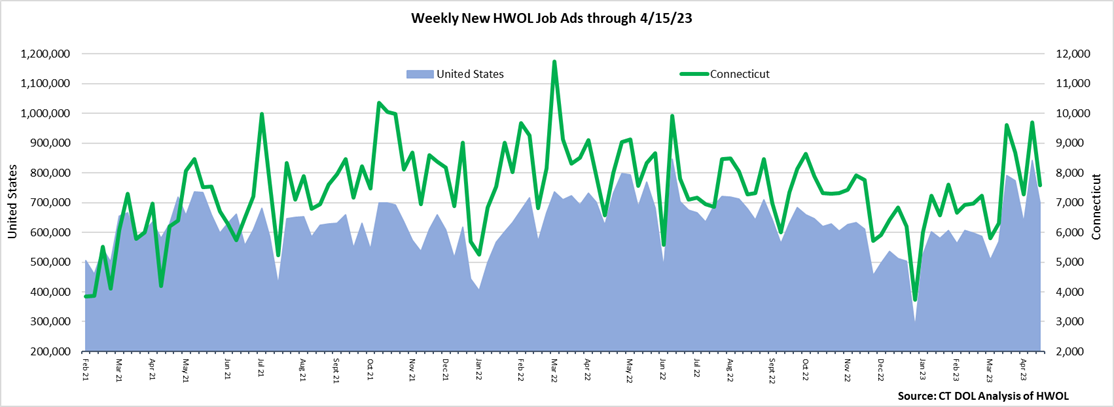

April 15th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending April 15th, 18 of 21 industries had over-the-week declines. Among those decreasing industries, three were down by over 50%, three were down between 30%-49%, and nine were down between 20%-29%. A combined 55% of the 2,071 new ad decline occurred in Health Care & Social Assistance (-605 new ads), Retail Trade (-343 new ads), and Finance & Insurance (-181 new ads). Employers with the largest over-the-week declines in these three respective industries were Yale-New Haven Health System (-295 new ads), UnitedHealth Group (-125 new ads), and The Home Depot (-113 new ads). Among the three increasing industries, the largest was Educational Services, up 129 new ads or +32%. Educational Service employers with the largest over-the-week increases include Stratford Public Schools (+43 new ads), Bridgeport Public Schools (+37 new ads), and New Haven Public Schools (+16 new ads).

Employers with the most new job postings during the week ending April 15th, were mostly within Health Care & Social Assistance, Retail Trade, and Educational Services. The employers with the most new ads in these three respective industries were Hartford Healthcare (147 new ads), CVS Health (46 new ads), and Stratford Public Schools (45 new ads). Overall, the 25 employers with the most ads account for a combined 18 percent of total new ads. Among the 25 employers shown above, 12 decreased over the week, one was unchanged, and 12 increased. Among decreasing employers, the largest drops occurred at Yale-New Haven Health System (-295 new ads), UnitedHealth Group (-125 new ads), and The Home Depot (-113 new ads). The 9 other decreasing employers had new ad declines of 58 ads or less. The largest employer increases occurred at Cigna Corporation (+66 new ads) and KPMG (+66 new ads). |

|

| |

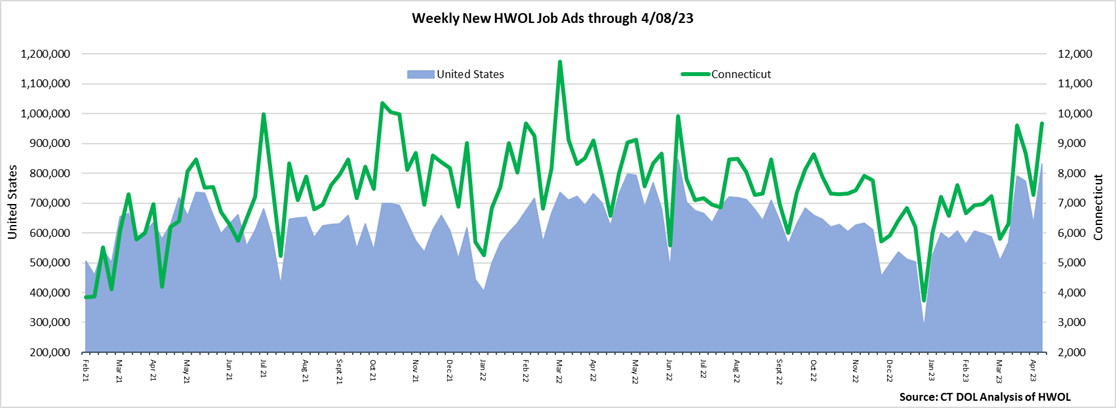

April 8th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending April 8th, 2023, nineteen of twenty-one industries had over-the-week increases. More than half of the 2,395 new ad total increase occurred in one of three industries; Retail Trade (+572 new ads), Health Care & Social Assitance (+436 new ads), and Finance & Insurance (+379 new ads). These three industries represented a combined 58% of over-the-week change and 45% of new ads during the current week. The employers with the most ads within those three industries respectively were The Home Depot (154 new ads), Yale-New Haven Health System (361 new ads), and UnitedHealth Group (192 new ads). Total new ads are up 3,359 from four weeks ago. All but two industries had four-week increases. The three largest were Health Care & Social Assitance (+790 new ads), Retail Trade (+671), and Finance & Insurance (+437 new ads).

Employers with the most new job postings during the week ending April 8th, were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. Health Care & Social Assistance accounted for eight of the top 25 employers and seven were in Retail Trade. The 25 employers shown above combined account for 2,151 of total job ads or 22 percent of all new ads. The four employers with the most new ads during the week had between 152 and 211 more new ads than a week ago. Twenty-three of twenty-five employers had over-the-week increases, the two down over-the-week were Keystone Human Services (-31 new ads) and Masonicare Corp. (-26 new ads) |

|

| |

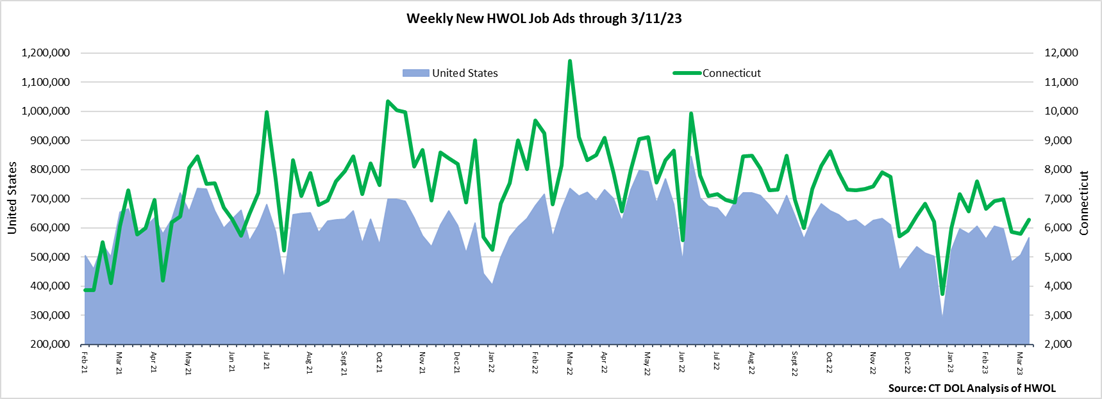

March 11th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending March 11th, 2023, fourteen of twenty-one industries had over-the-week increases. The largest increases occurred within Healthcare & Social Assistance (+139 new ads), Educational Services (+60 new ads), and Professional, Scientific, & Technical Services (+50 new ads). The largest employer increases within those three industries respectively were the Child Guidance Center of Southern Connecticut (+47 new ads), the University of Connecticut (+11 new ads), and Quest Global (+15 new ads). Among the seven decreasing industries, the largest was Accommodation & Food Services (-105 new ads). The remaining six industries with over-the-week decreases fell by fewer than 34 new ads.

Employers with the most new job postings during the week ending March 11th were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. Health Care & Social Assistance accounted for eight of the top 25 employers. The 25 employers shown above combined account for 846 of total job ads or 13 percent of all new ads. They were up a combined 222 new ads from a week ago. The largest over-the-week increases occurred at Child Guidance Center of Southern CT (+47 new ads) and Travelers (+44 new ads). The largest over-the-week declines among the top 25 employers were Yale-New Haven Health System (-35 new ads) and the State of Connecticut (-30 new ads). |

|

| |

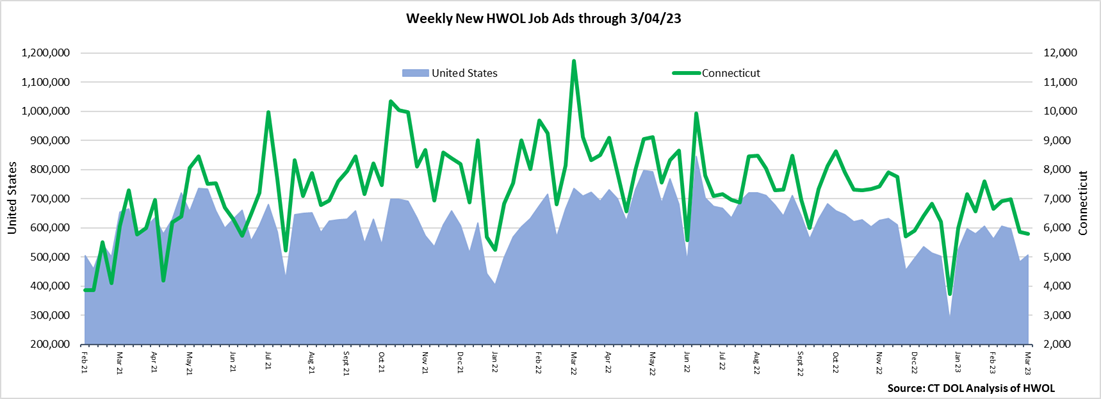

March 4th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending March 4th, 2023, the slight overall new ad decrease overlays larger shifts within specific industries in the state. Eleven industries had over-the-week increases and ten had decreases, the largest of each respectively were Accommodation & Food Services (+83 new ads) and Health Care & Social Assitance (-129 new ads). Over four weeks, total ads are down 13%, with 15 of 21 industries showing declines. The largest four-week decline occurred in Health Care & Social Assistance, down 410 new ads. Among the six industries with four-week increases, the largest was Other Services, up 41 new ads.

Employers with the most new job postings during the week ending March 4th were mostly within Retail Trade, Health Care & Social Assistance, and Finance & Insurance. Retail Trade accounted for seven of the top 25 employers. The 25 employers shown above combined account for 956 of total job ads or 16 percent of all new ads. A week ago, the top 25 employers accounted for 1,356 job ads, or 23 percent of all new ads. Sixteen employers in the top 25 increased over the week, two were unchanged, and seven decreased. Among the 25 employers with the most ads, the largest increase occurred at Trinity Health (+63 new ads) and the largest decrease occurred at Hartford Healthcare (-99 new ads). |

|

| |

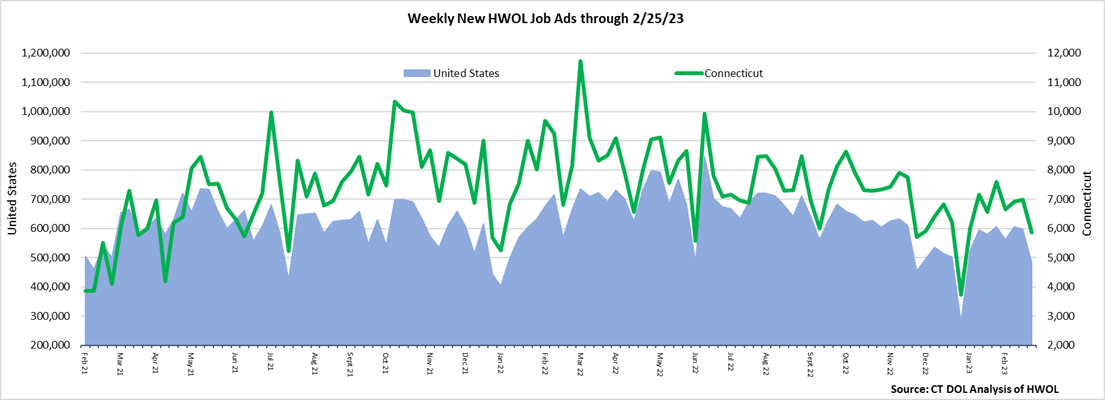

February 25th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending February 25th, 2023, the 1,148 new ad decrease is the net result of industry-level declines in 17 of 21 industries. More than half the overall decrease occurred in Health Care & Social Assistance (-273 new ads), Pro., Sci., & Tech. Services (-161 new ads), and Manufacturing (-157 new ads). The over-the-week drop to 5,829 new ads is the lowest level of 2023. The most recent week of new ads was the lowest level of 2023 for 7 out of 10 industries with the most ads.

Employers with the most new job postings during the week were mostly within Health Care & Social Assistance, Finance & Insurance, and Education. Healthcare & Social Assistance accounted for eleven of the top 25 employers. The 25 employers shown above combined account for 1,356 job ads or 23 percent of all new ads. Thirteen employers in the top 25 had over the week increases, the largest occurred at Travelers (+187 new ads), Hartford Healthcare (+104 new ads), and Cigna (+68 new ads). Among the 25 employers with the most ads during the week ending February 25th, the largest over the week declines occurred at Lumen Technologies (-181 new ads). |

|

| |

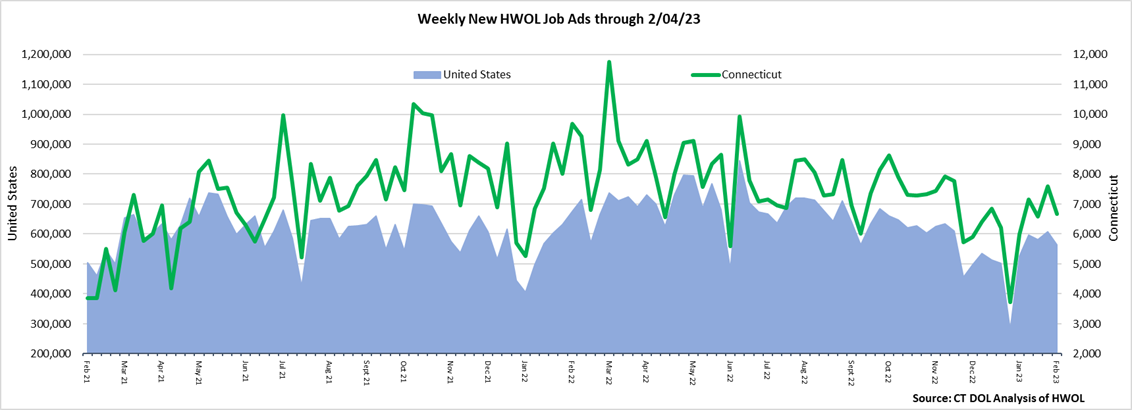

February 4th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending February 4th, 2023, the 942 new ad decrease is the net result of a combined 1,065 ad decline among fourteen industries and a combined 123 ad increase among five industries. Manufacturing had a 341 new ad decrease over the week, which follows a 337 new ad increase during the prior week. Most of this can be attributed to Raytheon which was down 245 new ads over the week after having increased by 234 ads in the prior week. During the week ending February 4th, the five increasing industries grew by 72 new ads or less. Accommodation & Food Services had the largest increase (+72 new ads) and the employer with the largest increase in that industry was Starbuck's Coffee (+47 new ads).

Employers with the most new job postings during the week were mostly within Health Care & Social Assistance, Retail Trade, and Manufacturing. Healthcare & Social Assistance accounted for eleven of the top 25 employers. The 25 employers shown above combined account for 1,404 job ads or 20 percent of all new ads. Raytheon had the largest over the week decrease, down 245 ads over the week. This over the week drop at Raytheon follows a 234 ad increase during the week ending January 28th, 2023. |

|

| |

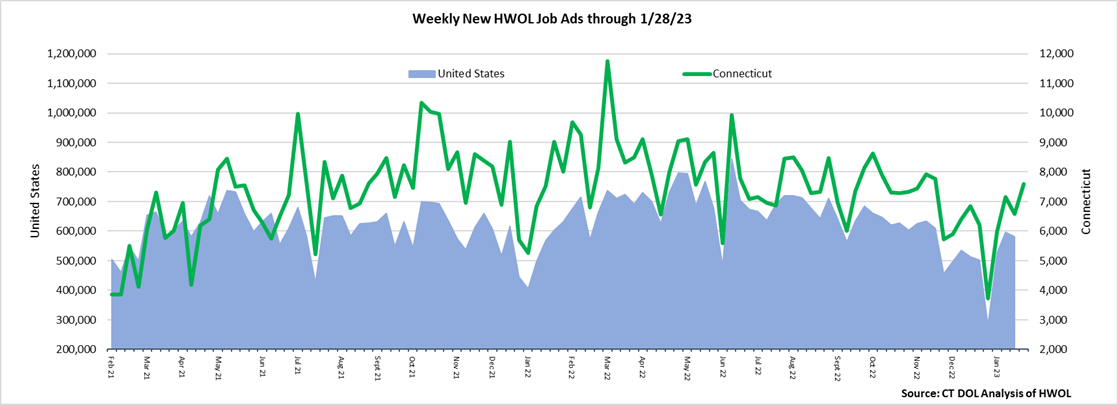

January 28th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending January 28th, 2023, the 1,031 new ad increase is the net result of a combined 1,223 ad increase among 15 industries and a combined 192 ad decrease among five industries. The largest industry increases over the week were Manufacturing (+337 new ads), Health Care & Social Assistance (+177 new ads), and Retail Trade (+89 new ads). Educational Services (-90 new ads) had the largest new ad decrease. The three Manufacturing industry employers with the most ads were Raytheon (312 new ads), General Dynamics (59 new ads), and Lockheed Martin (15 new ads). The three Health Care industry employers with the most ads were Yale-New Haven Health System (222 new ads), Community Health Center (98 new ads), and Saint Francis Health System (69 new ads).

Employers with the most new job postings during the week were mostly within Health Care & Social Assistance, Manufacturing, and Retail Trade. The 25 employers shown above combined account for 1,718 job ads or 22 percent of all new ads. The largest over-the-week increases occurred at Raytheon (+234 new ads) and Yale-New Haven Health System (+188 new ads). The largest occupational increase at Raytheon was Mechanical Engineers (+35 new ads) and at Yale-New Haven Health System, the largest increase was Registered Nurses (+40 new ads). |

|

| |

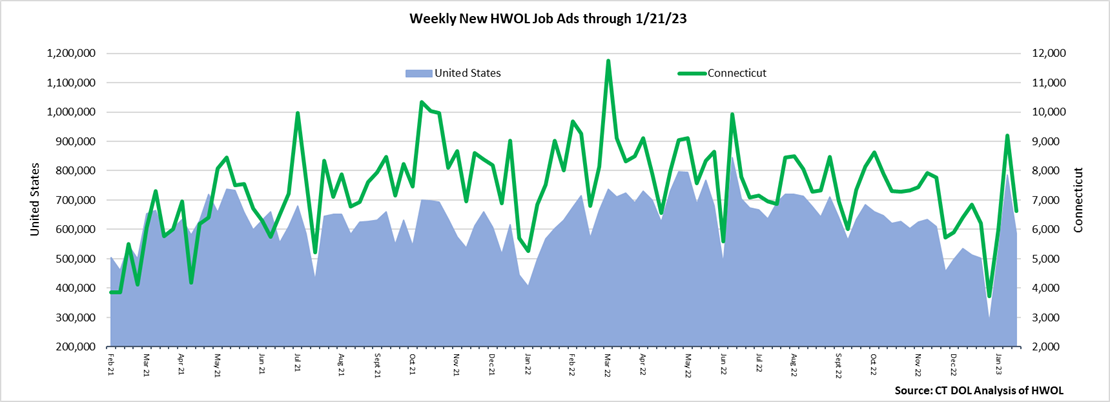

January 21st 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending January 21st, 2023, The 2,491 total decline is the net result of a combined 2,671 decrease among 18 industries and a combined 180 ad increase among three industries. The industries that declined over the week fell by between 11% and 64% while the three increasing industries grew by between 15% and 50%. Health Care & Social Assistance had the largest decrease, down 691 new ads and Educational Services had the largest increase, up 167 new ads. The largest employer decrease within Health Care & Social Assistance occurred at Yale-New Haven Health System (-207 new ads) and the largest employer increase within Educational Services occurred at Stamford Public Schools (+57 new ads).

Employers with the most new job postings during the week were mostly within Health Care & Social Assistance, Education, and Finance & Insurance. The 25 employers shown above account for 18 percent of all new ads. Fifteen employers in the top 25 increased over the week, one was unchanged, and nine decreased. Among the five employers with the most ads, the first four were all within Healthcare & Social Assistance, and Registered Nurses was the most common occupation within those employers. The fifth employer with the most ads was Raytheon and Architectural & Engineering Managers was the occupation at that employer with the most ads. |

|

| |

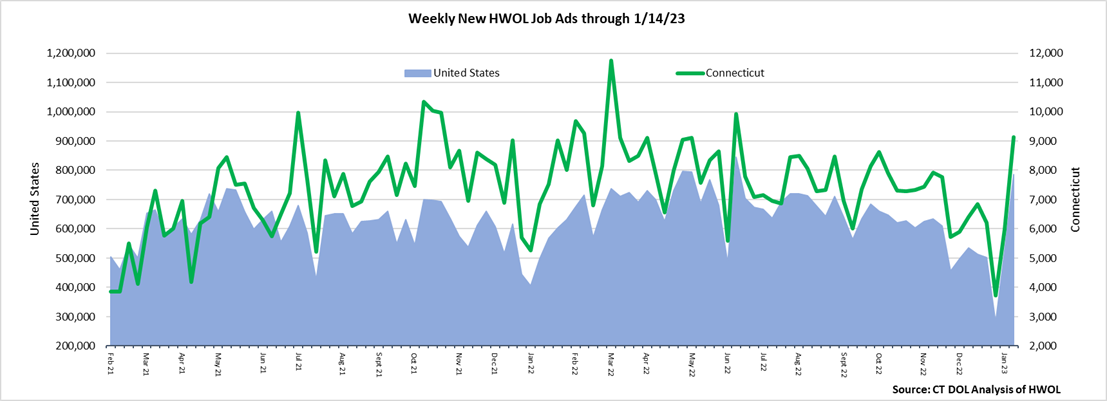

January 14th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending January 14th, 2023, the 52% new ad total increase is the net result of increases in all twenty-one industries shown in the above table. Fifteen industries had over-the-week gains of 50% or more, and seven were up 75% or more. The largest over-the-week increase occurred in Health Care & Social Assistance (+674 new ads) and the smallest increase occurred in Mining & Extraction (+2 new ads). Compared to four weeks ago, total ads are up 33% or +2,287 new ads, and every industry other than Health Care & Social Assistance (-4 new ads) was up over four weeks.

Employers with the most new job postings during the week were mostly within Health Care & Social Assistance, Retail Trade, and Manufacturing. The 25 employers shown above account for 18 percent of all new ads. Twenty-one employers in the top 25 increased over the week and four decreased. Within the 25 largest employers, the largest increase occurred at Yale-New Haven Health System (+201 new ads) and the largest decrease occurred at Community Health Center, Inc. (-41 new ads). |

|

| |

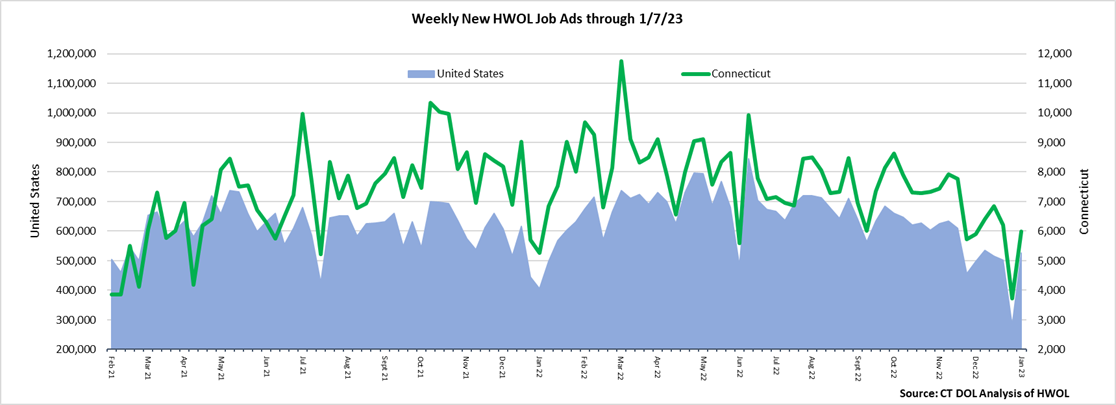

January 7th 2023 Help Wanted OnLine Data Series |

|

| |

|

During the week ending January 7th, 2023, the 61% new ad total increase is the net result of increases in 19 of 21 industries. Most industries had over-the-week gains of 50% or more, as overall ad levels returned to levels from two weeks ago when there were 6,410 total new ads. The largest over-the-week employer increases among the four industries with the largest new ad change include Hartford Healthcare (+138 new ads) in Health Care & Social Assistance, CVS Health (+26 new ads) in Retail Trade, Cigna (+48 new ads) in Finance & Insurance, and Raytheon (+43 new ads) in Manufacturing. Compared to four weeks ago, total ads are down 7% or -419 new ads, and 14 of 21 industries had four-week declines, the largest being Manufacturing (-124 new ads) and Professional, Scientific, & Technical Services (-110 new ads). The largest four-week increase occurred in Accommodation & Food Services (+132 new ads).

Employers with the most new job postings during the week were mostly within Health Care & Social Assistance, Retail Trade, and Finance & Insurance. The 25 employers shown above account for 17 percent of all new ads. 22 employers in the top 25 increased over the week and 3 decreased. Within the 25 largest employers, the largest increase occurred at Hartford Healthcare (+138 new ads) and the largest decrease occurred at Community Health Center, Inc. (-137 new ads). |

|

| |

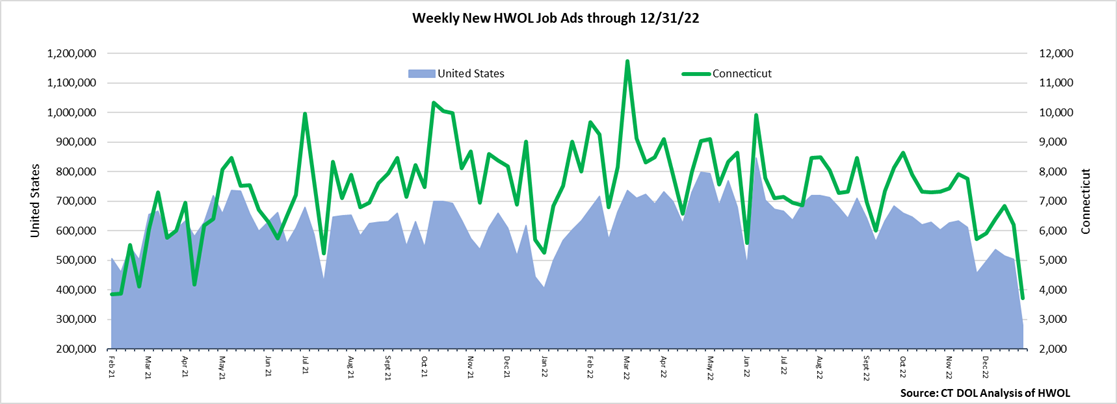

December 31st 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending December 31st, 2022, the 40% new ad total decrease is the net result of decreases in every industry other than Agriculture, which had a slight increase. Decreasing industries were down between -22% (Accommodation & Food Services) and -69% (Information). The largest over-the-week employer declines among the four industries with the largest declines include Hartford Healthcare (-181 new ads) in Health Care & Social Assitance, Cigna (-52 new ads) in Finance & Insurance, Raytheon (-80 new ads) in manufacturing, and University of Connecticut ( 23 new ads) in Educational Services. Over four weeks, every industry except for Agriculture was down between -25% to -79%.

Employers with the most new job postings during the week were mostly within Health Care & Social Assistance, Retail Trade, and Manufacturing. The 25 employers shown above account for 23 percent of all new ads. 13 of 25 employers in the top 25 increased over the week and 12 decreased. Within the 25 largest employers, the largest decrease occurred ad Hartford Healthcare (-181 new ads) and the largest increase occurred at Community Health Center, Inc. (+115 new ads). |

|

| |

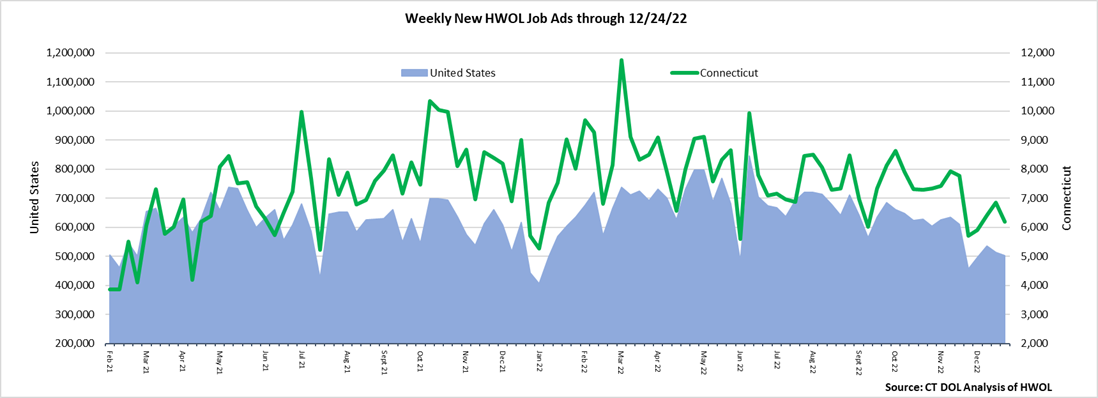

December 24th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending December 24th, 2022, the 10% new ad total decrease is the net result of decreases in ten industries and increases in ten industries. The decreasing industries were down a combined 969 new ads, and Health Care & Social Assitance accounted for 679 of that combined decline. This drop during the most recent week corresponds with similar gains the week before. Health Care was up 639 new ads during the week ending December 24th. The other declining industries had over the week drops of less than 75 new ads. The ten increasing industries had slight gains that were mostly less below 100 new ads.

Employers with the most new job postings during the week were mostly in Health Care & Social Assistance, Retail Trade, and Finance & Insurance. The 25 employers shown above account for 21 percent of all new ads. 15 of 25 employers in the top 25 increased over the week and 10 decreased. Seven employers were in Healthcare & Social Assistance and four of those seven had the largest over-the-week declines within the top 25. Hartford Healthcare was down the most (-208 new ads) over the week and was previously up 266 new ads during the week ending December 24th. Among the top 25 employers, the largest increase occurred at Trinity Health (+79 new ads). |

|

| |

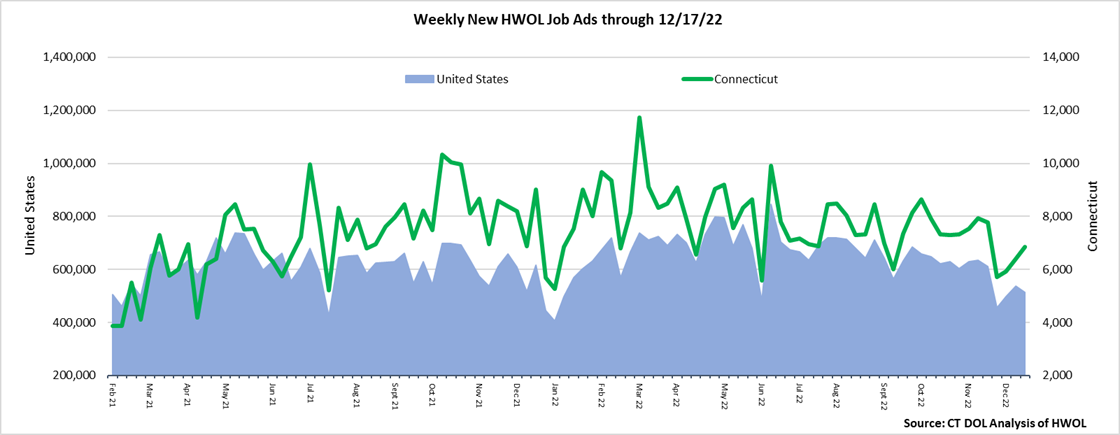

December 17th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending December 17th, 2022, the 7% new ad total increase is the net result of increases in nine industries and decreases in eleven industries. Some of the largest percent increases include Health Care & Social Assistance (+38% or +639 new ads) and Retail Trade (+23% or -63 new ads). Over four weeks, new ads were down 12% or -932 new ads. Fifteen of twenty-one industries had four-week declines and seven had decreases of 100 new ads or more. The largest were Accommodation & Food Services (-53% or -240 new ads), Educational Services (-45% or -240 new ads), and Manufacturing (-23% or -171 new ads). Among increasing industries, Health Care & Social Assitance had a four-week increase of 42% or +685 new ads.

Employers with the most new job postings during the week were mostly in Health Care & Social Assistance, Manufacturing, and Retail Trade. The 25 employers shown above account for 28 percent of all new ads. 23 of 25 employers in the top 25 increased over the week and 2 decreased. Healthcare & Social Assistance accounted for 10 employers in the top 25. Hartford Healthcare had the largest increase over the week, up 266 new ads. |

|

| |

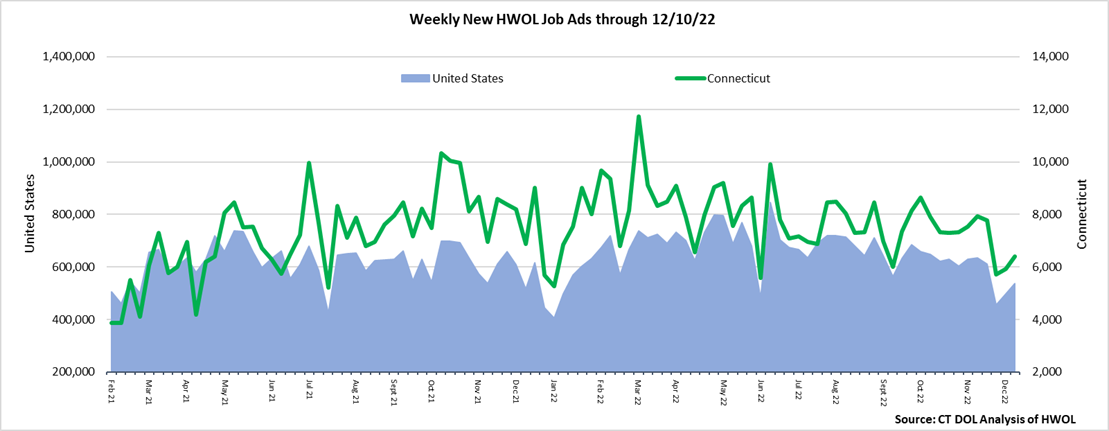

December 10th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending December 10th, 2022, the 8% new ad total increase is the net result of increases in twelve industries and decreases in nine industries. The twelve increasing industries grew by a combined 747 new ads and the largest industry increases occurred in Manufacturing (+117 new ads), Health Care (+106 new ads) and Administrative & Support (+65 new ads). The nine decreasing industries fell by a combined 256 new ads, Accommodation & Food Services was down the most (-136 new ads). Over four weeks, total ads were down 19% or 1,524 new ads, sixteen industries were down, one was unchanged, and four were up. Half of the overall decline occurred in Educational Services (-770 new ads). The largest four-week industry increase occurred in Health Care (+217 new ads).

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Manufacturing, and Retail Trade. The 25 employers shown above account for 18 percent of all new ads. 18 of 25 employers in the top 25 increased over the week, seven decreased. The top 25 employers with the largest over the week increase and decrease respectively were Hartford Healthcare. (+123 new ads) and Community Health Center, Inc. (-101 new ads). |

|

| |

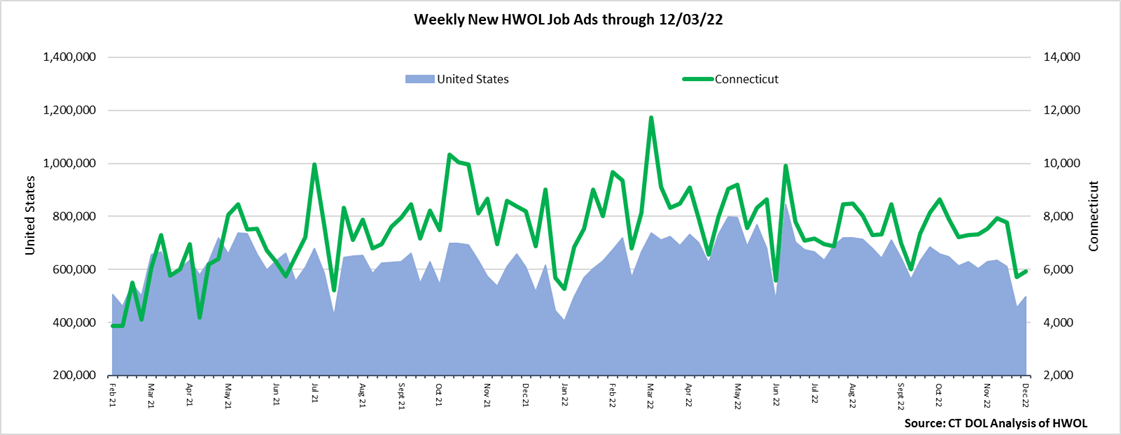

December 3rd 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending December 3rd, 2022, the 3% new ad total increase is the net result of increases in fourteen industries and decreases in seven industries. The fourteen increasing industries grew by a combined 522 new ads and 45% of that combined increase occurred in Accommodation & Food Services (+138 new ads) or Professional, Scientific, & Technical Services (+96 new ads). The seven decreasing industries fell by a combined 325 new ads, Educational Services was down the most (-130 new ads). Over four weeks, total ads were down 22%, fifteen industries were down, two were unchanged, and four were up. The largest four week industry decrease was Manufacturing (-353 new ads) and the largest increase was Accommodation & Food Services (+21 new ads).

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Finance & Insurance, and Retail Trade. The 25 employers shown above account for 21 percent of all new ads. 21 of 25 employers in the top 25 increased over the week, one was unchanged and three decreased. The top 25 employers with the largest over the week increase and decrease respectively were Community Health Center, Inc. (+192 new ads) and Yale-New Haven Health System (-38 new ads). |

|

| |

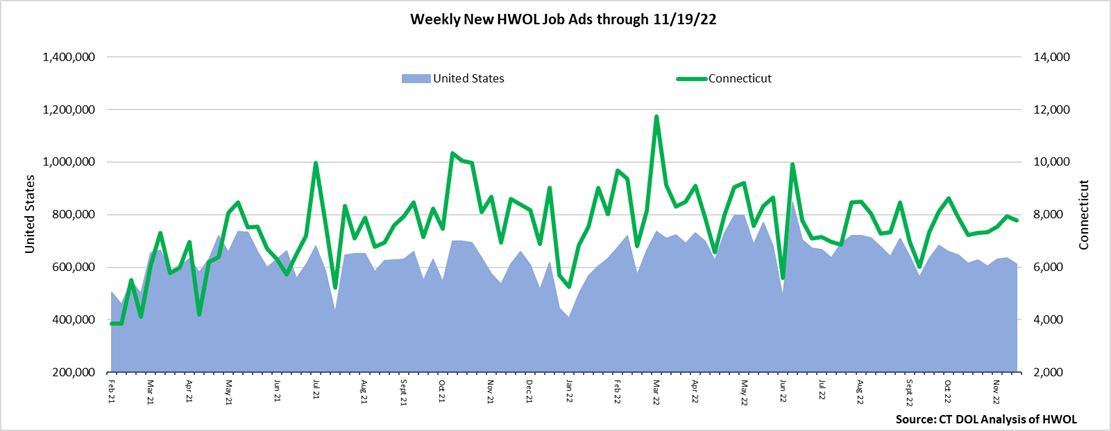

November 25th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending November 25th, 2022, the 3% new ad total increase is the net result of increases in 10 industries and declines in 11. The 10 increasing industries grew by a combined 429 new ads and most of that increase occurred in Manufacturing (+115 new ads) and Finance & Insurance (+97 new ads). The decreasing industries fell by a combined 213 new ads with most of that occurring in Educational Services (-65 new ads) and Arts, Entertainment, & Recreation (-41 new ads). Over four weeks, new ads were down 4% or -317 new ads. 12 industries were down and 9 were up. Large four-week declines occurred in Retail Trade (-143 new ads) and Accommodation & Food Services (-67 new ads). The 9 industries with four-week increases grew by a combined 252 new ads. Manufacturing (+115 new ads) had the largest four-week increase.

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Finance & Insurance and Retail Trade. The 25 employers shown above account for 19 percent of all new ads. 15 of 25 employers in the top 25 had over-the-week increases, one was unchanged, and 9 had decreases. The top 25 employers with the largest over the week increase and decrease were ATX Learning (+79 new ads) and the State of Connecticut and Community Health Center Inc., both down 35 new ads. |

|

| |

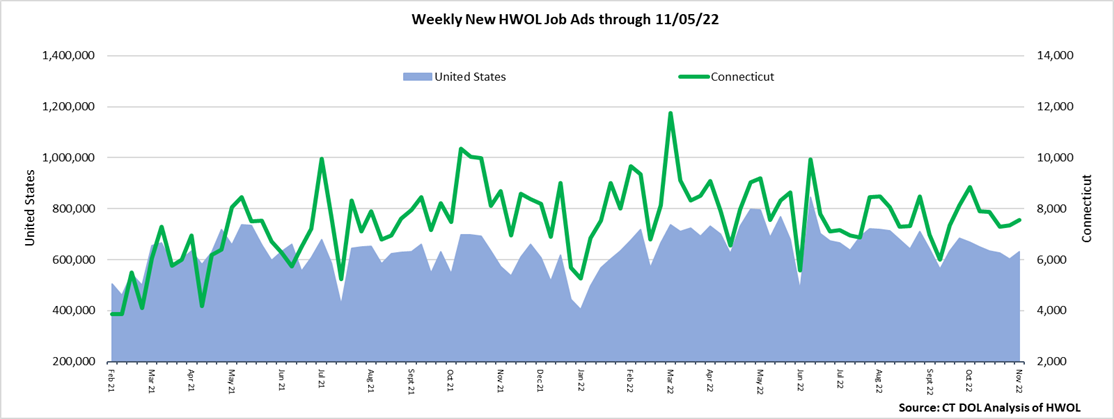

November 5th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending November 5th, 2022, the 3% new ad total increase is the net result of increases in 10 industries and declines in 11. The 10 increasing industries grew by a combined 429 new ads and most of that increase occurred in Manufacturing (+115 new ads) and Finance & Insurance (+97 new ads). The decreasing industries fell by a combined 213 new ads with most of that occurring in Educational Services (-65 new ads) and Arts, Entertainment, & Recreation (-41 new ads). Over four weeks, new ads were down 4% or -317 new ads. 12 industries were down and 9 were up. Large four-week declines occurred in Retail Trade (-143 new ads) and Accommodation & Food Services (-67 new ads). The 9 industries with four-week increases grew by a combined 252 new ads. Manufacturing (+115 new ads) had the largest four-week increase.

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Finance & Insurance and Retail Trade. The 25 employers shown above account for 19 percent of all new ads. 15 of 25 employers in the top 25 had over-the-week increases, one was unchanged, and 9 had decreases. The top 25 employers with the largest over the week increase and decrease were ATX Learning (+79 new ads) and the State of Connecticut and Community Health Center Inc., both down 35 new ads. |

|

| |

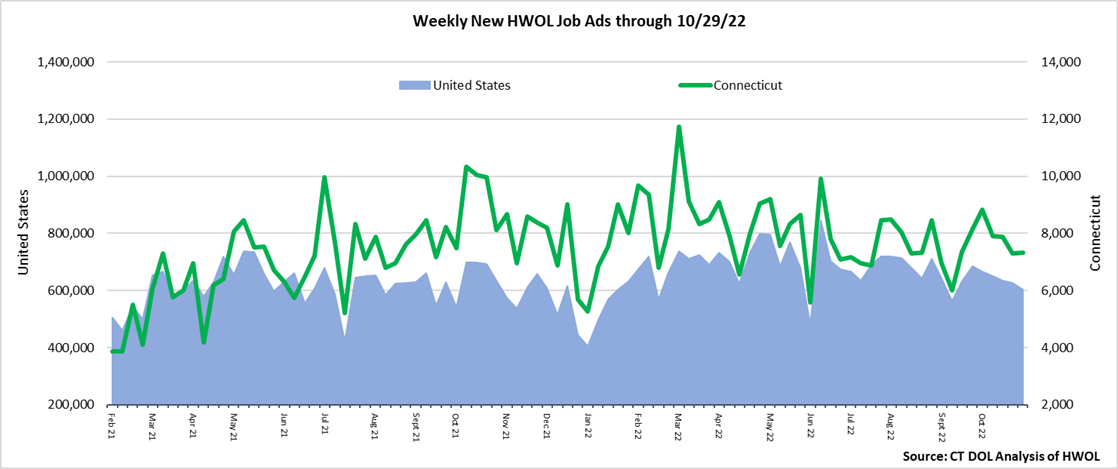

October 29th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending October 29th, 2022, the slight 0.6% new ad total increase is the net result of increases in 12 industries and declines in 9. The 12 increasing industries grew by a combined 393 new ads and most of that increase occurred in Accommodation & Food Services (+104 new ads) and Educational Services (+97 new ads). The decreasing industries fell by a combined 346 new ads with most of that occurring in Finance & Insurance (-93 new ads) and Pro., Sci., & Tech. Services (-63 new ads). Over four weeks, new ads were down 18% or -1,556 new ads. 15 industries were down, one was unchanged and 5 were up. More than a third of the total four-week decline occurred in Retail Trade (-563 new ads). The industries with the largest four week increases were Public Administration and Other Services, both up 23 new ads.

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Manufacturing, and Finance & Insurance. The 25 employers shown above account for 19 percent of all new ads. 14 of 25 employers in the top 25 had over-the-week increases and 11 had decreases. The top 25 employers with the largest over the week increase and decreases were Gartner Incorporated. (+80 new ads) and Yale-New Haven Health System (-61 new ads) respectively. |

|

| |

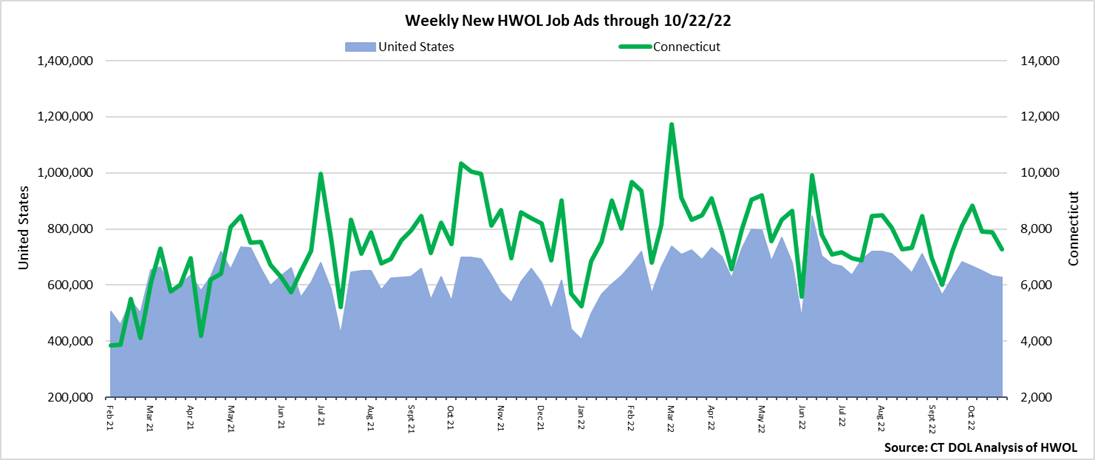

October 22nd 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending October 22nd, 2022, the -8% new ad total decrease is the net result of increases in 8 industries and declines in 13. The 8 increasing industries grew by a combined 335 new ads and most of that increase occurred in Professional, Scientific, & Technical Services (+57 new ads). The decreasing industries fell by a combined 930 new ads with most of that occurring in Health Care & Social Assistance (-552 new ads). Over four weeks, new ads were up 8% or up 512 new ads. 11 industries were up and 10 decreased. The largest four week increase occurred in Health Care and Social Assistance (+345 new ads) and the largest decrease occurred in Real Estate (-91 new ads).

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Retail Trade, and Finance & Insurance. The 25 employers shown above account for 20 percent of all new ads. 18 of 25 employers in the top 25 had over-the-week increases, one was unchanged, and 6 had decreases. The top 25 employers with the largest over the week increase and decreases were Community Health Center, Inc. (+135 new ads) and Hartford Healthcare (-152 new ads) respectively. |

|

| |

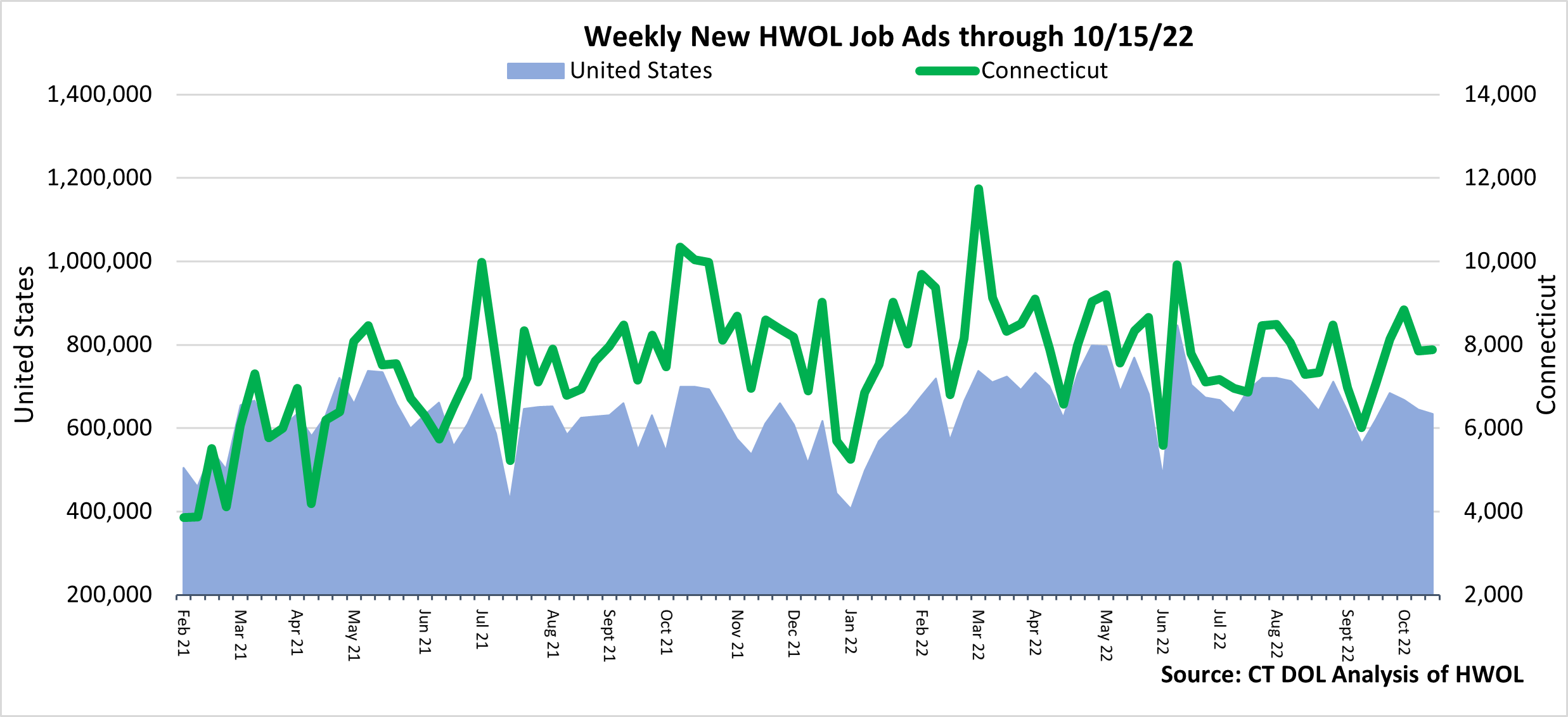

October 15th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending October 15th, 2022, the total ad decrease of 1,023 new ads or -12% is the net result of decreases in 16 of 21 industries. The 16 decreasing industries fell by a combined -1,207 new ads and the increasing industries grew by 184. Seventy-two percent of the total decline occurred in three industries; Retail Trade (-374 new ads), Professional, Scientific, & Technical Services (-242 new ads), and Manufacturing (-124 new ads). The over the week drop in Retail Trade follows a prior week gain of 537 new ads. Over four weeks, 17 industries were up, two were unchanged, and two were down. The largest four-week increase occurred in Health Care & Social Assistance (+529 new ads) and the largest decrease occurred in Manufacturing (-35 new ads).

Employers with the most new job postings during the week were mostly in Retail Trade, Healthcare & Social Assistance, and Finance & Insurance. The 25 employers shown above account for 19 percent of all new ads. 18 of 25 employers in the top 25 had over-the-week increases and seven had decreases. The top 25 employers with the largest over the week increase and decreases were The Home Depot (+174 new ads) and Amazon (-511 new ads) respectively. At the Home Depot, more than half of that new ad increase was due to postings for five occupations: Interior Designers (+25 new ads), Supervisors of Office & Admin. Support Workers (+22 new ads), Cashiers (+19 new ads), Stock Clerks (+18 new ads), and Retail Loss Prevention Specialists (+17 new ads). Most of the over the week ad decline at Amazon was due to a drop in ads for Laborers, Freight, & Material Movers (-353 new ads). |

|

| |

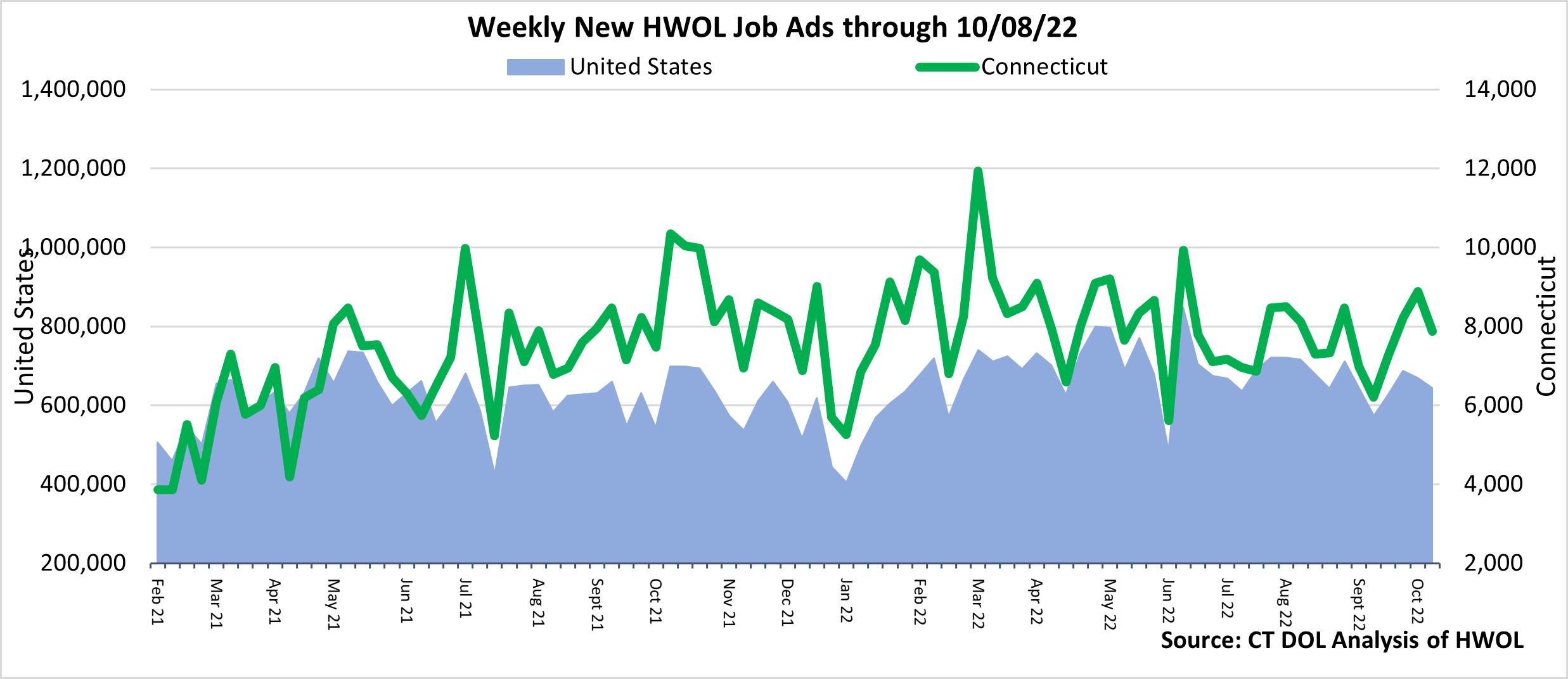

October 8th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending October 8th, 2022, the total ad decrease of 1,023 new ads or -12% is the net result of decreases in 16 of 21 industries. The 16 decreasing industries fell by a combined -1,207 new ads and the increasing industries grew by 184. Seventy-two percent of the total decline occurred in three industries; Retail Trade (-374 new ads), Professional, Scientific, & Technical Services (-242 new ads), and Manufacturing (-124 new ads). The over the week drop in Retail Trade follows a prior week gain of 537 new ads. Over four weeks, 17 industries were up, two were unchanged, and two were down. The largest four-week increase occurred in Health Care & Social Assistance (+529 new ads) and the largest decrease occurred in Manufacturing (-35 new ads).

Employers with the most new job postings during the week were mostly in Retail Trade, Healthcare & Social Assistance, and Finance & Insurance. The 25 employers shown above account for 19 percent of all new ads. 18 of 25 employers in the top 25 had over-the-week increases and seven had decreases. The top 25 employers with the largest over the week increase and decreases were The Home Depot (+174 new ads) and Amazon (-511 new ads) respectively. At the Home Depot, more than half of that new ad increase was due to postings for five occupations: Interior Designers (+25 new ads), Supervisors of Office & Admin. Support Workers (+22 new ads), Cashiers (+19 new ads), Stock Clerks (+18 new ads), and Retail Loss Prevention Specialists (+17 new ads). Most of the over the week ad decline at Amazon was due to a drop in ads for Laborers, Freight, & Material Movers (-353 new ads). |

|

| |

October 1st 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending October 1st, 2022, the total ad increase of 2,115 new ads or +31% is the net result of decreases in 15 of 21 industries. The 15 increasing industries grew by a combined 2,162 new ads and the 6 decreasing industries fell by 47. Half of the overall increase occurred in Retail Trade (+537 new ads) and Health Care & Social Assistance (+520 new ads). The 537 new ad jump in Retail Trade represents the largest one week increase for that industry since January 2022. Almost all of the over-the-week Retail Trade increase can be attributed to Amazon, which increased by 472 to 540 new ads. Over four weeks, total ads were up 1,902 new ads or +27%.

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Finance & Insurance, and Manufacturing. The 25 employers shown above account for 22 percent of all new ads. 19 of 25 employers in the top 25 had over-the-week increases, one was unchanged and five had decreases. The top 25 employers with the largest over the week increase include Amazon (+472 new ads), Trinity Health (+203 new ads) and Hartford Healthcare (+69 new ads). The five employers in the top 25 that fell over the week include the State of Connecticut (-65 new ads) and Travelers (-17 new ads). |

|

| |

September 24th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending September 24th, 2022, the total ad decreases of 321 new ads or -5% is the net result of decreases in 10 of 21 industries. The 10 decreasing industries fell by a combined 589 new ads and the 11 increasing industries grew by 268. The three industries with the largest over the week declines were Finance & Insurance (-208 new ads), Health Care & Social Assistance (-130 new ads), and Utilities (-121 new ads). Over four weeks, total ads were down 1,436 new ads or -17%. More than half of this overall decline occurred in Health Care & Social Assistance (-744 new ads) and 13 of 21 industries had four-week declines. The largest four week increase among the seven increasing industries occurred in Retail Trade (+92 new ads).

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Finance & Insurance, and Manufacturing. The 25 employers shown above account for 17 percent of all new ads. 19 of 25 employers in the top 25 had over-the-week increases. The largest increases in the top 25 include TJX Companies, Inc. (+103 new ads), State of Connecticut (+73 new ads), and Amazon (+52 new ads). The largest one-week decreases in the top 25 include Yale-New Haven Health System (-151 new ads) and Trinity Health (-52 new ads). Over four weeks, 17 employers in the top 25 increased and 8 decreased. The largest four-week increase occurred at TJX Companies, Inc. (+94 new ads) and the largest four-week decrease occurred at Community Health Center, Inc. (-64 new ads). |

|

| |

September 17th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending September 17th, 2022, the total ad increases of 893 new ads or +14% is the net result of increases in 13 of 21 industries. The 13 increasing industries grew by a combined 1,018 new ads and the 7 decreasing industries fell by 125. Three industries accounted for more than two-thirds of the increase: Finance & Insurance (+300 new ads), Health Care & Social Assistance (+193 new ads) and Utilities (+158 new ads). The seven decreasing industries fell by a combined 125 new ads. The largest over the week drop occurred in Accommodation & Food Services (-67 new ads). Over 4 weeks, total new ads were down 256 new ads or -3%. 14 of 21 industries had 4-week declines, the largest occurred in Health Care & Social Assistance (-213 new ads), Accommodation & Food Services (-150 new ads), and Educational Services (-129 new ads). Utilities (+196 new ads) had the largest four-week gain.

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Retail Trade, and Finance & Insurance. The 25 employers shown above account for 18 percent of all new ads. 20 of 25 employers in the top 25 had over-the-week increases. The largest increases in the top 25 include Yale-New Haven Health System (+177 new ads) and Target (+59 new ads). The largest one-week decrease in the top 25 occurred at Aya Healthcare (-61 new ads). Over four weeks, 18 employers in the top 25 increased and 7 decreased. The largest four-week increase occurred at Yale-New Haven Health System (+69 new ads) and the largest four-week decrease occurred at Aya Healthcare (-46 new ads). |

|

| |

September 10th 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending September 10th, 2022, the total ad decreases of -785 new ads or -11% is the net result of decreases in 15 of 21 industries. The 15 decreasing industries fell by a combined 871 new ads and the 6 increasing industries grew by 86. Three industries accounted for almost two-thirds of the drop over the week: Health Care & Social Assistance (-234 new ads or -19%), Finance & Insurance (-146 new ads or - 22%), and Professional, Scientific, & Technical Services (-136 new ads or -27%). The six increasing industries grew by 34 or fewer ads over the week. Over 4 weeks, total new ads were down 1,116 new ads or -15%. 16 of 21 industries had 4-week declines, the largest occurred in Health Care & Social Assistance (-306 new ads), Finance & Insurance (-178 new ads), and Professional, Scientific, & Technical Services (-157 new ads). Manufacturing (+121 new ads) had the largest four-week gain.

Employers with the most new job postings during the week were mostly in Healthcare & Social Assistance, Retail Trade, and Finance & Insurance. The 25 employers shown above account for 17 percent of all new ads. 17 of 25 employers in the top 25 had over-the-week increases. The largest increases in the top 25 include Gap Inc. (+46 new ads), Walgreens Boots Alliance (+35 new ads), and Hartford Public Schools (+33 new ads). The largest one-week decrease in the top 25 occurred at Yale-New Haven Health System (-108 new ads). Over four weeks, 15 employers in the top 25 increased, one was unchanged, and 9 decreased. The largest four-week increase occurred at Aya Healthcare (+65 new ads) and the largest four-week decrease occurred at Trinity Health (-80 new ads). |

|

| |

September 3rd 2022 Help Wanted OnLine Data Series |

|

| |

|

During the week ending September 3rd, 2022, the total ad decrease of -1,223 new ads or -15% is the net result of decreases in 15 of 21 industries. More than half of the overall decline occurred in Health Care & Social Assistance (-573 new ads) and Professional, Scientific, & Technical Services (-121 new ads). Over 4 weeks, total new ads were down 1,134 new ads or -14%. 13 of 21 industries had 4-week declines, the largest occurred in Health Care & Social Assistance (-343 new ads), Retail Trade (-160 new ads), and Educational Services (-128 new ads).