2017 Housing Market in Review

By Kolie Sun, Senior Research Analyst, DECDConnecticut’s housing sector in 2017 continued to exhibit mixed results mirroring the state’s modest economic recovery. In this article, we will examine several aspects of state’s housing industry including permits, sales and prices.

Economic Indicators

Job creation, gross state product (GSP), and personal income are some of the economic indicators that can impact the housing sector and housing growth.

Connecticut’s employment conditions remain positive. Based on annual average data (not seasonally adjusted) from state Department of Labor (DOL), Connecticut gained 1,800 jobs in 2017. However, employment increased 8,700 (seasonally adjusted) from April 2017 to April 2018. Since the great recession (August 2008-March 2010), Connecticut’s economy has continued to recover in terms of jobs. According to DOL Labor Situation (March 19, 2018) release that Connecticut’s private sector has recovered 100% of the jobs lost in the recession of 2008-2010.

With an improved job market, Connecticut’s unemployment rate remained low. According to Bureau of Labor Statistics, the state’s unemployment rate, on an annual average basis, was estimated at 4.7% in 2017. Hawaii had the lowest unemployment rate at 2.4% and Alaska the highest at 7.2%. Connecticut ranked near the middle. 1

GSP is the most commonly used barometer to measure a state’s economy, and it is defined as the total value of all goods and services produced during a specified time. While the overall GSP for 2017 was down slightly (-0.2%), there has been strong growth in the past three quarters. According to the Bureau of Economic Analysis (BEA), the state’s GSP increased at a seasonally adjusted annual rate of 2.4% in the fourth quarter of 2017. Numbers for Q2 and Q3 were revised upward to 3.1% and 4.6%, respectively. Connecticut economy was valued at $224.7billion 2 in 2017.

Connecticut’s personal income increased 1.5% on average in 2017, after increasing 1.2% in 2016 according to estimates released from BEA. At the national level, personal income grew, on average, at 3.1% in 2017 and 2.3% in 2016. However, Connecticut’s per capita income remains the highest in the nation, at $70,121.

Housing Production

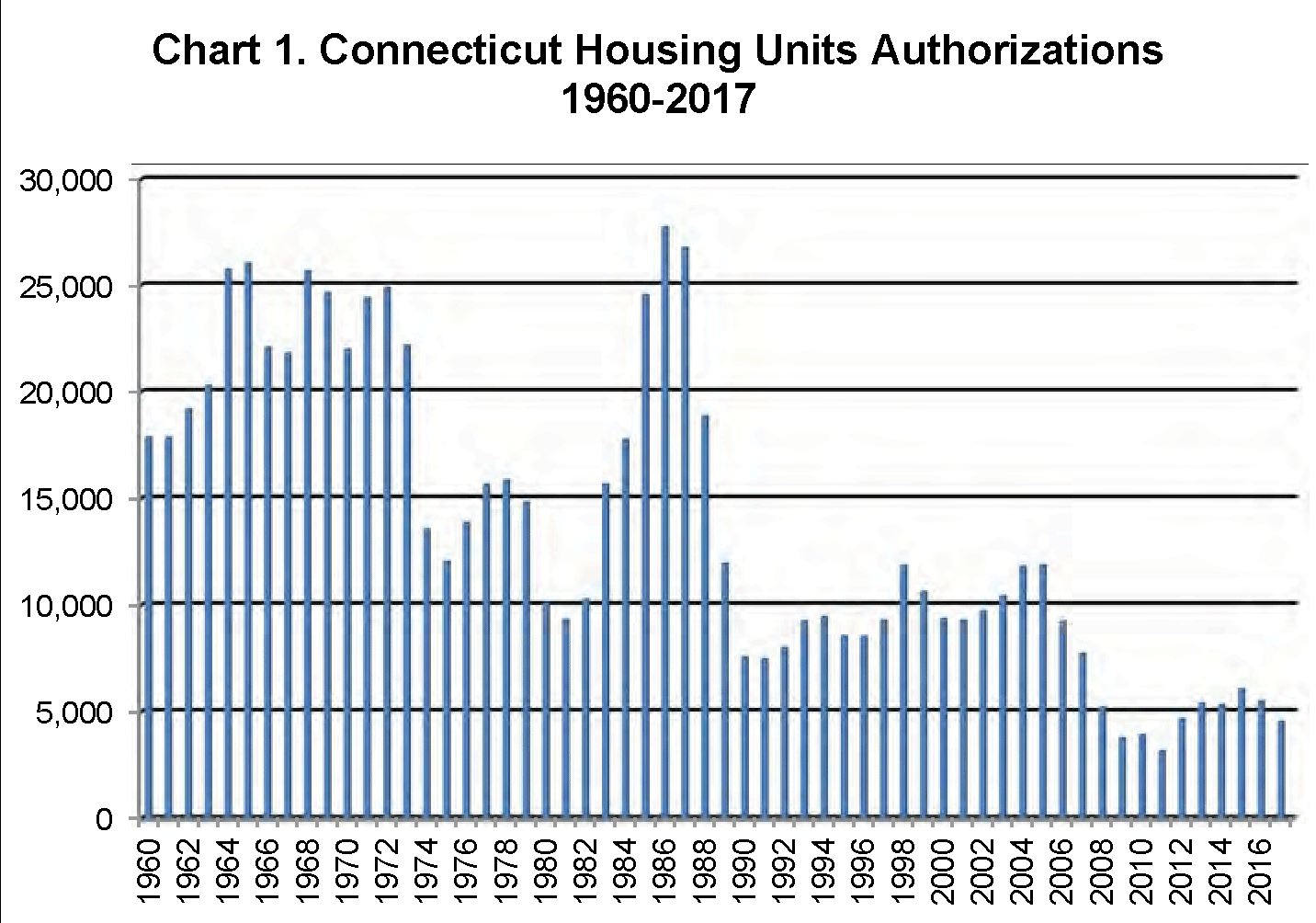

According to data release by the Bureau of the Census, cities and towns in Connecticut authorized a total of 4,547 single and multifamily homes with a total valuation of $1.185 billion in 2017. This level of production represents 17.4% and 25.2% decreases from 5,504 in 2016 and 6,077 in 2015 (See chart 1).

Fairfield County again dominated the number of housing permits with the largest share (37.8%) in 2017, followed by Hartford County (21.0%) and New Haven County (16.5%). Windham County had the smallest share (2.4%).

In 2017, Connecticut issued 2,480 one-unit permits, which accounted for 54.5% of the total number of housing units authorized, while 42.0% were multifamily (5-units or more), reversing the trend of multifamily units surpassing single family in the previous two years.

Several municipalities showed strong performance in the number of permits authorized. Norwalk led all municipalities with 429 units, followed by Greenwich with 250, Milford with 194, Windsor Locks with 173, and Westport with 159. The combined permits issued for the top five municipalities accounted for more than a quarter of all housing permits issued in the state.

DECD annually surveys each municipality for demolition information. One hundred thirty-four Connecticut towns responded (79.3% response rate), reporting 1,403 demolished units last year. As a result, the state’s net gain of 3,144 units brings its housing inventory estimates to 1,514,065 units.

Home Sales and Prices

A bright spot of state’s real estate market is the continuing upward trend of home sales and median prices two years in a row.

According to the Warren Group report, Connecticut “single-family sale numbers reached pre-recession high not experienced since 2006. Last year, single-family home sales totaled 34,259, a 5.0% increase from 2016.”3 Condominium sales followed the same pattern, increasing 7.9% to 9,054 units.

From the same report, the median single-family home sales price had an increase of 1.6% to $249,900 in 2017. Condominium sales price also increased 0.3% during the same time period.

According to the Federal Housing Finance Agency’s House Price Index (HPI), the U.S. house prices advanced 6.7% from the fourth quarter of 2016 to the fourth quarter of 2017 while the state’s HPI increased 3.7%. For a five-year period (Q4:2012 to Q4:2017), Connecticut’s HPI registered at 7.9%, indicating very little home price appreciation.

The Fed raised interest rates three times (March, June and December) in 2017. Raising rates affects millions of Americans, including home buyers, savers and investors. According to Freddie Mac, the conventional 30-year mortgage rate, on annual average basis was 3.99% last year, up from 3.65% in 2016 and 3.85% in 2015. Despite the increase, mortgage rates ended in 2017 under 4.0% for the fifth time in six years and remained at historic lows.

Population and Households

Population and housing are closely related. The size of population, and especially the number of households, determines the demand for housing.

Data from the last two decennial Censuses shows that Connecticut population grew at a level of 52,867, or 1.7% on average, annually. According to 2016 American Community Survey (ACS), the latest Census data, state population was estimated at 3,588,570. Since 2010, the state’s population has shown little growth, having increased by an average of 7,122, or 0.2% annually.

Connecticut had an estimate of 1.354 million households at the end of 2016, according to the ACS. The number of households stayed nearly flat since 2010, due in part to low population growth. By comparison, from 2000 to 2010, households grew at a faster pace of 0.5% or 6,942 on average annually, as a result of a higher rate of population growth during the same period.

Migration is a movement from one place to another. People move for many different reasons, such as jobs, climate, cost of living, proximity to families or simply personal preferences and so on. Migration, along with birth and death, are three major components of population growth.

The state has specifically taken several measures to build stronger urban areas and make our cities attractive for all, particularly to attract and retain young professionals. These include increasing investments in housing and funding more than 9,100 housing units in Stamford, Waterbury, Hartford, New Haven and Bridgeport; supporting over 50 transit-oriented-development projects; and promoting newer initiatives, such as the Innovation Places offering planning and implementation grants to public/private partnership aimed at creating places that foster innovation and entrepreneurship where talented people want to live.

Quality and affordable housing attract certain groups of migrants and influences young people’s decision in becoming homeowners. According to Connecticut Department of Housing, the state has funded over 21,000 housing units across the Connecticut.

The homeownership rate in the state remained relatively flat at 66.5% 4 in 2016, 67.5% 5 in 2010 and 66.8% 6 in 2000.

According to Andrew Paciorek, Principal Economist, and Board of Governors of the Federal Reserve System: “Fewer new households formed has meant less demand for houses, leading to persistently low house prices and, in turn, a slump in new residential construction.”7

Conclusion

In 2017, the U.S. economy experienced robust growth with real GDP increased more than 2% while Connecticut’s economic recovery has been more modest. As a result, state housing market recovery has been slower than expected. But if the GSP growth over the past quarters continues, we may see an uptick.

There are some promising signs for 2018. For example, April’s state median single-family home price increased 6.4% from a year ago, marking the seventh consecutive month of median price gains, according to a recent Warren Group report.

Also, according to economists speaking at the National Association of Home Builders (NAHB) International Builder’s show: “The newly enacted tax law will create a more favorable tax climate for the business community, which should spur job and economic growth and keep single-family housing production on a gradual upward trajectory in 2018.” 8

1 Bureau of Labor Statistics, Local Area Unemployment Statistics, Unemployment Rates for States, 2017 Annual Averages

2 In 2009 chained dollars, Bureau of Economic Analysis

3 Conn. Single-Family Sales Plummet 9.4 Percent in December, by Mike Breed, January 30, 2018, Press Release

4 2012-2016 American Community Survey 5-year Estimates DP-4, Connecticut

5 US Census 2010 Table DP-1, Connecticut

6 US Census 2000 Table DP-1, Connecticut

7 The Long and the Short of Household Formation; by Andrew Paciorek; April 1, 2013

8 Economic Panel Predicts Housing Will Gain Ground in 2018, January 9, 2018