2019 Economic Outlook: Steady Growth Globally, Slower Growth Yet Positive Potential for Connecticut

By Alissa K. DeJonge, VP of Research, Connecticut Economic Resource Center, Inc.

Global and U.S. Overview

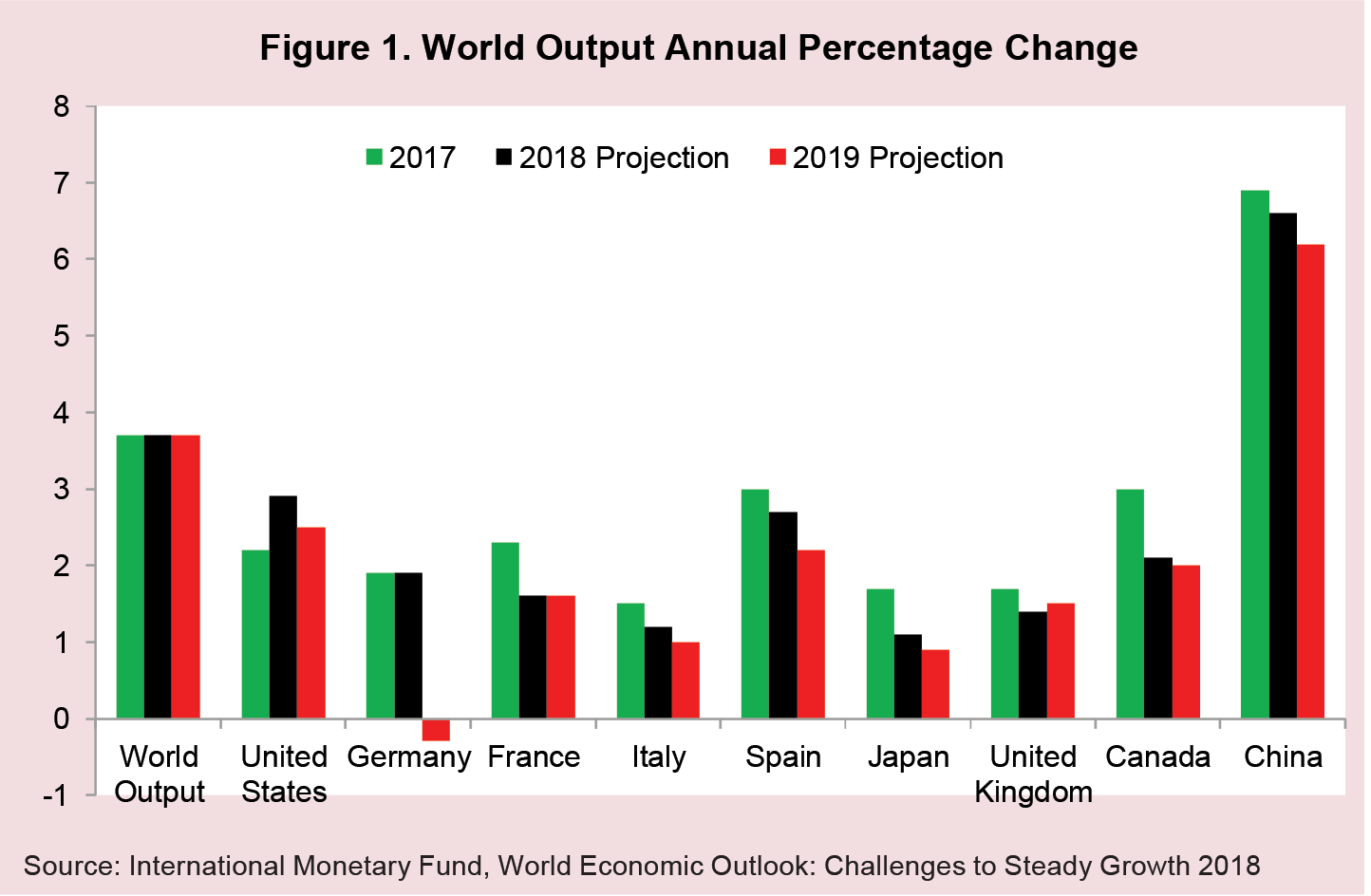

The global economy in 2019 should continue its track of steady growth since mid-2016. However, the growth has peaked in some major economies, and risks of slower growth have risen. The World Bank projects a 3.7 percent growth rate in world output for this year, which is 0.2 percentage points lower than previously forecasted. (Figure 1).

Trends to note include:

- U.S.: Economic growth is still strong due to the effects of federal tax cuts, but 2019 growth is expected to be weaker as a result of uncertain trade environments, including the tariff negotiation with China.

- Europe: Affected by the ongoing Brexit negotiations, growth projections for the Euro area and the UK are also adjusted downward.

- Emerging Markets: Anticipated higher oil prices raise the growth prospects of many energy- exporting countries, but Argentina, Brazil, Iran and Turkey are affected by downward pressures such as geopolitical uncertainty or worsening financial conditions.

- Asia: China and several Asian economies are expected to experience weaker growth in 2019 under the shadow of the recent trade disputes.

The growth in China is likely to remain strong but will decline gradually. The prospects in many emerging markets and developing economies remain less than ideal as a result of the threat of regional conflicts. Policy uncertainty—including rising trade barriers—is a main driver of weaker growth prospects. 1

Notable Industry Trends

In the United States, a number of larger industry trends will affect how businesses anticipate consumer demand, profitability and competitiveness. Some of these critical trends involve the insurance, healthcare, grocery retail, aerospace/defense and energy sectors, which are also important in Connecticut’s economy.

Insurance

The Insurance industry is undergoing a transformation with the incorporation of technology. InsurTech companies are propelling the industry forward, innovating to create a more personalized customer experience and streamline the back office. On the front end, insurers are reaching out to younger audiences with intuitive customer interfaces and customization. For administrative, back-end segments of the industry, technology is being used to streamline claims adjustments, assess risk, and create customized pricing. Workers who have expertise in data analytics are in demand in this industry, while the use of artificial intelligence is projected to replace the need for some workers who handle claims.2

Insurance in Connecticut: In November 2018, the National League of Cities and Schmidt Futures acknowledged Hartford as “the country’s premier destination for insurance technology.” 3 Now that CVS has committed to keeping Aetna in Hartford, and other large corporations are looking to InsurTech startup companies for new ideas, Connecticut is seeing renewed energy for its historic industry giant, which employs more than 60,000 people in the state.

Healthcare

Employers and health plans are trying to offer more convenient options to their consumers by providing more ways to receive care. Telehealth, the ability to talk with a healthcare provider at any time, is starting to take hold in the industry. Another trend involves mergers among providers, so choices are becoming concentrated. There is also consolidation among doctor groups, practicing as employees of hospitals or health systems, which tends to increase prices. Some other trends that are improving patient quality of life, yet driving up costs in the short term, are advances in medical technology and innovation, along with the introduction of specialty drugs and gene therapies. Analysts expect in the short-term for healthcare prices to increase, although improvements will also be seen in patient outcomes and overall health. 4 The CVS-Aetna deal is also an indicator of the restructuring of the healthcare delivery system in the state and across the country.

Healthcare in Connecticut: With a median resident age of 40.8 years in 2017, and ranking 6th oldest in the country, 5 Connecticut is seeing the effects of aging baby boomers at a higher level than many other states. As this generation of people retires, they will typically have more health needs, and this will drive up healthcare costs. More than 90,000 workers were employed in ambulatory health care services, with another almost 59,000 working in hospitals in 2017. 6

Grocery Stores

A little over one year ago, the online giant Amazon purchased the Whole Foods grocery store chain. In reaction, incumbent stores such as Walmart, Costco and Target have increased online delivery and in-store pickup and have kept prices low despite high costs. While the entry of Amazon into the grocery business has the incumbents fighting for online grocery sales, customers’ preferences to purchase meat and produce from physical stores has kept the majority shopping in the same stores. It appears that the Whole Foods purchase by Amazon is part of a larger strategy that has many components. Still, this industry has been disrupted and the result has been increased technology and a play for customers who want to purchase goods online. 7

Grocery Stores in Connecticut: There were almost 44,000 workers in Connecticut food and beverage stores in 2017, of which grocery stores is a part. 8 Amazon’s presence is growing in Connecticut; currently there is one fulfillment center in Windsor with another scheduled to open in North Haven in mid-2019, and there is one sorting center in Wallingford. 9 There are currently nine Whole Foods markets in Connecticut. 10

Aerospace and Defense

This industry projects strong growth, driven by increasing commercial aircraft production due to passenger travel demand. Also, demand from the federal government reacting to geopolitical risks will boost the number of F-35s, Black Hawk helicopters, submarines and other weapons systems produced. 11

Defense in Connecticut: There are substantial worker increases planned at General Dynamics Electric Boat and United Technologies Corporation, and many other aerospace and defense companies in Connecticut because of the growing demand for their products. For instance, Pratt & Whitney, a maker of jet engines, and part of United Technologies Corporation, is currently working through a backlog of 8,000 next-generation engines. 12

Defense workers are employed in a variety of industries in the state. For example, there were almost 44,000 working in transportation equipment manufacturing in 2017. 13

Energy

The energy sector is seeing changes due to changing consumer demands and prices. After decreasing oil prices through 2018, the new year will likely bring about price hikes for home heating and gasoline. 14 Residents and small businesses are mainly interested in lowering power bills and increasing their energy independence, and are also seeing more choices from power producers. Corporations and universities, like the residential segment, are interested in lowering costs and increasing independence, but can do so at a larger scale with microgrid technology. Installers are seeing tremendous demand for residential solar, and at a larger scale, demand for solar microgrids. Power generation companies are focusing on figuring out how to generate power in different ways and make it dispatchable and from a business model that works. Utility and distribution companies’ main concern is grid reliability and stability. Increased renewables adds to uncertainty on the grid so energy storage may be a way to smooth out renewables at higher penetration levels.

Energy in Connecticut: A growing energy-related industry in Connecticut involves installers of solar and micro grids. Potential energy industries for Connecticut include energy storage to manage generation from increased renewables, and power generation via renewables including offshore wind. In 2017, there were more than 5,300 Connecticut workers in the utilities industry, and solar panel installers were a part of the 40,500 workers in specialty trade construction. 15

Connecticut: Modest Economic Growth With Glimmers of Potential

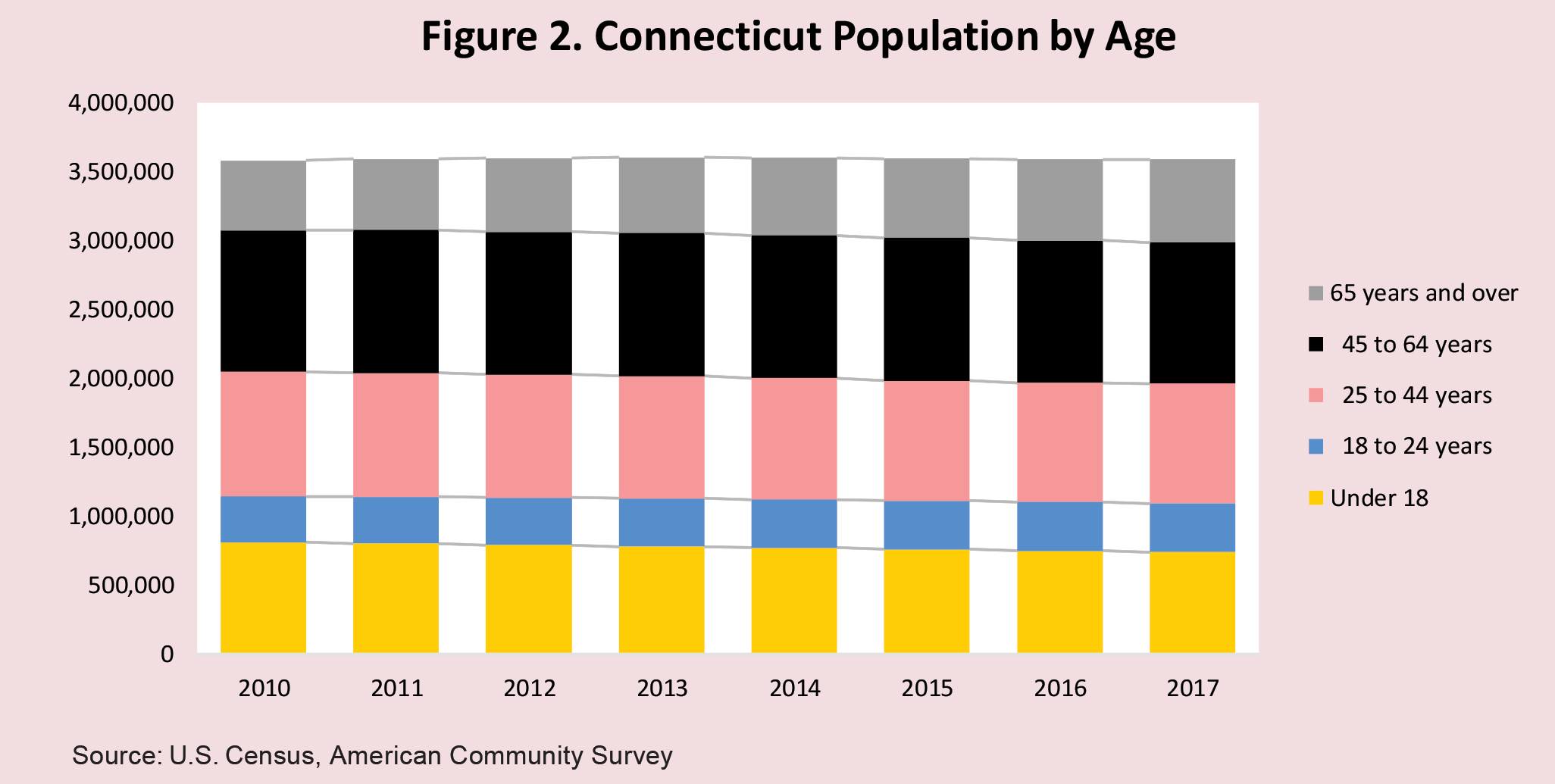

After three years of population declines during the 2014-2016 period, Connecticut saw a very slight increase of 0.01 percent between 2016 to 2017. (Figure 2)

During the period from 2010 to 2017, as in many other states, Connecticut saw a steady increase of retirement age population, while the school age population (those below 25) and working age population (25-64) each experienced a small but steady decrease.16 Consistent with these demographic shifts has also been a substantial decline in the student population attending public schools. What do these demographic shifts mean for Connecticut? The overall population changes affect consumer demand and overall economic potential. In addition, the large generation of baby boomers continues to retire and because the next generation, the Gen Xers, are a smaller age group, this will further reduce the overall level of economic demand and output. This demand should eventually be mitigated by the larger Millennial generation coming up behind Gen X, but in the mid-term, there could be a dip in the amount of GDP produced in the state.

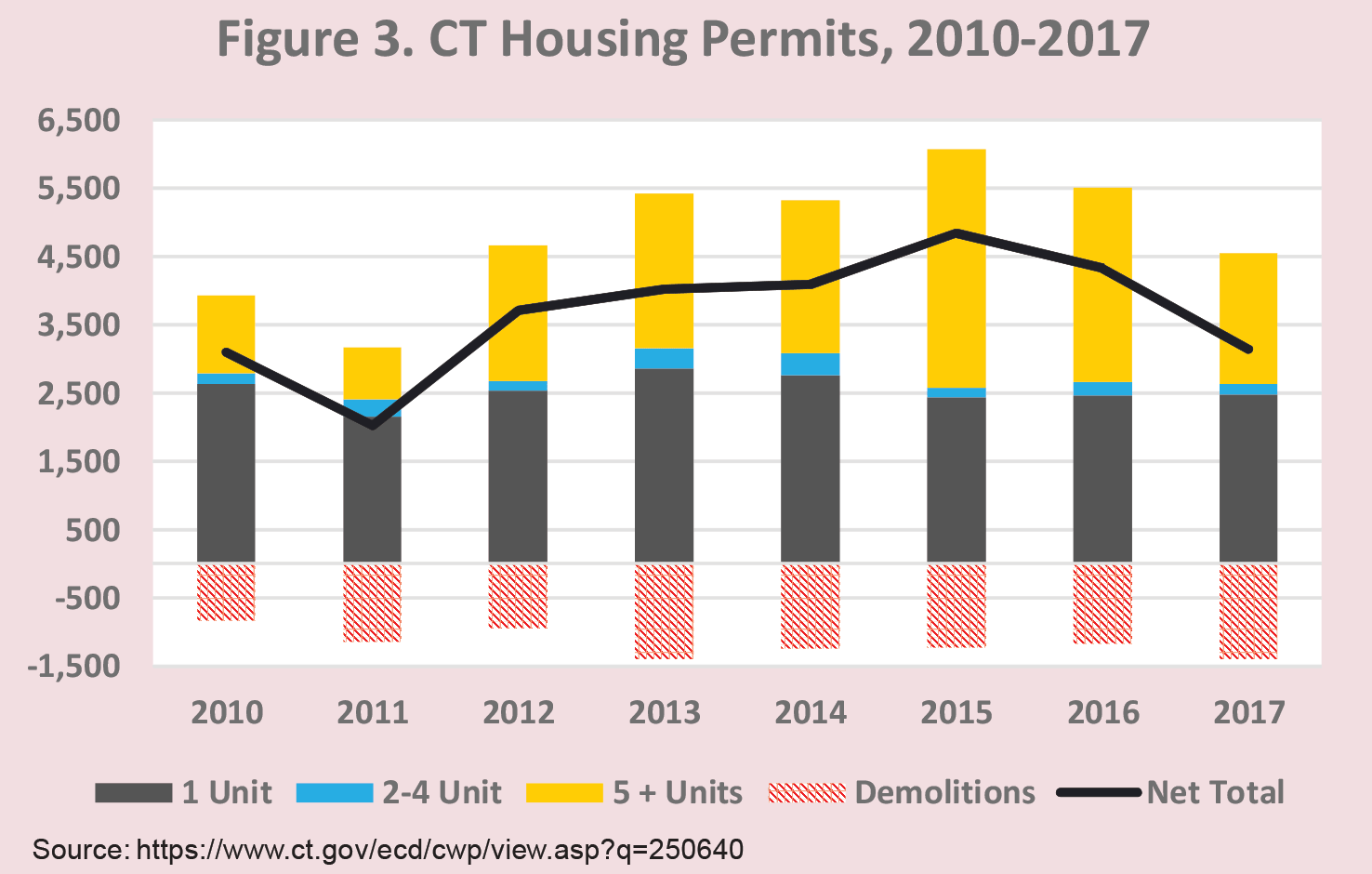

In terms of numbers of new housing permits, 2017 was lower than the previous two years but still higher than the years following the last recession. (Figure 3) While single-family housing permits made up 55 percent of the total in 2017, the share of multi-family (5 plus units including apartments) was 42 percent. This trend of apartment building, seen over the past several years, has been meeting demand from many consumers who either choose to downsize or could not afford to purchase a home. In 2017, the municipalities with the greatest number of multi-family permits issued included Norwalk (387 units), Milford (161), Windsor Locks (160), Stamford (104) and Greenwich (99). 17

As seen from data for 2015 just released in December 2018, Connecticut economic growth accelerated, particularly in Hartford and Middlesex counties, due in large part to growth in aerospace manufacturing and insurance. With 4.6 percent growth between 2014 and 2015, Hartford’s economy was $74.9 billion, ranking second in size after Fairfield County’s $86.1 billion. Middlesex County’s economy grew by 4.1 percent between 2014 and 2015 to $7.8 billion, ranking fifth among the eight counties in Connecticut. 18

An opportunity on the horizon for Connecticut’s economy involves investments in its federally-designated Opportunity Zones. Recent changes in the federal tax law created qualified opportunity zones to encourage tax-favored investment in distressed communities throughout the U.S. If investing capital gains in opportunity zones, investors may defer or eliminate those gains. There are 72 zones (defined by Census tract) in 27 municipalities across Connecticut, and receiving infusions of capital to develop downtown and other areas will serve to boost the Connecticut economy. 19

Conclusion

The global economic growth in 2019 looks similar to what it has been in 2018, although several countries are expected to see slower growth because of trade restrictions or geopolitical risks. The national economy will continue to be relatively strong in 2019 although not quite as strong as in 2018, largely due to trade issues, and there is a growing concern that an economic recession in the United States may start in 2020. Connecticut’s economy, while still lagging behind most states and the nation as a whole, is seeing glimmers of acceleration among certain industries such as aerospace, insurance and energy, although the start of a national recession would mitigate many of the positive advances in the economy. The potential of additional investments being made as a result of the Opportunity Zone program bodes well for a state rich with assets yet needing a boost in order to gain economic momentum and have sustained economic growth.

The author would like to thank Mia Ying, CERC's Research Analyst, for her research contributions.

CERC drives economic development in Connecticut by providing research-based data, planning and implementation strategies to foster business formation, recruitment and growth.

1 https://www.imf.org/en/Publications/WEO/Issues/2018/09/24/world-economic-outlook-october-2018

2 https://www.naic.org/cipr_topics/topic_insurtech.htm

3 http://www.courant.com/business/hc-biz-hartford-insurtech-startups-20181203-story.html

4 https://www.pwc.com/us/en/health-industries/health-research-institute/assets/pdf/hri-behind-the-numbers-2019.pdf

5 U.S Census Bureau, calculated by CERC

6 https://www1.ctdol.state.ct.us/lmi/202/202_annualaverage.asp

7 https://money.cnn.com/2018/08/28/technology/business/amazon-whole-foods-365-walmart-kroger-costco-grocery/index.html

8 https://www1.ctdol.state.ct.us/lmi/202/202_annualaverage.asp

9 https://www.avalara.com/small-business/en/amazon-fulfillment-center-locations.html

10 https://www.wholefoodsmarket.com/stores/list/state

11 http://www.defense-aerospace.com/articles-view/reports/2/198308/2019-global-aerospace-%26-defense-industry-outlook.html

12 https://www.courant.com/business/hc-biz-county-economies-20181212-story.html

13 https://www1.ctdol.state.ct.us/lmi/202/202_annualaverage.asp

14 https://www.eia.gov/outlooks/steo/report/prices.php

15 https://www1.ctdol.state.ct.us/lmi/202/202_annualaverage.asp

16 U.S. Census, American Community Survey

17 https://www.ct.gov/ecd/cwp/view.asp?q=250640

18 https://www.courant.com/business/hc-biz-county-economies-20181212-story.html

19 https://www.cdfifund.gov/Pages/Opportunity-Zones.aspx