Connecticut's Overall Economy Improves in 2018

By Jungmin Charles Joo, Associate Research Analyst, Department of Labor

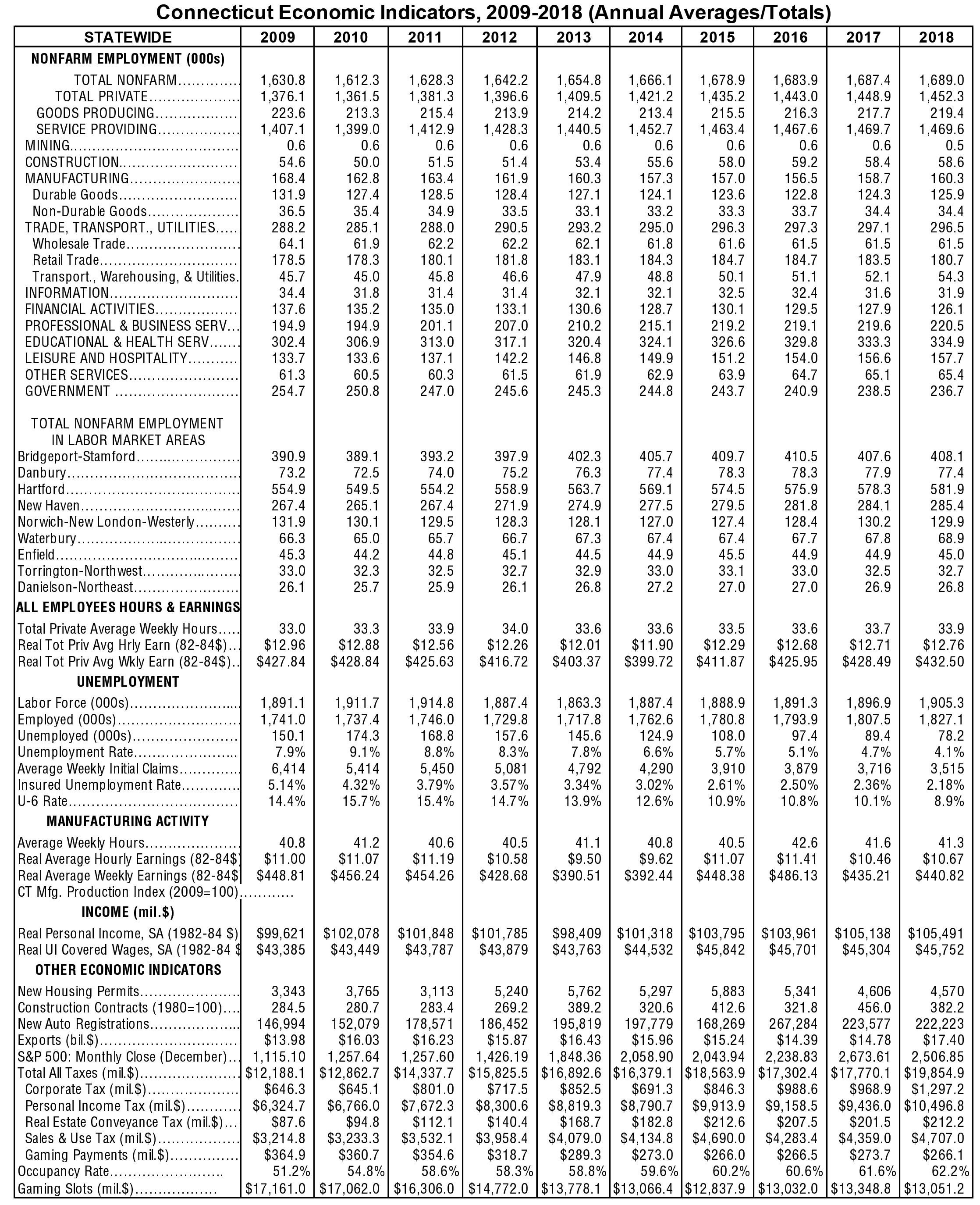

Although employment growth slowed in Connecticut, the overall economy did pick up in 2018. The revised total nonfarm employment increased for the eighth consecutive year, while the unemployment rate has been falling since 2011. Moreover, real personal income has increased for the last five years, and the value of annual diffusion index of 57 state economic indicators rose higher than in 2016 and 2017.

Nonfarm Employment

After our latest annual revision, Connecticut gained (based on annual average, not seasonally adjusted data) 1,600 jobs (+0.1%) in 2018, which was fewer than the 3,500 jobs (+0.2%) in 2017. By contrast, employment grew much faster in the nation (1.6% in 2017 and 1.7% in 2018).

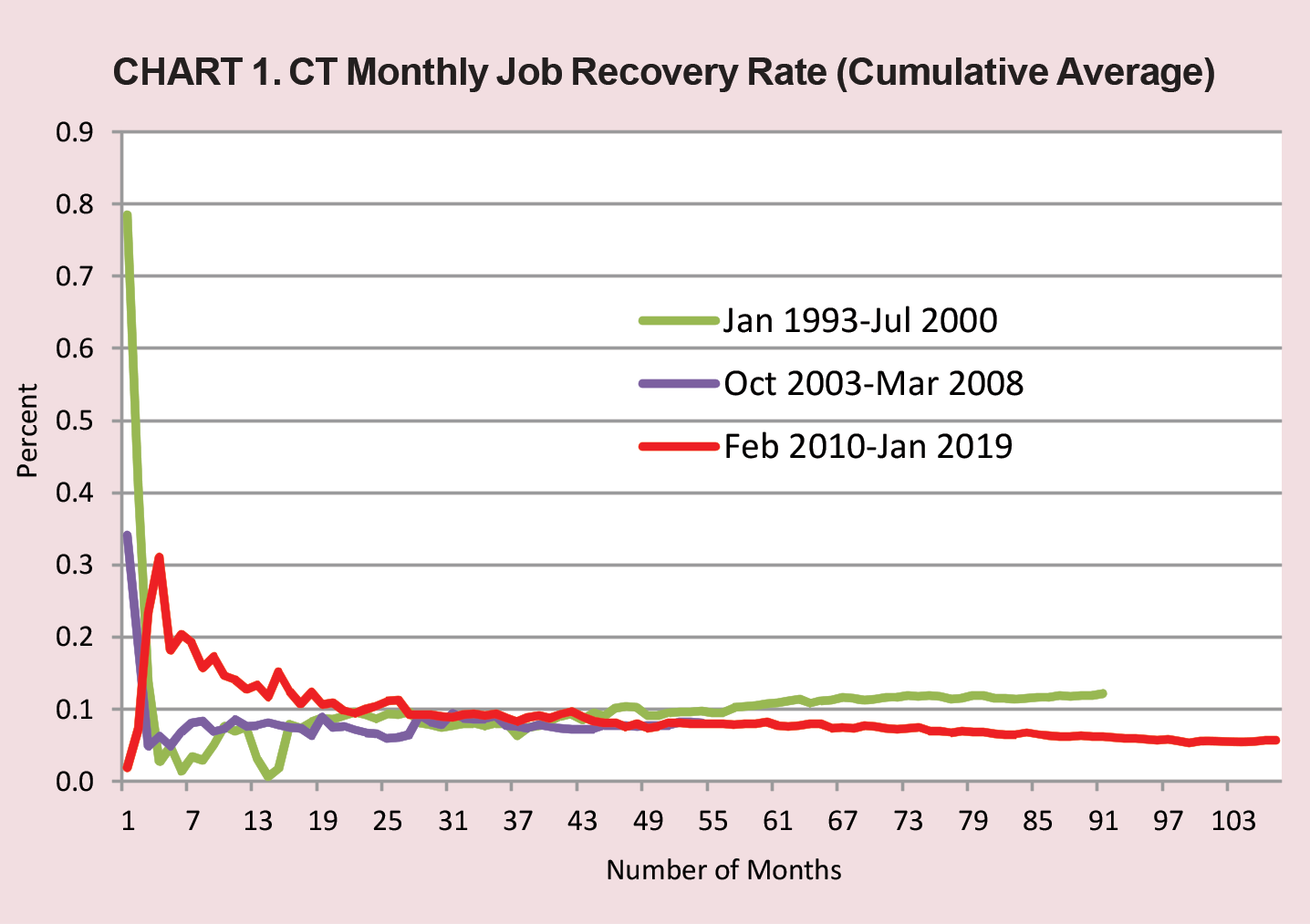

The past two years of Connecticut’s employment recovery has been the slowest of the last eight years. In fact, the current 2010-2019 monthly job recovery rate has been trending downward, averaging below 0.1 percent throughout the most of its 107-month employment recovery so far through January 2019. In contrast, the 2003-2008 recovery period showed a rising recovery rate, and during the 1993-2000 period, the monthly job growth rate rose steadily, increasing above the 0.1 percent threshold in later years of its employment recovery. (Chart 1)

Unemployment

A number of unemployment indicators do point to a healthier labor market situation. Local Area Unemployment Statistics (LAUS) were again revised back to 2010, due to changes in one of the input components, nonfarm employment. The annual average unemployment rate has trended downward over the past eight years, with last year’s 4.1% being the lowest since 2001 (3.1%). Meanwhile, the nation’s rate fell from 4.4% in 2017 to 3.9% in 2018.

In addition, the U-6 rate, a broader measure of labor underutilization which also includes those who are marginally attached workers and part-timers that want full-time work, fell from 10.1% in 2017 to 8.9% in 2018 for the state, the lowest rate since 2007’s 8.2%. Moreover, the number of average weekly initial claims for unemployment dropped in 2018 (3,515) for the seventh straight year to the lowest level since 2000 (3,426). Also, the insured unemployment rate fell for the ninth consecutive year to 2.18% in 2018, the lowest rate since 2000 (1.77%).

Employment by Industry

As shown in (Table 1), Connecticut has added jobs for the eighth year. Seven of the ten major industry sectors gained jobs over the year, up from five in 2017. Manufacturing, once again, led the employment growth (1.0%), adding 1,600 jobs, after breaking a five-year losing streak in 2017. Education and health services and leisure and hospitality continued to add jobs last year as well.

On the other hand, the financial activities sector has lost jobs three years in a row, and experienced the fastest employment decline (-1.4%) from 2017. The government sector also continued to shed jobs, losing employment every year since 2009.

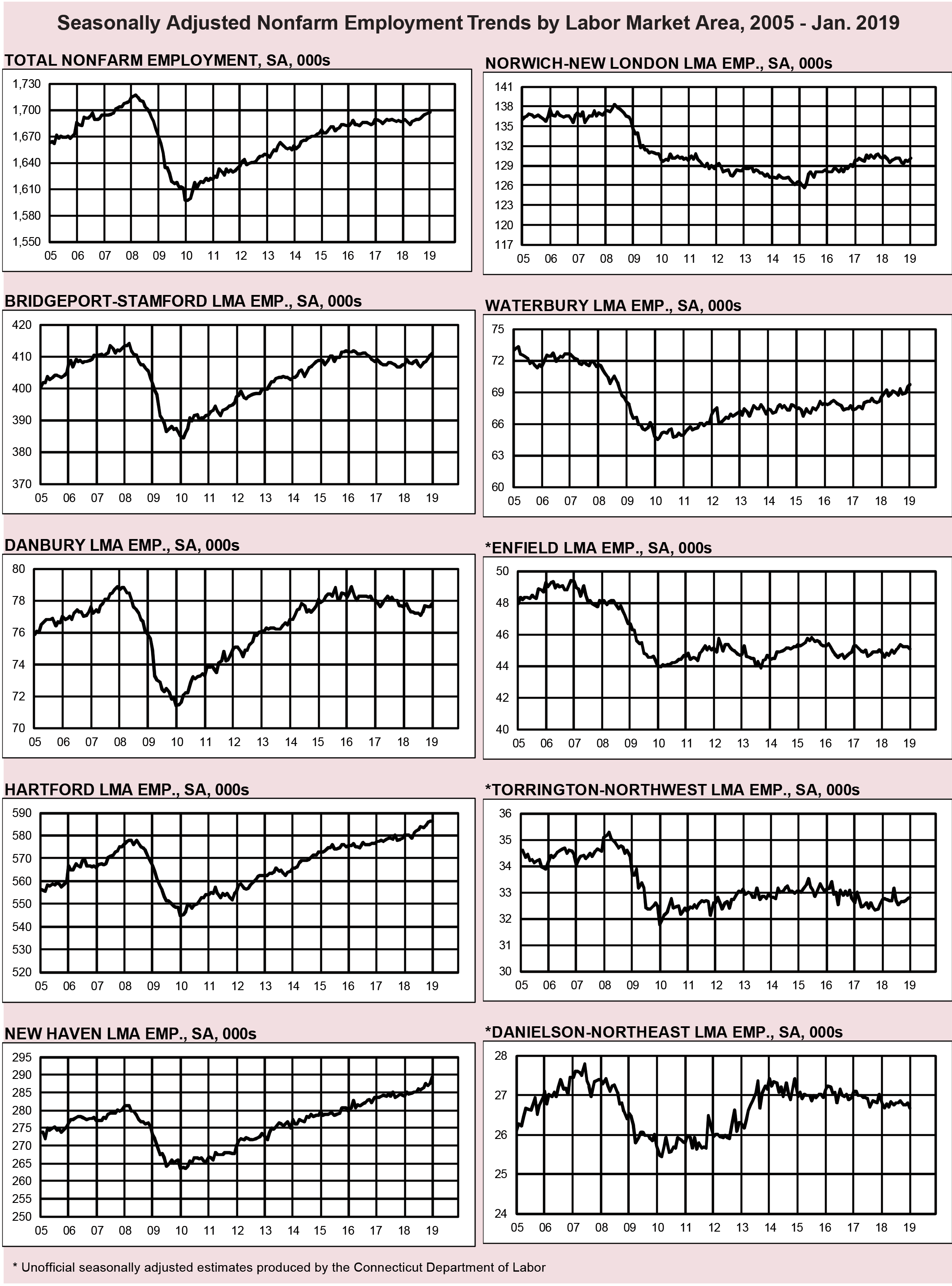

Employment by LMA

In 2018, six of nine labor market areas (LMAs) in Connecticut added jobs, up from four in 2017. The biggest job growth occurred in the Waterbury LMA, while the Norwich-New London-Westerly region lost employment last year, after three years of gains. The Charts also show long-term seasonally adjusted total nonfarm employment trends of Connecticut and all its nine LMAs from 2005 to January 2019.

Other Economic Indicators

In addition to employment and unemployment data, other economic indicators showed mixed results last year. The good news is that, as the table on page 3 shows, inflation-adjusted total personal income of state residents rose for five consecutive years, and real Unemployment Insurance covered wages finally turned around in 2018, after two years of decline. Both total taxes collected and exports increased for the second year.

However, the number of new housing permits, construction contracts, and the new auto registrations total were down over the year. Moreover, the stock market, and revenues from both gaming payments and slots all fell in 2018.

Annual Diffusion Index

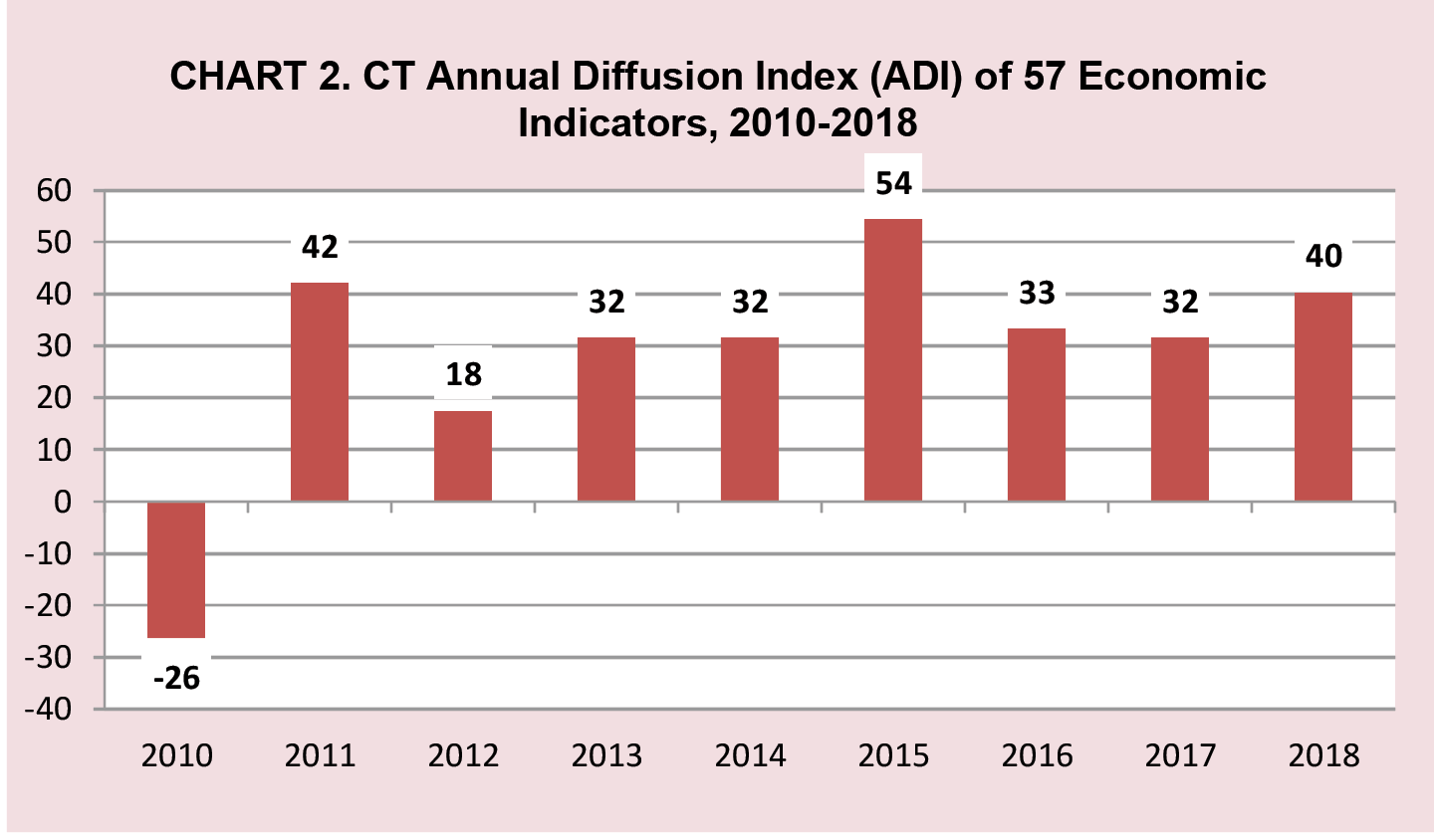

An Annual Diffusion Index (ADI) is one way to measure overall economic activity by summarizing all 57 economic indicators on page 3. For each economic indicator, the movement is up, down, or unchanged over the year. Results are reported as a diffusion index that is calculated by subtracting the share of indicators with negative economic movement from the share that moved in a positive economic direction.

For example, out of 57 indicators, 20 (35%) went up and 35 (61%) went down in 2010. The ADI is then calculated by subtracting 61 from 35, resulting in an indicator of -26. If an ADI is positive, then that is generally interpreted as an expansion in economic activity (because more indicators are improving), while negative values are interpreted as a contraction (because more indicators are deteriorating) for that year. This value of -26 makes sense, given that 2010 was the year coming out of the last economic recession in Connecticut. As (Chart 2) shows, the ADI rising from 32 in 2017 to 40 in 2018 suggests a slight improvement in state’s overall economic condition last year.

Looking Ahead

More new jobs are expected this year and in the near future. For example, it was announced in the media that Electric Boat, a submarine manufacturer based in Groton, will add 900 jobs this year. Indeed, a job-search firm, plans to add another 500 employees in its Stamford location. Gartner Inc., a research and information technology company, plans to expand its Stamford headquarters and add 400 jobs in Connecticut over the next five years.

Despite a job slowdown in 2018, growth in manufacturing and the low unemployment rate suggest Connecticut is poised for future growth.