Is a Job Shortage Becoming a Labor Shortage?

By Matthew Krzyzek, Economist, DOL

he total count of job openings exceeded the total number of unemployed workers in the U.S. for the first time on record. 1 As of September 2018 there were more than seven million job openings compared to six million unemployed. While there is no equivalent state level statistic for job openings, there is evidence that Connecticut is experiencing a similar trend with a falling unemployment rate and a large number of job postings. Further examination of the Job Openings and Labor Turnover Survey (JOLTS) coupled with additional data sources such as the jobs postings available from Help Wanted Online (HWOL) can contextualize the labor market and explain how the Connecticut economy is doing.

he total count of job openings exceeded the total number of unemployed workers in the U.S. for the first time on record. 1 As of September 2018 there were more than seven million job openings compared to six million unemployed. While there is no equivalent state level statistic for job openings, there is evidence that Connecticut is experiencing a similar trend with a falling unemployment rate and a large number of job postings. Further examination of the Job Openings and Labor Turnover Survey (JOLTS) coupled with additional data sources such as the jobs postings available from Help Wanted Online (HWOL) can contextualize the labor market and explain how the Connecticut economy is doing.

UNITED STATES

Since early 2004, the Bureau of Labor Statistics (BLS) has published JOLTS to serve as a demand-side indicator of labor shortages at the national level. 2 These data are updated monthly and include information on job openings, hires, and separations down to two-digit industry levels and serve as a useful leading indicator of where employment growth is likely to occur.

What industries are experiencing vacancies?

Education and Health Services, Trade Transportation and Utilities, and Professional and Business Services had the most U.S. openings, accounting for a combined 54.2% of total openings while accounting for 48.6% of total U.S. employment.

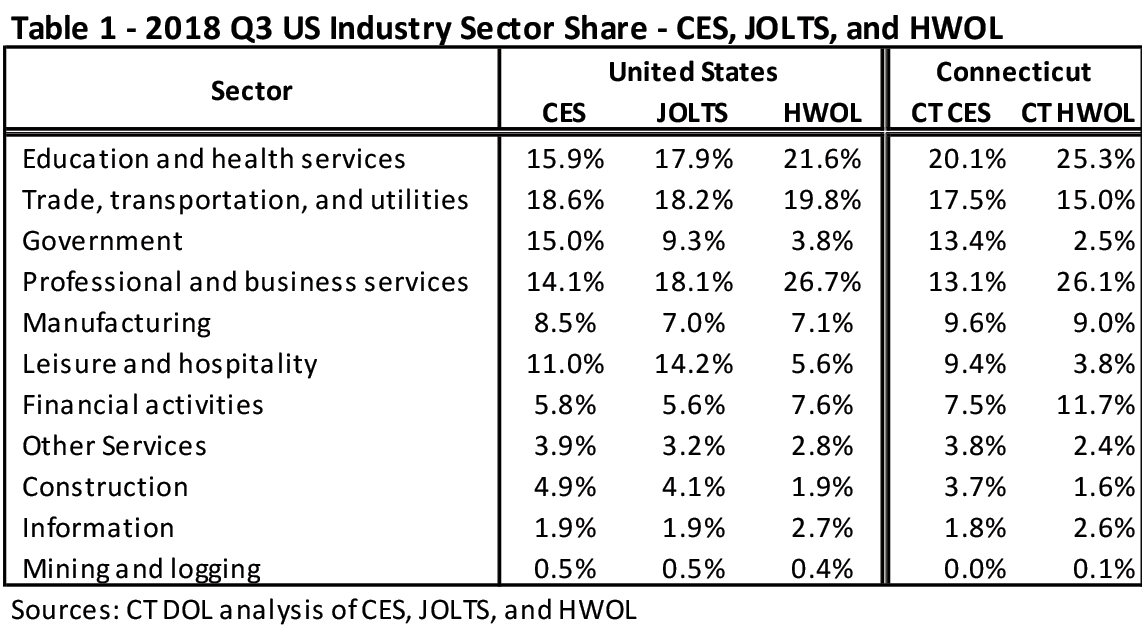

Table 1 includes job vacancy and employment share by sector for the third quarter of 2018. The table also includes Industry-classified HWOL job postings to illustrate how that data series aligns with measures of job vacancies. In total, 68.1% of industry-classified job postings during the third quarter were in those three aforementioned sectors, significantly above JOLTS and Current Employment Statistics (CES) employment shares. The higher concentration of HWOL job postings to those three sectors is due to a combination of seasonality and attributes of the data series.

Professional and Business Services had significantly more postings (12.6 percentage points) than its employment share. Overrepresentation of that sector highlights an attribute of the HWOL data series. Most of that percentage point difference is due to the Employment Services industry, which alone accounts for 33.7% of Professional and Business Services sector job ads. That industry includes temporary help placement agencies and recruitment services which by nature post a lot of job ads. 3

Education and Health Services job postings’ share was 5.7 percentage points above corresponding industry employment. This reflects the seasonality of Educational Services employment as postings peak during the summer months before the start of the school year. On the Health Services side of that sector, postings for Registered Nurses is always a top occupational posting and makes up a large portion of Health Care and Social Assistance industry postings.

Trade, Transportation, and Utilities was the third largest job posting sector at 19.8%, but was only 1.2 points above sector employment share of 18.6%. The three most common occupational job postings in this industry sector are Retail Salespersons, Supervisors of Retail Sales Workers, and Heavy and Tractor-Trailer Truck Drivers. Retail employment has high turnover which explains its large contribution to sector postings even as that sector lags the overall economy. Truck driving likewise is experiencing a worker shortage amid low unemployment and increased freight volumes. 4

This comparison of industry employment to JOLTS survey and HWOL data illustrates how various data sources can be utilized to help understand the labor market during a period of record low unemployment. JOLTS and HWOL share their three largest industry sectors, but they are proportionally different due to the described methodological and economic factors. Similar analysis of state level employment and available HWOL data both echoes some of these U.S. level trends while illustrating other unique characteristics of Connecticut’s economy.

CONNECTICUT

Connecticut’s employment and postings profiles are similar to those of the U.S. with a few significant differences. For example, the share of employment and postings in manufacturing is higher than in the U.S. overall.

Table 1 also shows statewide third quarter employment and HWOL job ads by industry sector in Connecticut. The state has the same three largest private industry sectors as the U.S., but Government employment is the third highest by a slight margin over Professional and Business Services. The three largest private sector industries in Connecticut amounted to 66.3% share of job ads, slightly less than the 68.1% share of those industries at the U.S. level.

Connecticut Similarities

Many of the same economic factors that contribute to job posting counts at the U.S. level also occur in the state. Table 2 shows that the same five occupations have the most job postings in both the U.S. and Connecticut, though the rank order differs slightly. The factors that contribute to high levels of postings for Nurses, Truck Drivers, and Retail Workers noted at the national level are also unfolding in the state. Another top occupation in both the U.S. and Connecticut, Applications Software Developers, is posted by companies from a wide variety of service industries. Seventy percent of U.S. postings are from companies classified in Professional, Scientific, & Technical Services, Administrative Support & Waste Management, Finance & Insurance and Information. The companies with the most job ads include well-known tech firms and financial institutions.

Connecticut Differences

Some unique characteristics of job postings data for Connecticut are a reflection of key industries in the state. Engineering-related job ads make up a much larger share of statewide postings, and job ads for Applications Software Developers are more likely be posted by Connecticut insurance companies and manufacturers. That occupation is projected to grow by 29.3% through 2026. 5 Employers with the most job postings in the state typically include major universities, manufacturers and hospital networks, while the largest U.S. employers includes large retailers, the military, and other organizations with a broad nationwide presence.

Conclusion

With national unemployment at record lows and job vacancies at record highs, employers and workers alike are experiencing labor market conditions far different than those of recent memory. Though not a perfect substitute for unavailable state-level JOLTS data, the HWOL data series provides a useful tool to examine how labor market scarcity is impacting key industries in Connecticut. While the state’s job growth has been slower than the nation’s since the end of the great recession, its employment to population ratio is higher. Job growth requires both businesses ready to hire and workers ready to fill those positions. Connecticut and the nation are looking for both.

Note:

HWOL assigns a SOC occupational code to every job posting, but many postings do not have an assigned industry classification. Monthly data on the HWOL can be found here: https://www1.ctdol.state.ct.us/lmi/HWOL.asp.

HWOL is a measure of de-duplicated job postings and not openings, and as such, certain industries will be better represented than others, high turnover industries will likely have more postings than others, and some industries rely less on online job boards to hire workers, and thus will be underrepresented in the data series.

1 Wall Street Journal.U.S. Job Openings Topped 7 Million for the First Time. October 16, 2018.

2 Bureau of Labor Statistics. JOLTS Overview. https://www.bls.gov/jlt/jltover.htm

3 Office of Management and Budget. North American Industry Classification System. 2017. Page 491.

4 Transport Topics. Truck Driver Shortage Constrains Booming Texas Oil Fields. August 31, 2018. And Wall Street Journal. Trucking Companies are Struggling to Attract Drivers to the Big Rig Life. April 3, 2018.

5 Connecticut Economic Digest.Long Term Industry and Occupational Projections: 2016-2026. September 2018.