2020 Economic Outlook: Slowing Growth Globally, Technology Changes Abound

By Alissa K. DeJonge, VP of Research, Connecticut Economic Resource Center, Inc.

Global and U.S. Overview

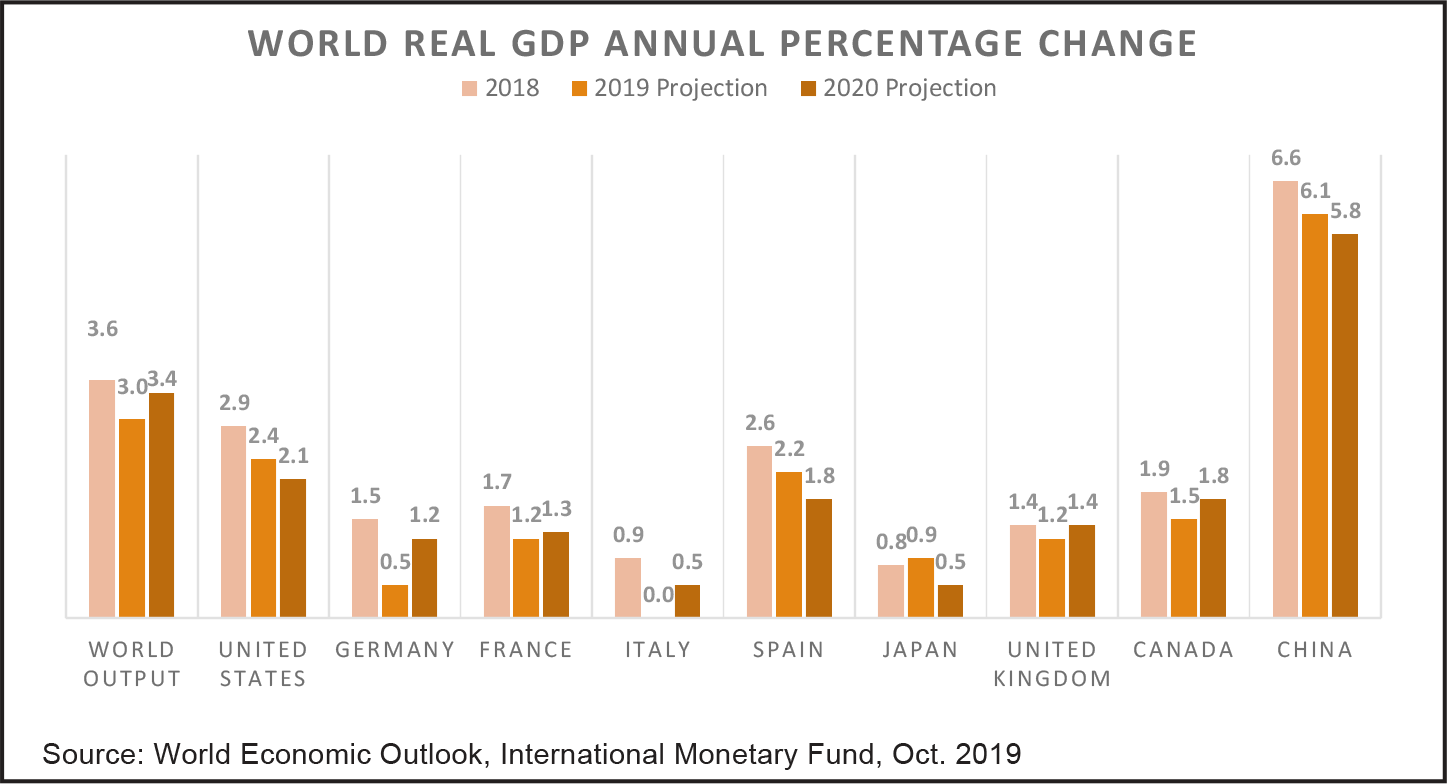

The global economy slowed somewhat in 2019 with growth anticipated to be approximately 3.0 percent – the slowest pace since the global financial crisis. There is expected to be a slight uptick in growth in 2020 to 3.4 percent, yet still below the 2017 level of 3.6 percent.

Several countries will follow the overall global economic trend with slightly higher growth rates in 2020, including Germany, France, Italy, the United Kingdom and Canada. Other countries, such as the United States, Spain, Japan, and China, are expected to continue to soften.

There are several factors contributing to this economic deceleration, including prolonged trade tensions; macroeconomic strains in several emerging markets; and structural factors, such as low productivity growth and aging demographics in advanced economies.

In the United States, part of the slowdown is due to the end of the temporary boost from the 2017 Tax Cuts and Jobs Act, but 2020 growth is also expected to be weaker due to prolonged uncertainty regarding trade and higher tariffs, which has led to decreased investment. These factors are having a particularly heavy impact on manufacturing, while services are faring better.

Connecticut Industry Profile

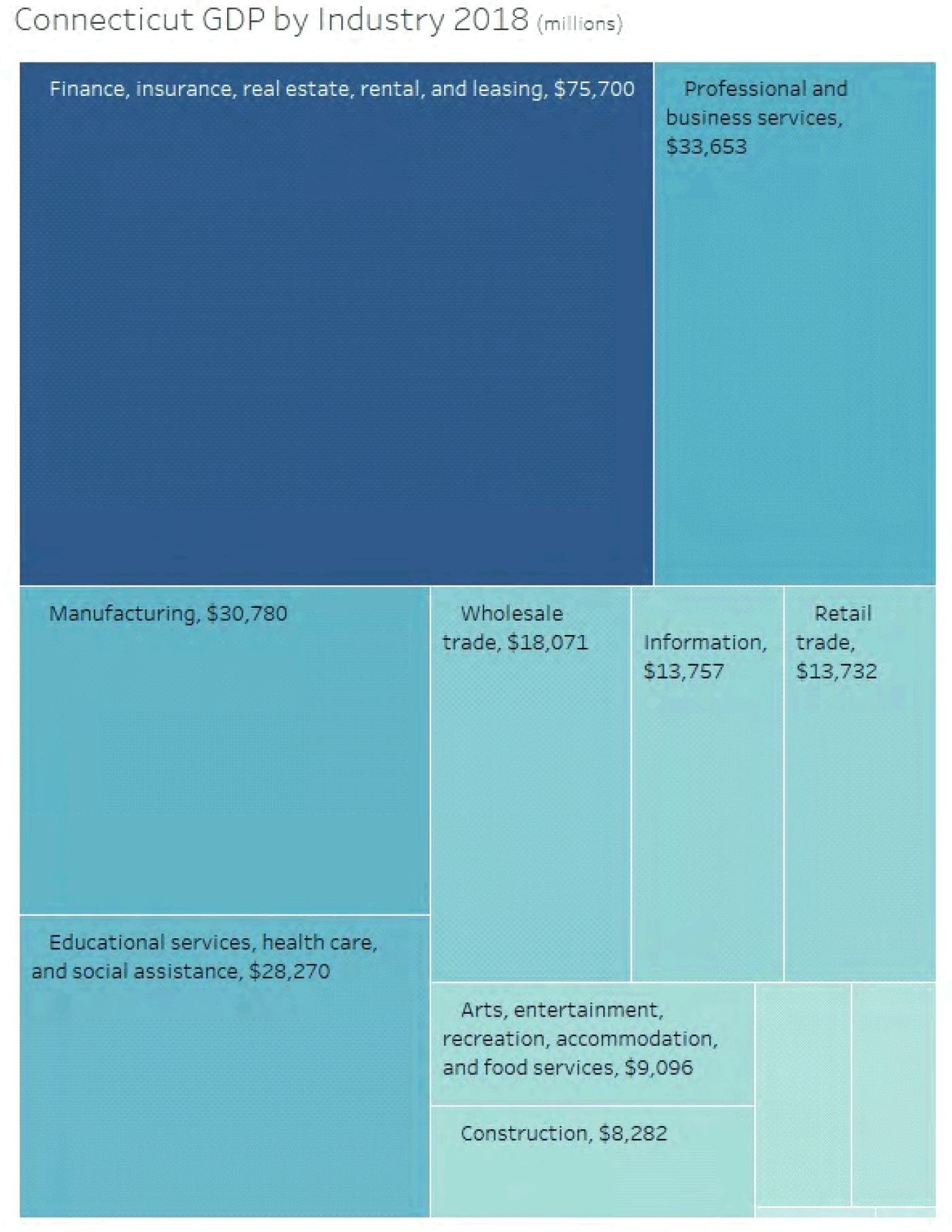

The largest contributor to Connecticut’s gross domestic product (GDP) is the finance, insurance and real estate industry, which is more than twice the size of the second largest industry. Professional and business services; manufacturing; and educational services, healthcare, and social assistance also comprise large portions of Connecticut’s GDP. Connecticut’s real private-sector GDP declined from 2008 to 2011, and has experienced ups and downs but no significant, sustained growth since.

In terms of employment, the largest number of employees in Connecticut are in the educational services, healthcare, and social assistance (327,000 workers); professional and business services (221,000); and retail trade (181,000) sectors. These three sectors and the other seven that comprise the top ten in terms of employment (manufacturing; arts, entertainment, recreation, accommodation, food services; finance and insurance; other services; wholesale trade; construction; and transportation and warehousing) together account for 97 percent of statewide private sector employment.

Anchor Industries in Connecticut

There is a myriad of industries in the state that are innovating and changing. The Connecticut industries listed below represent relatively large groups of employment and are classified as traded industries, or industries that sell or export their goods and services outside the local markets. These industries represent both core strengths in Connecticut, as well as some legacy activities that have the potential to continue to carry the state’s economy into the future.

Advanced Manufacturing:

There are approximately 75,000 advanced manufacturing jobs in Connecticut which created $12 billion of state gross domestic product in 2018. Advanced manufacturing includes activities such as aircraft parts, boat building, fabricated metals (e.g. tools, hardware, wires, coatings, etc.), machinery (e.g. elevators, semiconductors), and computer and electronic products. The sector’s relative employment concentration, or location quotient (LQ), is 2.0, meaning that Connecticut is roughly twice as dense in employment in this sector relative to the United States as a whole. The jobs multiplier is relatively high at 2.6, representing the total number of jobs created when one job is created in this sector. This sector represents a substantial share of the state’s workforce, and positively affects jobs in other industries because of its high multiplier effect. However, this sector is expected to see flat to slightly decreasing employment in Connecticut and the U.S. through 2028 because of productivity improvements through technology advances. However, this industry is particularly important for the state because almost one-quarter of its jobs pay above the state median wage and include benefits but do not require a college degree.

is 2.0, meaning that Connecticut is roughly twice as dense in employment in this sector relative to the United States as a whole. The jobs multiplier is relatively high at 2.6, representing the total number of jobs created when one job is created in this sector. This sector represents a substantial share of the state’s workforce, and positively affects jobs in other industries because of its high multiplier effect. However, this sector is expected to see flat to slightly decreasing employment in Connecticut and the U.S. through 2028 because of productivity improvements through technology advances. However, this industry is particularly important for the state because almost one-quarter of its jobs pay above the state median wage and include benefits but do not require a college degree.

Insurance Services:

Insurance services is another mainstay in Connecticut’s economy, employing approximately 47,000 people and producing $14 billion in state gross domestic product in 2018. Insurance services covers several lines including life, health, medical, and property and casualty. This sector’s relative employment concentration, or LQ, is exceptionally high at 2.9; and there are positive ripple effects in the economy because its jobs multiplier is approximately 4.0. This sector is expected to see some growth at the national scale because of expansions in emerging markets and increased demand for services; yet decrease at the state level, primarily because of technology changes affecting the workforce.

This sector is expected to see some growth at the national scale because of expansions in emerging markets and increased demand for services; yet decrease at the state level, primarily because of technology changes affecting the workforce.

Financial Services:

With approximately 37,000 employees, the financial services sector in Connecticut comprises a substantial share of the state’s total employment. In addition to banks and credit unions, the financial services sector includes securities and financial investments. This sector contributed $9 billion to the state’s gross domestic product in 2018. Its relative employment concentration, or LQ, is also high at 1.6, and its jobs multiplier, or total number of jobs created when one job is created in this sector, is very high at 2.5. This industry is poised to increase in the nation as a whole through 2028, yet there is a more subdued scenario for Connecticut during that time period. Technology changes, as have been seen with all of the other industries, will certainly affect the financial services industry over the next several years. In addition, many advanced economies, particularly in Europe, are likely going to see persistent low growth, low inflation (or deflation), and near zero (or negative) interest rates, which will adversely affect growth and profitability for the banking industry all over the world.

Technology changes, as have been seen with all of the other industries, will certainly affect the financial services industry over the next several years. In addition, many advanced economies, particularly in Europe, are likely going to see persistent low growth, low inflation (or deflation), and near zero (or negative) interest rates, which will adversely affect growth and profitability for the banking industry all over the world.

Software and Data Services:

This sector employed 33,000 people in Connecticut and created $7 billion in state gross domestic product in 2018. Companies in this sector are involved with software publishing, data processing and hosting, computer programming, computer systems design services, and internet publishing and broadcasting. Its LQ, or relative employment concentration, is larger than the national ratio at 1.2, while its jobs multiplier presents a hefty 2.1. This sector is expected to grow 4.3 percent nationally between 2018 and 2028 and grow by almost 1.0 percent in Connecticut during that time period. Cloud computing and artificial intelligence continue to grow in this sector,

Cloud computing and artificial intelligence continue to grow in this sector, and more companies will see the benefits of processing data locally (also known as “edge computing”) to improve response times and save bandwidth.

and more companies will see the benefits of processing data locally (also known as “edge computing”) to improve response times and save bandwidth.

Biosciences:

The biosciences sector employs 17,000 workers and contributed $6 billion in state gross domestic product in 2018. Bioscience activities include medicine and pharmaceutical manufacturing, optical instrument and ophthalmic goods manufacturing, surgical and medical instrument manufacturing, dental equipment manufacturing, and research and development. This sector’s relative employment concentration, or LQ, is 1.3; and there are positive ripple effects in the economy because its jobs multiplier is 2.9. For the nation as a whole, this sector should see job growth of 1.9 percent between 2018 and 2028; while for Connecticut the outlook is growth of 0.8 percent. Approximately 16 percent of its jobs pay above the state median wage and include benefits but do not require a college degree. As digitization continues to assist how companies innovate, there are opportunities for both startups and large companies in Connecticut to take advantage of the changes.

As digitization continues to assist how companies innovate, there are opportunities for both startups and large companies in Connecticut to take advantage of the changes.

Technology Advancements are Disrupters and Opportunities

As noted in the previous section with every anchor industry, technological advances abound and are affecting the economy in numerous ways. For instance, an increasing number of processes are becoming automated – such as self-checkout kiosks in many retail locations and algorithms that personalize marketing messages to potential consumers. Automation will continue to disrupt labor markets in more industries, having workforce implications. However, there can also be an opportunity for Connecticut’s software companies to thrive because of the increasing demand for services.

Another trend that is affecting the entire economy is the ability to process more data more quickly. The way each of us has portable computers at our fingertips in the form of smartphones is one trend, and companies are using more complex data systems to find more efficient ways to promote products. Much data is being generated and data storage has increasing importance. Consumers and the workforce are data-savvy, and companies are using data to stay ahead in terms of understanding their markets. There are opportunities for FinTech and InsurTech companies to expand their markets in Connecticut.

The greater use of advanced materials (such as very light or very strong) in manufacturing processes is an industry trend that has tremendous opportunity for the advanced manufacturing industries in Connecticut. The state has several companies that are part of the advanced manufacturing supply chain and can apply these materials to new innovations and to enhance other processes.

The retail industry continues its transition because of the effect of online shopping. Traditional storefront retailers that remain profitable will adopt a hybrid approach of retaining less inventory on site and enhancing the shopping social experience.

Demographic Trends Affect the Connecticut Economy

Connecticut has had population declines each year since 2014, with the 2018-2019 decrease being 6,233; bringing the 2019 annual population estimate to 3,565,287. As in many other states, Connecticut saw a steady increase of retirement age population, while the school age population (those below 25) and working age population (25-64) each experienced small but steady decreases. What do these demographic shifts mean for Connecticut? The overall population changes affect consumer demand and overall economic potential. In addition, the large generation of Baby Boomers continuing to retire and the next generation of Gen Xers being a smaller age group will further reduce the overall level of economic demand and output. This shift in demand should eventually be mitigated by the larger Millennial generation coming up behind Gen X, but in the mid-term, there could be a dip in the amount of gross domestic product produced in the state.

As in many other states, Connecticut saw a steady increase of retirement age population, while the school age population (those below 25) and working age population (25-64) each experienced small but steady decreases. What do these demographic shifts mean for Connecticut? The overall population changes affect consumer demand and overall economic potential. In addition, the large generation of Baby Boomers continuing to retire and the next generation of Gen Xers being a smaller age group will further reduce the overall level of economic demand and output. This shift in demand should eventually be mitigated by the larger Millennial generation coming up behind Gen X, but in the mid-term, there could be a dip in the amount of gross domestic product produced in the state.

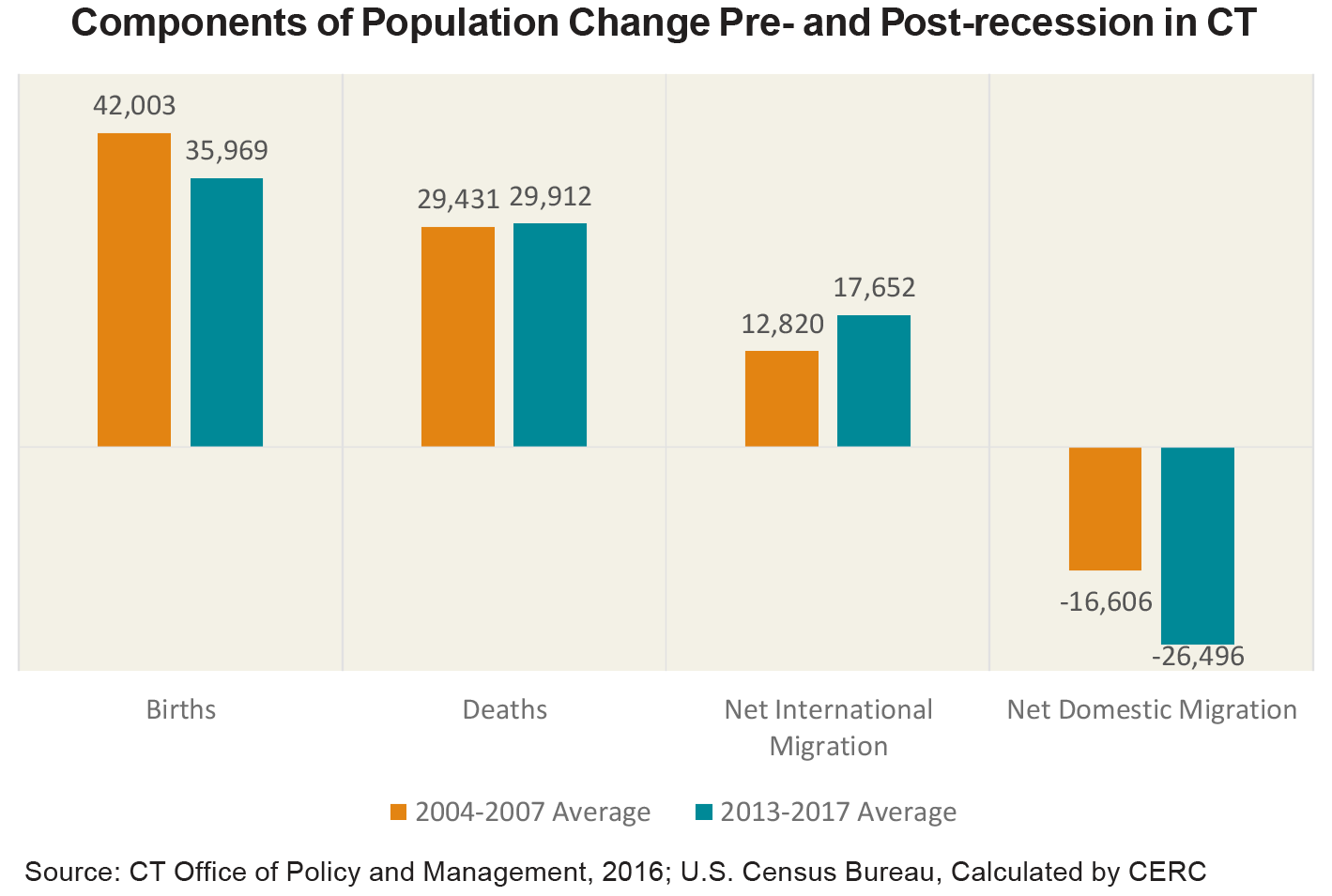

Prior to the last recession in 2008-2010, population in Connecticut was generally increasing because of positive natural changes (there were more births than deaths) and net domestic migration (people leaving for other states) was roughly offset by net international migration (people moving in from other countries). However, after the recession ended, the number of births decreased so the natural change in population has a much slimmer positive margin. And while net domestic migration has seen a larger outflow, net international migration has also increased, but by a smaller amount.

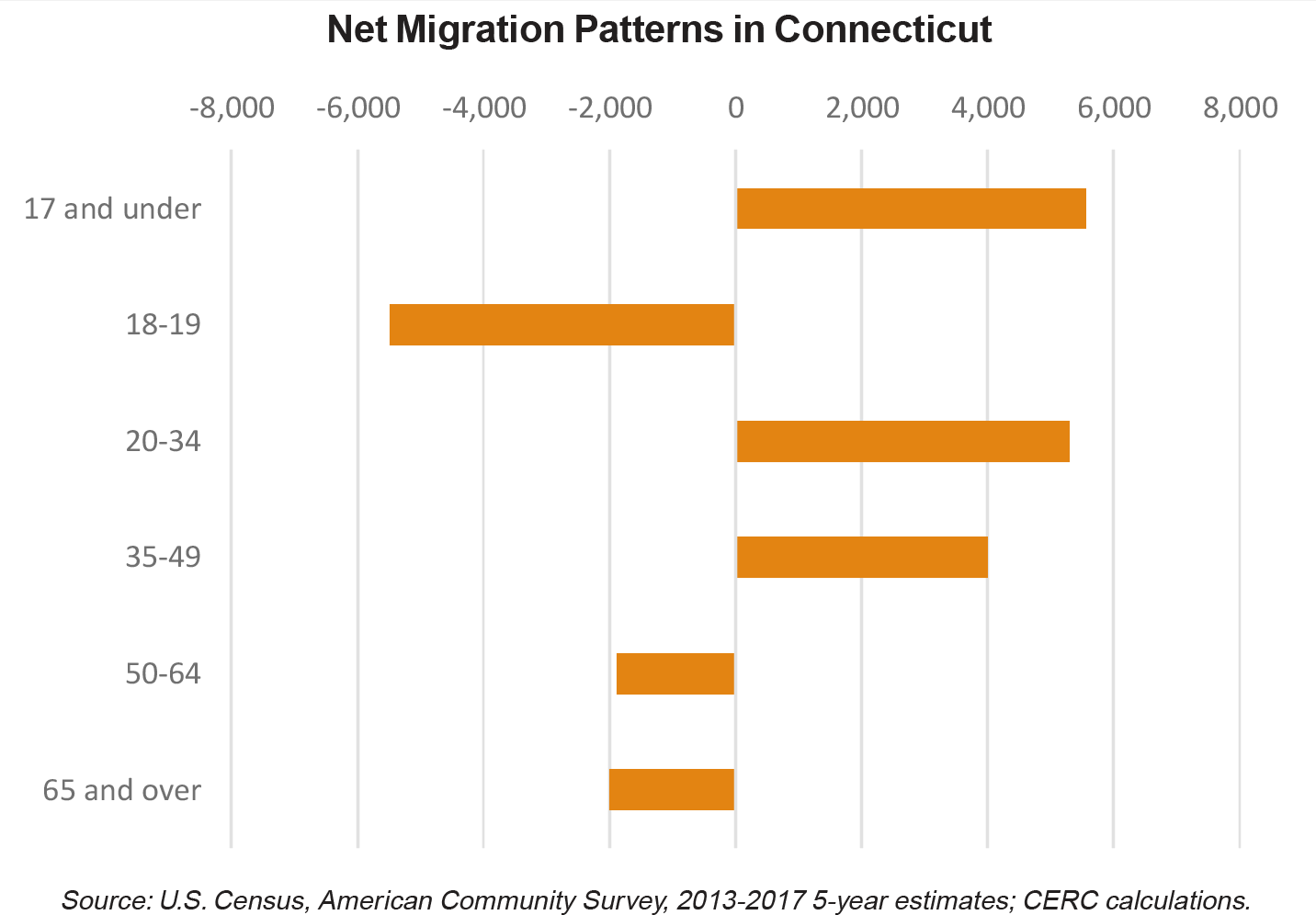

Digging into the concept of migration in a different way, by age, presents a different look into who is moving in and out of the state. Net total migration is the combination of net international and domestic migration. Most recently, more children (age 17 and under) and working-age residents are moving to Connecticut than are leaving. However, more college-age and retirement-age residents are leaving than are moving to Connecticut.

Conclusion

The projection for global economic growth for 2020 is marginally higher than what we saw in 2019, bust still slower than recent years. Several countries are expected to see slower growth because of trade restrictions or geopolitical risks. The U.S. economy will soften in 2020, largely due to trade issues, and demographic trends in Connecticut continue to dampen the state’s economic growth potential. All of these factors will likely place a drag on the state’s economy. However, disruptions from technological advances and other factors will continue to present both challenges and opportunities for companies, particularly in the state’s traded industries that employ substantial shares of workers and bring in dollars from out of state. How well these sectors capitalize on these disruptions and boost their growth will have a large impact on the state’s economy in 2020 and beyond. The state and municipal governments should consider these factors as they consider how to best support the state’s long-term economic growth.

The author would like to thank Rachel Gretencord, CERC’s Financial and Research Analyst, for her research contributions.

World Economic Outlook, International Monetary Fund, Oct. 2019

World Economic Outlook, International Monetary Fund, Oct. 2019

United Nations, World Economic Situation and Prospects: November 2019 Briefing, No. 132

United Nations, World Economic Situation and Prospects: November 2019 Briefing, No. 132

Deloitte, United States Economic Forecast, 3rd Quarter 2019

Deloitte, United States Economic Forecast, 3rd Quarter 2019

U.S. Bureau of Economic Analysis

U.S. Bureau of Economic Analysis

State of Connecticut Department of Labor, Average Annual Employment, 2018

State of Connecticut Department of Labor, Average Annual Employment, 2018

LQ is a measurement of the comparative concentration, or density, of industries relative to the nation; the ratio of a sector’s share of jobs in a given area to that industry’s share of jobs in the U.S. as a whole.

LQ is a measurement of the comparative concentration, or density, of industries relative to the nation; the ratio of a sector’s share of jobs in a given area to that industry’s share of jobs in the U.S. as a whole.

EMSI

EMSI

EMSI

EMSI

https://www.pwc.com/us/en/health-industries/health-research-institute/assets/pdf/hri-behind-the-numbers-2019.pdf

https://www.pwc.com/us/en/health-industries/health-research-institute/assets/pdf/hri-behind-the-numbers-2019.pdf

EMSI

EMSI

https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook.html

https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/banking-industry-outlook.html

EMSI

EMSI

https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/technology-industry-outlook.html

https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/technology-industry-outlook.html

https://www.gartner.com/en/webinars/3846163/what-is-edge-computing-and-why-should-you-care-

https://www.gartner.com/en/webinars/3846163/what-is-edge-computing-and-why-should-you-care-

EMSI

EMSI

https://www2.deloitte.com/global/en/pages/life-sciences-and-healthcare/articles/global-life-sciences-sector-outlook.html

https://www2.deloitte.com/global/en/pages/life-sciences-and-healthcare/articles/global-life-sciences-sector-outlook.html

McKinsey Global Institute, US Future of Work in Connecticut, June 2019

McKinsey Global Institute, US Future of Work in Connecticut, June 2019

U.S. Census Bureau, Annual Estimates of the Resident Population, released December 2019

U.S. Census Bureau, Annual Estimates of the Resident Population, released December 2019

U.S. Census, American Community Survey

U.S. Census, American Community Survey

|