Connecticut Projected to Add Fewer Jobs Through 2021

By Matthew Krzyzek Office of Research, Department of Labor

he whole world has changed in the few short weeks since we completed the latest short term projections in February 2020. At the time, the U.S. unemployment rate was lower than it had been at any time since the late 1960s and Connecticut jobs were growing. Since then the COVID-19 health crisis and the related shutdown of nonessential businesses caused a drastic shift in the employment outlook. Many leading analysts

he whole world has changed in the few short weeks since we completed the latest short term projections in February 2020. At the time, the U.S. unemployment rate was lower than it had been at any time since the late 1960s and Connecticut jobs were growing. Since then the COVID-19 health crisis and the related shutdown of nonessential businesses caused a drastic shift in the employment outlook. Many leading analysts  have declared that there is a 100% chance that the U.S. economy has entered a recession. One indicator of change is claims for unemployment insurance. As of April 11, 16 million American workers were collecting unemployment insurance with another 4 million filing claims the following week.

have declared that there is a 100% chance that the U.S. economy has entered a recession. One indicator of change is claims for unemployment insurance. As of April 11, 16 million American workers were collecting unemployment insurance with another 4 million filing claims the following week.

Connecticut's economy has also been affected by the health crisis and the shutdowns and has seen a large increase in unemployment claims and will clearly suffer a recession along with the nation. What we don't know (what no one knows) is how long it will last. Therefore, we are presenting below our previously-completed short term projections for employment in the 2nd quarter of 2021. This represents a "best case" scenario - that while severe, the recession will be short and the national and Connecticut economies will bounce back early next year so that by next summer we'll be back on track. We will then discuss the risks to this outlook which are, unfortunately, all on the downside.

CONNECTICUT EMPLOYMENT PROJECTIONS 2019-2021

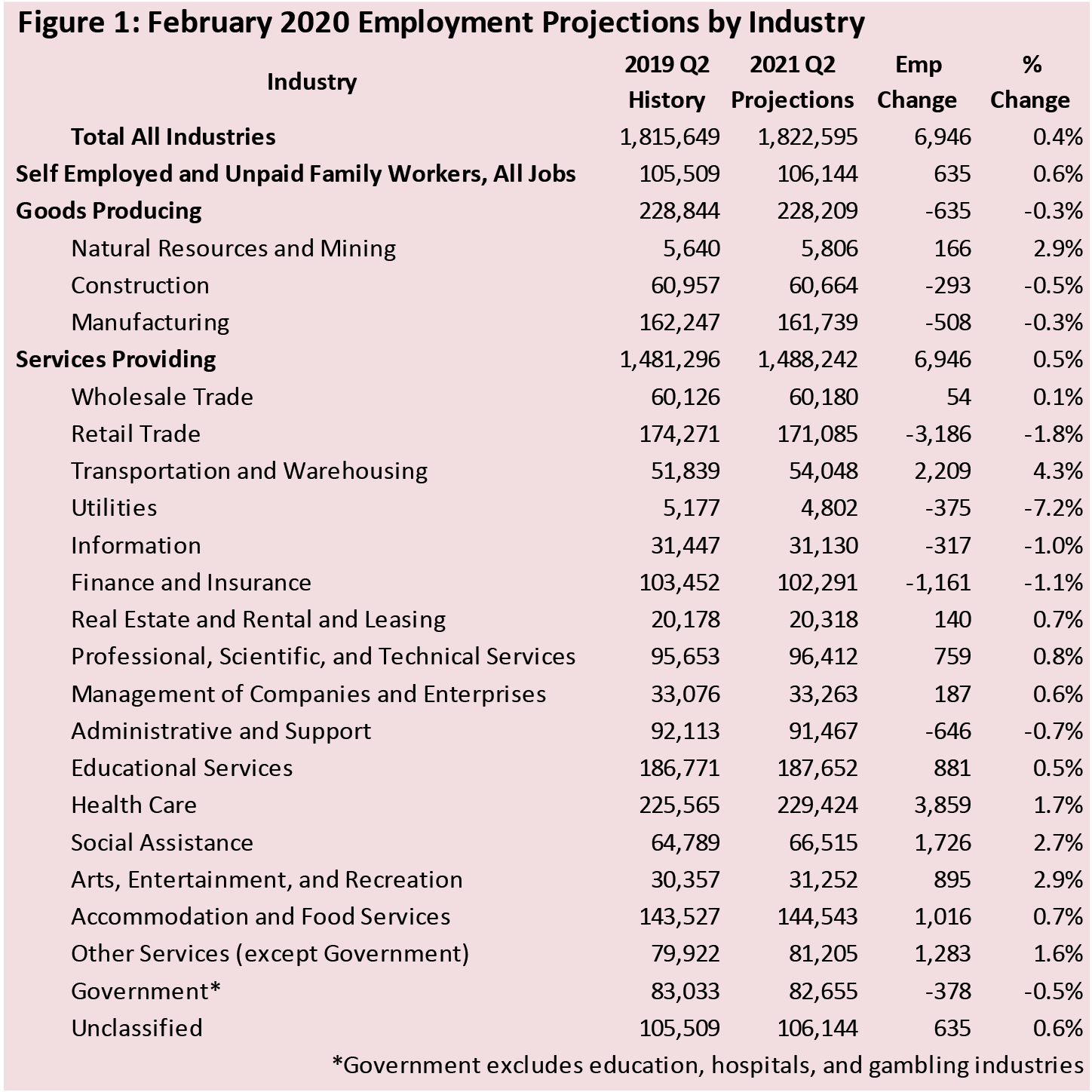

In February 2020, the Connecticut Department of Labor's Office of Research projected that Connecticut's overall employment increase by 0.4% from 2019Q2 to 2021Q2. Employment was projected to increase in Connecticut from 1,815,649 to 1,822,595 with Health Care, Transportation & Warehousing, and Social Assistance adding the most jobs.

The projected two year employment growth of 6,950 jobs is comparable to many northeast states. Almost every other New England state had projected growth of 1.5% or less. Massachusetts' 2.3% projected two-year growth differentiates it from the rest of the region and is driven in large part by its Boston metropolitan area. Additionally, neighboring New York projected 2.0% growth through 2021.

Projections by Industry

The sectors driving overall growth in Connecticut include the industries mentioned above as well as Other Services and Accommodations & Food Services. In total, these sectors were projected to add over 10,000 jobs through 2021Q2. Declining industries we expected to dampen overall growth include sizable declines in Retail Trade of over 3,000 and additional smaller declines in Finance & Insurance, Administrative & Support, Manufacturing, Government, Utilities, Information and Construction. In total we projected 12 out of 20 industries to add jobs through 2021Q2.

More than three quarters of Health Care growth is in Ambulatory Health Care which is projected to grow by 3.1%, roughly twice the rate of Health Care overall. The other two components of Health Care, Hospitals and Nursing & Residential Care Facilities are projected to grow by 0.7% and 0.6%, respectively. These two industries have experienced relatively flat employment over the past five years, while Ambulatory care is up 7.8% from 2014Q2 to 2019Q2.

Nearly two-thirds of the projected growth in the Transportation & Warehousing sector is in Couriers & Messengers and Warehousing & Storage. The growth of these two industries is the result of increased consumer demand for online shopping. Since 2014, Couriers and Messengers (which includes package delivery services) employment is up 33% and Warehousing and Storage employment is up 38%.

The Social Assistance sector provides a wide variety of services directly to clients, including Individual & Family Services, Vocational Rehabilitation, Child Day Care, and Community Food & Housing. Our projected two year growth of 2.7% is driven by increases in Individual and Family Services, which account for 67% of Social Assistance growth.

Our projected two year growth of 2.7% is driven by increases in Individual and Family Services, which account for 67% of Social Assistance growth.

Eight industries are projected to decrease through 2021Q2, with the largest losses occurring in Retail Trade and Finance & Insurance. These two industries are projected to decline by 1.8% and 1.1%, respectively, and both represent long term employment trends. Retail has been declining since late 2015 and fell by 4.5% from 2017Q2-2019Q2. Most of that decline occurred in Food & Beverage Stores and Clothing & Clothing Accessories Stores, which accounted for half of employment losses in retail overall. Through 2021Q2, our projections indicate that those two industries will account for 46 percent of losses in Retail Trade. Finance & Insurance employment peaked statewide in 2007 and has steadily contracted through 2019, falling 17.4% over that 12 year span. Credit Intermediation & Related Activities (banking) and Insurance Carriers & Related Activities have each fallen by more than 8,000 from 2007-2019 with decreases of 26.6% and 12.2%, respectively. Our projections expect another 1.1% decline through 2021Q2.

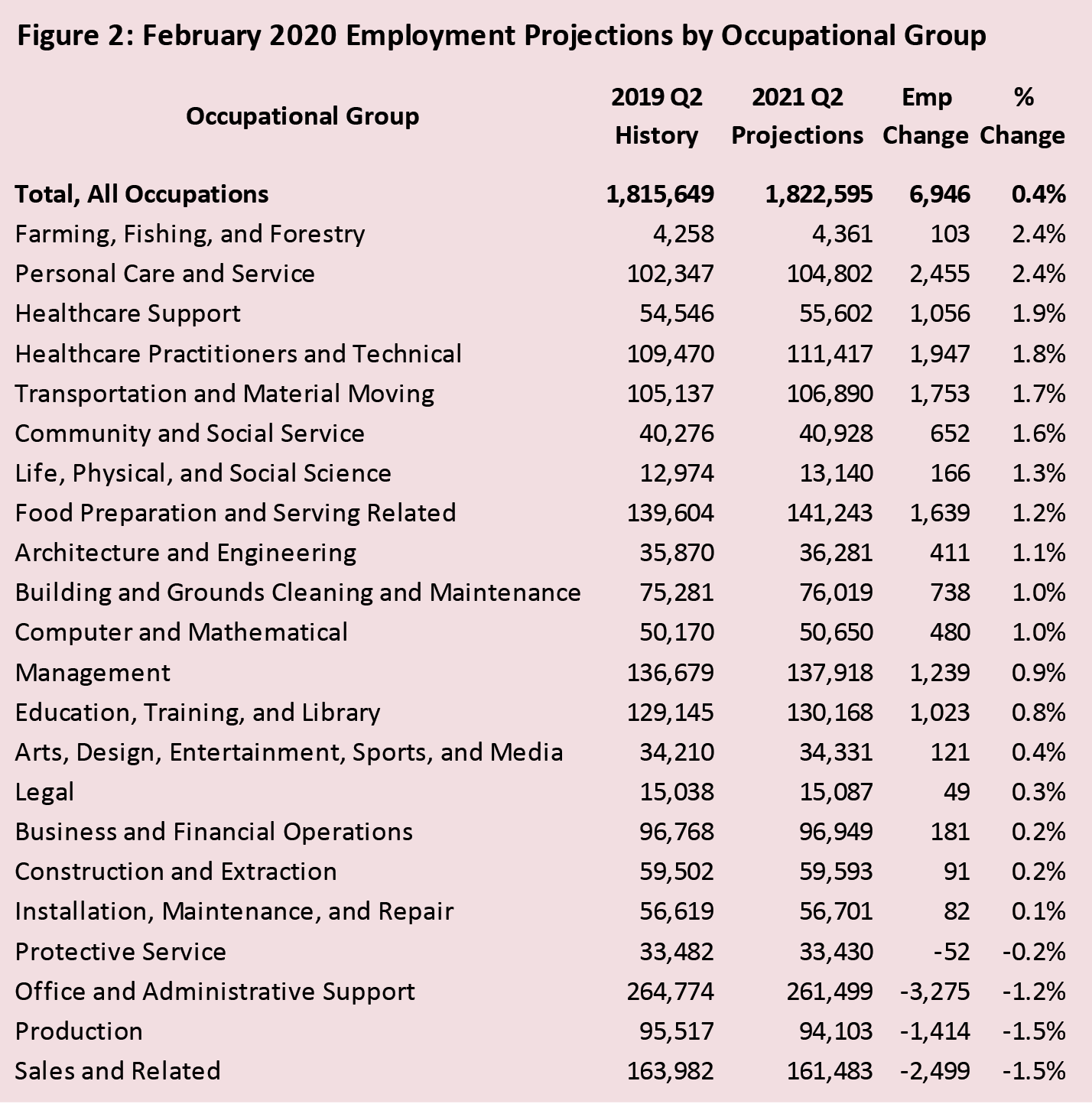

Projections by Occupation

Nearly all (18 out of 22) occupational groups were projected to add jobs by 2021Q2 when we prepared our short term projection in February. The three projected to increase the most through 2021Q2 are Personal Care & Service Occupations, up 2,455 jobs, or 2.4%, Healthcare Practitioners & Technical Occupations, up 1,947 jobs, or 1.8%, and Transportation & Material Moving Occupations, up 1,753 jobs, or 1.7%. These three groups represent 43% of the projected gains in the growing occupational groups driven by increases in industries such as Health Care and Transportation & Warehousing.

The four occupational groups projected to decline through 2021Q2 are Sales & Related, down 1.5%, Production Occupations, down 1.5%, Office & Administrative Support, down 1.2%, and Protective Service Occupations, down 0.2%.

Occupational Projections by Wage

The Department of Labor does not project wages. However, we do collect and publish detailed wage information about every occupation in the economy. In 2019, the median overall Connecticut wage was $47,979. Occupations earning $30,000 a year or less make up 21% of occupational employment and are projected to grow by 1,630 jobs through 2021Q2, or 23.5% of total growth, despite declines in the two largest occupations in this wage tier, Retail Salespersons and Cashiers. On the other hand, Personal Care Aids is expected to add the most jobs for occupations under $30,000/year, up 1,220 jobs, or 3.5%.

In 2019, the median overall Connecticut wage was $47,979. Occupations earning $30,000 a year or less make up 21% of occupational employment and are projected to grow by 1,630 jobs through 2021Q2, or 23.5% of total growth, despite declines in the two largest occupations in this wage tier, Retail Salespersons and Cashiers. On the other hand, Personal Care Aids is expected to add the most jobs for occupations under $30,000/year, up 1,220 jobs, or 3.5%.

Occupations with wages between $30,000 and $60,000 include Medical Assistants, Secretaries & Administrative Assistants, Cooks, and Tractor-Trailer Truck Drivers. Overall occupational growth for this wage tier is expected to be relatively flat, growing by 0.1% over two years. Though flat overall, specific occupations within this wage tier are expected to have large employment. The occupation with the largest projected increase is Laborers & Freight, Stock & Material Movers, up 508 jobs, expected decreases are within the Secretaries & Administrative Assistants and Customer Service Representatives Occupations, down 747 and 612, respectively. This group encompasses 41% of total employment and is expected to amount to 11.7% of overall growth.

A majority of the projected two-year job growth is projected to occur in occupations with a median annual wage of $60,000 or more. The occupations projected to add the most jobs are Registered Nurses (591 jobs, or 1.8%), Applications Software Developers (365 jobs, or 3.1%) and Financial Managers (301 jobs, or 1.9%). Almost 300 specific occupations fall within this category, and most are expected to see employment increases. Of the 78 expected to lose jobs through 2021, Executive Secretaries & Administrative Assistants and First-Line Supervisors of Office & Administrative Support Workers are expected to lose the most, down 353 and 214, respectively. These occupations making $60,000 or more amount to 36.2% of 2019 employment and represent 56.1% of projected change, with 24.9% of overall growth occurring in occupations with median annual wages between $90,000 and $120,000.

RISKS TO THE PROJECTIONS

In the weeks since the Department of Labor completed its short-term projections in February 2020, the world changed dramatically with the outbreak of COVID-19 and the resulting economic contraction. When the projections were prepared showing quite modest growth they were a baseline scenario with, in our judgment, equal chances that growth would be faster or slower than we projected. Now they are a "best case scenario" - for employment to achieve the levels described above strong growth in early 2021 will need to offset the 2020 losses that are now inevitable.

The Impact of COVID-19 on Projections

The health crisis has dramatically changed the national - indeed the global - outlook. The national unemployment rate in February (the month we completed our projections) was 3.5%, and there were 1.7 million workers collecting unemployment benefits in the country with approximately 200,000 workers per week filing initial unemployment claims. At the same time (February) there were more than 7 million job openings so the prospects were good that many of these workers would soon find work. As of April 11, 16 million U.S. workers were collecting unemployment and an additional 4.4 million had filed initial claims the following week. These numbers are unprecedented and no one knows for certain how these events will impact the economic outlook. What follows is a review of what some forecasters are saying.

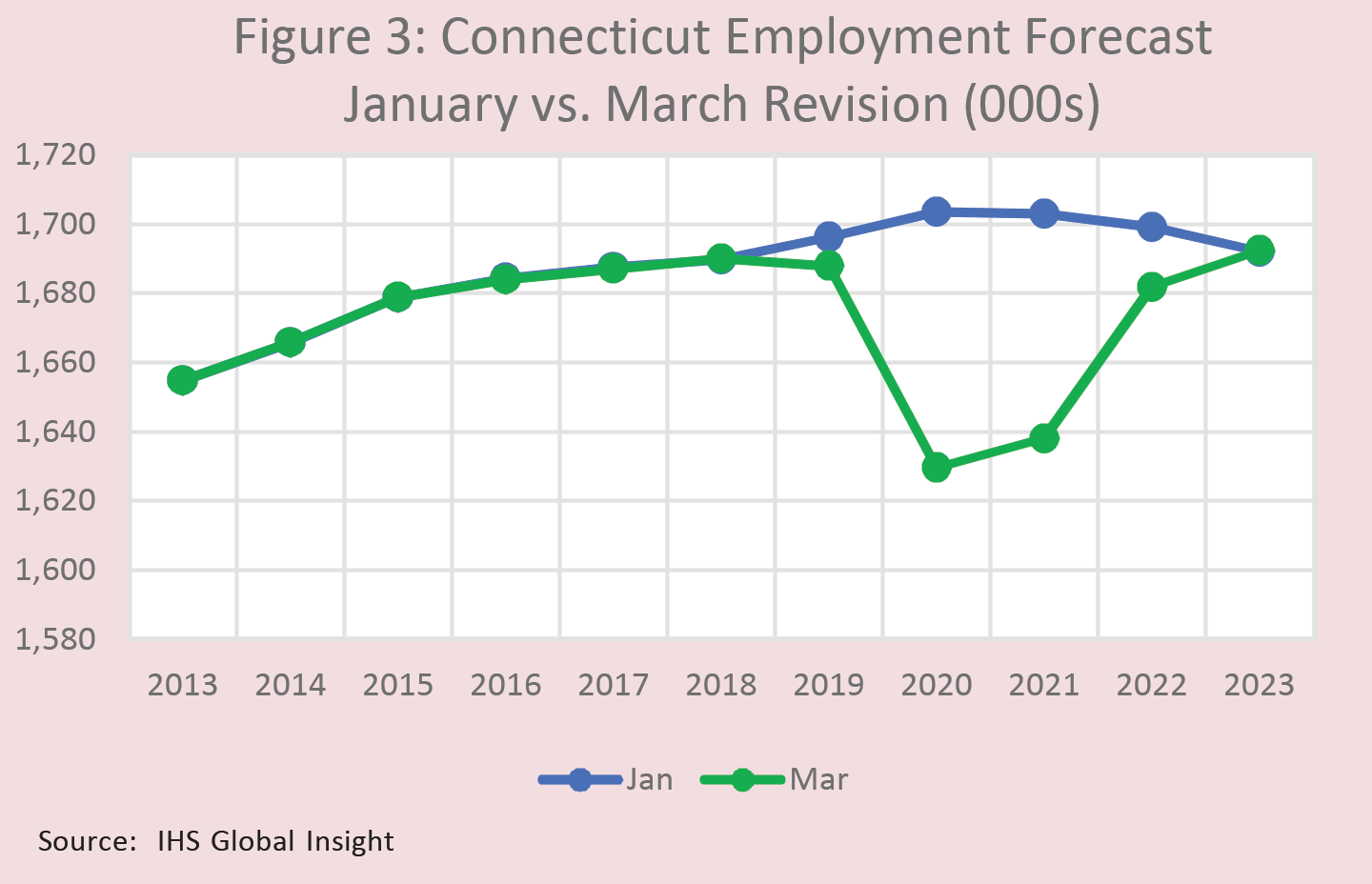

In March, IHS Global Insight revised its forecast of Connecticut employment, reducing their forecast for 2020 by 74,000 jobs with jobs starting to grow slowly in 2021 with employment back to previously-forecast levels by 2023. In revising their forecast the largest decreases (from their previous forecast) were in Retail Trade, Manufacturing and Accommodation and Food Service. On the other hand, they increased their projections for Health Care & Social Assistance, Government, and Transportation and Warehousing, but of course the declines far outweighed the gains.

McKinsey & Co. outlines various COVID-19 recovery scenarios where public health and economic responses were modeled as ineffective, partially effective and high effective interventions. For Connecticut, if the virus is effectively contained, GDP decline of less than 10% during 2020Q2 with full recovery by the end of 2020Q4 is expected. Under a muted recovery scenario GDP is expected to remain below 90% of 2019Q4 levels through the end of 2020. The sectors projected to drive overall declines include Leisure & Hospitality, Retail Trade, Other Services, and Transportation & Utilities. Industries that are categorized by McKinsey as highly vulnerable to the recent slowdown include Accommodation (90% of industry employment vulnerable), Recreation (87%), Personal & Laundry (64%) and Retail (64%). The least likely to incur job losses include Agriculture (6%), Professional Services (11%), Finance (11%), and Public Administration (14%). Additional industry variables identified as at higher risk for impact by COVID-19 include industries with lower wages, lower educational attainment, and a higher share of small businesses with fewer than 99 workers. Corresponding occupations that align with industries heavily impacted by the social distancing slowdown include Food Service, Customer Services & Sales and Office Support, which account for nearly 60% of employment McKinsey determines to be vulnerable.

Industries that are categorized by McKinsey as highly vulnerable to the recent slowdown include Accommodation (90% of industry employment vulnerable), Recreation (87%), Personal & Laundry (64%) and Retail (64%). The least likely to incur job losses include Agriculture (6%), Professional Services (11%), Finance (11%), and Public Administration (14%). Additional industry variables identified as at higher risk for impact by COVID-19 include industries with lower wages, lower educational attainment, and a higher share of small businesses with fewer than 99 workers. Corresponding occupations that align with industries heavily impacted by the social distancing slowdown include Food Service, Customer Services & Sales and Office Support, which account for nearly 60% of employment McKinsey determines to be vulnerable.

The Wall Street Journal's April 2020 economist survey notes that 17 million Americans have sought unemployment insurance benefits in recent weeks and expects another 14.4 million more jobs will be lost in coming months, bringing the US unemployment rate to an estimated 13% by June. The journal also notes that upcoming layoffs have the possibility to include sectors of the economy initially thought to be insulated from the slowdown such as Finance & Insurance and Business Services. A key distinction of the recent slowdown is that a large percentage of unemployment is due to temporary layoffs, whereas during the 2007-2009 recession, far fewer workers were unemployed temporarily. In March 2020, unemployment due to temporary layoffs amounted to 26.5% of unemployment, almost double typical levels. The number of temporary layoffs was 1.8 million in March 2020, up 130.7% from a month before and up 113.4% above March 2019 levels.

The journal also notes that upcoming layoffs have the possibility to include sectors of the economy initially thought to be insulated from the slowdown such as Finance & Insurance and Business Services. A key distinction of the recent slowdown is that a large percentage of unemployment is due to temporary layoffs, whereas during the 2007-2009 recession, far fewer workers were unemployed temporarily. In March 2020, unemployment due to temporary layoffs amounted to 26.5% of unemployment, almost double typical levels. The number of temporary layoffs was 1.8 million in March 2020, up 130.7% from a month before and up 113.4% above March 2019 levels.

In late March, Goldman Sachs published a widely referenced GDP and unemployment forecast for the US economy. It projects that the unemployment rate will increase from 3.5% to 9.0% over coming quarters. It estimates that the decline in overall GDP will likely be concentrated in Labor-intensive industries and is likely to disproportionately affect low-wage occupations prone to temporary layoffs. These expected declines correspond with recent Congressional Budget Office (CBO) projections that US GDP will decline 7.0% during 2020Q2 and that the US unemployment rate to exceed 10%.

These expected declines correspond with recent Congressional Budget Office (CBO) projections that US GDP will decline 7.0% during 2020Q2 and that the US unemployment rate to exceed 10%.

Conclusion

Earlier this year and only a few months ago, expectations of where the US and global economies were heading were drastically different than the present outlook. Since then, a pandemic radically altered daily life and economic functions. The effects on the economy will be severe, but the question is for how long. A prolonged national recession will severely harm Connecticut. On the other hand, a quick rebound could get Connecticut back on track by the middle of next year. When the recovery comes, we expect long term Connecticut trends of growth in Health Care, Transportation Equipment Manufacturing, and Transportation and Warehousing to continue.

At the federal level, the swiftly passed CARES act and other stimulus will inject more liquidity into the economy than occurred during the 2007-2009 recession. Additional policies such as direct payment to taxpayers from the Treasury and additional unemployment insurance payments seek to help forestall the impact of decreased consumer spending. These quick responses make our projections of a return to modest growth in Connecticut by 2021 a possible best case scenario. As the global pandemic unfolds and its impact evolves, economic projections will be revised as new policy is adopted to help mitigate the global contraction.

Data Limitations: The Department of Labor's short-term projections in this report have been carefully prepared to ensure accuracy, but by nature are subject to error. For more detail on the short-term occupational projections, visit: www.projectionscentral.comProjections/ShortTerm

One example among many, Bloomberg Economics

One example among many, Bloomberg Economics

Short-Term Occupational Projections by State are available at https://www.projectionscentral.com/Projections/ShortTerm

Short-Term Occupational Projections by State are available at https://www.projectionscentral.com/Projections/ShortTerm

Bureau of Labor Statistics. Industries at a Glance: Social Assistance: NAICS 624 https://www.bls.gov/iag/tgs/iag624.htm

Bureau of Labor Statistics. Industries at a Glance: Social Assistance: NAICS 624 https://www.bls.gov/iag/tgs/iag624.htm

The Occupational Employment Statistics (OES) https://www1.ctdol.state.ct.us/lmi/wages/default.asp

The Occupational Employment Statistics (OES) https://www1.ctdol.state.ct.us/lmi/wages/default.asp

McKinsey & Company. COVID-19 Economic Response and Recovery in Connecticut. April 7, 2020.

McKinsey & Company. COVID-19 Economic Response and Recovery in Connecticut. April 7, 2020.

Wall Street Journal. A Second Round of Coronavirus Layoffs Has Begun. Few Are Safe April 14, 2020.

Wall Street Journal. A Second Round of Coronavirus Layoffs Has Begun. Few Are Safe April 14, 2020.

Goldman Sachs. US Daily: A Sudden Stop for the US Economy. March 20, 2020.

Goldman Sachs. US Daily: A Sudden Stop for the US Economy. March 20, 2020.

Congressional Budget Office. Updating CBO's Economic Forecast to Account for the Pandemic. April 2, 2020.

Congressional Budget Office. Updating CBO's Economic Forecast to Account for the Pandemic. April 2, 2020.

|