The Growing Brewery Industry Employment Trend in Connecticut

By Lincoln S. Dyer, Associate Economist, Department of Labor

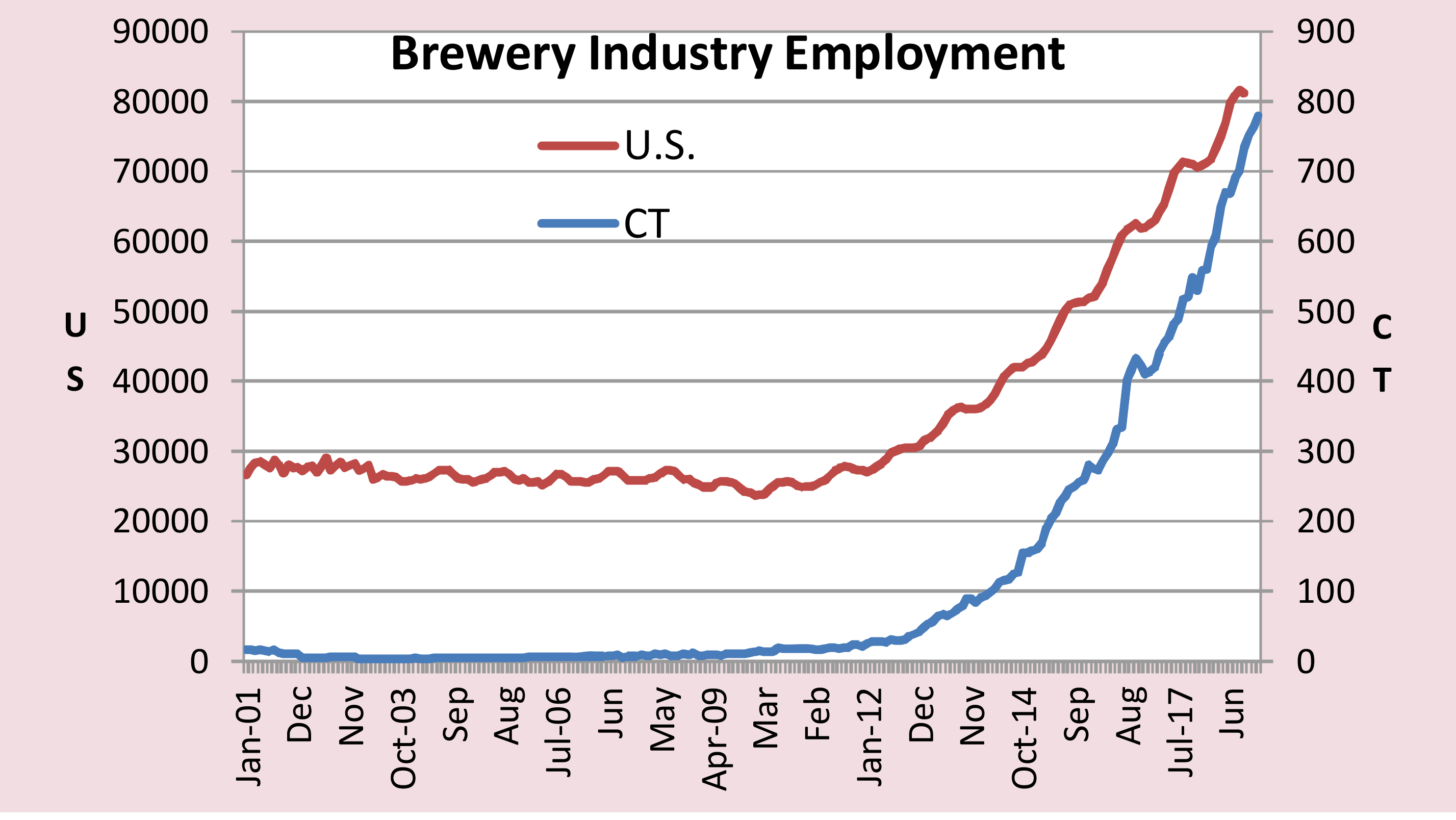

he craft beer industry, consisting of microbreweries, brewpubs, regional craft breweries, and contract brewing companies, has really established its calling in America over the last ten years. Overall total brewery employment in the U.S. (NAICS* code 31212), which also includes the large brand-name breweries, has grown from under 25,000 in the first quarter of 2010 to 81,180 in September 2019.1 This exciting brewery job growth is clearly being led by the craft beer industry portion. In Connecticut, with no large commercial breweries and mainly consisting of the craft beer industry segment, employment has grown from less than 15 in the first quarter of 2010 to close to 800 in December 2019 (780 jobs from 63 establishments). Notice the hockey stick or boomerang-like job growth since coming out the Great Financial Crisis shown in the chart.

he craft beer industry, consisting of microbreweries, brewpubs, regional craft breweries, and contract brewing companies, has really established its calling in America over the last ten years. Overall total brewery employment in the U.S. (NAICS* code 31212), which also includes the large brand-name breweries, has grown from under 25,000 in the first quarter of 2010 to 81,180 in September 2019.1 This exciting brewery job growth is clearly being led by the craft beer industry portion. In Connecticut, with no large commercial breweries and mainly consisting of the craft beer industry segment, employment has grown from less than 15 in the first quarter of 2010 to close to 800 in December 2019 (780 jobs from 63 establishments). Notice the hockey stick or boomerang-like job growth since coming out the Great Financial Crisis shown in the chart.

Sell your own

This core Connecticut brewery industry employment, classified under the nondurable manufacturing sector, may appear small in a 1.7-1.8 million-job state. However, the employment growth since state law changes in 2012 has been impressive. Those law changes allowed craft brewers to have onsite taprooms and take advantage of the growing national employment trend.2 This has been helpful in a mature, slower growing state like Connecticut. Still, not all of the craft beer market segment employment is distinctly classified in NAICS 31212 (Breweries), because some of these microbreweries have associated brewpubs that serve extensive food which often gets them coded in NAICS 722 (Food Services and Drinking places). While they are still making beer on location, the food service aspect just makes up more than 50% of their business, giving them the separate restaurant classification but still craft beer associated.

One stimulating attribute of the craft beer industry is the nurturing, cross-breeding, and synergies among various activities and other industries. Food trucks, neighboring restaurants (bring your own food), yoga, art sales, fund raising, hobbies, farmer’s markets, showers, and everything and anything in between are happenings that can go along with a freshly-brewed cold beer. Craft brewing can be a catalyst for leisure activity, making this market segment impact bigger than it may appear. Combinations seem infinite and locations could be more geographically situated.

The recent rapid pace of brewery industry growth off a low base of employment in Connecticut has some questioning the sustainability of this growth in terms of craft brew market oversaturation – too many breweries or too much beer.3 This is plausible, considering that not everybody likes beer. However, in terms of employment, Connecticut seems to be somewhat underserved in this industry compared to the current national brewery employment distribution percentage.

Beer Here!

The Location Quotient (LQ) is one straightforward way of measuring how concentrated a certain industry metric is in a region or state as compared to the nation. In terms of this industry employment LQ for breweries for all states for the 3rd quarter of 2018, Connecticut measures 0.79. A state having a level of brewery employment distribution similar to the U.S. national distribution would have a LQ equal to one (1.0, 1=1).

Looking at this LQ employment measure only, Connecticut is about 80% of the way toward matching the U.S. employment distribution and concentration, not close to employment saturation yet. Colorado (at 4.08 LQ, 6,049 jobs - 9/18) leads the nation in brewery employment concentration (four times as much!), but that is likely helped by having a large brewer there (Coors). Still, nearby states Vermont (3.54), Maine (2.14), New Hampshire (2.02), and Massachusetts (1.13, Sam Adams is there) have higher brewery job concentration. New York is similar (0.78) but Rhode Island is lower (0.62).

Average weekly wages paid for primary brewery employment in the Nutmeg state seem low at $573 (3Q 2018). This may be due in part to the shortened part-time hours many of the smaller brewery taprooms are open in our state. A good number of the smaller breweries with tasting rooms seem to be open only from Thursday to Sunday and close by 10 p.m. Many Connecticut local microbreweries seem to be a part-time entrepreneurial activity for most and can include many partners. U.S. weekly wages at breweries averaged $834 over this same time period. This gives Connecticut a quarterly LQ of just 0.46 for brewery industry wages. There is definitely room for higher pay, it probably would need to come from working longer hours with additional days of operation from the many smaller taprooms and include more beer volume to be allowed out the door.

It is conceivable an adult recreational cannabis law change could result in a similar employment ramp-up like the 2012 craft beer law change that catalyzed recent job growth for craft breweries, perhaps resulting in even more job gains off a zero base. This could provide a potential new growing and taxable industry for Connecticut’s mature economy (only seven recreational states so far) and an alternative for the adults who don’t drink alcohol. This industry has many cross-pollinating attributes as well, linking to other industries, such as bakers, farmers, greenhouses, laboratories, and wellness centers. Both of these trending industries seem to attract a younger demographic.

1 Full 4th quarter industry data for all states and nation will be available on bls.gov after June 5th 2 Hartford Business.com. Hooray Beer! CT craft brewers realize national trend. August 4, 2014. http://www.hartfordbusiness.com/article/20140804/PRINTEDITION/308019961 3 Hartford Business.com. Cooper, Joe. CT beer brewers wonder if growing sector is becoming over saturated. October 29, 2018. http://www.hartfordbusiness.com/article/20181029/PRINTEDITION/310259939